Housing Boom On The Cards - Low Oil Prices Stimulating

09-19-2015

House Price Boom - on the cards - oil prices are a key driver for the property market.

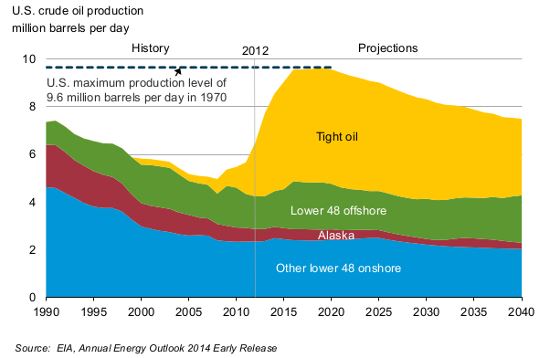

Low Oil Prices Stimulate: Oil prices have crashed from $110/bbl in August 2014 to $48/bbl now mainly because of an additional 5 million bbl/day light sweet crude oil that has been added since 2008 from the fracced shale oil wells-fields in the USA. This technology revolution combining long reach horizontal wells drilled clusters with each well having up to 30 fracs at depths of 3km and well lengths of up to 6km has created the surge in oil production. Meanwhile some of the smaller Middle East producers like Egypt, Yemen and Syria along with Libya have seen their oil product crash from civil wars and sectarian violence. Nigeria has also been affected. But this has not been enough to offset the remarkable production increases in the USA. Russia and Saudi Arabia have also been producing at record rates with Iraq adding 2 million bb/day in the last few years. On the demand side, the Chinese economy has slowed as the economy has matured and construction has slowed. Meanwhile the European economy has been lack-lustre and some developed nations have struggled. The combined effect has been to soften demand and increase supply as everyone has been producing at maximum rate to try and keep revenues high. OPEC has lost discipline and Saudi Arabia appears to have gone for market share rather than act as swing producer. OPEC as a cartel is dead for the time being and discord and mistrust is high. There are particular tensions been the regional powers of Iran (a non Arab Shia country) and Saudi (an Arab Sunni country). Saudi are flooding the market and Iran want Saudi to cut back production to boost prices. There is bound to be some high level geopolitics going on possibly related to Russia and th e USA but we will never know the real reason why Saudi is so intent on going for low prices and market share. The conspiracy theorist might conclude that Saudi and the USA are working in tandem to drive down prices to put pressure on the Iranian and Russian economies and regimes whilst boosting the overall global economy and preventing a recession in the USA that could have hit end 2014. But it might also be a miscalculation by Saudi that they could have driven the US shale oil producers out of business but the US Fed and Government probably have a different strategy they will probably pump billions through the back door to prop up the private sector oil national champions because they want to be self-sufficient in oil and not constantly getting involved in deeply unpopular wars in oil producing countries trying and largely failing to secure oil supplies like they did in Iraq.

e USA but we will never know the real reason why Saudi is so intent on going for low prices and market share. The conspiracy theorist might conclude that Saudi and the USA are working in tandem to drive down prices to put pressure on the Iranian and Russian economies and regimes whilst boosting the overall global economy and preventing a recession in the USA that could have hit end 2014. But it might also be a miscalculation by Saudi that they could have driven the US shale oil producers out of business but the US Fed and Government probably have a different strategy they will probably pump billions through the back door to prop up the private sector oil national champions because they want to be self-sufficient in oil and not constantly getting involved in deeply unpopular wars in oil producing countries trying and largely failing to secure oil supplies like they did in Iraq.

Future Oil Price Rise End 2016: As oil prices stay low, oil investment are rapidly drying up and this will sow the seeds for the next oil price rise in a few years time. Already the shale oil production as of April 2015 has started to drop sharply and oil demand has picked up because of the low oil prices. Our best estimate is that demand and supply will pass by each other quite dramatically by end 2016 thence oil prices will rise sharply, especially if there is a new war breaking out in the Middle East that threatens supplies.

Impact for UK Property Investors: You might be thinking why this is relevant to the property investor. Well it is very relevant for the following reasons when oil prices rise, in oil importing countries thats all European countries except Norway - we get:

· Higher CPI and RPI inflation

· Higher borrowing costs

· Higher interest rates

· Lower GDP growth

· Higher unemployment

· Greater debts and debt servicing costs

· Lower property prices

· Weaker currency

· Depressed rental demand

· Depressed rental prices

Boom: In the current low oil price environment we get the opposite for the UK and NW Europe we get:

· Lower CPI and RPI inflation

· Lower borrowing costs

· Lower interest rates

· Higher GDP growth

· Lower unemployment

· Reducing debts and debt servicing costs

· Higher property prices

· Stronger currency

· Strong rental demand

· Strong rental prices

More Disposable Income: With the current low oil prices, we are even seeing an employment recovery and house price recovery in northern England despite the public sector cut-backs. This is quite predictable and hardly surprizing since oil feeds into almost all goods and services costs so low oil prices help manufacturing and create an effect like a tax giveaway or tax cut. It gives consumers more disposable income then this drives up property prices because with low mortgage rates, people can afford to take on bigger mortgages fighter for the few properties available to purchase in the UK. Of course a strong currency will also reduce inflation because imports become cheaper and banks will charge less for borrowing.

