UK house price growth has picked up to hit an annual rate of 10.1%, a one and a half year high, but could ease in coming months amid Brexit fears, according to the country’s biggest mortgage lender.

The price of an average home rose to £214,811 in March, up 2.6% from the month before, Halifax said. House prices in the three months to March were 2.9% higher than in the final quarter of 2015. The annual rate rose from 9.7% to 10.1%, the strongest since the three months to July 2014.

Analysts said this suggested that the rush by buy-to-let landlords and second home buyers to beat April’s rise in stamp duty pushed prices up.

The Halifax figures have been stronger and more volatile than other house price surveys, but Nationwide, Britain’s other major mortgage lender, also reported a marked pick-up in house price growth, to an annual rate of 5.7% in March.

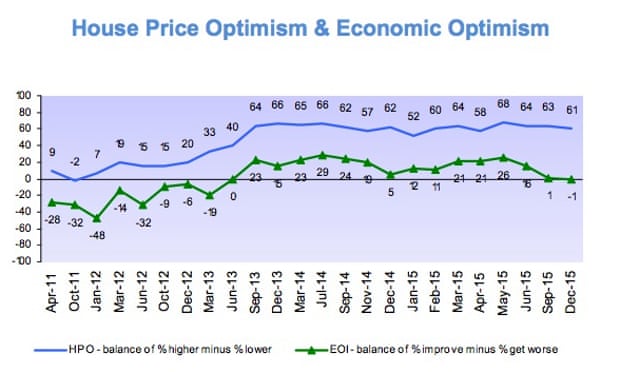

However, the next two months could see a lull, as Martin Ellis, the Halifax housing economist, explained: “Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months.

Howard Archer, the chief UK and European economist at business research firm IHS, said: “Post April, a likely waning of buy-to-let and second home interest may modestly dilute housing market activity and ease upward pressure on prices.”But in the long run, house prices are likely to push higher as demand continues to outstrip supply, experts say.

Ellis noted: “Current market conditions remain very tight with an acute supply/demand imbalance continuing despite an improvement in the number of properties coming on to the market for sale in recent months. This, together with continuing low interest rates and a healthy labour market, indicate that house price growth is set to remain robust.”

Prices of flats have risen more sharply than prices for other property types since 2008, rising 57% compared with a 37% increase for all residential properties. Detached homes recorded the smallest rise, of 20%, while terrace and semi-detached houses posted increases of 38% and 34% respectively.