Property Investors Update - Post Brexit Outlook

02-01-2020

PropertyInvesting.net team

Brexit finally out: At 11pm UK time 31 January 2020 the UK finally left the EU. Whilst 50% of the population probably feel quite a bit of trepidation and stress, our view is long term it will be better to be out for the UK in view of:

Upholding democratic values unshackling the UK from the non elected Brussel Eurocrats

Upholding national laws no longer will the UK have to put up with often ridiculous EU laws imposed on the nation

Getting out of the EU before an EU Army is created an idea that was proposed just before the 2016 Referendum

Ability to avoid uncontrolled migration of EU nationals and refugees - whilst having to turn away migrants from Commonwealth countries and developing nations

Ability to attract financial businesses by creating competitive tax incentives for a truly global financial sector that supports the fast growing 5 billion people in the developing world (instead of EU nations that total 0.5 billion population)

Putting a stop to payments to the EU - most of which never returned to the UK in the form of investments in infra-structure

Mitigating against the risk of Euro debt contagion and/or the break-up of the EU project and all the fall-out

Euro: Looking back, its a good job the UK never joined the Euro currency because this would have made it far more difficult to unshackle ourselves from Brussels, and the UK would have been beholden to Euro interest rates regardless of how our inflation and economy was acting.

Why Did People Vote Brexit: If one can try and look at Brexit objectively may be the tipping point was a number of things coming together by June 2016:

Firstly they were offered a Referendum in large part because of the rise and threat of UKIP (then Brexit) parties that threatened a Tory majority over Labour ever since around 2013 - the Tory party succumbed to pressure from Farage and held the Referendum - allowing people to vote.

Thinking back to the fact the UK joined the Common Market in 1973 in large part to p revent the risk of Europe ever going to war again - but it got out of control - and Brussels slowly took over

revent the risk of Europe ever going to war again - but it got out of control - and Brussels slowly took over

In addition, a realisation that the EU machine wanted far more EU Integration in future years the status quo was not achievable - it would only get worse culminating in plans for than EU Army controlled by Brussels

Refugee crisis after wars in North Africa and the Middle East exacerbated by a serve desert climate and resources shortages and people's concern on this point looking at the challenges that face Greece, Italy and Spain

Half the population was sick of the Eurocrats telling the UK what to do with new laws imposed even though they are appointed in Brussels and not elected

Concern the UK was wasting money on the EU projects in far off places the benefits not outweighing the costs

Many people in the far off UK provinces saw no evidence that EU funding was helping them they came out motivated and strongly in protest and voted for Brexit (whilst many of the Remainers were less motivated, or thought Remain would win and did not bother to vote particularly amongst the younger population - the younger first time voters also did not have much experience of voting - the process/options)

Realisation that the EU started 47 years ago with a Common Market but had got so far it crept up on the UK citizens. Meanwhile the fastest growing areas are - China that has 1.7 billion people, India that has 1.3 billion people and USA 0.36 billion that has people and the UK was not able to do any trade deals with them incredible. The UK was not even allowed to do trade deals with our Commonwealth neighbours. EU citizens were treated far better than the Commonwealth citizens despite the UKs historic connections.

Dis-trust that the all economically powerful German-Franco axis was creating an economic fortress working against the UKs interests (and probably some festering resentment particularly in the very elderly that all the British efforts to liberate Europe in WWII was not being recognized)

Global Opportunities: Its worth pointing out though the vote was Brexit 17.2 million and Remain 16 million if one break it down into constituencies - modelling this - it was 460 for Brexit and 260 for Remain. Leave voted most strongly in 270 counting areas whilst remain only came first in 129 voting areas. The turnout was high with 72% of people voting. Translated into the election, the UK had a similar majority. The cities tended to vote Remain, particularly London which is the only socialist stronghold now in the UK - and everyone else voted Brexit apart from Scotland and Northern Ireland.

