30-something homeowners: Now is the time to buy your second house

01-19-2015

House prices for 'second steppers' are lower than 10 years ago - even in London, says Lloyds

Debt crisis: UK housing slump will deepen, warns IMF . Woman looking at estate agents window

Despite sharp falls in property prices following the banking crisis, the IMF believes they are still too high and could drop by a further 10-15pc relative to Britons’ salaries. Photo: ALAMY

How will the election affect the UK economy 2015?

With an unpredictable general election and a cooling housing market, the next 12 months could prove tricky

Anna White

By Anna White, Property correspondent

Married couples and young families poised to move into their second home can afford a detached property for the first time, following the housing market recovery.

First-time homeowners, typically 34 years old and married, have cashed in on the recent spike in house prices and are using their new-found equity to take the next step on property ladder, according to Lloyds Banking Group.

House price appreciation means that this bracket of buyer, who could afford to move to a semi-detached home in 2013, can now upgrade to a detached property, as chunkier deposits, higher earnings and lower interest rates have made larger homes more affordable.

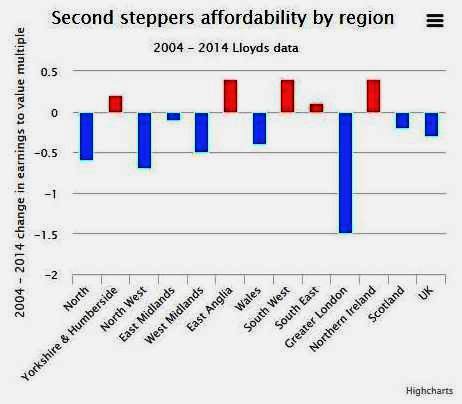

House prices paid by the average "second stepper" are now lower than a decade ago, as a value of the property in relation to earnings fell from seven times in 2004 to 6.7 times last year, the report revealed.

"The standard first-time owner [with a household income £58,500] has lived in their home for four-and-a-half years, meaning they bought in 2009 or 2010," explained Martin Ellis, chief economist at Lloyds Banking Group.

"House price appreciation over that time has boosted the equity they can put towards their next home and progress up the ladder," moving typically from a city centre flat to a suburban house.

The surge in UK house prices following the recession, 26pc over the past five years, has rendered home ownership unrealistic for many first-time buyers, but has given potential second-stage buyers a £10,000 equity handout.

This takes their average equity level to £76,131, a quarter of the average price of a typical second home (£299,428).

"But it was all about getting on the ladder at the right time," said Mr Ellis. "Those first-time buyers who bought at the peak of the boom in 2007/08 will not have accumulated as much equity and could face a severe problem."

There are also huge regional differences, he continued, with five areas of the country becoming more of a stretch for second steppers.

The housing market recovery was weaker in areas such as Yorkshire & Humberside and East Anglia and therefore those homeowners have not accumulated as much equity.

As a result of ferocious house price growth in London over the past 18 months, the level of income to value fell from 12.8 to 11.8, lowering monthly mortgage repayments.

However, following the exodus of families and first-time buyers into the South East in search of better value for money and more space, recent price inflation in the region has made it less affordable for second steppers looking to commute into London from further afield.