Growth in average home value paves way for a further boom over the coming months, although some experts warn against making ‘overblown’ presumptions

UK house prices set to surge over rest of 2015 as election uncertainty clears

06-03-2015

Boom conditions are back in the UK housing market and prices look set for a new surge before the end of the year after the Conservative election victory has galvanised buyers and sellers.

As the Land Registry reported prices in England and Wales had risen in April – leaving the average value of a home just £1,200 below its pre-financial crisis peak of 2007 – economists said they now expected further increases in the months ahead.

The annual rate of house price inflation, which at 5.1% had reached its lowest level for 14 months, could be about to take off again. Matthew Pointon, property economist at City consultancy Capital Economics, said that with the stock of homes for sale at a historic low, “the conditions are in place for further price gains this year.” He added : “The low point for the annual rate of house price inflation is now in sight.”

: “The low point for the annual rate of house price inflation is now in sight.”

Steven Bell, chief economist at City fund manager F&C Investments, said competition between mortgage lenders, together with rising incomes and falling arrears, were all boosting the supply of home loans and pushing up prices. “In the UK housing market, the global financial crisis seems a long time ago,” he said.

The Land Registry figures – which are regarded as the most accurate because they reflect completed transactions rather than asking prices or mortgage loans – showed that prices rose by 0.9% in April across England and Wales, following a 0.8% dip in March.

In the weeks before the general election, the average price of a home hit £179,817: almost £9,000 higher than a year earlier and approaching the pre-crisis high of £181,014 reached in November 2007. In London, the average price was up £47,000 in 12 months, and prices grew by more than 10% in 28 of the capital’s 33 boroughs.

Jonathan Hopper, managing director of Garrington Property Finders, an agent for wealthy clients, said it was “encouraging to see how well prices held up in April”, when it was unclear if a new government would bring new property taxes.

The prospect of a Labour mansion tax on properties costing more than £2m hit the top end of the market: the Land Registry reported a 30% slump in the number of sales in February, compared with the previous year. But Hopper said: “In the weeks since the election the market has quickly become much more free-flowing, with energised buyers and supply improving dramatically. Buyer demand and confidence are robust – both bode well for a strong summer moving season.”

Trevor Abrahmsohn, whose Glentree estate agency sells luxury homes in north London, said political uncertainty had deterred buyers in his part of the market: “The mansion tax, the threat to non-doms and the anti-business rhetoric from Labour made it very difficult. Since the election, people feel there’s no restrictions again. That’s good for everyone in the UK.”

In a note put out before the Land Registry figures were published, Bell said he believed the Bank of England would prefer to wait until the end of the year to see the impact of the July budget before raising interest rates, but it was likely to be confronted with surging prices in the next few months.

“This will confront the Bank of England with a dilemma: whether to raise base rates early ... or risk yet another house price boom,” he said. “A strong housing market is both an indicator that financial conditions are too loose and a mechanism by which those loose conditions feed through into the rest of the economy.”

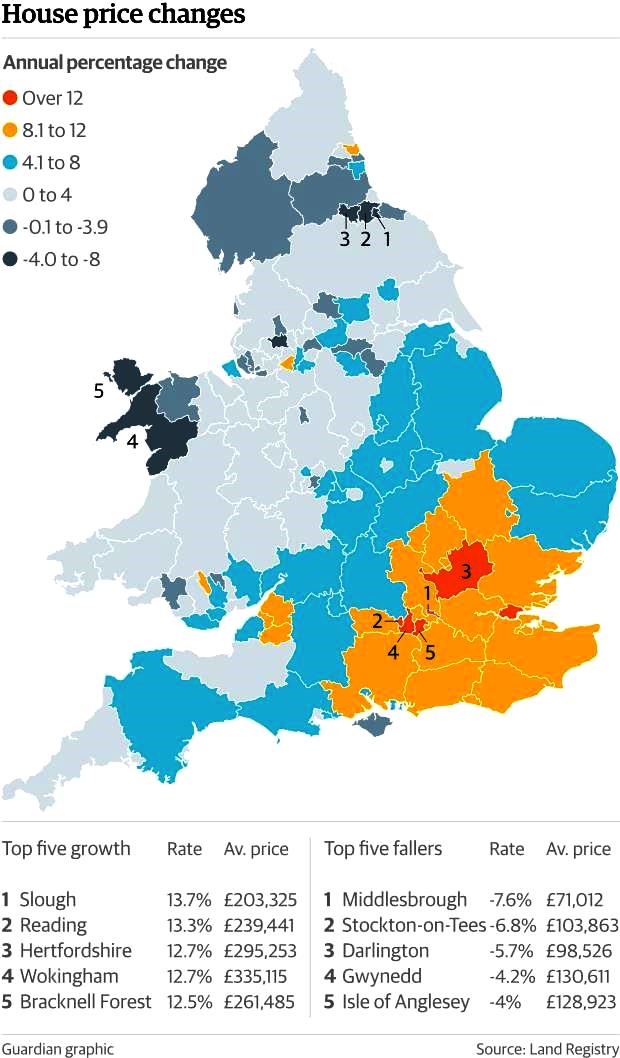

The Land Registry’s data, which is based on repeat sales and so does not include new-build homes, showed large leaps in prices in several parts of the country. The biggest monthly price increase in April was in Yorkshire and the Humber, where prices increased 2.7% over the month to an average of £123,471. In London, prices rose by 2.3% to £474,544 and annual growth across the capital was 10.9%.

There was also strong growth in the north-west of England, which registered a 2.1% rise during the month. However, prices fell in Wales and the north-east of England, by 1.1% and 0.5% respectively.

Howard Archer, chief UK economist at IHS Global Insight, increased his forecast for growth in 2015 from 5% to 6% “partly due to the increased upward impact on prices coming from a lack of properties on the market”. He added: “We also suspect that the housing market will benefit from reduced uncertainty following the decisive general election result.”

Pointon said that it was possible that more sellers would come forward now the election was out of the way, but he said that would not ease upward pressure on prices because “any new supply is likely to be matched by demand”.

Fionnuala Earley, residential research director at property firm Hamptons International, said a post-election bounce was not unusual: “Our research over the last eight elections shows that there is always a bounce in activity after the vote, making up for a slowdown in the previous six months and some of this will feed into price growth.” But Earley insisted it was “overblown to say that there is another dangerous house price boom on the way.

Housing charity Shelter said the £9,000 increase in prices since April 2014 meant goalposts had moved “yet again” for those saving for a home. Its chief executive, Campbell Robb, said: “With over 80% of homes on the market in England unaffordable for a typical family – even if they have a deposit – for many, a home of their own has gone from possibility to pipe-dream.”