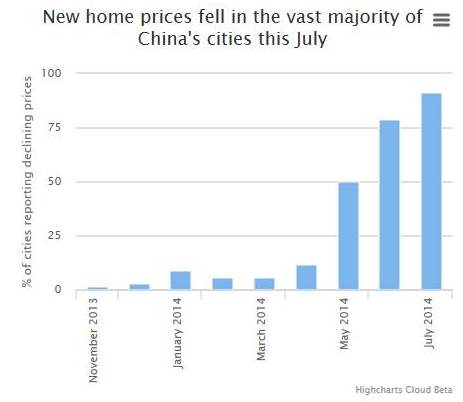

New home prices dropped in 64 of 70 cities, the highest proportion seen since records began in July 2005, according to the National Bureau of Statistics of China.

Despite local authority efforts to ease or remove home restriction policies (HPRs) across several regions, the prices of new homes fell by a weighted average of 0.9pc between June and July.

The data provided “more evidence that the property market correction is continuing”, said analysts at Nomura.

Falling growth in China could have sweeping knock-on effects throughout the global economy, as business depend on continuing Chinese growth to buoy demand worldwide.

Nomura said that “structural oversupply in China’s property sector is a long-lasting issue and the largest risk to China’s economy”.

Economists fear that the unravelling of the Chinese housing boom is now becoming entrenched.

“The magnitude of the slowdown … remains a major uncertainty for the [Chinese] growth outlook in the second half of this year and 2015”, said Haibin Zhu, a JP Morgan analyst based in Hong Kong.

Shares were left broadly untouched, as the Shanghai Composite closed up by around 0.6pc, powered by gains in tech and shipping.

But homebuilders suffered on the news, with Sun Hung Kai Properties and Cheung Kong stocks down 1.5pc and 1.1pc respectively.