325: Investing in the UK with all the uncertainties

06-03-2010

PropertyInvesting.net team www.google.co.uk

PropertyInvesting.net team www.google.co.uk

Difficult to Identify Value: It’s becoming increasingly difficult to identify value in the UK at present. There are just too many uncertainties – to name a few:

· Potential capital gains tax increase for buy-to-let investors (and stock equity holders)

· Inflation starting to run out of control – interest rate rises on the cards

· Likely unemployment increases from public sector jobs cuts and manufacturing sector struggle

· Euro debt contagion never far away – it’s just on hold for a few months or a year

Winning Deficit Plan: The good news is that the government is finally starting to win over the private sector with regard to deficit reduction plans - starting immediately. This has meant the UK has kept its AAA rating for the time being. Meanwhile Sterling has improved against the Euro and many other currencies off the back of the deficit reduction plans. As long as the new government does not shoot itself in the foot with capital gains tax increases with no big tapered relief, the UK could start to become more attractive as a safe haven for investors. There are a few key reasons for this:

Winning Deficit Plan: The good news is that the government is finally starting to win over the private sector with regard to deficit reduction plans - starting immediately. This has meant the UK has kept its AAA rating for the time being. Meanwhile Sterling has improved against the Euro and many other currencies off the back of the deficit reduction plans. As long as the new government does not shoot itself in the foot with capital gains tax increases with no big tapered relief, the UK could start to become more attractive as a safe haven for investors. There are a few key reasons for this:

· New government gains confidence – deficit reductions

· UK imports only 30% of its oil and gas needs – it's still a Petrocurrency (albeit in decline)

· Population is expanding at an economically healthy pace – less of an aging population and pensions issue compared with most western countries

· London remains the global banking/finance centre and tourist destination – wealthy people love London

· London is a magnet for knowledge, diversity, educated professionals and world finance – it will remain so under the current administration

London: We have not changed our view that London and southern England – with the expanding population, economy, lack of building and dynamic business environment will outperform other UK areas in the short, medium and long term - for property investment. Floods of international money coming into London UK property as Sterling has declined married with the UK’s stable security and general environment probably bodes well – European, US, Russian, Middle Eastern, African and Far East investors will continue to view London as a safe haven.

London: We have not changed our view that London and southern England – with the expanding population, economy, lack of building and dynamic business environment will outperform other UK areas in the short, medium and long term - for property investment. Floods of international money coming into London UK property as Sterling has declined married with the UK’s stable security and general environment probably bodes well – European, US, Russian, Middle Eastern, African and Far East investors will continue to view London as a safe haven.

Stock Market Disaster Over 13 years: If you are thinking seriously about dipping into the stock market, remember you cannot leverage by borrowing money for stocks and shares. Also, the FT100 is lower now that 13 years ago on a non inflation adjusted basis. On an inflation adjusted basis, its about 40% lower. So ask yourself, “do I think I can beat the market” – the answer is probably – no, because even people with detailed company knowledge cannot seem to beat the average of a 40% decline in 13 years. And it shows no signs of improving. In fact, since 2000, the FT has declined by 55% on an inflation adjusted basis – not a good place to put your pension savings.

Capital Gains Tax To Make Worse: But the big uncertainty is capital gains tax. If this is set at 40% or 50% for stocks and shares – better sell up right now. It’s not worth the risk – unless we are missing something.

No Tapered Relief and Increase Would be Disastrous for all: Also, for property investors, if no large tapered relief is available on any capital gains tax increase – then it’s seriously worth considering selling up if you don’t think it will be reversed. If you think "big fat flat tax" will stay, why should anyone use savings made after paying earned income tax of 40% to 50% to then invest in property, that is then taxed again at 40% or 50% after ten years even though inflation may have been a compounded 50%. That’s an equivalent tax rate of 90%! Yes – we are serious – why would anyone invest or risk 100% downside for only a 10% upside? It's economically stupid.

No Tapered Relief and Increase Would be Disastrous for all: Also, for property investors, if no large tapered relief is available on any capital gains tax increase – then it’s seriously worth considering selling up if you don’t think it will be reversed. If you think "big fat flat tax" will stay, why should anyone use savings made after paying earned income tax of 40% to 50% to then invest in property, that is then taxed again at 40% or 50% after ten years even though inflation may have been a compounded 50%. That’s an equivalent tax rate of 90%! Yes – we are serious – why would anyone invest or risk 100% downside for only a 10% upside? It's economically stupid.

