Property Investing As A Passion

04-13-2019

PropertyInvesting.net team

Is property Investment The Thing For You?

With any profession or investment hobby in life, you have to be passionate about your work – otherwise its not likely to add value and work out well. But along with this – for property investors - you need to be practical, objective and pragmatic.

What is Your Passion? In every person - there is a passion for something – and th at something can make serious money if it is channelled correctly. To be a successful property investor, you need to like or love properties. You need to have some form of obsession for them. A property needs tender loving care – to maximise returns. If you can give a property this, your profitability is likely to rise sharply.

at something can make serious money if it is channelled correctly. To be a successful property investor, you need to like or love properties. You need to have some form of obsession for them. A property needs tender loving care – to maximise returns. If you can give a property this, your profitability is likely to rise sharply.

Passionate People Learn As They Go Along: If you are passionate about property – then it’s probably the single easiest way of making money for the average person in the UK. If you research things well, buy at a low prices, like doing places up at low cost and are good at managing and renting properties – and/or building and extending them – you have a very high chance of making very good money from this passion. It’s probably about the most easily lucrative passion to have. The average person in the UK will not have made any serious money out of anything except property in their lifetimes – and many do this almost by mistake. They buy a property and over time the property prices rise and their borrowings decline in real terms leading to increasing equity. This is playing the inflation game. As successive governments print currency out of thin air and create inflation - this drives up property prices. Anyone that has many properties will be well protected from the ravages of inflation. The more debt you take on and the more properties you buy, the more leverage you have to the upside whilst increasing risks on the downside.

Governments will always want to create some form of inflation to give the impression of growth in earnings and general GDP growth and prosperity. This is unlikely to change over the ne xt decades.

xt decades.

What Chance That Property Prices Will Keep Rising? Let’s look at house prices historically. The average house prices in the UK have been:

1950 £1,000

1960 £2,000

1970 £10,000

1980 £20,000

1990 £35,000

2000 £100,000

2010 £200,000

2019 £300,000

Inflation Every Decade: You get the point. House prices normally rise by 50% to 100% every ten years. This is particularly true in the UK because compared with mainland Europe, we tend to have a higher general inflation level and a weaker currency. The only way the government can pay off the national debt is to try and keep inflating it away.

Spare Time: One of the great benefits of property investment is that you can do i t in your spare time, and use the proceeds of a salaried job to fund its expansion. Only when you are making serious cashflow would you normally jack in the job and go full time into property. Property investment is a generally accepted thing to do outside work – one could describe it as a very lucrative hobby – most people own homes and if you have a few more, no one is really going to bat an eye-lid. In any case, you don’t have to tell anyone – they will only get jealous and be under a false illusion that you no longer need to work. This is dangerous for your job prospects of course. Our steer is – don’t talk about property at work, because people will start thinking you care more about your outside passion for property than your job – and this would often indirectly lead to you either losing your job or not getting new job opportunity.

t in your spare time, and use the proceeds of a salaried job to fund its expansion. Only when you are making serious cashflow would you normally jack in the job and go full time into property. Property investment is a generally accepted thing to do outside work – one could describe it as a very lucrative hobby – most people own homes and if you have a few more, no one is really going to bat an eye-lid. In any case, you don’t have to tell anyone – they will only get jealous and be under a false illusion that you no longer need to work. This is dangerous for your job prospects of course. Our steer is – don’t talk about property at work, because people will start thinking you care more about your outside passion for property than your job – and this would often indirectly lead to you either losing your job or not getting new job opportunity.

Passionate: If you are interested in property investment, you have to ask yourself – are you “passionate” about it, because it really does help if you have passion or obsession with property. You like working on it, always looking to grow, improve and have high standards. You aspire to live in a gigantic house – it helps drive you having this “dream.” If you are only interested in making money from property – you probably won’t be very successful. You really need to put a lot of effort and soul into property investment. It might mean decorating properties in the evening in your spare time, coordinating contractors and doing reams of paperwork and tax returns – the books. If you don’t dread this – in fact if you like it or lo ve it – you will probably do very well in property investing.

ve it – you will probably do very well in property investing.