Tory Opportunity Seized: At the end of the day, Boris Johnson waited for his opportunity as his ratings rose steadily from the depths of Teresa Mays crash PM exit and Tory turmoil, wh ilst Corbyns ratings crashed then he chose the moment of maximum Brexit emotion and negativity towards both the Lib Dems and Labour who were clearly seen by the electorate to block Brexit (and the will of the people) for their own political ends - against national interests then mounted an exceptionally effective campaign focussed within the far off provinces to convince all the wavering voters with a simple message Lets Get Brexit Done and please lend me your vote so we can get it done. Then the predictable happened - he won a huge majority. Corbyn and Swintons strategies completely and spectacularly back-fired. Yes, we had an Eton educated posh elite Londoner travelling all around the UK properly engaging with the average UK citizen and die hard Labour supporters - many in ex-mining districts to convince them to vote Tory, a pretty incredible feat. And particularly humiliating for Corbyn since they chose Johnson over himself the peoples leader. And Corbyn is still maintaining the loss was nothing to do with himself, he still has not resigned, he still surrounds himself with his followers and he still maintains he has some great policies, and the best policies? Do you detect some arrogance in this? it certainly does not bode well for the future learning within the Labour party repeating old mistakes - or their ability to win the next election in 2024.

ilst Corbyns ratings crashed then he chose the moment of maximum Brexit emotion and negativity towards both the Lib Dems and Labour who were clearly seen by the electorate to block Brexit (and the will of the people) for their own political ends - against national interests then mounted an exceptionally effective campaign focussed within the far off provinces to convince all the wavering voters with a simple message Lets Get Brexit Done and please lend me your vote so we can get it done. Then the predictable happened - he won a huge majority. Corbyn and Swintons strategies completely and spectacularly back-fired. Yes, we had an Eton educated posh elite Londoner travelling all around the UK properly engaging with the average UK citizen and die hard Labour supporters - many in ex-mining districts to convince them to vote Tory, a pretty incredible feat. And particularly humiliating for Corbyn since they chose Johnson over himself the peoples leader. And Corbyn is still maintaining the loss was nothing to do with himself, he still has not resigned, he still surrounds himself with his followers and he still maintains he has some great policies, and the best policies? Do you detect some arrogance in this? it certainly does not bode well for the future learning within the Labour party repeating old mistakes - or their ability to win the next election in 2024.

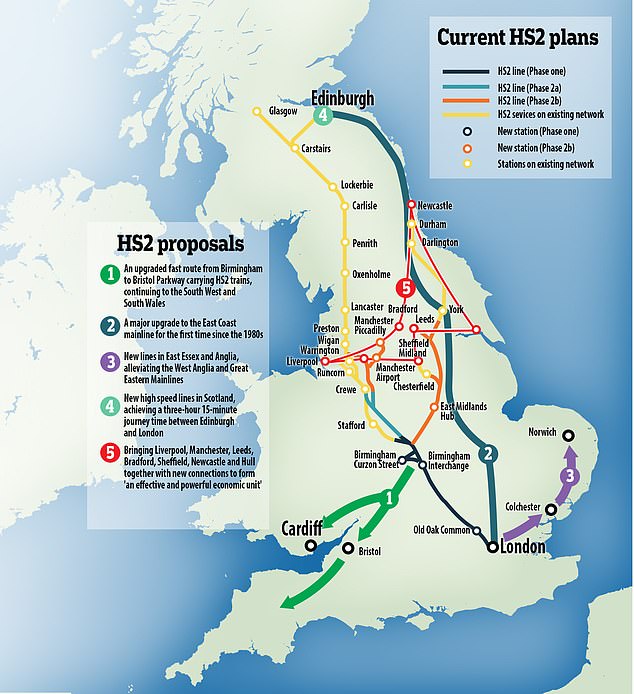

Initiative Moving Fast: Since Boris Johnson took over, he seems to have almost on his own (with some effective advisers for sure), turn the Brexit constitutional crisis around, eradicate the threat of ultra-negative neo-Marxist Corbyn and a messy socialist coalition then achieve Brexit in the space of 3 months flat. He also got the DUP and Sinn Fein together to re-start Stormont further cementing ultra-important Northern Ireland the peace agreement. On 31 January he held the first ever Cabinet Meeting outside London in the city of Sunderland. It looks odds on that HS2 will get the green light in some shape or form. Hes also almost green lighted 5G. He seems to be going extremely fast with his initiatives/projects and it bodes very well for the next 4 years. We also think Johnsons strategy of getting his Cabinet Ministers to work hard, deliver initiatives that help the average UK citizen and stop being ego-centric appearing on TV / Twitter all the time is going to work very well indeed. It will be very popular. Basically the electorate are sick of politicians being in the limelight - polishing their egos and want them to deliver services, improvements and well-being for the voters. You can already see this happening its super. The North and Midlands will get particular attention. There will also be far more direct central control from 10 Downing Street. With the stable Tory majority plans for significant investments particularly in the Midlands and northern England we expect the following to happen in the next year:

