Commercial property: Expect returns of '10pc this year, and next’

03-09-2014

Private investors warmed to commercial property funds in the years up to the financial crisis – and then suffered setbacks as values fell. Now the sector is bouncing back very strongly, analysts say

Commercial property

By Richard Dyson

Commercial property funds are growing again in popularity on the back of strong recent returns – and some extremely upbeat recommendations from professional investors.

Wealth manager Equilibrium Asset Management, for example, expects UK commercial property (embracing offices, shops, factories and warehouses) to return more than 12pc this year. For commercal property funds – the easiest way for private investors to access the sector, see right – returns will be a lower, but still attractive, 10pc, Equilibrium said. The difference reflects the cost of managing funds and the resulting drag on performance.

“It’s a bold prediction, but we believe commercial property will deliver the best risk adjusted returns during 2014,” said Equilibrium’s managing partner Colin Lawson. “Returns could be better than the FSTE for a fraction of the risk. Property is strongly linked to economic performance, so the recent recovery in the UK is a strong 'buy’ signal in my view.”

He recommends investors holding 20pc to 30pc of their portfolio in this type of asset – “depending on their attitude to risk” – a proportion which is far higher than many other advisers would suggest.

He is not alone in his confidence. Aviva, the insurance giant which pours billions of its customers’ money into commercial property, issued a “UK Real Estate” outlook in which it says returns will be “very strong” and “in double digits” for each of 2014 and 2015, although returns will peak this year and start to tail off in the next, it predicts. It puts total returns for UK commercial property – that means rental income generated plus the growth in the value of the buildings – at about 15pc for 2014 alone.

Commercial property has only relatively recently become easy for small investors to buy into. In the early 2000s a number of major fund companies promoted commercial property unit trusts, which worked by massing investors’ cash together and then buying office blocks, shops and other properties.

Many did extremely well as the value of UK commercial property rose.

But the onset of the 2007 banking crisis impacted commercial property values drastically with sharp falls in the value of the buildings and the rents many could command. During the period 2009-12 much if not all the returns earned by commercial property came from rental income, and even this was not sufficient in some periods to generate an overall positive return as the capital values continued to fall.

Capital values started to creep back up only in 2012, according to sector analyst Investment Property Databank (IPD), with the trend gaining strength last year.

The consensus is that the sector will do well this year and next. But, over a longer period of time, the benefits of commercial property are less clear.

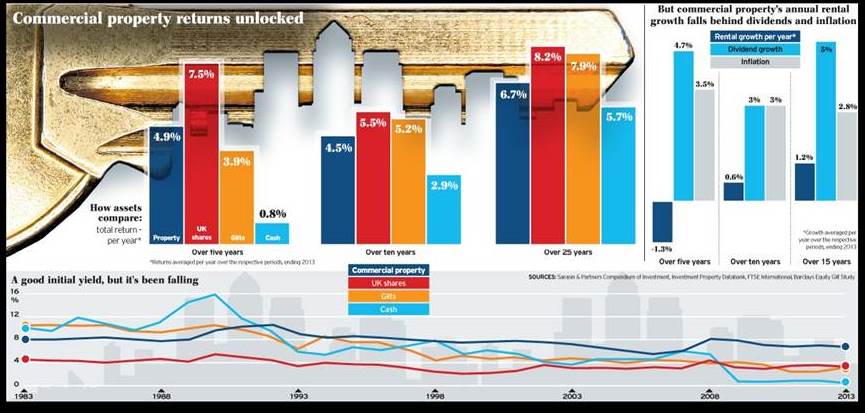

The main graph, above, shows the yearly returns generated by property, shares, gilts (UK government bonds) and cash – averaged over different periods. Only over the shortest period (five years) does property beat the returns on gilts.

Richard Maitland, partner at specialist asset manager Sarasin, explained that commercial property exhibits characteristics of both equity (shares) and fixed interest (gilts) investment. He said: “It is like equity in that tenants are often commercial enterprises whose ability to pay rent depends on their profitability, which in turn depends on the health of the economy. It is fixed interest in character in that rents are static for periods that may be many years.”

