390: Slipping into crisis - debt, recession and the markets

08-03-2011

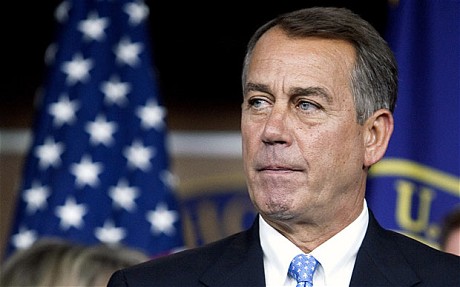

US Debt: We all know that the US debt ceiling increase and budget cuts was just a temporary stop-gap to tied the current Administration over until after the US 2012 elections. And the Republicans won - helped by the the crisis coordinated by the Tea Party in forcing the issue to the post and thereby scuppering any tax increases for high earners. The US debt is now a staggering $14.3 Trillion. We predict the Fed will start QE3 by early 2012. Unemployment will continue to rise. The economy will continue to slow and stall.

Euro Debt: Meanwhile the markets took a look at the small print of the Greek bail-out i n July and discovered there was not much in this deal and the deal also exposed Spain and Italy to the requirement for a gigantic bail-out. There has subsequently been a run on the Italian and Spanish debt interested rates shot up to 6.25% - close to the 7% figure generally regarded to require a bail-out.

n July and discovered there was not much in this deal and the deal also exposed Spain and Italy to the requirement for a gigantic bail-out. There has subsequently been a run on the Italian and Spanish debt interested rates shot up to 6.25% - close to the 7% figure generally regarded to require a bail-out.

Timing: So the US debt issue has been delayed may be 18 months if they are lucky. And the Euro-contagion continues with both Spain and Italy requiring a bail-out as early as next week.

Markets: No wonder the stock markets have started dropping. This is just the beginning of a mid bear market crash as we predicted a few months ago. We think stock markets should correct downwards in the UK and USA by about 40%. The FT100 to ~4000 and Dow to ~8000. Please dont think this is a temporary drop its almost certainly just part of a large down leg and just the start of a huge bubble that was created by the US fiat printed money. There will be more printed money followed by massive inflation starting early 2012 and hence gold will continue to rise. Were 60% of the way through the commodities bull run, not at the end by any means.

hence gold will continue to rise. Were 60% of the way through the commodities bull run, not at the end by any means.

US Crisis: The USA is in a critical situation. The government is spending of $2.75 Trillion and has $1.75 Trillion in tax receipts per annum a deficit of 10% of GDP. 60% of the GDP is consumer spending from printed fiat money and borrowed money. The spending cuts are token and minimal not a serious effort. Rating agencies look frankly "not objective" in keeping the USA as AAA rated sovereign - when they downgrade everyone else. Its only a question of time before they lose this rating but it won't matter anyway because the rating agencies lost all reasonable credibility after the last crash in 2008.

Fiat Printed Money: Ev er since President Nixon took the dollar off the gold standard, the dollar has depreciated in real value as the printing presses have continued to water down the currency. If the GDP of the country with stable debt was to increase by 10%, it would seem reasonable for the government to be "allowed" to print 10% more money. But the US economy from 2007 to 2011 on average has not grown - however, the Fed has printed a giant $2 Trillion of money. This is not back by any assets - in fact, the overall value of US assets is dropping - just look at real estate prices, oil reserves and the Dow Jones index. Stock markets are lower today than in 2000 despite 11 years of inflation. The printed money has been used to prop up the stock market and keep big investors happy - thereby delaying the fateful day the bubble goes pop and a US default occurs.

er since President Nixon took the dollar off the gold standard, the dollar has depreciated in real value as the printing presses have continued to water down the currency. If the GDP of the country with stable debt was to increase by 10%, it would seem reasonable for the government to be "allowed" to print 10% more money. But the US economy from 2007 to 2011 on average has not grown - however, the Fed has printed a giant $2 Trillion of money. This is not back by any assets - in fact, the overall value of US assets is dropping - just look at real estate prices, oil reserves and the Dow Jones index. Stock markets are lower today than in 2000 despite 11 years of inflation. The printed money has been used to prop up the stock market and keep big investors happy - thereby delaying the fateful day the bubble goes pop and a US default occurs.

Warning: The reason why we write this Special Report is to warn you that things will get far worse and we are probably already in a recession. All key indicators are now pointing to recession and this will be confirmed by end September we believe. There might be a slight increase in activity moving into the winter period, but not enough to prevent a general western develo ped economy recession. When the stock markets realise this, it will look like 2008 all over again, by mid Q3 2011.

ped economy recession. When the stock markets realise this, it will look like 2008 all over again, by mid Q3 2011.

Get Out: Its time to be into cash and gold. Out of the market.

UK Safe Haven: The good news for the UK is that property in London is increasingly being used as a safe haven against inflation and as Europeans and Americans pull their money out of these markets. Furthermore, foreign investors are buying UK gilts driving rates down to record lows and hence borrowing costs are dropping. These should also help reduce inflation.

By for Now: That's it for now, we hope this snap-shot has helped frame your investment decisions.