Brilliance: In any walk of life – the very brilliant people have a combination of:

• Skill, knowledge and experience

• Passion (or obsession)

• Hard work

Re-enforcing: One thing normally leads to the rest – they are self re-enforcing. For instance, if you have a reasonable artistic skill, and start to paint, your knowledge and skill will develop with passion (obsession) and hard work. You will then through practice get a lot better – and could then become famous. If you have the skills, but don’t work hard and/or are not passionate (or obsessed) then you will never be a famous brilliant artist. Exactly the same is true with property. The more property experie nces you have the more properties you own and have to renovation and let out – the more you will learn.

nces you have the more properties you own and have to renovation and let out – the more you will learn.

The More You Practice the Luckier You Get: This also goes for property investing – if you are passionate and obsessed about property investing – you will research, read, analyse, then with hard work and some reasonable levels of skill-knowledge you will get better and better at property investing then end up making serious money. But if you think you can make serious money by not working hard at it – forget it – it’s not going to happen. We hate to disappoint you, but you might as well stop before you start. Very few property investors made serious money by not putting some focussed effort and/or hard working into their portfolios. As Greg Norman, the world famous golfer once said, the more he practiced, the luckier he got. If you practice through hard work – you will become a better (or “luckier”) property investor.

Natural Traits: Obviously some people have a knack in business and property investment – they are particularly savvy at unearthing bargains and doing excellent deals, but if you research, practice, focus and try hard yourself, you will probably find you also get good at it – if you follow certain methodologies. It does not matter what gender, race, colour, age, background you are from – if you can work nicely with people, and have a good reputation with banks, then you can make serious money. Don’t hold back whatever you do.

Low Ball Offers a Must: One example of a “methodology” – is finding the most central flat in a large city with lowest prices – and putting in low ball offers on 5 properties in a rotating time-sequence until someone accepts. Making sure all the properties are structurally sound but need simple renovation and/or repair to make them look good again and add value. And not being “wedded” to one particularly property – as long as the price is right on your chosen “picks” then you should go with it even if it’s not the one you would necessarily want to live in.

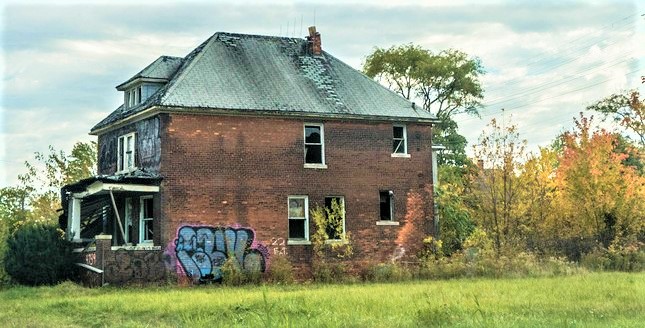

Superficial Grottiness: For instance, properties with heavy smokers, graffiti, awful decorative colours, old bathrooms and kitchens, un-kept gardens – they all go for massively below normal market value. The trick is to keep you eye on such bargains – then see through the superficial eye-sores – and make low-ball offers for such properties – then simply fix them up – by decorating, tidying, cleaning, repairing, cutting the grass. It means some hard work, but you can make tens of thousands of pounds in value added and rapidly by using this simple strategy.

Victorian Property in Central “Leafy” Areas: Remember in large UK cities, professional high earning people and families like to live in leafy areas that are close to the city centre and good  schools, where the houses are spacious but older. So its best to try and focus on Victorian or older housing in nice areas, but in need of re-decoration and some simple upgrades. Victorian and Edwardian properties normally sell for a premium versus 1950s or 1970s properties – but we aren’t building any Victorian properties anymore – they are normally central and in more prosperous areas – and people love the terraces as long as they are fairly specious (not back-to-back in the north). The closer they are to high paid professional jobs the better – and longer term – these are the properties that will continue to climb – particularly if the Tories stay in power. This is particularly true in major cities like Leeds, London, Edinburgh, Manchester, Birmingham, Cambridge, Oxford, Bristol and Southampton. Wealthy young professional families also like to be in areas with large prestigious Universities – and you will find money follows education – so properties around top Universities and Schools will see prices rising faster than areas with poor education or no major colleges (like Barrow-on-Furness, Redcar, Morecambe Bay, Bodmin). But if you look at Lincoln, York, Warwick, Falmouth, Exeter, Lancaster, Bath – you will find towns and small cities with good universities that have property prices rising sharply.

