Silver the greatest investment for 100 years - inflation and the dollar demise

08-17-2020

Silver the greatest investment for 100 years - inflation and the dollar demise

PropertyInvesting.net team

Inflation All The Way: On average, there is a major recession every 8-10 years. The cause of the recession can be anything from a gigantic oil price hike (1983 and 1973), high-tech share price crash (2000 dot.com bust) or home loan-mortgage banking crisis and contagion (2008). Ever since gold came off the Gold Standard around 1973, the US Federal Reserve (US Central Bank ) has been able to print the dollar currency at will – whenever a recession hits. This is called “monetary easing” or “quantitative easing” (QE). It’s important for all property investors to understand the fundamentals of inflation and monetary policy as this provides a context to investing in property and inflationary impacts.

) has been able to print the dollar currency at will – whenever a recession hits. This is called “monetary easing” or “quantitative easing” (QE). It’s important for all property investors to understand the fundamentals of inflation and monetary policy as this provides a context to investing in property and inflationary impacts.

Illusion of Growth: Essentially, governments like to create inflation – to give the illusion of real growth – so people feel their wages are rising. It also means people that take on debt feel like the debt is reducing over the years – even if it stays the same in nominal terms, because rents, wages and costs all rise – hence the real terms cost of borrowing in comparison drops. The UK government likes to keep inflation at around 2%. If inflation drops well below 2% - often because of a recession – then the government will then print currency to try and get inflation back to the 2% mark. They will also drop interest rates – to make borrowing cheaper and to try and stimulate the economy. They can also reduce taxes to create a stimulus. This is what is happening at this time – because of the gigantic COVID-19 shock to the UK and global economy. All nations will be trying to print currency to keep their currency value suppressed – also to stimulate exports and prevent massive import costs.

Physical Assets: It’s important for all investors – in our view – to facilitate “getting ahead in life” – to focus on amassing assets that also generate income. Property is definitely a solid asset class that can generate a good income if managed correctly – for example – high yielding buy-to-let property. If you look at solid assets that you can look at, see, feel and don’t go away – they are things like.jpg) :

:

• Property

• Artwork

• Gold and silver

• Oil and commodities

• Land

• Diamonds, gems and jewellery

Paper Assets Can Implode: If you invest in other so called assets like stocks and shares, bonds and ETFs (exchange traded funds)– these are “paper assets” that can be risky are more likely to “implode” in value compared to physical assets – they can go down to nothing if the company goes bankrupt and you have less control over their outcome. Managed stocks and shares have the same problem – you are relying on someone else to properly manage them and they charge significant annual fees, so most fund managed stocks make less return than putting your money into an index like the FTSE100 or NASDAQ.

Fiat Currencies: It’s also very important for investors to understand about currency, printing currency and how every currency is “fiat” – meaning the money supply and debt keeps expanding rapidly as currency is “printed electronically”. When there is a recession, the bonds are issued, the balance sheet is expanded and currency printing goes crazy – this “easy money” is provided by the Bank of England though the high street and city banks so many people can assess – and thence create growth and recreate inflation.

Gold and Silver – Store of Wealth – Real Money: Which brings us back onto gold and silver. Sliver is generally a bi-product of gold mining – gold costs around $1200/Troy ounce to mine (note a Troy ounce for bullion determination is around 10% more than a normal ounce). But silver price is around $28/Troy ounce. One of the fascinating things to look at is how much silver there actually is available in the world. This is around 0.5 billion Troy ounces. That’s 0.5 billion coins. The cost of a Troy Ounce of silver is $27. The population of the world is 7 billion people. So if you divide the population by the amount of silver available – you get one Troy Ounce – or one silver coin – costing $27 – for every 14 people. That means if you buy just one coin for $27 – its 14 people’s worth of silver. In our minds – that’s the bargain of the century. It’s worth pointing out that silver topped out at $55/ounce in 1980. It’s the onl y commodity we can think of that is cheaper now than in 1980. Everything else has followed inflation like house prices, artwork, cars, oil, other metals – but silver prices have been suppressed for years. Many people believe the US Fed has commissioned JP Morgan Bank for decades to place short positions to suppress the price of silver – to encourage investors to purchase dollar bonds instead. There is no concrete proof – but stories have been circulating for years on this shorting.

y commodity we can think of that is cheaper now than in 1980. Everything else has followed inflation like house prices, artwork, cars, oil, other metals – but silver prices have been suppressed for years. Many people believe the US Fed has commissioned JP Morgan Bank for decades to place short positions to suppress the price of silver – to encourage investors to purchase dollar bonds instead. There is no concrete proof – but stories have been circulating for years on this shorting.

