397: Sell Cash-Bonds - Buy Gold-Silver

10-14-2011

Debt Doldrums: What most people dont realise is that the debt situation Europe and USA is not going to go away. Its only going to get worse over a long period of time. The reasons for this are:

· Economic growth will be stifled by high oil prices as Chinese and developing nation's oil demand rises and oil supply is constrained

· Western nations are not competitive in labour cost terms compared with developing nations

· The continuing affects of Peak Oil mean oil prices will remain high and hence lead to high inflation and stagnating growth in western economies this will make debt repayment impossible for many indebted nations

· Europe and US politicians are not prepared to take tough decisions to reduce public spending and reduce borrowing never mind actually paying off debt

· Western developed economies have aging populations, high retirement costs and few savings along with declining oil production

· High environmental costs and taxes will further stifle economic growth and development

· Interference and over-regulation will s tifle competition and efficiency gains thereby further slowing growth

tifle competition and efficiency gains thereby further slowing growth

· Higher taxes will slow growth

Political Suicide Option: The only option being considered by politicians is to kick the can down the road namely:

· Bail-out underperforming banks, public sectors, entities and countries

· Printing more money

· Delay taking action until elected back into power

Bull or Bear: The other key aspect of the current difficulties is that the world is about 60% of the way through a secular bull run in commodities and 60% of the way through a secular bear market in stocks and shares. This means that all nations that export and produce large amounts of commodities will do well in this period. Meanwhile those countries that have few or no commodities will suffer enormously.

Invest: Western Nations With Plentiful Commodities

· Norway

· Canada

· Australia

Divest: Western Nations With No Commodities

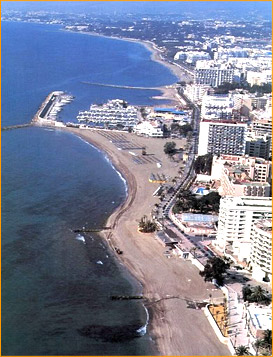

· Portugal

· Italy

· Greece

· Spain

· Ireland

· Belgium

6 Years Left: The secular bear market for stock and share started March 2000 and should last for about 17½ years until about 2018 another six years left. This is when the final run up in oil prices, commodities prices, gold and silver prices is likely to occur as inflation ravages western economies and enormous amounts of wealth are destroyed through inflation.

Printing Money: Realistically, every time the western economies look as if they will slow down, the politicians and central banks will start printing more money to prop the whole lot back up again. As money in printed, stock markets rise again, oil prices rise then the economy slows further because of the high oil prices as debts increase. Then stagnations re-commences, unemployment rises, inflation rises further and then the politician will start the printing presses again. Its quite simple really.

US Fed Private: A little know fact is that the US Federal Reserve is not a bank, not a public entity and has no reserves. Instead it is a private institution back by nothing but fiat paper promises with European and Middle Eastern investors controlling policy. Every time more money is printed, investors make some short-term gains before the smart investors short and pile more money into gold and silver.

Bond Market Bubble: The bond market is a bubble about to go pop. The rates for bonds are so ridiculously low, they are almost laughable. How is it the no-one sees a risk premium in the US dollar surely investors must wise up shortly  to the risks of US debt default and start asking for premiums. When this happens, the US interest rates will sky-rocket just as they did in Greece, and the US will no longer be able to pay interest on its $14 Trillion debt. They will of course try and print more money to cover the interest rates charges, but eventually the dollar will crash, foreign investors will stop putting money into the dollar and the US will no longer be viable economically. Its only the Chinese that are propping the whole lot up now by keeping their currency tied to the dollar thereby giving the dollar strength that it would not normally deserve. Our advice is get out of bonds now quickly, before it goes pop.

to the risks of US debt default and start asking for premiums. When this happens, the US interest rates will sky-rocket just as they did in Greece, and the US will no longer be able to pay interest on its $14 Trillion debt. They will of course try and print more money to cover the interest rates charges, but eventually the dollar will crash, foreign investors will stop putting money into the dollar and the US will no longer be viable economically. Its only the Chinese that are propping the whole lot up now by keeping their currency tied to the dollar thereby giving the dollar strength that it would not normally deserve. Our advice is get out of bonds now quickly, before it goes pop.

