Exponential Growth of Assets Technological Innovation aiming to capture this opportunity to make stellar returns - by PropertyInvesting.net

05-31-2021

PropertyInvesting.net team

Exponential Growth of Assets Technological Innovation aiming to capture this opportunity to make stellar returns

The history of business has been punctuated with periods of massive technological innovation that has created massive wealth in the developed world. To name a few technologies:

Electricity 1900

Steel for building skyscrapers 1890-1930

Railroads 1870-1940

Automobiles, trucks 1915 2050

Airplane travel 1945-1985

Radio, TV, cinema, phones 1920-1960

Internet 1995-2010

Social media 2005-2021

Iphones, mobile computers 2005-2015

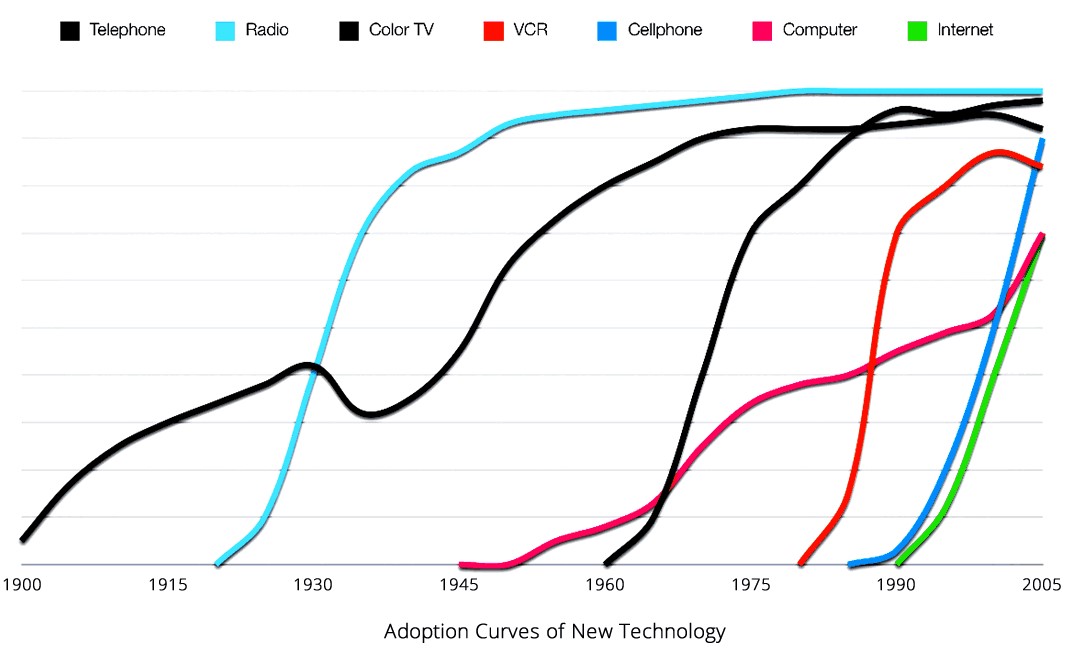

Exponential Growth in New Innovative Technologies - These technologies normally show a very predictable trend. There are the early innovators, early adopters then an exponential growth occurs where take-up rockets from around 8% to 50% or more within a 5-10 year period in each developed country with developing countries following some time after this. More recently developing country adoption often takes place at a similar pace to developed countries with things like iPhone/mobile phone/computers, because of the global environment and infrastructure has made this possible.

The adoption forecast for Crypto Assets

Technology Adoptions - similar new technologies and the speed of adoption

What Are The Next Big Technologies? So the big question is for people hunting the very best return on investment opportunities what are the big exponential trends that are just about to hit us and how can I get into these trends to maximise my returns?

Property as a Foundation: Firstly as a back-drop, to all property investors, let's not forget that property is the foundation of most people's wealth base, unless you are super rich or a big business owner. Even super-rich people park a sizable proportion of their wealth in property - in large part as a secure hedge against inflation and fiat currency debasement. The reason most people have most of their wealth in property is because they can borrow money to leverage and purchase a property the property then goes up in price because of inflation (because of all the fiat printed currency debasement) this means that people holding real assets physical assets like property normally do well in the long term. This is also because of scarcity of building land and proximity to the top desirable locations. Many ordinary people often do this almost by mistake - as a conventional process that is handed down through the generations - a "you need to buy yourself a property - you can't go wrong" type of mentality. Nothing has changed with this narrative over the last century. But if you sell a property and have cash or you are a reasonably high net worth individual with access to cash, it's wise to invest a large proportion of the cash in potentially high growth asset classes. This is especially true at the moment because real inflation is 15-25% a year what we mean is this is the rate of the annual M1 and M2 money supply expansion the best proxy for real inflation. Forget CPI inflation - its a manipulated basket of items most people don't buy much of, particularly middle to upper income people. So to prevent any cash savings being destroyed by 50% over a 3 year period (halved in real value), it's better to invest in higher growth investments with the aim of making at least the projected inflation rate of 15% a year for the next 3 years. This will then at least preserve your wealth in this higher inflationary period coming up.

