House prices leap £50 a day due to 'starving' first-time buyers - how to find an affordable home

09-12-2015

By Julia Rampen

Getty

People look at properties advertised in an estate agent's window

House prices are ticking upwards, with the average buyer paying more than £200,000 for a home in August 2015. Here's what to do if you're looking for your first home

House prices rose £50.88 a day in the year to August as buyers fight over a limited supply of property.

Buyers paid an average £204,674 for a house in August 2015, according to the Halifax house price index. That’s £18,573 more than they would have paid a year ago.

House prices also chugged upwards by 2.7% compared to July.

Jonathan Hopper, managing director of Garrington Property Finders, said: "Britain's economic strength - wage growth, low inflation and bullish sentiment - is inspiring thousands of would-be buyers that now is the time to act.

"But buyers are being starved of supply - not just of the new homes being built in insufficient numbers, but of existing stock too.

"That mismatch is creating a shortage of properties at all but the highest price points, and steadily increasing prices is the inevitable result.”

What do rising house prices mean for me?

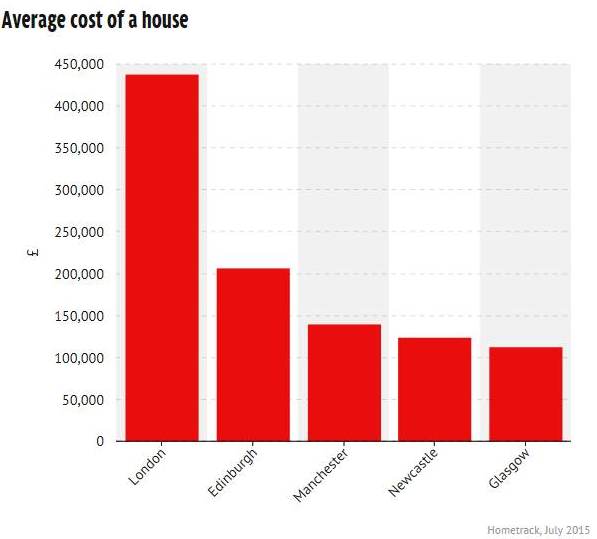

It depends where you live. While the Halifax index is focused on the UK picture as a whole, there's a massive difference between the price of a house in London and Newcastle, for example.

If you're a homeowner, rising house prices are usually good news. It means you'll be able to sell your property for more than you bought it for (although if you're staying in the same area, you may have to spend all that profit on your next house).

If you're a wannabe homeowner, though, it can seem really unfair - especially when wages aren't growing as fast as house prices.

First-time buyers in London and the South East, where prices are highest, may have to move to find a house they can afford. Check out this map of the most affordable areas.

Another option is to use a mortgage scheme to get on the housing ladder quicker. You can get a better rate on your mortgage if you save up for a large deposit, but if prices are rising fast you may prefer to get on the housing ladder. Here's our guide to finding a mortgage with a small deposit, and some of the best rates for a 5% deposit.

There's nothing worse than buying a house for an extortionate amount of money - and then finding you can't sell it for the same amount or more.

It's not an exact science, but there are some signs that house prices will rise. Find out what they are here.