Slow Long Collapse Worse Than 1970s: The bottom line is we see a very low chance indeed of the debt contagion ending and the crisis will only get worse. It will be a long steady collapse almost in slow motion over so many year s that people might not notice it creeping up on them.

s that people might not notice it creeping up on them.

· Firstly, savers will be destroyed by inflation

· House prices will remain stagnant and drop in inflation adjusted terms (albeit mortgage debt will be eroded by inflation)

· Oil prices will remain stubbornly high for many years to come

· Gold and silver prices will sky-rocket

· Inflation rates will rise chasing the tail of inflation

· Unemployment will keep rising youth unemployment and unemployment of women will be particularly high

· Riots will become more common in the less well off urban areas

· Public sector wages will keep rising despite the economic problems instead, jobs will be lost to cut budgets

· Left and right wing political extremism will grow

· Terrorism is likely to become more common-place as disaffected populations turn to radical movements

History Will Repeat Secular Cycle: It will be a bit like the post 1964 era all over again. 1964 is equivalent to the year 2000, the end of the great stock market and housing boom and we are now 12 years down the road in 1976 when house prices have been depressed for five years and oil prices have been high for seven years. But its not over yet, because we are totally indebted with rising inflation and unemployment and more printing of money. Fast forward a further six year s to 2018 (or the equivalent of 1982) and you have the debts of the stock market bear and the commodities bubble finally going pop as oil prices start dropping back and gold prices crash.

s to 2018 (or the equivalent of 1982) and you have the debts of the stock market bear and the commodities bubble finally going pop as oil prices start dropping back and gold prices crash.

No Oil To Save Us: Regrettably for the USA and UK, the recession at the end of this commodities bull run will be worse than in 1982 because in this year the UK was saved by massive new oil production from the North Sea. And the USA was saved by massive new oil flows from Alaska. This time the UKs oil production crashed after March 2011 when the government increased North Sea taxes decline rates have doubled in six months from 5 to 10%. This will make balancing the books almost impossible. We believe by end 2012 the UK will lose its AAA rating with Standard & Poors. Interest rates will then start to rise. As high oil prices reduce GDP growth, the UK will stay in the recession that it has now just entered for a prolonged period. Higher unemployment will lead to lower tax receipts and higher deficits. Money printing opportunities will lead to short term boosts in growth but debt levels will continue to rise. All this will put pressure on Sterling. And gold and silver prices will just keep rising.

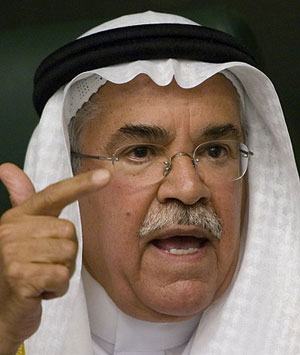

Middle Eastern Social Spending System: Another fundamental reason why we are mired in stagflation is because Middle Eastern oil exporting  nations now need $100/bbl oil prices after the Arab Spring to keep their gigantically expanding desert populations from rioting against autocratic kingdoms. In 1986, oil prices crashed when the Saudis help the US flood the world with cheap oil to cause the collapse of the Soviet Union three years later. But now the Saudis cannot help reduce oil prices because the Kingdom would come to an end if they had to cut social spending. So indirectly it is the gigantically expanding desert populations that are causing economic strain in the west with high oil prices, stagflation and high debt levels from high oil import bills. In the 1970s, Saudis population as 5 million plenty of petrodollars to go around. Now its population is 65 million a so called desert kingdom and they used three times more energy than the average UK citizen mainly because its so hot. Oil prices will therefore stay high. Its difficult to see how western economies can get out of this mess. Thats another reason why gold and silver seem like cheap investments at this time. Surer to rise compared to any other investment.

nations now need $100/bbl oil prices after the Arab Spring to keep their gigantically expanding desert populations from rioting against autocratic kingdoms. In 1986, oil prices crashed when the Saudis help the US flood the world with cheap oil to cause the collapse of the Soviet Union three years later. But now the Saudis cannot help reduce oil prices because the Kingdom would come to an end if they had to cut social spending. So indirectly it is the gigantically expanding desert populations that are causing economic strain in the west with high oil prices, stagflation and high debt levels from high oil import bills. In the 1970s, Saudis population as 5 million plenty of petrodollars to go around. Now its population is 65 million a so called desert kingdom and they used three times more energy than the average UK citizen mainly because its so hot. Oil prices will therefore stay high. Its difficult to see how western economies can get out of this mess. Thats another reason why gold and silver seem like cheap investments at this time. Surer to rise compared to any other investment.

6 Year Plan: What we are trying to do here is set you up and help you in a six year investment time frame. You may not know which way to turn to protect your wealth, and try and make investment returns in this highly unstable bear market.

Investment Strategy To Prosper: Some key principles to help safeguard your wealth:

· Do not put large amounts of cash in a bank many will go broke and governments will no longer be able to bail them out

· Do not put large amounts of money into bonds and treasuries sovereign debt default and inflation will destroy these investment they are very risky

· Consider putting money into the very best and most stable multi-national private business stocks because:

· They cannot be seized by governments (unlike saves, treasuries, bonds and even gold in some circumstances)

· Although the asset value is not likely to rise, it might keep close to inflation as more money is printed

· It will be pay dividend of up to 5-6% a year (albeit this is subject to tax)

· Many companies have histories of >100 years (Shell, Exxon) so its difficult to see these companies going bankrupt and hence are relatively safe heaven investments with high dividends

Buy gold: In inflation adjusted (or dollar money supply) terms, gold prices should be at least $6000/troy ounce. It trades at $1600 today. Gold still looks cheap. As the printing presses accelerate, the prices will rise sharply we believe.

Buy Silver: The developing nations require huge quantities of silver for industrial use. There is only 60% of the amount of silver at surface compared to gold. But the price is $32 compared to $1600 for gold. Stock will start to ru n very low very soon. Silver prices are erratic, but we believe they will go ballistic in the next 1-5 years. Prices will rapidly rise from $32/troy ounce to at least $100/troy ounce. The upside is more like $1000/Troy ounce if severe shortages are made transparent.

n very low very soon. Silver prices are erratic, but we believe they will go ballistic in the next 1-5 years. Prices will rapidly rise from $32/troy ounce to at least $100/troy ounce. The upside is more like $1000/Troy ounce if severe shortages are made transparent.

Final Blow-Off: As the stock market bear run comes to an end, and the dollar crashes amid awash of printed dollars at the end of the commodities bull run the final blow-off we thing the Dow Jones should equal the gold price. Yes, we think if gold is $5000/Troy ounce, then the Dow Jones index will be 5000. If the Dow Jones after rampant inflation remains around 10000, then gold will rise to $10,000/Troy ounce. This might take another six years but this is our central investment forecast. At the end of a commodities bull run, it is quite normal for the Dow Jones Index to Gold Price to equal one e.g. then same. Whether this is 2000, 7000 or 12000 we dont know, but whatever it is, it will be the same. Either stocks will crash or gold will sky-rocket in inflation adjusted terms. And gold will massively out-perform stocks in inflation adjusted terms.

Starting Now: We have started piling into gold and silver after the summer 2011 correction down by 20% for gold and 40% for silver. This is a great buying opportunity.

Shift Out Of Cash: The trick will be to shift out of cash held in banks, and risky assets into physical gold and silver coins, bars, the real stuff held in safe deposit boxes and secure audited vaults in London and Zurich.

No to ETFs: Our steer is, dont buy gold or silver ETFs they are controlled by banks and the banks are controlled by the governments. Do you trust banks and governments. Hopefully you will answer no. If so, why would you ever trust them with a paper gold or silver ETF that can fold just like a bank?

The Ultimate Currency: If things get very bad, no-one will accept cash anymore it will be almost worthless if hyper-inflation takes off. The only thing that will be worth serious money and be properly tradable will be gold and silver coins. Eventually government may revert back to the gold standard. Gold and silver will increasingly become legal tender for the purchase of goods and services.

Gold Seizure: Some governments may try and seize gold make it unlawful to hold gold like the USA did in the 1930s but we doubt this will happen in Europe. If this happens, it will be a sign that everything has broken down including society as a whole. Unlikely.

Just in case you are thinking of buying gold and silver and having it in your house. Simple answers is dont whatever you do. The reason being you become a target for the worst criminals. Dont ever believe news will not get out that you have your gold at home someone will find out eventually and if you are lucky it will go missing without you or your family being threatened. Its best kept in a safe deposit box in the most solid and trustworthy bank you can imagine okay, thats not easy but making serious money never is.

