Buy-to-let landlords and second-home buyers face a big jump in stamp duty under plans designed to ease the path to home ownership for first-time buyers.

Experts said the new measures would deter landlords from buying up properties, but could also “turbo-charge” house prices in the short term as, investors race to complete sales before the higher tax – on all properties more than £400,000 – comes into force next April.

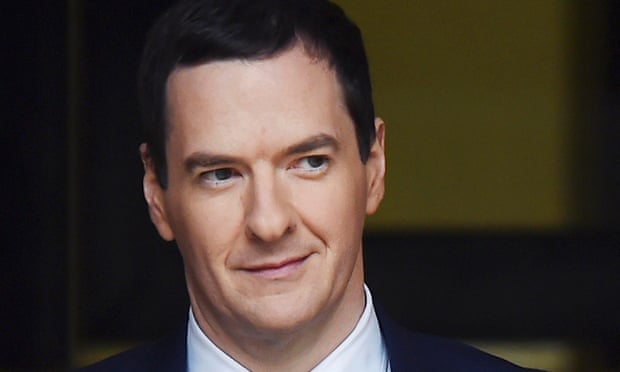

George Osborne announced a clampdown on purchases of buy-to-let and holiday properties as part of a spending review package to tackle “a growing crisis of home ownership in our country”. He said: “15 years ago, around 60% of people under 35 owned their own home, next year it’s set to be just half of that.”

Announcing the measures, the chancellor said he was setting out a “bold plan to back families who aspire to buy their own home”, amid a property boom that has seen the average UK house price rise by 6% in the year to September, to £286,000.

As well as the new higher rate of stamp duty, the announcements designed to help would-be homebuyers include:

- The help-to-buy interest-free loan scheme will be boosted for homebuyers in London. They will be able to borrow double the current £20,000 allowed under the current scheme.

- 135,000 new affordable shared ownership homes to be built for buyers earning up to £80,000 outside London and £90,000 in London.

- Public-sector land with capacity for 160,000 homes will be released

The stamp duty changes mean that from April 2016, anyone buying any kind of property alongside their main home will pay a 3 percentage-point premium. The move, which will add more than £10,000 to the upfront costs typically faced by landlords in London, is the latest in a series of moves designed to make investment in property less attractive.

The chancellor said: “[The change] addresses the fact that more and more homes are being bought as buy-to-lets or second homes. Many of them are cash purchases that aren’t affected by the restrictions I introduced in the budget on mortgage interest relief; and many of them are bought by those who aren’t residents in this country.”

He said that by 2021 the policy would raise almost £1bn a year, and £60m of this money would be reinvested “in local communities in London and places like Cornwall, which are being priced out of home ownership”.

However, experts warned that in the short term it could lead to a flurry of purchases and higher prices.

Under the new rules, buyers of second homes will face a 3 percentage-point surcharge on normal stamp duty bills. While owner occupiers buying property do not pay any tax on purchases costing up to £125,000, second-home buyers will face a 3% bill.

The average buy-to-let property cost £184,000 last year, and the change would mean a bill of £6,700 instead of the current £1,180. In London, where the typical price was £337,734, investors will pay £17,018 to the taxman, compared with £6,686 today.

The changes follow an announcement in July’s budget that buy-to-let landlords will face higher tax bills from 2017, when 40% relief on mortgage repayments starts to be phased out.

Doug Crawford, head of conveyancing firm My Home Move, said: “The stamp duty changes will turbo-charge the housing market over the next four months as buy-to-let landlords and holiday home buyers race to beat the deadline before the changes bite in April. This will inevitably push up property prices in the short term, especially in locations popular with buy-to-let investors, such as London.”

Jonathan Adams, director of estate agency Napier Watt, said he expected both investors planning to buy and those wanting a second home to bring the decision forward and do so before April.

“It is interesting that Osborne did not impose the extra tax straight away, as he did in last year’s autumn statement, but he has given potential buyers a few months’ grace,” he said. “The unintended consequence is that this could push property prices up further in coming months – the opposite effect to that intended.”

Lucian Cook from property firm Savills said that in the long term buy-to-let investors were “likely to display greater caution faced with higher transaction costs”. He said: “These buyers have historically been particularly attracted to new-build housing. That means once the changes are introduced housebuilders will be less able to rely on this type of buyer and will have to focus more on demand for the shared ownership, starter homes and help-to-buy product that is supported by other government policy.”

Richard Lambert, the CEO of the National Landlords Association, accused the chancellor of wanting to “choke off” future investment in private properties to rent.

“The exemption for corporate investment makes this effectively an attack on the small private landlords who responded to the housing crisis by putting their own money into providing homes by the party that they put their faith in at the election,” he said.

“If it’s the chancellor’s intention to completely eradicate buy-to-let in the UK then it’s a mystery to us why he doesn’t just come out and say so?” he added.

Under the new London help-to-buy scheme, homebuyers in the capital will be able to take out a mortgage for little more than half the cost of a property, after the government unveiled plans to offer interest-free loans worth up to 40% of the price.

The original help-to-buy loan scheme programme allows homebuyers with just 5% of a property’s price to buy a new-build home costing up to £600,000 with the help of an interest-free loan of up to 20% of the price.

Detailed information on how London’s scheme will work will not be released until early 2016, which is also when the scheme will take effect.

Mark Hayward, managing director of the National Association of Estate Agents, said the London scheme was “a step in the right direction” for first-time buyers, though he added: “A 5% deposit on the average price of a home in London is still not affordable enough.”

Stuart Law at Assetz for Investors, a buy-to-let estate agency, said the higher equity loans in London would “create further upward price pressure” in the capital.

However, Adrian Anderson, the director of mortgage broker Anderson Harris, said offering a 40% interest-free loan “will make a huge difference, enabling many to get on the housing ladder when they simply couldn’t before”.

He gave the example of a one-bedroom flat in Camberwell, south London, which was on the market at £360,000. A 5% deposit works out at £18,000, but if an individual did not buy via help-to-buy, they would need to raise a mortgage for the rest, which would require earnings of around £85,000, thereby pricing out many buyers.

Under London help-to-buy, a 40% interest-free loan would be available, leaving the individual needing a mortgage of £198,000. “This could be done with an income of £50,000, which is much more achievable in the capital,” said Anderson.

In another addition to the help-to-buy scheme, the chancellor announced an extension of shared ownership in England, where buyers get on the housing ladder by purchasing a part-share in a property and renting the rest from a housing association.