Property Market Update Post COVID-19 Lockdown

07-03-2020

PropertyInvesting.net team

Massive Economic Damage: The COVID-19 pandemic is and will have a lasting impact on the UK property market and the way people work for years to come. Its been a massive economic shock and the ramifications will take a long time to play out. The key negative to house prices and marke t activity overall is far high unemployment in the short to long term as the economy takes years to fully recover from the COVID-19 shock.

t activity overall is far high unemployment in the short to long term as the economy takes years to fully recover from the COVID-19 shock.

Market Depressing Criteria: Let's firstly take a look at variables that will depress house prices then follow with items that will stimulate it.

Far higher unemployment

Tough jobs market suppressing wage growth

Less variety of mortgage lending and tougher tending criteria, an end to most 95% mortgages

Buy to let landlords that start to sell down their portfolio as tenant demand decreases and unemployment rises

Overhang of new builds - built in the period up to March 2020 that need to be sold

Tax rises to pay for COVID-19 response likely by March 2021

Market Boosting Criteria

Lower interest rate and mortgage rates - making purchase more attractive than renting

Government stimuli for first time buyers

Lack of new home building because of the COVID-19 shock lower home starts - along with growing population in most areas-cities

Possibility that the main 3 month COVID-19 shock passes rapidly into the distant memory if no further lockdowns announced and people start to look forward with confidence

memory if no further lockdowns announced and people start to look forward with confidence

Furlough system protects the market from a major downturn

Low oil price dropping from $70/bbl in 2019 to $40/bbl July 2020 stimulates the economy

Bank of England currency printing stimulates the economy and general inflation that then feeds through into house price increases

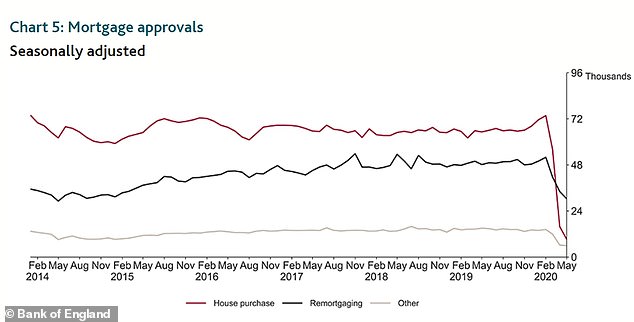

Mortgage Approval Crash: Of particular note and concern is the 90% mortgage approval crash in May 2020 compared to Feb 2020 before COVID-19 hit. Thats massive. If mortgage are not being approved it points to significantly lower house prices and more subdued market conditions. Of course at the end of the Lockdown when so many people had been Furloughed, mortgage companies were going slow with approving plus the market was almost dead after Estate Agents closed one can expect a big drop. But a 90% drop is quite worrying and it will take a long time before numbers bounce back to the Feb 2020 rate if ever it could take until 2022 for instance.

House Prices May: What is surprising is that house prices so far have stayed so resilient. Indeed the last Rightmove survey mid-June indicated that in most areas particularly outside London prices actually rose. Its possible that pent-up demand from the period mid March 2020 to end June 2020 is leading to a short low level boom but we expect prices t o sharply dip by Sept-Dec 2020 as the higher unemployment rates start to kick-in across the country. Expect to start seeing house price reports for the next few months showing house price declines in most areas.

o sharply dip by Sept-Dec 2020 as the higher unemployment rates start to kick-in across the country. Expect to start seeing house price reports for the next few months showing house price declines in most areas.

Post-COVID-19 Behavioural Changes: Its also worth pointing out that there will be quite a few behavioural changes in the UK as people reflect on their individual and family COVID-19 Lockdown experiences and adjust their lifestyles accordingly. Lets give you some examples of changes in culture-behaviours - triggered by the pandemic that are likely to be seen in some shape or form in the property market henceforth -

The importance of:

A garden to sit outside (with options to meet people, sunbath and exercise)

In cities terraces and balconies (allowing people to sit outside, preferably south-west facing)

Proximity to green spaces and parks

Broadband quality-speed and access

Car parking to allow access to and from property without using public transport

Leafy areas well away from the most densely populated areas but close enough to businesses-offices

Outside Space: We are likely to see the price of flats with outdoor spaces hold their value better than those without any outside access. Areas close to large parks like Richmond (London), Headlingley (Leeds), Edgbaston (Birmingham) are likely to see their prices hold up better than most. High rise areas with flats, no balconies and very dense population will likely see prices dropping.

Fastest Drop: Areas that are likely to see prices drop the most and fastest are remote rural areas with poor broadband connectivity and many holiday lets and holiday homes where people will be forced to sell in part because the holiday let market and tourism has been so badly impacted in the period 23 March to 4 July 2020. There will undoubtedly be destressed sellers in places like Cornwall, south Devon, Cumbria-Lakes, coastal Dorset second home owners that decide to cash-in after a very bad season. However, these areas are also popular for people wanting to "get away" from cities and there could be a boost from people re-locating and working from home - time will tell. Regardless - there's going to be a switch around in the market in such areas.

