Social Economic Health For Investors

07-15-2015

PropertyInvesting.net team

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gain, for our five thousand website visitors a day and the thousands of people signed up to your Newsletter. This Newsletter cover two key topics:

The global population explosion is having a profound impact on the economies of western developed nations and this also impacts property prices. Let’s explain.

Migration: So called “Globalization” – the freer trade of goods and services around the world – has kept a lid on prices of manufactured goods and services for the last 1½ decades. But it’s the free movement of people resources that is arguably having a bigger impact moving forwards.

Lid on Inflation: Migration of people from poorer developing countries to the more wealthy developed countries is keeping a lid on wage inflation, providing low priced labour for manual  jobs and supplementing high end technical jobs with some very well-educated entrants to the labour market. The migrants tend to be higher motivated individuals and families that want a better life and work hard. The countries that have allow large scale immigration like the UK and USA have generally grown at a far faster pace since the 2008 crash than countries that have keep immigration levels down like Italy and Greece.

jobs and supplementing high end technical jobs with some very well-educated entrants to the labour market. The migrants tend to be higher motivated individuals and families that want a better life and work hard. The countries that have allow large scale immigration like the UK and USA have generally grown at a far faster pace since the 2008 crash than countries that have keep immigration levels down like Italy and Greece.

Lower Interest Rates: In addition, this wage inflation has capped general inflation levels and therefore allowed lower interest rates, more affordable borrowing, and encouraged a higher level of borrowing on properties because of the low repayment rates.

Higher Property Demand: Furthermore, large influxes of migrants to major cities has created higher demand for both purchased and rented properties and helped drive prices up as well - because of property shortages and insufficient supply, particularly in areas of the UK with strong business growth like London and Manchester.

GDP Growth: The migrant workers also create demand of their own for public and private sector  goods and services – and hence have a marked positive impact on overall GDP levels. As the population expands, so does the GDP. As migrant families tend to have larger families with more kids, this also stimulates growth and GDP. This is particularly important in countries with an aging “babyboomer” population – which characterised the UK back in in 1995. This problem will start to go away if the population continues to grow strongly with many young people being added – supporting the elderly population.

goods and services – and hence have a marked positive impact on overall GDP levels. As the population expands, so does the GDP. As migrant families tend to have larger families with more kids, this also stimulates growth and GDP. This is particularly important in countries with an aging “babyboomer” population – which characterised the UK back in in 1995. This problem will start to go away if the population continues to grow strongly with many young people being added – supporting the elderly population.

Aging Babyboomers: Conversely, if we look at Greece with a very low fertility rate, declining population, low retirement age, low immigration levels and an aging babyboomer population – you will see a country destined for many decades of economic decline as GDP growth is simply not able to rise sharply because so many elderly people are reducing their expenditures and not creating any products and services. Demand for property will be weak – particularly in rural inland areas with low levels of tourism, away from the main jobs centres.

Migrants Go To Cities: In this environment where migrants generally gravitate to the cities and larger towns to look for work, and be with their fellow nationals, you can see how property prices in London, Manchester and Leeds would rise sharply, whilst the areas like rural Wales and Cumbria – where indigenous English populations are aging and declining will see property price rising at different lower trend level.

London Boom: Despite all talk of a property bubble in London – for the long term – with 1,000,000 additional people expected in the next 10 years, it’s hard to see property prices declining because demand is just so strong – particularly for middle level properties. Not enough low priced flats and homes are being built. Building rates would need to triple to make a big difference, The only building seems to be high rise flat with prices >£800,000.