90% Tax No Thanks: So – without labouring the point – best not buy any property until it's clear on 22 June what the new tax regime will be. If you are very worried – like we are – then you might want to consider writing a letter to your MP. Is it fair that there is a potential 90% tax on long term buy-to-let investment? It’s the most ridiculous taxation idea we have ever seen anywhere in the world – serious.

Gold: Just in case you are thinking about gold, be careful here as well. Despite the financial meltdown and Euro crisis and contagion threat – gold has not risen dramatically in the last few years. Yes, its risen above inflation, but it's not been a stellar increase. Why is this? We are not gold experts, but our view is that:

· During periods of economic meltdown – demand for jewellery from India, China and USA goes down

· Less money is available to buy gold

· The risked threat of governments seizing gold assets (like the USA did in the Great Depression) affects the demand for gold and upside price

· It could be good to hedge with 10% of your wealth in gold, but centring your core investment around gold is probably unwise

-

Oil prices dropped to $65/bbl creating a slowdown in much needed oil investment

-

The BP disaster we believe will slow oil investments offshore and also impact onshore developments primarily in the USA, but also with a knock-on impact to a lesser extent internationally

-

Most large oil companies are reporting declines in oil production – meanwhile demand increases in all regions except Europe and USA where demand is flat (no a surprise in mature markets).

Oil Underpins Economies: At $70/bbl we believe oil exploration, development and production company shares are a great buying opportunity. We just cannot see a massive shift away from oil in the next five years. Demand for oil sands in Canada and crude all in all parts of the world will increase, as production remains stubbornly on a bumpy plateau with a likely slight decline after 2015. Do you really trust and believe OEPC have 5 million barrels of spare capacity? – we don’t.

Yes, we are running short of investment recommendations in this harsh environment, but London property and oil companies are still tops for us. We are neutral on gold, we think metals mining companies are interesting.

What we are avoiding like the plague are:

· Retail, shops, far flung tourism

· Airlines, airports, package holidays

· Shipping – containers ships and ports

· Real estate in all oil, gas, coal and metals importing nations – particularly if the ratio of GDP to oil usage (intensity) is low, the country is not famed for its manufacturing or finance and has a declining and aging population (e.g. Italy, Spain, Greece, Portugal)

IT: If you like investing in IT companies, one thing is for certain, there are three truly gre at leading companies out there. Google. Apple. Facebook. As people gravitate to hand held internet based devices for social networking - these companies will continue to lead and dominate their markets. Google is such a spectacularly innovative and dynamic company - we have huge admiration for everything they have done. We like the Apple iPad - and they truly listen to their costumers and provide excellent service and products. Facebook is the world leading social networking site - one cannot ignore their stellar growth - and this networking in the young expanding world population is transformational - older people that ignore this trend will be out of business in 5-10 years time. Anyone ignoring the internet - ditto.

at leading companies out there. Google. Apple. Facebook. As people gravitate to hand held internet based devices for social networking - these companies will continue to lead and dominate their markets. Google is such a spectacularly innovative and dynamic company - we have huge admiration for everything they have done. We like the Apple iPad - and they truly listen to their costumers and provide excellent service and products. Facebook is the world leading social networking site - one cannot ignore their stellar growth - and this networking in the young expanding world population is transformational - older people that ignore this trend will be out of business in 5-10 years time. Anyone ignoring the internet - ditto.

Back to Basics - fro us it's London property, oil companies – and possibly some gold and mining companies. Assets that are underpinned by "bricks and mortar" or "oil, gas, coal or metal reserves". But not underpinned by "mirage money", and potentially "fake paper". Anything with significant exposure to middle and lower income debt should be avoided. Anything with large negative exposure to oil prices rising should be avoided. We believe in positioning investments that can be part of the positive exposure to oil prices rising – for the UK, there are only two places: London and Aberdeen (middle to upper end).

International Safe Havens: are Canada, Norway and Australia. Just watch the strength of their currencies in the next few years. Interest rates will remain high as their economies boom - and this will also attract currency investors. Property prices will be rising along with metal, gas and oil prices in these very politically secure environments with good governance.