Networks and Communities The Network Effect: The biggest growth businesses in the last 15 years have been companies that have leveraged networks and communities of millions or billions of people to create sales of goods-services or advertising thereby boosting their stock prices. To name some examples Amazon, Apple, Google, Twitter, Paypal, Facebook, Tesla, Microsoft, Bitcoin. It's very important to bear this in mind for the future your stock or asset picks.

Platforms: The above extremely exponential companies all have platforms that they leverage on whether this is a software platform, internet platform, car design-battery platform, or crypto asset platform they all have a massive global pervasive platforms. This is then used as a multiplier to leverage the size of their communities that then lead to exponential earnings growth. So remember and have this in the back of your mind - Communities or Networks and Platforms.

Demographics: When investing it's also best to consider the demographics of the customer base. For instance, if there is a new young generation that you can see or sense are getting into something that these communities are passionate about something then its likely to growth rapidly. People aged 35 to 55 tend to spend the most when they earn the most and have kids and spend the most. People aged 65 and over tend to save, spend far less, have huge amounts of locked up wealth (80% of wealth) and can lose interest or track of the latest innovations. You probably wont find exponential growth in things like: 1) funeral services, 2) expensive cruises for the retired; or 3) terrestrial TV on the whole they will be steadily in decline.

Old World Dies: The old world of oil, gas, tobacco, coal, terrestrial TV, nuclear power, dirty manufacturing, petrol and diesel cars, global airline travel are and will be in decline henceforth. You really wont get exponential growth from in businesses. The environmental pressures related to climate change, CO2 emissions targets and health will affect all these business leading to a death by many cuts, taxes, regulations and new laws. Note we have bundled in nuclear power into the list the reason is that nuclear power became mainstream in 1950 and rapidly expanded, but its been dying slowly in the last 20 years in developed nations despite its extremely low CO2 emission. Its the layers of red tape, safety concerns-regulations, environmental (waste) concerns and huge cost increases in the reactors on top of 3 plants out of 430 by 2014 that exploded a disastrous safety record by any accounts that killed thousands of local civilian (e.g. Chernobyl - Ukraine, Fukushima - Japan, Three Mile Island - USA).

Political Will: For the first time this century, we see politicians actually strongly getting behind the drive to reduce CO2 emissions it's probably also to do with the wishes of voters both young and older they want to see leadership on this issue. In the early part of this century, most politicians probably did not take it very seriously but to win votes they need to take concrete actions on climate change and we see this trend accelerating henceforth. This is very important because it will lead to a huge boom in renewable energy investment, and put huge pressures on the coal, oil and gas industries unless they start to transition quite quickly (BP and Equinor have taken some concrete steps in the last two years) .

Super Exponential Technology Trends: After a lot of research and considered thought we have come up with the following list below all the below innovative technologies will massively expand in the next ten years and we would encourage everyone to research them further and seriously consider investing in them.

Crypto Assets (e.g. Defi, NFT, crypto exchanges and coins-tokens-currencies)

5G

Biotech (e.g. gnome science and vaccines)

Autonomous vehicles (SAV Shared Autonomous Vehicles)

Electric cars (and batteries)

Renewable energy (solar, wind, and zero carbon businesses)

The most explosive and most disruptive growth is likely to come from Crypto Assets in the next 10 years. Crypto assets that use blockchain technology are the internet of financial assets and money. Recall the internet became popular from 1994 onwards and created a platform firstly for the global flow of information (e.g. Google) then social media (e.g. Facebook/Twitter) engaging with huge global communities. At the start in 1995 there was much talk of governments shutting it down because it was not regulated and did not pay taxes there is still talk today that this might happen with Crypto Assets but this is unlikely because Crypto Assets have been deemed assets or property by the US, UK and European government that are liable for capital gains taxes on price increases they are truly global and internet based and it would be almost impossible to close this new asset class down in large part because it is on the whole de-centralise. Roll on to 2003 - and we also had e-commerce ebay and Amazon using their platform and communities. Establish banks created their own internet banking website using old world transactions.