Clustering: Another interesting angle is that migrants tend to like living in cities – partly  because they can find clusters of their own nationals in communities that make them feel more “at home”. It can be because of churches, grocery stores, clothes shops, cafes, schools, restaurants, cinemas, nightclubs – for example, the French like South Kensington, the Japanese Ealing, the Americans Little Venice, the Lebanese Edgware Road, the Australian Earls Court, the Nigerian’s New Cross and Peckham, the Chinese Soho. That said, major cities tend to be very cosmopolitan places and people from all backgrounds mix and feel at home in London – this creates a magnet for people from all over the world that come to work in London. This keeps a lid on wages, keeps a lid on inflation and keeps a lid on borrowing costs whilst driving up property prices.

because they can find clusters of their own nationals in communities that make them feel more “at home”. It can be because of churches, grocery stores, clothes shops, cafes, schools, restaurants, cinemas, nightclubs – for example, the French like South Kensington, the Japanese Ealing, the Americans Little Venice, the Lebanese Edgware Road, the Australian Earls Court, the Nigerian’s New Cross and Peckham, the Chinese Soho. That said, major cities tend to be very cosmopolitan places and people from all backgrounds mix and feel at home in London – this creates a magnet for people from all over the world that come to work in London. This keeps a lid on wages, keeps a lid on inflation and keeps a lid on borrowing costs whilst driving up property prices.

North Growths At Half Pace of South: We expect more of the same in the coming years – as the economic growth in southern England motors onwards at approximately double the rate compared to northern England. All the talk of a “Northern Powerhouse” is posturing – yes, there will always be successful industry in the north as well, but far more investment, population growth, int ellectual property and high-tech business will grow in the area within 50 miles of London compared to further north.

ellectual property and high-tech business will grow in the area within 50 miles of London compared to further north.

High Growth Cities: Longer term, for property investors, we maintain that investment in cities like London, Bristol, Cambridge, Oxford and Reading will see a better return than mid Wales, Cumbria and Newcastle for instance. These areas in southern England have the highest population growth, highest property demand, low property supply and highest employment growth with a smaller aging population compared to in the far north, west and Scotland.

Principles: If you use these principles to guide your property investments – it will lower you exposure-risk, and likely lead to higher returns in the long run.

Public Sector Cuts: It’s also worth pointing out that if the Tories get into power in May 2015 – they will drive through swinging public sector-services cuts – they need to cut £65 billion off the annual budget by 2020 to balance the budget as they have promised. These cuts would definitely effect the north and west more than SE England because there is a far higher proportion of public sector jobs in these northern regions – and the reliance on the public sector economy and services for aging populations is far higher.

North vs South Public Sector: The area least likely to be affected is London because it has such a small – approx 19% (compared to 48% in Newcastle) part of its economy reliant on the public sector. Even if Labour get into power, frankly they also will not have any money to invest in a big public sector expansion in the north – if they tried – they would create a collapse in the value of Sterling, high general inflation rates and this would cause a depression.

public sector. Even if Labour get into power, frankly they also will not have any money to invest in a big public sector expansion in the north – if they tried – they would create a collapse in the value of Sterling, high general inflation rates and this would cause a depression.

UK Growth Through Inward Migration: It is our view that the key reason why the UK is now able to grow at a far higher rate of GDP growth compared to Germany and Switzerland for example at present is because of its massive inward migration of workers. Take this away and by now, Sterling might have declined sharply and inflation would be far higher.

Escaping Bankruptcy: It is definitely the case that without the Tories at the helm – trying to reign in public sector expenditure and therefore supporting a higher value Sterling and lower inflation, the UK would be bankrupt by now. They managed to save the country from humiliation in 2010 – when the markets turned in UK’s favour just in time in April 2010 after hearing Osborne’s first budget. It was a close call. But headwinds remain strong - however now that the Tories have a majority and Labour have been set back for at least another 5 years, a general depression has been averted and we are likely to see lower inflation, rising property prices and unemployment dropping as the Tories continue to get the finances back in good order - the UK will not now go the same way France and Greece - that have been hit hard by socialist governments - with their tax, regulation burdens and spending levels leading to recessions.

We hope this Newsletter has helped give some insights as you develop your property investment strategies. If you have any queries, please contact us on enquiries@propertyinvesting.net

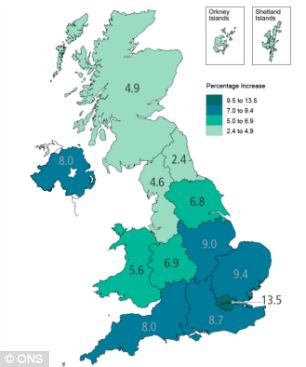

Population increase mid-2011 to mid-2012 - showing highest increase in London and SE England (London's percentage increase is about five times that of NE England).

2: High Performance Individual Investors

Lifestyle: If you want to make serious money and have a sustainable lifestyle, you have to start from the fundamentals. It’s possible to be fabulously wealthy from being in business in any sector, but there are few things that really help – that might seem obvious but are worth mentioning all the same.

If you want a successful business – it’s best:

· You are obsessed by it and love it

· You have a natural affinity to it – are skilled and knowledgeable in it

· You like working hard in the area of business

· You are good at the business – helped by the above

· You stay healthy

· You are focussed, efficient and effective – good at managing

Love It: If you love it and are skilled at it, you will almost certainly be good at it – regardless of what “it” is. You’ll notice this if you meet property investors – they are normally very enthusiastic about what they do, they love properties, and making money from properties – they get a kick out of this. That’s why when you get the bug, it’s so easy to work hard and be enthusiastic – and normally the wealth follows just behind.

Discipline: It’s important of course to be very disciplined – to manage your time very  effectively. If you are good at paperwork, finance and have a good eye for properties where value can easily be added, you’ll normally be a good and successful property investor. If you pride yourself in not wasting money, making high returns and providing an honest service to tenants and fellow investors, you’ll probably also do very well.

effectively. If you are good at paperwork, finance and have a good eye for properties where value can easily be added, you’ll normally be a good and successful property investor. If you pride yourself in not wasting money, making high returns and providing an honest service to tenants and fellow investors, you’ll probably also do very well.

It’s critical to be and stay healthy. This sounds like motherhood and apple pie, but if you have poor health, it’s very difficult to make money – you’ll end up losing it. No health no wealth - when it comes to property investing.

Exercise: We have this theory that – if you exercise 60 mins a day – it will add 3 hours to your life for every hour spent exercising. So it creates a lot of life and value – as long as you don’t injure yourself or have an accident. Fit healthy slim people live long. If you are unfit, smoke, drink, don’t get exercise and are overweight or obese, you’ll probably live 15-20 years less long. That’s a heck of a lot of life – time and in that time you can be making serious money of course and spending it and enjoying it. If you stay healthy when you are 80 years old, there is absolutely no reason why you cannot continue to make serious money – look at Warren Buffett for example. Old age has not slowed his returns.

Dump the Car: It’s important to try and lead a healthy lifestyle. Consider this – the average person spends about 2 hours a day in the car – in a very stressful and very dangerous and polluting environment. Bombing around in a one ton car at speeds up to 70 mph – no wander people that drive a lot feel stressed out, tired and their performance suffers – work wise and financially. Best to try and dump the car as much as possible. Walk, cycle, catch the train, bus or tube, run – try and get away from the crazy car – and you might all of a sudden find you save masses of money, get very fit, save lots of time (no traffic jams, you can work or relax on the train) and your overall quality of life will improve. For some strange reason, many people choose to travel colossal distances to work – it’s almost like a daily challenge on top of everything else – it’s crazy. Everyone bombing around busy roads risking their lives and getting totally polluted and stressed out – then spending all weekend recovering (or jumping in the car to visit relatives and friends to make matters worse).

environment. Bombing around in a one ton car at speeds up to 70 mph – no wander people that drive a lot feel stressed out, tired and their performance suffers – work wise and financially. Best to try and dump the car as much as possible. Walk, cycle, catch the train, bus or tube, run – try and get away from the crazy car – and you might all of a sudden find you save masses of money, get very fit, save lots of time (no traffic jams, you can work or relax on the train) and your overall quality of life will improve. For some strange reason, many people choose to travel colossal distances to work – it’s almost like a daily challenge on top of everything else – it’s crazy. Everyone bombing around busy roads risking their lives and getting totally polluted and stressed out – then spending all weekend recovering (or jumping in the car to visit relatives and friends to make matters worse).

No to travel: So consider say – NO – to trips to see family and friends that involve huge car travel distances. Ask people to come and visit you instead. Try and go on holiday on the train hire some bikes, get some fresh air and enjoy life. Dump the car! It’s so much easier these days now that the internet and mobile phones allow remote communications. You can do business almost anywhere – and contact people remotely – you don’t need to bomb around in the car anymore – and try and avoid all those supposedly important face-to-face meetings. It’s probably better using your time to making phone calls and sending emails – far healthier as well.

Walk: Try and take any opportunity to walk, jog or cycle somewhere – it’s often a lot faster. As an example, if you live in West London, it normally takes ten minutes to find a car parking slot, costs huge amounts and is stressful. Better to walk to the tube get away from the road pollution.

Stay Married: Consider this – probably the single biggest wealth destroyer is divorce. The problem is, before most people have a fling then file for divorce, it never even crosses their minds. Until the divorce lawyers come out of the woodwork – if you cheat (if you are a dishonest cheat), the n are caught – you will be taken to the cleaners. You’ll lose your house, then half your wealth or more on top, then have to pay maintenance – a large part of your future cash-flow. With tax, legal costs and other cost like getting another house to live in – you will almost certainly lose 65+% of your wealth overnight. It will be very difficult for you to recover from this – it’s quite possible this will tip you into bankruptcy or close to it – end up on social support or living in a bed-sit. No kidding, just do the calculations – everyone will want to take you to the cleaners – ex-partner, kids, family, government, schools, lawyers – you will be the cheat that was caught. Don’t do it! It’s not worth it! It’s stupid! On the whole, most millionaires are happily married (or single and have never been divorced). If you are a divorcee of cause it’s possible to rebound especially if you are fabulously wealthy already, but it will be so much more difficult after being shot down. It will likely lead to huge amounts of stress, time wasted, lack of focus, poorer health both physical and mental and set you back a lot. You might lose your new partner – they won’t like this losing streak. If you are happily married – best stay that way. If you are divorced, you may have got away lightly or you may recognise some or all of these risks above. You need to try and treat your life like a business – use you time effectively, be disciplined, make sure you enjoy life but don’t throw everything away by destructive elements – e.g. drink, drugs, smoking, divorce or cheating on your partner. Try and stay in control of your life. If you’re not convinced, then try and find examples of:

n are caught – you will be taken to the cleaners. You’ll lose your house, then half your wealth or more on top, then have to pay maintenance – a large part of your future cash-flow. With tax, legal costs and other cost like getting another house to live in – you will almost certainly lose 65+% of your wealth overnight. It will be very difficult for you to recover from this – it’s quite possible this will tip you into bankruptcy or close to it – end up on social support or living in a bed-sit. No kidding, just do the calculations – everyone will want to take you to the cleaners – ex-partner, kids, family, government, schools, lawyers – you will be the cheat that was caught. Don’t do it! It’s not worth it! It’s stupid! On the whole, most millionaires are happily married (or single and have never been divorced). If you are a divorcee of cause it’s possible to rebound especially if you are fabulously wealthy already, but it will be so much more difficult after being shot down. It will likely lead to huge amounts of stress, time wasted, lack of focus, poorer health both physical and mental and set you back a lot. You might lose your new partner – they won’t like this losing streak. If you are happily married – best stay that way. If you are divorced, you may have got away lightly or you may recognise some or all of these risks above. You need to try and treat your life like a business – use you time effectively, be disciplined, make sure you enjoy life but don’t throw everything away by destructive elements – e.g. drink, drugs, smoking, divorce or cheating on your partner. Try and stay in control of your life. If you’re not convinced, then try and find examples of:

· an exceptionally wealthy alcoholic whose business is doing remarkably well

· a business person with fabulous wealth that has a double digit growth company a few years after a divorce