GDP growth rate to pick up from trending 1% to 2.5%

Unemployment to remain very low at current levels

Inflation to start picking up from around 1.7% to 2.5% by year end

Go fast on 5G, infra-structure development facilitating private foreign investment and growth

Boom on the Cards: House prices will to start booming almost across the board. We see massive new foreign investments into London as people look forward to a financially liberated London and stable centre-right business friendly government for the next 4 years. We also see booming house prices in the Midlands and North as investors get going in cities like Manchester, Leeds, Birmingham, Newcastle, Liverpool and also smaller cities like Sheffield, Nottingham and Derby. Boris Johnson has promised a levelling up he desperately wants to reward Labour voters for voting Tory and win their hearts for the end 2024 election that hes already planning for. We expect therefore to see healthy house price growth in the cities mentioned above. There should be a ripple effect out from these city areas into the more rural areas. Areas with holiday homes should also see house prices rise sharply.

London and SE England: Established wealthy areas like Oxford, Cambridge, Reading and Southampton should also see house price growth though this might be at rather lower rates than further north this time. West London house prices will start to see large increases as some of the super-rich within the 7 billion people living globally buy London property. Remember how super London is foreigners know this:

Excellent shops, theatre, cafes, restaurants, pubs, nightlife, hotels, museums, attractions one of the top few global tourist destinations

Excellent schools, universities

Exceptionally wooded most of London is either parks or gardens (it can be classified as a forest in view of the number of trees believe it or not check it out on Google Earth)

Super transport tube, rail, taxis, buses all relatively safe (compare with Los Angeles or Cape Town if you dont believe us)

Population density four times less than Paris

Best, largest and most successful financial services sector in the world all the services for business-investment you would ever need

Cool climate in the summer and warm in the winter temperate (22 deg C in summer, 5 deg C in winter) to put this into perspective London if further north than Newfoundland and end January London temperatures were +10 deg C whereas Newfoundland was -20 deg C)

For the super-rich wealthy global elite London is a huge attraction and it's little wander so many billionaires live in London. We expect this to take a big tick up now that the Torys have a majority and people start moving in again now the uncertainty is lifted.

Trade Deals: Although the trades deals have to be struck, and there will always be some negative news flow around this, we dont expect a significant dent in the economics or investment because of this despite all the scare stories. Remember 50% of people never wanted to leave the EU so we will always get lots of negative stories on the treats of no trade deals being struck. Lets also remember we import more from Europe that we export to them so the EU cant afford not to have a trade deal and they certainly dont want a Hard Brexit Trade Deal either since it would damage their exports the UK would go other places instead somewhere else within the 7 billion people in the world.

5G the Real Story: Just a final word on 5G and Huawei. We believe the threats around the security aspects of 5G from the USA are a smoke screen tot he real issue. The simple fact is the Chinese are 2 years ahead of the US developing this 5G technology. Boris Johnson wants 5G fast to help UK business rapidly expand - create a business boom. The USA could not offer the same they had no offering. They must also be deeply worried that the UK will steal a march with the 5G on financial services and high-tech foreign inward investments thats why they wanted to stop it. So well done Boris Johnson for resisting the pressures. Because in a few years time the GDP might get a huge boost as some of the 7 billion people in the world businesses decide the UK is the best place to start or expand their businesses because of super fast efficient 5G broadband. London and the whole of the UK outside the EU, with competitive tax regime and 5G with stable centre-right government - its going to be a VERY attractive proposition. Hence our bullishness on house prices. However, it has to be said there are real security concerns having Huawei and the Chinese building our long term high-tech communication network, especially if this is linked up to our military and intelligence networks.

UK citizens should be proud and positive: Finally its about time the UK citizen started to get back their pride forget the navel gazing and self esteem crisis we should be really looking forward to our great country doing some super things again in a united way. It really is opportunity rather than threat. And this message seemed to have resonated with the electorate 12 Dec 2019. Forget the negativity lets go for the opportunity.

We hope this Newsletter has been insightful and given you an interesting prospective on Brexit, the UK economic potential and property investment in the next five years. If you have any queries, please contact us on enquiries@propertyinvesting.net.

For Reference - all the HS2 options being considered: