House prices in Ireland leapt by 16% in 2014, putting it at the top of Knight Frank’s global house price index – but the market remains a long way off its pre-crisis peak.

Globally, property markets slipped in the final quarter of 2014, Knight Frank said, with prices in the 55 countries on the index falling by 0.6%.

But the index, which uses local price data and weights it according to each country’s GDP, showed that while some countries saw prices fall by up to 5.2% in that period, prices went up by almost as much in other parts of the world.

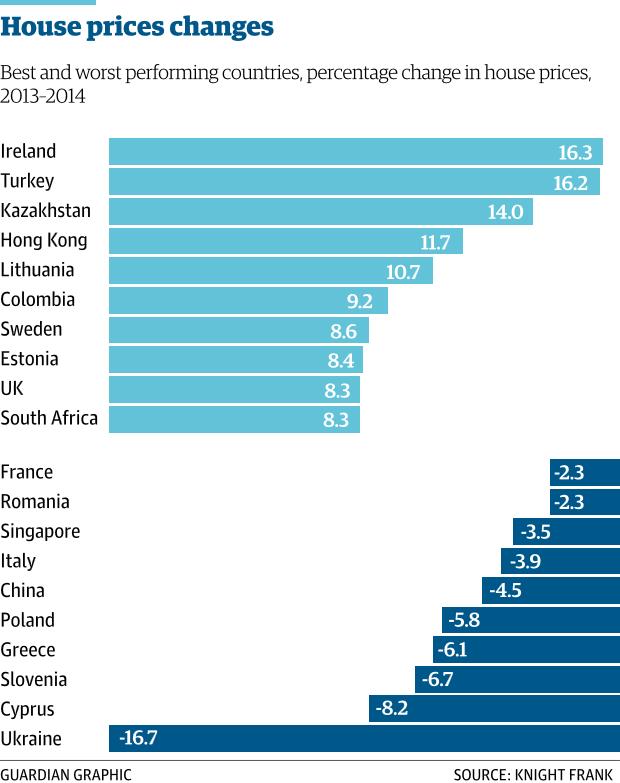

Over the year, five countries recorded double-digit price growth. Not far behind Ireland’s 16.3% rise came growth of 16.2% in Turkey. In Kazakhstan, Hong Kong and Lithuania prices also rose by more than 10%.

Knight Frank said prices in Hong Kong’s mainstream market had risen by almost 12%, while the cost of luxury homes had increased by just 1.1%. Small, relatively inexpensive flats now dominate the market there, it said, as affordability constraints and double stamp duty rates on larger properties have altered demand.

Despite the sharp rise in Ireland’s market the average price of a home there is still 38% below the peak it reached in the autumn of 2007.

At the other end of the table, the only country to record double-digit price falls in 2014 was Ukraine, where the market dropped by 16.7%. Poland, Greece, Slovenia and Cyprus all saw falls of more than 5% over the year.

Kate Everett-Allen, from Knight Frank’s international residential research team, said the outlook for property markets in 2015 would be dominated by two monetary policy decisions: the quantitive easing programme in Europe and the timing of a rate rise in the US.

“The focus is not just on the resilience of the US market and the extent to which it absorbs the rise, but the impact on those markets whose currencies are pegged to the dollar,” she said.