This mix of attributes explains why commercial property has, historically, not been very good at delivering an income which grows in line with inflation.

The second graph compares the growth in the rents from commercial property with the growth in dividends from shares, and inflation. Commercial property falls behind.

This might surprise some investors, as commercial property is often viewed as a “real asset”, capable of offering protection against inflation. Mr Maitland said: “The definition of a real asset class is where the underlying driver of returns exceeds inflation. In the case of dividends paid on company shares, it does. But in the case of property, perhaps surprisingly, it does not. Unless rental growth starts to motor, you cannot really think of it as a real asset.”

Brian Dennehy, financial adviser and founder of broker FundExpert.co.uk, agreed and said: “There is a belief that commercial property provides a growing income. But the reality is very mixed. Since the year 2000 income from property funds has barely changed, and it has not been a reliable source of growing income.”

But what about the yield on commercial property, relative to the yield on other assets? The bottom graph shows that commercial property yields have generally been highly attractive, although they have drifted down over the period shown (30 years). So how does that tally with the message in the second of the graphs, regarding inflation. Mr Maitland explained: “Over the very long term, returns on commercial property are driven by a high starting yield, some modest subsequent income growth, and capital growth.”

How to pick the best funds that own the best buildings

Investment planners reckon a portfolio should contain some exposure to commercial property: precisely how much depends on the investor and their timescales. For the average private investor’s portfolio, the proportion is generally put at between 5pc and 15pc.

This is similar to the portion a long-term institutional investment, such as a pension fund or charitable endowment, might hold.

Which commercial property funds should I buy?

There are relatively few widely regarded funds investing directly in UK commercial property (see below for an important distinction). They include Henderson UK Property, Threadneedle UK Property, SWIP Property Trust and Ignis UK Property.

The SWIP fund, at £2.6bn, is one of the biggest and oldest portfolios, with three-year returns of almost 30pc and a current yield of 3.5pc. Its biggest holdings include shops in London, Windsor and Edinburgh.

The Ignis fund (£1.2bn) has a similar track record and yield, and its biggest holding is an office block in the City of London.

The Henderson and Threadneedle funds yield slightly more (4.2pc and 4.6pc respectively). Higher yields are generally achieved by owning more properties in regional centres such as Birmingham or Leeds, pictured, where rents are higher relative to price.

Brian Dennehy of broker FundExpert.com tips the Threadneedle portfolio and said: “It tends to focus towards the lower end of prime property and outside central London, where they can find more value.”

The difference between funds directly investing in property and those buying property company shares

Some property funds – those mentioned above – buy actual properties and then manage and let them. Others own the shares of property companies. Aberdeen Property Share, for example, is a £252m portfolio that does the latter, and its top holdings include shares in major property firms Great Portland Estates and Land Securities. It has rocketed in recent years (up nearly 60pc over the past three) as this sector has bounced back.

The direct property trusts, where the biggest holdings are listed as actual buildings with physical addresses, have delivered steadier returns over time.

The risk of too little liquidity

Where a fund owns buildings directly it can face problems if too many investors wish to withdraw money at once. It could have to sell properties to meet withdrawals, possibly at a bad time in the market. Hence most “open-ended” commercial property funds, structured as unit trusts, can bar investors from accessing their cash in extreme circumstances.

This has rarely happened, even in the very difficult markets of 2009 and 2010.

Unit trust or investment trust?

Unit trust structures pose the liquidity risk described above.

Commercial property investment trusts are different, because although they pool investors’ cash and buy property directly – just like the unit trusts – they then issue their own shares, which are traded on the stock market. This means existing investors who want out can sell their shares, without the portfolio manager having to sell underlying properties.

But the problem is that the price of shares in the trust might not equate to the value of the underlying properties. This is the case now, where most UK commercial property investment trusts are trading at a higher price than the value of their underlying assets – or premium. Jason Hollands of broker Bestinvest explained: “Normally we prefer closed-end structures for illiquid assets like physical property, but the leading trusts are trading at hefty premiums, reflecting strong demand for income-generating investments.”

He cites F&C Commercial Property Trust and Schroder Real Estate Investment Trust, both trading at a 15pc premium.