London Attraction: Anyone that doubts London's attractions should visit Shaftsbury Avenue in the evening, Camden Market at the weekend and the London Eye during the day. It’s a massive tourist  playground. But many of these people are very wealthy – and the men are off visiting the investment bankers whilst their partners and kids are off playing at Harrods. Things haven’t changed since the 1980s – it’s just that instead of Saudi Princes – it’s all wealthy global people seem to gravitate to London. No-one notices or bothers them – and they love the open safe environment. The wealthy Brits tend to sell up in May and spend the summers at festivals and on boats the Med. They then return in September and start buying shares again. We've seen this pattern for many years - and property in no different. The market goes dead in June, but is always very active from January to mid May. It starts warming again end September each year. Yes - this is a generalisation, but it's worth considering with regard to investment timing - for all you knowledgeable investors.

playground. But many of these people are very wealthy – and the men are off visiting the investment bankers whilst their partners and kids are off playing at Harrods. Things haven’t changed since the 1980s – it’s just that instead of Saudi Princes – it’s all wealthy global people seem to gravitate to London. No-one notices or bothers them – and they love the open safe environment. The wealthy Brits tend to sell up in May and spend the summers at festivals and on boats the Med. They then return in September and start buying shares again. We've seen this pattern for many years - and property in no different. The market goes dead in June, but is always very active from January to mid May. It starts warming again end September each year. Yes - this is a generalisation, but it's worth considering with regard to investment timing - for all you knowledgeable investors.

USA versus China: Just one other consideration – a global one. USA and China are on a resources collision course. USA imports 12 million barrels of oil a day. It has 5% of the world’s population but uses 25% of world oil consumption. So far – despite all the talk – there is absolutely no evidence that the USA will drop its abnormal oil consumption. In fact, oil consumption in the last few months has started rising. Meanwhile, there are 1 billion Chinese all wanting to own cars. We predict they will need at least as much oil as the USA by 2030. Where will all this oil come from?

Exporter Use More Oil: Meanwhile, as normally happens, all oil exporting nations have low priced oil, or subsided oil and fuel prices. They use oil very inefficiently. But many also have declining oil production had their living standards and energy consumption increases. So any decline in oil production whilst consumption rises means the pace of exports decline accelerates. Mexico will import oil by 2015. Brazil will never export crude oil despite all the recent oil finds. Saudi Arabian exports will decline eventually as demand booms and the pollution continues to boom. India's demand will sky-rocket. It all leads to oil supply shortages in years to come.

Oil Price Have to Move Higher: Oil prices will have to rise to create severe demand destruction and a switch away from oil. But this is likely to be at prices higher than $125/bbl. So we see prices rising to $125/bbl – spiking upwards. They may then decline back again as demand destruction kicks in and the world economy slows once more. Global economic growth will be dictated to a large extent by the ability to find and produce more oil verses how efficient countries can become with regard to oil conservation – how much GDP can be squeezed out of lower energy and oil usage. Climate change will be forgotten about. Peak Oil – or oil shortages and water shortages with booming world population will be what everyone will be talking about in five years time or sooner.

Type of Oil Play: This brings us back to oil companies. The Chinese are quietly buying up small oil companies, assets and resources in all parts of the world, particularly Africa. But they have even started in the USA’s back yard – Canadian Oil Sands. We don’t know where all this will lead – all we know is that – previous major resources constraints have caused wars – or at least security instability.

Fuel for Growth: If you think of it very simply, if you want to build or grow foot – build an economy and produce things – everything needs oil. So without oil, GDP growth will drop. To own producible accessible oil reserves is like having fuel to run a car, house or lifestyle. Without it, you might have a car you cannot use, computer, heating and lighting that are never switched on, and you can never travel by rail or plane – your business and/or lifestyle would surely suffer. Oil is fuel for economic growth. To prevent social unrest and political instability there will be a clamber for oil – China started years ago. The USA is now well behind the curve in its over-reliance on imported oil from countries unfriendly to the USA. This married with it declining global political and military influence along with its declining oil production from private US companies is worrying to put it mildly. Even the US military are warning about Peak Oil now – but the US administration keeps quiet about the issue – the “elephant in the room”. Meanwhile China, India and other developing countries will pull like never before for the same resources. So for investors – one needs to position oneself in a place where reserves and oil resources value will increase – to protect your pension. Areas where the assets will not be seized or over taxed – yes, all assets can be nationalised – so make sure if you invest in oil, you invest in a place where there is very low chance of the assets being seized, nationalised or taxed to the hilt. Canada would seem a fairly safe place in this regard, but it’s not an easy call. Some of the larger floated state oil companies are also worth considering. For smaller companies, they need to be in places where the country needs their technical and operational skills and finance and there is little change the state can take over in a ten year time frame.