schools, where the houses are spacious but older. So its best to try and focus on Victorian or older housing in nice areas, but in need of re-decoration and some simple upgrades. Victorian and Edwardian properties normally sell for a premium versus 1950s or 1970s properties – but we aren’t building any Victorian properties anymore – they are normally central and in more prosperous areas – and people love the terraces as long as they are fairly specious (not back-to-back in the north). The closer they are to high paid professional jobs the better – and longer term – these are the properties that will continue to climb – particularly if the Tories stay in power. This is particularly true in major cities like Leeds, London, Edinburgh, Manchester, Birmingham, Cambridge, Oxford, Bristol and Southampton. Wealthy young professional families also like to be in areas with large prestigious Universities – and you will find money follows education – so properties around top Universities and Schools will see prices rising faster than areas with poor education or no major colleges (like Barrow-on-Furness, Redcar, Morecambe Bay, Bodmin). But if you look at Lincoln, York, Warwick, Falmouth, Exeter, Lancaster, Bath – you will find towns and small cities with good universities that have property prices rising sharply.

• If you are not convinced that property investing is for you – that you don’t like hard work and are not passionate enough about it – that’s fine and a good call – you just need to find something whatever it is that you are truly passionate about and see it through.

• If you love taking care of babies, why not start a creche?

• If you love fashion – then what about being a fashion designer – or making beautiful dresses or suites?

• If you love sports – then be a sportsperson – teach sports – coach – set up a fitness school – any passion can make money.

Obsession: The good news for people at propertyinvesting.net net is – that we are passionate to the point of obsession with property investment – and this sees us into making serious money. B ut you can’t do it without property research and building up your knowledge-skill base – which is why we set up this website to help fellow investors for free.

ut you can’t do it without property research and building up your knowledge-skill base – which is why we set up this website to help fellow investors for free.

Enjoy and Make Serious Money: There is nothing more enjoyable than immersing oneself in a passion that also makes serious money – and you can see it in front of your eyes – every time you do an upgrade, improvement and spend not much money to add a lot of value, whatever you do to your properties.

Other Traits: A few other key traits to consider:

• You have to be positive but realistic when you property invest.

• You have to identify and retain good service provides – like builders, letting agents, maintenance people – and dump any underperforming people rapidly. You should not accept poor performance, you should have high standards – always pay on time – as quickly as you can to builders and maintenance people then they will always want to work for you as long as you are fair and reasonable.

• You have to stay healthy – not drink lots or take drugs – to be objective, hard-working and respected by your suppliers and customers. Don’t think you can drink lots and make serious money – alcoholism (and also drugs) are about the fastest way to poverty and early death, make no mistake.

Open Minded – No Snobbery: In property investment, one needs to be very open minded about where to invest in. You need to be very objective. For example, if you firmly believe from your research that the rich will keep getting richer, and the poor will tread water – then you should focus on investing in the wealthy areas like Kensington and Chelsea in London. But if you firmly believe there will be a big re-distribution of wealth to the lower middle classes and working classes – then you might choose to invest in places like Rotherham, Bury, Middlesbrough, Bradford, Swansea and Barrow-in-Furness. Its not good to be either snobby or an inverted snob. You should try and leave your political views out of it – but instead understand what the political parties will do if they are in power.

Labour in Power: Beyond any doubt, if Labour get into power – then property prices will drop across the board – but particularly in the expensive southern areas and London. There would be more public sector spending, more public sector jobs and this would benefit northern and western plus rural areas that are deprived. Inflation would rise, borrowing costs would rise, Sterling would crash and u nemployment would eventually rise as the country dipped into stagflation. Certainly business investment would drop – their might be an immediate large public sector pending spree but this money would rapidly run out and overall growth would decline. Because of a weaker Sterling – this would likely lead to higher import costs, higher inflation and thence higher interest rates. Having a Labour government would be positive for renters and people with very low or no wages and the public sector.

nemployment would eventually rise as the country dipped into stagflation. Certainly business investment would drop – their might be an immediate large public sector pending spree but this money would rapidly run out and overall growth would decline. Because of a weaker Sterling – this would likely lead to higher import costs, higher inflation and thence higher interest rates. Having a Labour government would be positive for renters and people with very low or no wages and the public sector.

Tories in Power: If the Tories keep in power, property prices are likely to keep rising, particularly in the more expensive southern areas and London – where private sector will do fairly well and the public sector will continue to get hammered with jobs losses – as the re-balancing from the high spending days of Labour continues. Inflation would stay more subdued, interest rates would stay lower, unemployment would stay low and Sterling stronger than under Labour. Having a the Tories in government is positive for the debt/spending levels of the country – and hence more secure for investors leading to lower interest rates.