Stagflation: Overall the economy is tanking and though the emergency measures wi ll help its just currency that is formulated from thin air electronically - and will eventually lead to stagflation thats low growth with higher inflation to pay for the economic shock and lack of productivity and tax returns during the period 23 March to say Sept 2020. We expect food prices to rise sharply by the end of the year.

ll help its just currency that is formulated from thin air electronically - and will eventually lead to stagflation thats low growth with higher inflation to pay for the economic shock and lack of productivity and tax returns during the period 23 March to say Sept 2020. We expect food prices to rise sharply by the end of the year.

Borrowing Costs Drop: Its helpful that mortgage rates have dropped and government support for businesses and individuals will cushion the blow, but the key downer is far higher long term unemployment as many service related jobs have simply disappeared and may never come back. That said, borrowing will be more difficult as banks say cautious as prices drop.

Jobs That Will Dry Up: Just a few jobs that will probably never recover:

Cafι-restaurants - waitress/waiter/cook

Shops high street shopkeepers (particularly those without internet sales)

Hairdressers people have learned to manage without so fancy costly hairstyles might never come back

Football gate receipt will be lower until people get over the fright of mixing with thousands of people again

Concerts music/bands will struggle to get audiences and online sales have poor returns

Pubs many will or have already gone under and may never re-open particularly those without a beer-garden or outside chairs

Dry cleaning less office workers needing high-end cleaning

Impact on Economy: There will be far less money going around generally people will be trying to save and not spend on discretionary items with all the uncertainty even as the pandemic itself wanes.

Retail and commercial property - is going to take a massive hammer blow for a few reasons:

- People have learnt how to shop on the internet and are likely to avoid the high street for fear of catching COVID-19 for some time to come the high street in towns and many cities will never recover

- People have learnt how to work from home and new ways of working (ZOOM, MS Teams etc) has massively accelerated. The precedent is set. Companies have found little difference in productivity. Many employees have learnt to work from home and like it. Hence many more jobs will be working say half the time from home and half in the office using shared hot desks so office space requirements could drastically drop rendering many offices development sub-economic leading to dropping commercial rents. Its not a good time to be building-completing new offices. In addition, companies will be polling their employees to see what time of home-working model suit them since they see opportunities to lower office-c

ommercial costs including energy/utilities/tax.

Working From Home: On the flip side, people will be needing nice homes to work from and this goes back to the value of a small garden in cities - where people will be building more home offices (in many instances, a 10m3 wooden home office does not require planning permission, and if it costs £5,000 to build, it could add £20,000 to the value of your property and provide you this value amenity long term). If you have a small business then the cost of such a project may be tax deductible, particularly if the business is registered at your home address.

Overall Impact: In summary, commercial rental and offices will be severely impacted from higher unemployment (less jobs), and new ways of working. Residential sales and letting will be impacted by higher unemployment and the recession (lower long term trend GDP). By the end of 2020 if property prices in London have not dropped at least 10% we would be surprized. In the Midlands and North where a good head of steam was developing in Jan-Feb post General Election, we expect prices to start dropping but not quite as severely as London. Rural areas with many holiday homes might see prices drop the most areas like West Wales, Cumbria and Cornwall.

Jan-Feb post General Election, we expect prices to start dropping but not quite as severely as London. Rural areas with many holiday homes might see prices drop the most areas like West Wales, Cumbria and Cornwall.

Best Investment Opportunity in This Climate: When we consider the depth of the depression in the retail and commercial property in towns, cities and villages the conclusion is that huge swaths of the high street will be shut down. Business will go bust as will commercial property owners. The opportunity is to convert these at low cost to residential units then either sell them or rent them out. Many small shops on high streets have storage spaces at back and one or two stories above often with storage or office spaces. If you can buy these at low cost, then rapidly and efficiently convert to flats, then this could be a lucrative business opportunity in the current climate. Add to this an announcement 30 June by the government that they are hoping to ease planning to make this possible - commercial to residential in high streets not requiring planning permission this would lower the business risks of doing such a venture.

Challenging: Its going to be a very challenging economic period for the next few years and property prices realistically are likely to be hammered down. For first time buyers and property investors it would be best to wait a while for prices to drop down and possibly by end 2020 pick up a bargain off people forced to sell due to higher unemployment and lifestyle changes. On the positive side, there is a stable Tory government for the next 3½ years and very low inter est rates plus support from the Treasury that will help cushion the blow and help a rebound later possibly mid 2021. Its not a good time for the property investor, but do keep your eyes open for opportunities.

est rates plus support from the Treasury that will help cushion the blow and help a rebound later possibly mid 2021. Its not a good time for the property investor, but do keep your eyes open for opportunities.

Threat of COVID-19 has not gone: Finally and extremely importantly we hope everyone is staying safe a possible the threat of COVID-19 has not gone away. As we described early May - it looks like it hits an area-region for around 70 days after the first cases are identified the peak fatalities are after 40 days (4 April in UKs case) then cases dying away from this time and we hope it fizzles out by July but the big threat is it surges again in the Autumn the traditional flu season. Fingers crossed it stays very low end 2020. Stay safe.

We hope this Special Report has given you some insights into the economic impact of COVID-19 on the property market, opportunities and threats. If you have any queries or comments, please do not hesitate to contact us on