Investment focus: Global property market

05-27-2015

As fears of a UK property bubble increase, investors in the country are turning to overseas markets in search of diversification, decent liquidity and solid returns.

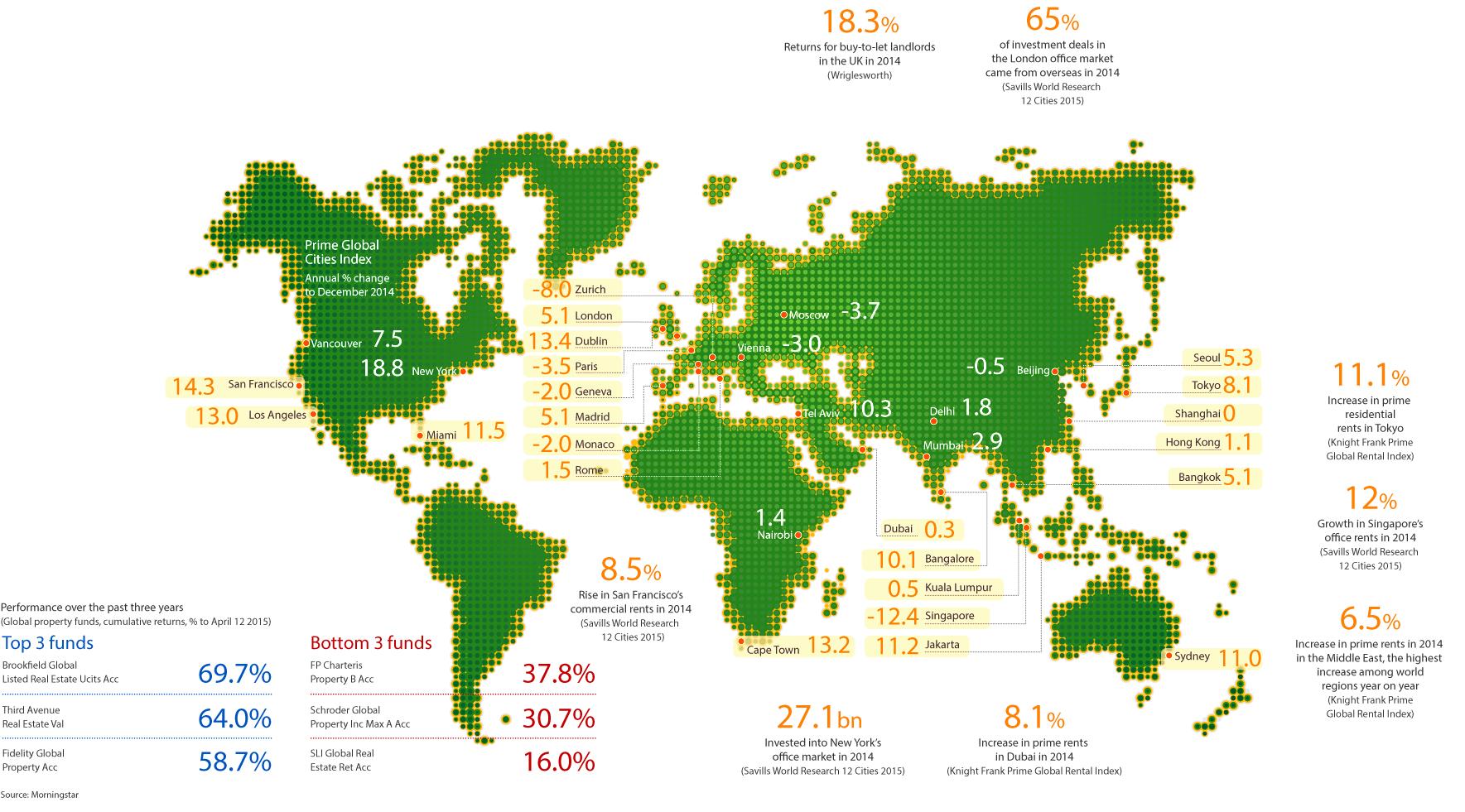

House price rises in most developed economies have been fuelled by attempts by central banks to sustain economic recovery by holding long-term interest rates at record lows over the past five years. The Knight Frank Prime Global Cities Index, a measure of price movements in luxury residential property, rose 4.2 per cent in 2014. Properties in 24 of the 32 cities in the index either held or increased their value. BlackRock Real Estate, the property arm of the world’s biggest fund manager, estimates the $12.9tn global real estate market could nearly double in value by 2020.

Weak spots remain, however, and the contrast between the US and Europe is stark. The average price of a luxury property in one of the four US cities tracked by Knight Frank ended last year 14.4 per cent higher, while the equivalent home in Europe rose just 0.7 per cent. Investors face an uncertain year, with possible new property taxes in London and New York, and potential government moves to cool overheated housing markets in the biggest Asian cities.

World property outlook

The biggest theme underpinning global property investment activity has been the ultra-low interest rate environment that the main world economies have experienced over the past five years, writes Liam Bailey.

This has led to a compression of yields as investors have competed ever harder to secure prime property in city markets such as London, Munich, New York, Singapore and Sydney.

This squeeze on investment returns, and the expectation of interest rate rises in 2015, is acting to push investors to look for more risk. Demand for property in markets such as Paris, which has been overlooked over the past four years, is likely to rise. More investors are betting on an upswing in recovery markets such as Dublin and Madrid.

Liam Bailey is head of residential research for Knight Frank

Copyright The Financial Times Limited 2015. You may share using our article tools.

Please don't cut articles from FT.com and redistribute by email or post to the web.