Draconian Taxes: Now regardless of who you vote for – if you really thin k Labour are about to get into power – it’s probably best to divest your property portfolio rapidly. Regardless of the political party in power, the building levels will definitely in our view stay very low – particularly with all the Brexit uncertainties and meanwhile the population continues to expanding dramatically. Also the draconian taxes on buy-to-let landlords will almost certainly not be reverses, so a rental crisis will start breaking out shortly – a really big shortage of rental accommodation particularly in London and SE England where businesses are expanding – no building is taking place, property prices and borrowing levels are highest and hence the taxes hit buy to let landlords the most and drive them ot of the market. Just where the most rental accommodation is required, its where there is the biggest tax deterrent for property landlords. Crazy. Anyway, expect rents to rise as inflation keeps rising as oil prices rise and interest rates rise – a massive triple bad whammy for SE buy-to-let landlords many of whom will start to sell up shortly – because of the giant tax bills – leading to an even greater rental crisis.

k Labour are about to get into power – it’s probably best to divest your property portfolio rapidly. Regardless of the political party in power, the building levels will definitely in our view stay very low – particularly with all the Brexit uncertainties and meanwhile the population continues to expanding dramatically. Also the draconian taxes on buy-to-let landlords will almost certainly not be reverses, so a rental crisis will start breaking out shortly – a really big shortage of rental accommodation particularly in London and SE England where businesses are expanding – no building is taking place, property prices and borrowing levels are highest and hence the taxes hit buy to let landlords the most and drive them ot of the market. Just where the most rental accommodation is required, its where there is the biggest tax deterrent for property landlords. Crazy. Anyway, expect rents to rise as inflation keeps rising as oil prices rise and interest rates rise – a massive triple bad whammy for SE buy-to-let landlords many of whom will start to sell up shortly – because of the giant tax bills – leading to an even greater rental crisis.

Trends with Younger People: Its worth pointing out – relevant to both more elderly and younger investors, that you people are probably less interested in owning than people say 30 years ago. This could simply be because it is so difficult to buy a property these days since property prices are so high. For instances, in the 1960s, price-to-earning ratios for homes was round 3.5 – whilst in SE England, they are something like 10 times. Furthermore in the early 1990s, you only needed 5% down deposit – now its more like 20%. It use to take 1-2 years to save up to buy a property. Now it ta ke more like 10 years.

ke more like 10 years.

Student debts - are another consideration – in the 1980s there were no student debts – and only 5-10% of 21 years olds had been to University. Now the average student debt is around £50,000 and 50% of people who are 21 have been to University. These debts depress people desire to buy property – since its another debt to pay off – some people even prefer to pay off their student debt before buying a home. Any wander most young people are renting these days. This is not likely to change any time soon.

Zero Hours Contracts: The other very negative thing is that young people normally don’t have steady salaries professional jobs anymore -the often have multiple zero hours contract jobs – and this makes it more difficult to go to then bank and get a mortgage.

Double Incomes More Women Working: Counter to this is that in 1990 for instance, interest rates were at 15%, few women worked and most mortgages were raised by one “bread winner”. These days, far more women work, there are far more double income partnerships, interest rates are around 3-4% and compared to renting – its actually cheaper to fund a mortgage than pay rent. Economically – its far better to buy a property – particularly looking at the prospects for inflation in the future and house prices continuing to increase because of an expanding population and shortage of house supply.

Social Media World: The other interesting tre nd amongst young people is that in this social media world of Instagram images and Facebook selfies – young people tend to want to travel, spend lots on travelling – going to exotic locations then share their experiences on social media. This is something that never happened through to the year 2000. People might have taken a few still photos and shared them over the table with a few friends – but there was never such competitive pressures to look good from all quarters. What we are saying is – many young people with high student debts, high rental costs, insecure jobs and many friends on social media have simply “thrown in the towel” – they realistically never expect to ever own a home. This is creating a whole generation of renters. This new strong rental demand has got to be met by the private sector landlords since there is almost zero new social housing being built. Meanwhile, successive government and Chancellor keep adding new tax and regulations that dent profitability and operability for Landlords – driving many out of the market. Landlords need to be very organised and robust to survive the waves of regulations and potential litigations by tenants and councils for any mino