Drugs and Destruction: Okay, there are a few drug taking alcoholic rocks stars and artists around – but they don’t normally last very long, and the most successful have been clean for year s (Mick Jagger, Sting, Paul McCartney, David Bowie, Bon Jovi, Bono, Bob Geldof). The ones that died generally took drugs – Michael Jackson, Elvis, Keith Moon, Kurt Kobain, Amy Winehouse, Whitney Houston, Jim Morrison. If you want to halve your expected life, then drugs are a pretty good way to make it happen. It seems that trying to come off them then overdosing at age 27 is a common way for these stars to go. Very sad indeed. If you want to destroy a business, alcohol is a pretty easy way of doing it – most people can’t think straight after drinking – they have the illusion they are doing great things – when in fact, it’s normally far from the case particularly if money, relationships, negotiations and money are involved. Deluded grandeur. Drugs are even more dangerous normally – they alter your mind and not just temporarily – for good. This is why people that have taken drugs will always be fighting to stay off them and their minds are altered and challenged. It must be almost impossible to be a heavy drinker and/or drugs taker and run a successful business venture.

s (Mick Jagger, Sting, Paul McCartney, David Bowie, Bon Jovi, Bono, Bob Geldof). The ones that died generally took drugs – Michael Jackson, Elvis, Keith Moon, Kurt Kobain, Amy Winehouse, Whitney Houston, Jim Morrison. If you want to halve your expected life, then drugs are a pretty good way to make it happen. It seems that trying to come off them then overdosing at age 27 is a common way for these stars to go. Very sad indeed. If you want to destroy a business, alcohol is a pretty easy way of doing it – most people can’t think straight after drinking – they have the illusion they are doing great things – when in fact, it’s normally far from the case particularly if money, relationships, negotiations and money are involved. Deluded grandeur. Drugs are even more dangerous normally – they alter your mind and not just temporarily – for good. This is why people that have taken drugs will always be fighting to stay off them and their minds are altered and challenged. It must be almost impossible to be a heavy drinker and/or drugs taker and run a successful business venture.

Think Positive: If you want to succeed in business, it’s critically important to have a positive frame of mind. It will reduce your stress levels, embolden you to action tricky things and giv e your motivation a boost. It will boost for self confidence and self esteem. Try and avoid negative people and commentary – try to gravitate towards positive people, images and thoughts. Try and not watch too much TV and news – its mostly negative – scare stories. The news is full on fear stories that are designed to keep you captured, returning to watch adverts and more fear and shock. Not good for yourself or your family/children. Best to concentrate if you do watch TV on positive programmes and films or programmes that you can learn from and that will help you in your business, lifestyle and management of these. Whenever you get worried about an issue – try and tackle it head-on – action it. Don’t leave it to fester. It will only get worse. Try and be pro-active at all times and look to manage your risks but continue to think positive and be positive to people around you. As they say, its amazing the positive outcomes that will come from giving and helping other people with a good service – and having a positive outlook. If you always sound worried and stressed out and negative – people simply won’t want to do business with you. They will go somewhere else – whether this is a tenant, supplier, customer, letting agent or building/handy-man – if you treat people badly with lack of respect or are negative to people, you’ll struggle with business.

e your motivation a boost. It will boost for self confidence and self esteem. Try and avoid negative people and commentary – try to gravitate towards positive people, images and thoughts. Try and not watch too much TV and news – its mostly negative – scare stories. The news is full on fear stories that are designed to keep you captured, returning to watch adverts and more fear and shock. Not good for yourself or your family/children. Best to concentrate if you do watch TV on positive programmes and films or programmes that you can learn from and that will help you in your business, lifestyle and management of these. Whenever you get worried about an issue – try and tackle it head-on – action it. Don’t leave it to fester. It will only get worse. Try and be pro-active at all times and look to manage your risks but continue to think positive and be positive to people around you. As they say, its amazing the positive outcomes that will come from giving and helping other people with a good service – and having a positive outlook. If you always sound worried and stressed out and negative – people simply won’t want to do business with you. They will go somewhere else – whether this is a tenant, supplier, customer, letting agent or building/handy-man – if you treat people badly with lack of respect or are negative to people, you’ll struggle with business.

We hope this Newsletter is helpful as part of your property investing toolkit and provides some interesting perspective - has helped stimulate some positive thoughts on how to improve your business. If you have any queried, please contact us on enquiries@propertyinvesting.net .