The figures provide an overview of the UK housing market just before the referendum, which could affect demand and prices. Photograph: Andrew Matthews/PA

Growth in UK house prices picked up in June, but agents and analysts are warning that Britain’s decision to leave the EU will affect demand and prices in the coming months.

The average price of a property rose by 5.1% from a year ago to £204,968, according to Nationwide building society (pdf). This compares with an annual growth rate of 4.7% in May. It has been fairly stable over the past 12 months at between 3% and 6%.

The data gives a snapshot of the housing market immediately before the EU referendum.

Samuel Tombs, the chief UK economist at Pantheon Macroeconomics, said: “Following the referendum, demand likely will weaken as unemployment begins to edge up and confidence falls. Meanwhile, banks soon will reflect the recent increase in funding costs in their mortgage rates. Prices in London look particularly vulnerable, given that job insecurity has increased in the City and banks will be thinking twice about high loan-to-income lending.”

Foxtons, the London-focused estate agent, issued a profit warning this week. It believes the vote to leave the EU will limit property sales in the capital for the rest of the year.

Jonathan Hopper, the managing director of buying agents Garrington Property Finders, said the brisk pace in June was likely to be the high water mark for the property market for some time. The data showed a “functioning market with decent price growth but limited supply – a languid calm before the storm”, he added.

“Unfortunately this data is about as much use in predicting the future course of the property market as sun-dappled photos of the summer of 1914. It’s a historical record of a lost age before Europe changed for ever. The referendum result has since plunged the property market into a ‘hard reset’, especially in the higher price brackets,” Hopper said.

“While we can’t be sure how much things will slow, it’s inevitable that more nervous investors will sit on their hands while the opportunists circle. Prime central London, where most property purchases are discretionary, is the most exposed to such confidence-sapping doubts.”

Figures from the Nationwide house price index. Photograph: Nationwide

Hopper, along with some analysts, expects a soft landing rather than a housing crash.

Nationwide’s chief economist, Robert Gardner, said it was too hard to predict what would happen in London, where increased uncertainty after the vote to leave the EU could put buyers off, while the sharp drop in the pound would attract overseas investors, leading to a “Brexit bubble”.

Sign up to The Guardian Today and get the must-read stories delivered straight to your inbox each morning

Charlie Campbell, an analyst at Liberum Capital, said: “London might be more resilient than we all first thought.”

Gardner noted that landlords and overseas buyers play a larger role in the capital than elsewhere, and that recent stamp duty changes and forthcoming alterations to the tax deductibility of landlords’ expenses would affect investor demand.

Turning to the UK as a whole, he said: “Even if demand does soften a little, there’s going to be underlying demand. There are so few properties on the market.”

Data from the Royal Institution of Chartered Surveyors suggests stock on estate agents’ books is nearly at the lowest level in 30 years, as construction of new homes has been slow, unable to keep up with demand.

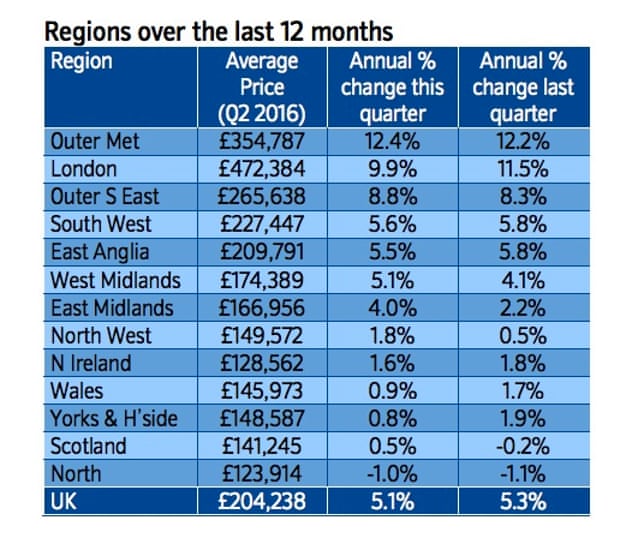

Figures from the Nationwide house price index. Photograph: Nationwide

The area around London again had the strongest rate of annual price growth of 12.4% in the second quarter, up from 12.2% in the first quarter. Despite a slowdown, London was still the second strongest region, with prices rising by 9.9% to an all-time high of £472,384 – 54% above pre-financial crisis levels.

Northern England was the only area where house prices fell in the second quarter, replacing Northern Ireland as the UK’s least expensive region. Prices in the north of England are now 9% below their pre-crisis peak.

Figures from the Nationwide house price index. Photograph: Nationwide

Following the surge in house buying in March before the introduction of stamp duty on second homes, Gardner said, it would be hard to assess “how much of the likely fallback in transactions in the quarters ahead is because buyers brought forward purchases to avoid additional stamp duty liabilities, and how much is due to increased economic uncertainty following the referendum result. Gauging the likely impact on house prices will be even more difficult”.

www.theguardian.com/