Trend Improving: In the UK, we have a new Tory government with a majority that are intent on running a surplus by around 2020 and reducing the mountain of debt. The financial markets love this its the only centre-right government in Europe that seems to want to properly manage the economy. Meanwhile the oil price crash has boosted England and Wales because the UK was importing oil in the last few years and its boosted consumer spending. The waves of migrants entering the UK has also ke pt a lid on wage inflation particularly unskilled and semi-skilled labour. Meanwhile we have a population boom particularly in southern England. The UK population is rising at a rate of about 500,000 a year, of which a new 320,000 are migrants (120,000 leaving, 440,000 entering). The UK is only building a meagre 130,000 net properties a year and these are almost all flats very few houses are being built. These are all the conditions for a house price boom. Yes, we kid you not. Prices have only just recovered to 2007 level in most parts of the country so if you exclude central London, we have plenty of room for property prices to rise in our view.

pt a lid on wage inflation particularly unskilled and semi-skilled labour. Meanwhile we have a population boom particularly in southern England. The UK population is rising at a rate of about 500,000 a year, of which a new 320,000 are migrants (120,000 leaving, 440,000 entering). The UK is only building a meagre 130,000 net properties a year and these are almost all flats very few houses are being built. These are all the conditions for a house price boom. Yes, we kid you not. Prices have only just recovered to 2007 level in most parts of the country so if you exclude central London, we have plenty of room for property prices to rise in our view.

A few other important points about the UK property market:

· The UK is considered a safe haven because it is secure, is an island, has a centre-right government that manages the economy well (50% of the way through clearing up the mess left by the last Labour government, on an improving trend) and attracts foreign investment

· Many neighbouring countries went pear shaped during the Euro crisis and are now h aving to field the burden of refugees because they are signed up to the Schengen open border agreement (the UK never signed up to open borders)

aving to field the burden of refugees because they are signed up to the Schengen open border agreement (the UK never signed up to open borders)

· Planning constraints, our old fashioned idea of the idyllic countryside, Nimbyism, envy, jealousy and all the other British traits make building a large new house almost impossible building land is massively expensive and hardly any is available

· No New Towns have been built since the 1960s most of the building seems to be luxury high rise apartments in London not what the average Brit is looking for

· The Chancellor instigated a draconian tax hike on buy-to-let investors that will kill off much of the new building that wold have gone to buy-to-let investors. No-one wants to pay tax on losses and thats exactly what the Chancellor wants by-to-let investors who borrow to do. This new tax will back-fire by reducing overall property supply, especially in the rental sector and drive up rental prices and increase overcrowding and severity of the housing crisis.

Interest Rates: We think the chance of an interest rate increase is minimal at the moment because productivity is low, inflation zero, global growth slowing, China has problems, Sterling is very strong and the BoE will not want to destabilize the economy. If anything, we could get more quantitative easing and/or negative interest rates to try and drop the value of Sterling to boost export competitiveness. This is the benefit of a well managed economy - low interest rates - which will feed through to higher asset/house prices.

Pointers to a House Price Boom: We hope you can see all things seem to point to a continued housing crisis, rising house prices and rising rents in the next 18 months as oil prices stay low and CPI/RPI inflation remains subdued. The only inflation will be in property prices and rental prices. This Autumn we expect to see house prices starting to accelerate again. First time buyers thought thinks were softening in April but this was mainly because of the fear of a Labour victory, followed by the normal summer lull. Now we have booming business, population growth, low oil prices and increasing disposable incomes and a feel good factor of a stable Tory government we expect property prices in England and Wales to shoot up as of early September when everyone is back at school, back from their summer holidays.

Autumn we expect to see house prices starting to accelerate again. First time buyers thought thinks were softening in April but this was mainly because of the fear of a Labour victory, followed by the normal summer lull. Now we have booming business, population growth, low oil prices and increasing disposable incomes and a feel good factor of a stable Tory government we expect property prices in England and Wales to shoot up as of early September when everyone is back at school, back from their summer holidays.

Not Hard To Predict: Because in December 2014 we predicted this would be the case as long as the Tories got back into power. What we did not anticipate was that oil prices would be quite so low for quite so long so this is boosting property prices in the UK even further. We should see a strong house price growth from early Sept 2015 to May 2016 as all indicators point in the right direction. Expect the ripple effect to fan out from London and start touching remoter parts of England and Wales.

Scotland: For Scotland, things will start to detach as the economy suffers from higher taxes and the low oil prices and low oil activity in the North Sea Aberdeen will sink into a recession there is estimated to have been 65,000 jobs losses in the UK North Sea and most of these are Scottish jobs. T he threat of another referendum is hanging over Scotland and this is deterring inward investment. Many English people are moving south we expect manufacturing to go into decline and house prices to start slipping by end 2015. The North Sea oil revenue is now only a fifth of that presented by Alex Salmond, an ex-oil economist, before the Scottish Yes/No Referendum. That said, the Referendum publicity has actually boosted Scottish tourism by some 13% since early 2014, though whether this will continue is uncertain. For Scotland we expect to see:

he threat of another referendum is hanging over Scotland and this is deterring inward investment. Many English people are moving south we expect manufacturing to go into decline and house prices to start slipping by end 2015. The North Sea oil revenue is now only a fifth of that presented by Alex Salmond, an ex-oil economist, before the Scottish Yes/No Referendum. That said, the Referendum publicity has actually boosted Scottish tourism by some 13% since early 2014, though whether this will continue is uncertain. For Scotland we expect to see:

· Higher taxes leading to higher inflation than England

· Lower GDP growth

· Higher unemployment

· Greater debts and debt servicing costs and public sector spending increases

· Lower property prices

· Depressed rental demand

· Depressed rental prices - before the next Referendum

The Scottish population is rising at less than half the rate of England and many rural areas continue to depopulate. Hence the supply-demand situation is more balanced than in England. We advise against investing in Scottish property for the foreseeable future.

We hope this article helps with your property investment strategy and tactics. If you have any queries, please contact us on enquiries@propertyinvesting.net