Crisis, Currency Printing, Reflation: When the COVID-19 pandemic created a ma ssive financial shock in mid-March 2020 – when panic was rife – silver prices crashed from $12/ounce to $9/ounce – as everyone was selling everything – everyone needed cash it seemed. But smart investors know that when there is a panic and also when there will be currency printing – gold, silver and oil prices after this initial dip – then rally like crazy. But it needs a lot of nerve to buy during a panic of course. Since mid-March 2020 – Silver prices have sky-rocketed from $9/ounce to $30/ounce – and recently dropped back to $27/ounce. Many will think the current Silver price is far too high and will crash. But when you consider how much Bitcoin rose, also Apple, Microsoft and Amazon stock – one could argue that silver is still the bargain of the century. Regarding gold, since the US dollar came off the gold standard in 1973, the amount of dollars printed has gone ballistic. The following two diagrams demonstrate this – the first is the M2 Money Supply of Dollars from the USA and the second shows Quantitative Easing.

ssive financial shock in mid-March 2020 – when panic was rife – silver prices crashed from $12/ounce to $9/ounce – as everyone was selling everything – everyone needed cash it seemed. But smart investors know that when there is a panic and also when there will be currency printing – gold, silver and oil prices after this initial dip – then rally like crazy. But it needs a lot of nerve to buy during a panic of course. Since mid-March 2020 – Silver prices have sky-rocketed from $9/ounce to $30/ounce – and recently dropped back to $27/ounce. Many will think the current Silver price is far too high and will crash. But when you consider how much Bitcoin rose, also Apple, Microsoft and Amazon stock – one could argue that silver is still the bargain of the century. Regarding gold, since the US dollar came off the gold standard in 1973, the amount of dollars printed has gone ballistic. The following two diagrams demonstrate this – the first is the M2 Money Supply of Dollars from the USA and the second shows Quantitative Easing.

It’s worth highlighting the two main schools of monetary supply / economics that dictate monetary policies. The below is our generalisation of their values and policy direction, but its good to describe these extremes – so you can identify what the central banks of elected governments are getting up to – and these policies certainly help frame what happens in the property market and return on investments within the property business.

Keynesian School of Economics

1. Believe in massive currency printing whenever a recession starts

2. Believe in dropping interest rates low to help boost demand and spending

3. Believe in large infra-structure projects to stimulate public and private sector employment and spending

4. Not worried about raising taxes – prefer to print currency and raise taxes

5. Work hard to avoid any form of deflation

6. Are vert sceptical about the value of gold and silver – do not consider them real money

7. They believe their currency of real money

8. Centre-socialist political outlook

9. Believe currency printing helps the poor

10. Would consider banning or confiscating gold and silver that compete against their local currency

11. Believe in a large and less efficient government and public sector to stimulate jobs

12. Believe in more rules and regulation to stop business exploiting the general public

13. Are very supportive of large Governments and Central Banks

14. Believe the dollar (or local currency) is king and gold and silver is a think of the past

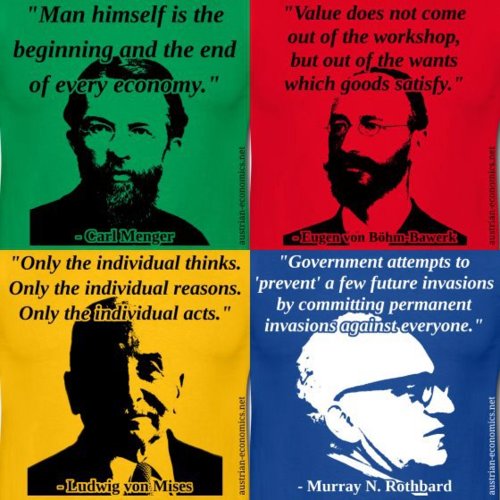

Austrian School of Economics

1. Dead against massive currency printing whenever a recession starts – prefer we ak companies to fold and let the market dictate price discovery

ak companies to fold and let the market dictate price discovery

2. Believe in having higher and attractive interest rates for investors to create better efficiency within business and the public sector

3. Do not believe in large infra-structure projects and are sceptical that these might stimulate public and private sector employment and spending