nd amongst young people is that in this social media world of Instagram images and Facebook selfies – young people tend to want to travel, spend lots on travelling – going to exotic locations then share their experiences on social media. This is something that never happened through to the year 2000. People might have taken a few still photos and shared them over the table with a few friends – but there was never such competitive pressures to look good from all quarters. What we are saying is – many young people with high student debts, high rental costs, insecure jobs and many friends on social media have simply “thrown in the towel” – they realistically never expect to ever own a home. This is creating a whole generation of renters. This new strong rental demand has got to be met by the private sector landlords since there is almost zero new social housing being built. Meanwhile, successive government and Chancellor keep adding new tax and regulations that dent profitability and operability for Landlords – driving many out of the market. Landlords need to be very organised and robust to survive the waves of regulations and potential litigations by tenants and councils for any mino r irregularity. The stress of handling bad tenants and challenging councils/regulators means mang Landlords gave up years ago. Young people simply don’t want to get involved in this business. They what more of an instant gratification rather than a longer-term financial gain. They certainly want to try and avoid such responsibility. Who can blame them.

r irregularity. The stress of handling bad tenants and challenging councils/regulators means mang Landlords gave up years ago. Young people simply don’t want to get involved in this business. They what more of an instant gratification rather than a longer-term financial gain. They certainly want to try and avoid such responsibility. Who can blame them.

Property Investors Older: This means that the property owning and property investing community is getting older on average by the day/year. It’s the older investors – Landlords – that are okay taking this responsibility – and providing the demands from the younger generation. Where are this leads is anyone’s guess. But what we would say is that if you are young and are able to buy your first property when you are still very young – then have a few lodgers to help pay the rent – you will be on a fast-track to very high wealth one day. You will leave all your young friends behind in the wealth stakes – they won’t think its particularly trendy though. What it needs is long term dedication and financial discipline:

• Saving for a deposit

• Avoiding spending on holidays, clothes, travel, meals out, Uber and Airbnb

• Working hard at a salaried higher paying secure job

• Borrowing or getting hand-out from a wealthy family members to get a “leg up”

Rich Kids Poor Kids: This brings us to the final point – that regrettable for society – the kids with rich parents will always manage to get a property – help with a deposit and a guarantor for a mortgage – this will put them on the fast-track. But if you have poor parents and a non secure low paid job – and are living in an areas with fairly high house prices, it will take a long time and be very difficult to buy a property in a ten year time frame.

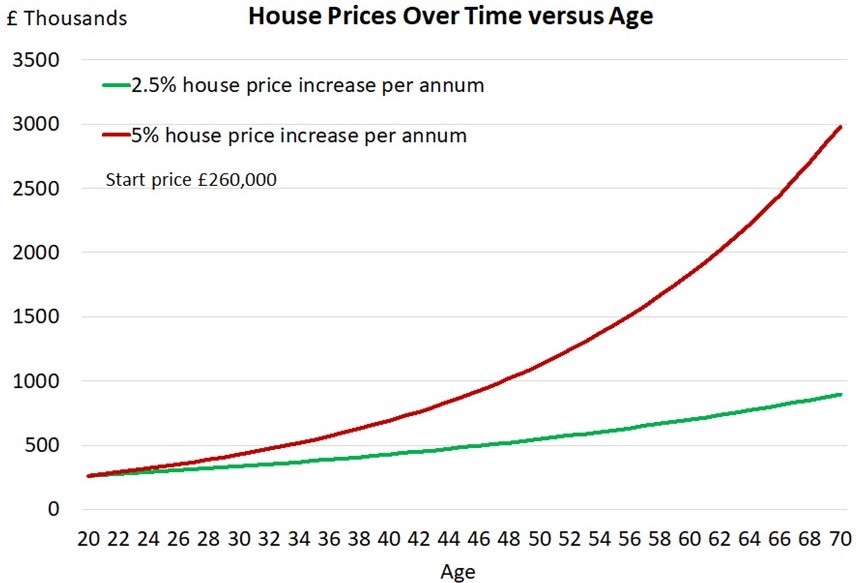

Start Young: Because of the time value of money – the inflationary aspects, someone that buys a property age 20 is likely to have double the property wealth when they retire aged 60 compared with someone that starts around 13 years later age 33 as the below graph shows. For example, shows that some buying a property age 20 at £260,000 with 5% inflation through to age 33 would have the same property valued at £520,000 13 years later and hence will have made an additional £260,000 - but by age 70 their total net worth would also be double by starting 13 years early. This demonstrated how important it is to start young.

We hope you have found this Newsletter insightful. If you have any comments or queries, please contact us on

enquiries@propertyinvesting.net . All the best for your property investing.