UK house prices in 2022: what the experts think

01-24-2022

Sellers’ market, what next and mortgage matters

THE WEEK STAFF

Estate agents window Shaun Curry/AFP/Getty Images

Sellers’ market

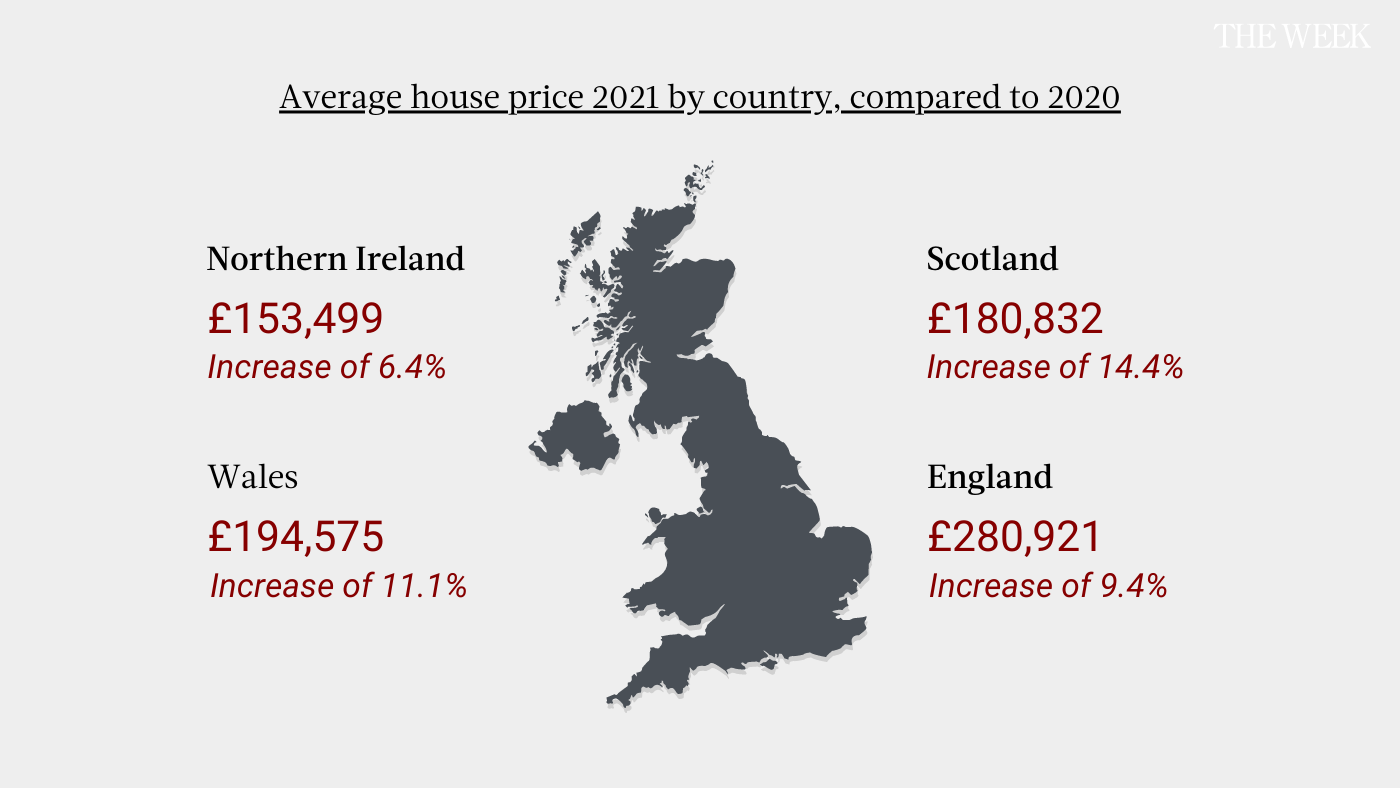

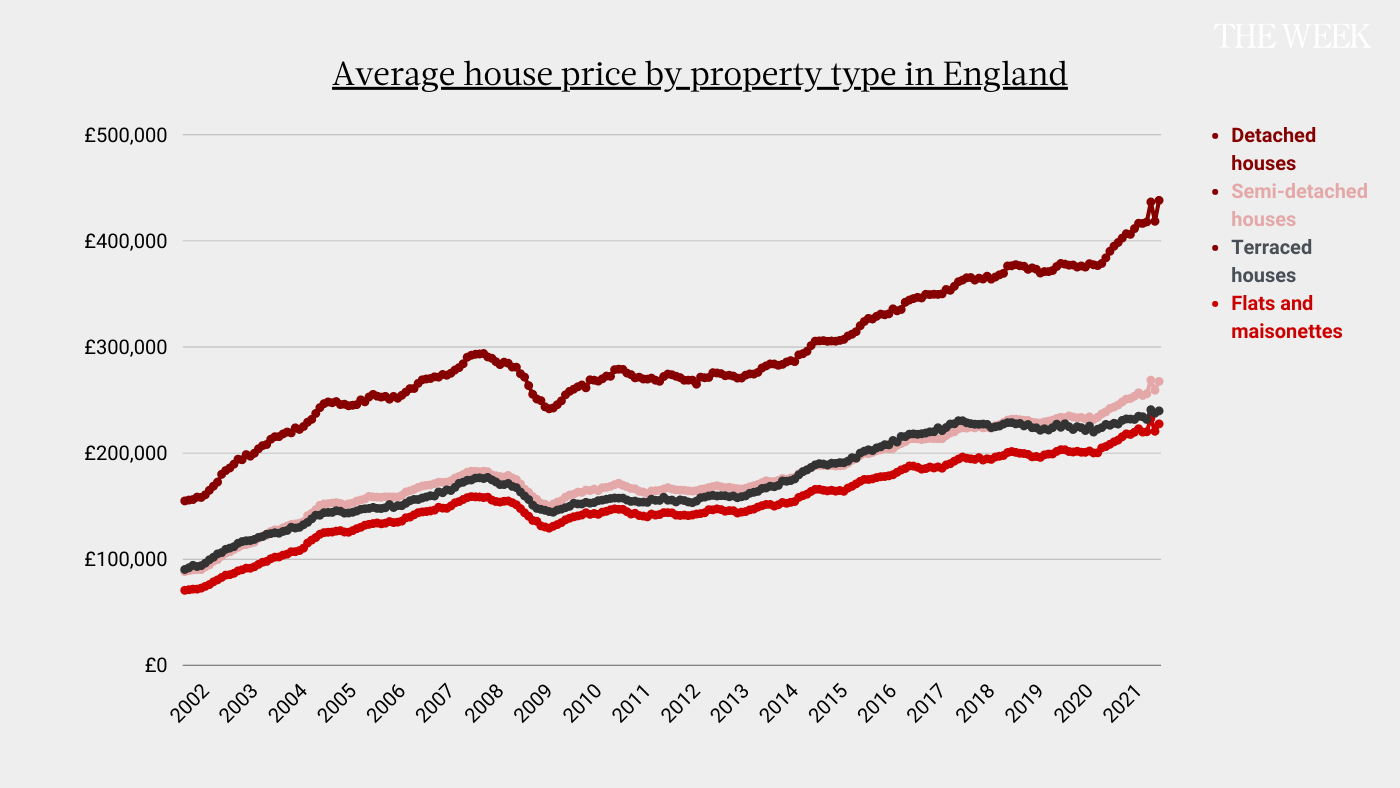

Nearly a third of homes in England and Wales sold for more than their asking price in 2021 – “twice the average over the previous decade”, said James Pickford in the FT. It’s a measure of the strength of the “sellers’ market” during the pandemic, and the impact of stock shortages. “Lockdowns, low mortgage rates and the added incentive of a stamp-duty holiday” all contributed – as did the drive for properties better suited to home-working.

House prices in England: 14 most expensive towns outside of London

Andrew Marshall, head of sales at Hamptons’ western region, reports that “competition among buyers” was “more intense than at any time in his 20-year-plus career”, with “homes of the right kind” selling “quicker than in any year on record”. By contrast, the speed of sales in London (where house-price growth was the slowest of any UK region, at 4.2%) decelerated to “a six-year low”.

2 What next?

“Given that many people brought forward purchases to benefit from the stamp-duty holiday”, price growth is expected to slow in 2022, said Investors’ Chronicle. “The prospect of interest-rate rises could also cool the market, as could affordability concerns,” noted Nationwide’s chief economist, Robert Gardner.

House price growth continues to outstrip wage inflation: a 20% deposit for a first-time buyer in London now costs £88,000, or 183% of average gross income – compared with 130% ten years ago. Still, a slowdown is by no means a certainty. “The strength of the market surprised in 2021 and could do so again,” said Gardner. “The market still has significant momentum” and “shifts in housing preferences” could keep it going.

3 Mortgage matters

Lenders are already raising prices, said Rachel Mortimer in The Sunday Telegraph. They withdrew “super-cheap deals en masse” ahead of an expected interest-rate rise from the Bank of England in November (which actually materialised in December). Although rates increased from a record low of 0.1% to just 0.25%, “sub-1%” mortgage deals “have all but disappeared”. “There are still some good deals to be had,” said analyst Katie Brain of Defaqto. But you’ll need to be quick. Nationwide, Britain’s biggest lender, is “increasing rates on some of its deals by three times the rise in Bank rate”.