Traits of Young Generation: But the young populations around the world tend to have the following traits - they are:

Computer savvy

Not particularly loyal to any particular service or offering compared to elderly people

Like to transact peer to peer

Have virtual communities that they join and communicate within

Likely to use YouTube to learning rather than books, written material and lectures

Fast moving, quick thinking

Environmentally conscious

Likely to use Twitter, Tiktok, Netflix, Messenger, Facebook rather than TV, email, radio

They understand what blockchain technology is

They are very quick thinking, highly intelligent, on the whole far better educated than people 50 years ago and have short attention spans - are fast moving intellectually

Meanwhile many of these people have got well versed with Crypto Assets (or Cyptocurrencies, like Bitcoin, Ethereum, Cardano, Polkadot, Polygon) there is around a 6% global take-up now the early adopters. With this in mind, for the next 3-5 years we firmly believe there will be a gigantic boom in the use of:

Defi or decentralized finance using crypto assets (or coins-tokens) to perform low cost ultra efficient transactions, banking and financial services

NFT or non fungible tokens the tokenisation of all assets on the blockchain - including artwork and property.

So with this as context, let's consider the three key pillars:

Platforms yes, the global encrypted blockchain technology platform has been created with new secure platforms for huge communities these communities help code and develop the coins or tokens or software entities-services e.g. Ethereum, Cardano, Polkodot, Polygon, Solano for DeFi and Bitcoin as a store of value (digital gold)

Communities yes, these young communities are democratising the financial system also using social media to communicate their messages working on crypto asset platforms to develop this alternative banking system that is hugely disruptive to the stuffy old highly inefficient banking system that have huge offices using huge quantities of CO2 emissions to produce very slow multiple check banking transactions with very high fees these are the so called too big to fail banks and the fiat banking system that was bailed out in 2009 and 2020. Many believe things are stack up against the younger people and the disruptive democratization of financial services and transactions in an environmentally efficient manner is a way of extracting appropriate levels of wealth for themselves in the longer term - the younger people, In any case, these younger people are in line for huge inheritance payments in the next 20 years and many believe they will use this to investing in Crypto Assets and the Blockchain technological revolution.

Environment Crypto Asset users believe Crypto Assets are a highly efficient new way of transacting using secure blockchain technology that encourages renewable energy development and over time will see hugely reduced CO2 emissions compared to the conventional fiat banking partly through lo w emissions coins like Cardano, Solano and Nano (plus Ethereum later in 2021) (note: 78% of Bitcoin miners use renewable energy in their power-mix, with Chinese bitcoin miner using around 50% mid 2021).

w emissions coins like Cardano, Solano and Nano (plus Ethereum later in 2021) (note: 78% of Bitcoin miners use renewable energy in their power-mix, with Chinese bitcoin miner using around 50% mid 2021).

Just to put the energy usage of Bitcoin into perspective compared with other industries:

Bitcoin Energy Usage (~2020)

Yearly Cost $Bln Energy Used (M GJ)

Gold Mining 105 475

Paper Currency and Minting 40 25

Banking System 28 2340

Governments 1870 5861

Bitcoin Mining 4.5 183

Bitcoin energy use is therefore 38% of gold mining and about 8% of the global banking system. It's around 0.5% of global electricity usage. 78% of the electricity has renewables as part of the mix. Around 50% if actually is renewable energy - which is a higher percentage than the banking system. One could argue it is a far more efficient store of value than gold and improves on the energy usage of the financial system. It also does not require a highly energy intensive military complex to secure the value within Bitcoin. As far as a global new technology is concerned, though it appears energy intense, for example YouTube uses 2.5% of the global electricity usage (3-5 times more than Bitcoin mining), but can anyone seriously say we should not use YouTube - it's night and day a super place to learn, without going to conferences using carbon intensive airplanes, and has been invaluable during COVID to supplement access to education - when people have not been able to attend Universities etc. Bitcoin encourages the use of renewable energy, uses energy at the fringes of the grid when it's not being used by normal customers during peak times. If we want to shut down all new innovation and technological progress because it has an increase on carbon footprint, we'd be shutting down all our PCs, pharma and new hospitals. One thing that is true, is that Bitcoin compared with other Crypto Assets is electricity intensive because of it's "proof of work" protocol. There are other far more efficient crypto assets when it comes to making transactions - these include Cardano (ADA), Nano (NANO), Solano (SOL) and Ethereum (ETH) (once ETH has switched it's code end 2021 from proof-of-work to proof-of-stake).

Renewable Energy: Bitcoin stimulates renewable energy estimated cost of electricity used is 0-2 cents (rather than 8-11 cents for normal industry) because using unwanted or off-peak electric from hydro, solar, wind small amount from coal/fossil fuels mainly in China energy usage is likely to drop after the Bitcoin price decline May 2021. Energy use may drop sharply because their is depleting Bitcoins to mine over the next 50 years as the protocol goes through it halving cycles. It's worth noting that Bitcoin mining is estimated to use 76% renewable energy (and only 24% from hydrocarbons, oil-gas-coal). This proportion is far higher than the banking sector as a whole.