Worried – Yes, We Should Be: You might find this a little worrying – and we apologise if it is unsettling – what we want to highlight is there is a downside threat. But one needs to position oneself to avoid the threat and access the opportunity – otherwise your hard earned assets will shrivel away under the ever increasing tax burdens and inflation as western developed nations stay indebted for years to come. They will attempt to squeeze every drop from the private sector and claim the public spending is an investment.

US Example: To give an example, the USA's $1.8 Trillion public sector spending programme (call investment by the administration) has caused a +3% GDP increase for a year. That's about $0.4 Billion worth of GDP increase - that's an extremely poor rate of return. Surely if you invest $1.8 Trillion, you should get something like $2.8 Trillion back, otherwise you should not be risking the money? May be we are missing something? And where did the $1.8 Trillion come from - either borrowed money that needs to be paid back, or a devalued currency which is probably even worse. If you keep borrowing to inflate an inefficient economy, eventually it will catch up on you. Markets run, inflation takes hold, asset prices drop and we end up like Argentina 5 years ago. The USA spends $6500 per person per year on healthcare, and $1500 per person on oil imports - it's totally unsustainable in our opinion. This is why, unless the USA can control oil imports and healthcare, we would not go anywhere near investing in property in this great country. The US dollar in our view is not a safe haven and will decline further. This following USA's borrowing costs rising, public sector expenditure increasing, private sector shrinking, oil production declining and oil imports increasing. All the trends are in the wrong direction regrettable - and the government do not seem to be interested in reducing the massive fiscal deficit. They are also in Peak Oil denial. At least it has plenty of coal, natural gas, food and technology. Sorry to be so downbeat on the USA at present - we love the country and people - but it's just not being run like a good economy at present in our opinion.

· Oil, gas, coal and/or metals exports

· Moderate public sector expenditures

· Expanding but still relatively small populations

Are again: Canada, Norway and Australia

Hoping and Praying Is A Bad Place To Be For An Investor: In summary, we just have to get through 22 June without the new government shooting everyone in the foot with capital gains tax increases – then things could improve for the UK later in 2010. But if no tapered relief is available and tax rates rise coupled with rising interest rates by end 2010 – we be won’t be making any property buy recommendations (who would risk 100% loss for a 10% gain). It will be sell-up instead. And find another country to invest in. Canada, Norway and Australia spring to mind. Or consolidation in Switzerland. As investors know, when it's time to start hoping and praying rather than managing risk, its time to get out. So the uncertainty is massively serious and the tax-fiscal instability in the UK in the last few years has been one of the worst in the world. No-one seems to have told the government though.

We hope you have found this Special report helpful - if you have any comments, please contact us on enquiries@propertyinvesting.net

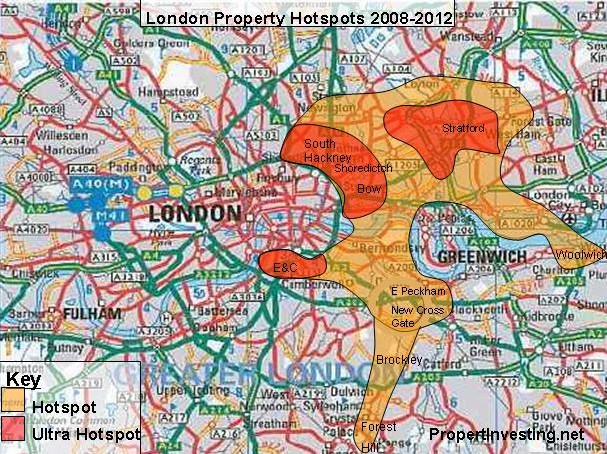

London property hotspots If capital gains tax does not destroy the market after 22 June 2010

Hotspots caused by:

-

London Olympics 2012

-

City jobs

-

Docklands jobs

-

West End jobs

-

DHL extension 2009

-

East London Rail development 2010

-

Crossrail start 2010 - finish 2017

-

City airport expansion

-

East London regeneration

-

Trendy arts developments South Bank, Hoxton, Clerkenwell, Peckham

-

Population increase Bow-Stratford area

-

Gentrification of areas like Limehouse, Shoreditch, South Hackney, Whitechapel

-

Improvements from a low base in Peckham, Hackney, New Cross, Brockley, Forest Hill

-

Elephant & Castle, Lambeth and Kennington - close to City and West End jobs and wealth

Kisten Stewart Edward Cullen