4. They believe in very low taxes – and prefer never to print currency and prefer to keep taxes low

5. No scared to encounter deflation – this might be required in an efficient market economy

6. Are very enthusiastically supportive of true value of gold and silver – and consider them “real money” and currency as “fiat currencies” that will be printed into oblivion

7. They believe local currencies are not real money

8. Tend to be centre-right wing in their political outlook

9. Believe currency printing does not help the poor and leads to higher fuel and food prices

10. Would never consider banning or confiscating gold and silver and realise that they compete against the local currency that is managed to Central Banks and the Government

11. Believe in a small efficient government and public sector

12. Believe in very few rules and regulation to encourage business and believe business can self-police and create a dynamic market led economy that will stimulate and creates huge numbers of well paid jobs

13. Are very sceptical about the value of large Governments and Central Banks

14. Believe the dollar (or local currency) is almost worthless – is a fiat currency that will be printed into hyper-inflation and implode one day – and the only real store of monetary wealth is in gold and silver – that cannot be printed (only mined at huge cost)

Betting With or Against Governments: In summary – Austrian school investors would tend to hold large amounts of gold and silver and in doing so are betting or at lead hedging on large governments and central banks imploding one day – losing control. Keynesian school investors would tend to be enthusiastically supporting large governments and central banks – believing that hyperinflation will never occur and any recession can and should be dealt with by printing currency and lowering interest rates – whilst taxing more – and they think gold and silver are just a side show that should be ignored and purchase of bullion is not an investment – rather you have to pay for it to be stored and it should not be traded – and it should be taxed.

For property investors that are sceptical about current printing and how Central Banks and Governments are managing the economy – should consider loading up on gold and silver. If you believe Governments and Central Banks will be able to avoid panics and monetary crises – through currency printing and hyper inflation will never happen – then may b e gold and silver investment is not for you.

e gold and silver investment is not for you.

US Elections and Democratic Policies: These are relevant in that it is most likely the Democrats will get into power and Trump will be defeated in October. This is supportive of further quantitative easing and “easy money” – with the more socialist Democrats believing they can keep interest rates low, print more currency to help the poor and middle class. They will likely increase taxes and be non supportive of oil and gas companies. This could eventually lead to higher oil prices, higher inflation rates and higher gold and silver prices into 2021.

Oil and Gas Boom to Bust: It’s worth recalling that the relative US boom between 2016 and March 2020 was lead by record US oil production from oil shale drilling – with the gigantic Permi an oil field of West Texas driving growth both in the US and globally that helped suppress oil and gas prices for US consumers, reducing general inflation and reducing the gigantic oil import bills that amounted to around $500 billion per annum back in 2007. Once the stimulus and funding for oil and gas drillers in the US is reversed – as now seems likely – the oil import bills should start rising and then the US deficit will likely increase faster because of this – putting pressure on the dollar value and thence leading to higher gold and silver prices in dollar terms. Furthermore, subsidies for renewable energy providers will likely also increase gas prices, and electric-energy price for manufacturers – as gas drilling reduces as support is taken away. We will write more on this after the US Election. We currently give the Democrats a 60% chance of winning, with the Republicans 40% - though as in the last US election, it’s still very unpredictable.

an oil field of West Texas driving growth both in the US and globally that helped suppress oil and gas prices for US consumers, reducing general inflation and reducing the gigantic oil import bills that amounted to around $500 billion per annum back in 2007. Once the stimulus and funding for oil and gas drillers in the US is reversed – as now seems likely – the oil import bills should start rising and then the US deficit will likely increase faster because of this – putting pressure on the dollar value and thence leading to higher gold and silver prices in dollar terms. Furthermore, subsidies for renewable energy providers will likely also increase gas prices, and electric-energy price for manufacturers – as gas drilling reduces as support is taken away. We will write more on this after the US Election. We currently give the Democrats a 60% chance of winning, with the Republicans 40% - though as in the last US election, it’s still very unpredictable.

US Investors: For US property investors, the areas likely to do best from a Democratic victory are north-east US – New York and Washington, Chicago and possibly California. The areas that are likely to suffer – exposed to the declining oil business under the Democrats – are Texas, Louisiana, North Dakota and Oklahoma.

We hope this Special Report has given you some interesting insights into the world of monetary supply and its impact on gold and silver prices. As we have mentioned many times in the last 15 years, we believe silver is the “bargain of the century” – it’s just so cheap in our view. That said, they call it the “devil’s metal” in part because its so unpredictable and one just does not know which direction it will go in next.