Bitcoin Price: For the younger investors it's difficult to see how this Crypto Asset growth trend wont exponentially grow in the next 5 years as adoption gets to the 8% take off point this year, regardless of what price Bitcoin gets to or crashes to this year. Its something for the 3-5 year time frame not for a quick buck trading standpoint. The strong hands will likely make huge returns like the strong hands did with Facebook, Google, Tesla, Amazon all of these have crashed at some stage in their early lives then went on to deliver 1000x gains. It's also worth pointing out that people fixated on the "price" of Bitcoin are probably missing the point. Like one house, one Bitcoin is one Bitcoin - and its the fiat currency volatility that is fluctuating around a very scare one Bitcoin that is not fiat. Its price discovery against in immutable asset that has never been hacked and its supply is strictly controlled by a decentralised protocol that over 12 years - 10 million people have failed to hack or change - it's nigh on impossible to manipulate the supply. Though of course the fiat price manipulation is ever present!

M1 Money Supply in the USA and global - Trillion US dollars over recent time

Bottoms Up Democratisation of the Financial World - it's worth pointing out that using a "bottoms up" process - fast moving younger software engineers and fintech workers are fast developing blockchain technology based Crypto Assets (or cryptocurrency coins, tokens and services) that will massively disrupt the traditional banking system - and thence the role of Central Banks in the next 10 years. The old banking order - suits, large high energy intensity offices, travel, slow transactions, slow services and local bank branches could rapidly start to disappear in the next few years as Crypto Asset services based on blockchain and the internet start to take over. Absolutely the worst place to invest in is large commercial central city office blocks used by bankers, or smaller retail commercial banks - they will close down rapidly as things go "virtual" - highly efficient peer to peer transactions and the tokenisation of assets. The big banks are likely to be the losers, and Crypto Assets the winners. This will be driven by mass adoption through the developing and developed world - by younger computer savvy people - that have their "internet financial social communities" all trading and being entrepreneurial with each other - peer to peer e-commerce - cutting out the "middle man" that charges large financial fees for slow and highly regulated - some would say over-regulated - financial services.

Hackernoon-internet vs cryptocurrency

We plan to cover the other disruptive technologies in the next few months, but just to get you warmed up a bit

5G this broadband internet using satellites to assist coverage and provide a gigantic increase in the speed and amount of data that can be streamed also in rural areas will have a big impact and help facilitate businesses like Artificial Intelligence (AI), autonomous vehicles and biotechnology aiming to irradicate cancer, malaria and improve health for the 7.5 billion people across the planet

Biotech (e.g. gnome science and vaccines) partly triggered by COVID-19 and breakthroughs in DNA and gnome sciences, with a malaria vaccine is close and a breakthrough to irradicate cancer is likely not far off now companies that patent-invent the drugs and equipment to prevent these diseases will skyrocket in value

Autonomous vehicles (SAV Shared Autonomous Vehicles) Tesla are leading the charge using powerful computers using AI technology (artificial intelligence) the first vehicles are likely to receive licences in the USA by end 2022 and become mainstream between 2025 and 2030. These electric cars and trucks instead of having a utilisation rate of say 5% (likely normal cars) will be shared (rented out) within communities and business and could have utilisation rates of 60% in a day (15 hours) this would bring the cost of each mile down from 50 cents to say 8 cents a mile and owners of such vehicles could earn $50,000 over a 3 year period, more than paying off the car and its running costs.

Electric cars (and batteries) adoption is set to hit around 8% in many developed countries then growth with be exponential. By 2028 we are predicting that 70% of all new cars will be either electric or hybrid electric. The best and most efficient battery manufacturers are likely to see exponential growth. It's worth considering investing in copper, nickel and heavy earths required for the transition from the fossil fuel world to the renewable world - more in metals mining later.

Renewable energy (solar, wind, and zero carbon businesses) wind and solar power for electric power generation in the last year has become economic without any subsidies compared with oil and gas (fossil fuels). Returns on these utility companies are not likely to be massive their revenues are likely to grow strongly - though the return on investment is normally not that high. Yes, these stock prices can rise sharply but they probably wont go exponential (this is evidenced from BP's stock market price decline after announcing in 2020 they were transitioning to low carbon energy (solar-wind) world.

Summary - We hope this special report has been insightful giving an overview of why networks and platforms are so important and how technological innovation will lead to the exponential growth in these new technology businesses. Crypto Assets and the shift to a low carbon world are likely to have a huge impact on the global financial systems, transport and industry in the next decade. If you have any queries, please contact us on enquiries@propertyinvesting.net

www.google.co.uk (recommended search engine)

Disclaimer This presentation material and discussion around it is for education and information purposes only. It is not financial advice. Investors in cryptocurrency do their own research and seek professional advise as appropriate.

Disclosure We are not paid by any entity. We do not get paid for this material. We do own a portfolio of crypto assets.