Inflation All The Way: Also consider inflation and the numbers cooked up by governments. Everyone knows that inflation is far higher than the 4-5% officially quoted. When food is rising at 15% meanwhile portions get smaller, and energy prices and rental prices rise 10-15% a year, then the government claim inflation is only 4% - its laughable. You savings if you have any are being eroded by about 8-10% a year they will be worth very little in ten years time. That is another reason why you need to buy gold and silver. The government is giving you 1% interest rate on savings, has inflation at 8% and allows people to borrow money at 5% to invest into risky assets. And you even get taxed on your 1% interest rate. Its robbery of the highest order. They know old aged pensioners dont riot so they will continue to get away with this and to make matters worse, print money and purposely inflate away thereby reducing your savings in spending terms. No wander people that retired ten years ago are going back to work. Its a very sorry story that will certainly get worse as inflation rises well over 10% moving into 2012. It will be like 1977 all over again and the big gold bull and blow-off will be some time later.

.gif)

The Herd: Do you know anyone that owns gold and silver? The answer is almost certainly no. Most hedge fund managers dont even own gold and silver never mind job public. But when people finally get wind of the fact that gold and silver are the only ways left to make serious money the herd will arriving everyone will hear about and people will become gold and silver traders just like they became property developers in 2005 and stock traders in 1998. Then the final feeding frenzy will take place followed the massive blow-off and crash likely some to near 2018. The smart investors will see this parabolic bubble developing and bail-out and head for the hills just before the crash. You just need to make sure you get in early and are not the last one at the party. Get out well before the top and dont get too greedy. Set yourself some target sell levels and keep to them.

Cash Is Not King: Back to cash or currencies. The cash and currencies of inde bted nations will crash as more money is printed to inflate the debt away, currencies decline and some governments default on their debt liabilities. So get out of cash in these countries with high debt levels. Shift into gold and silver, or at least sable currencies underpinned by oil/gas/metals like Canada, Norway and Australia that will not need to print money and will be awarding high interest rates because of strong indigenous economy growth. If you have to hold cash, its best to be in the currencies of these countries.

bted nations will crash as more money is printed to inflate the debt away, currencies decline and some governments default on their debt liabilities. So get out of cash in these countries with high debt levels. Shift into gold and silver, or at least sable currencies underpinned by oil/gas/metals like Canada, Norway and Australia that will not need to print money and will be awarding high interest rates because of strong indigenous economy growth. If you have to hold cash, its best to be in the currencies of these countries.

China: Many people believe China has a property bubble that will go pop. We really dont know whether this is the case or not, but normally when people say there is a bubble, they are normally right its pretty easy to spot. The big question is - what will happen if and when the Chinese property bubble pops. Will it lead to a big slowdown in the Chinese GDP and if so, will this then have a big knock-on impact around the world now that economies are so inter-linked. It could cause the US and European debt situation to worsen still further. Eventually, we believe there will be many sovereign debt defaults and many currencies will simply crash in value. Remember since 1913 the US dollar has dropped in value to 5% of what it was. Meanwhile gold has risen in value twenty fold in dollar terms. What we are saying is that cash in a weak currency with interest rates at 1% is not worth the risk in a bank, because:

· The interest savings rate is about 7% lower than inflation you lose 7% compounded each year assuming 8% inflation

· You risk losing all your savings if the bank goes bankrupt and the government is unable to bail it out (or the government goes bankrupt as well quite possible)

· You will lose further as the currency declines in value

· Any interest on the savings is taxed you lose this money as well

· When you spend the money, you are taxed at 20% VAT (or 80% on petrol)

· The currency can crash or the value of the money can crash as more fiat money is printed this will happen for sure

Gold Better than Cash: When you consider all of the above, why would you have your money in cash rather than buying physical gold or silver with it and storing in a safe deposit box? We cannot rationalise why anyone would chose cash over gold and silver when interest rates are non-existent and there are colossal quantities of fiat printed money coming off the printing presses. Even worse, governments dont even bother printing it anymore. They just flick an electronic number add the money make an IOU - and in so doing destroy your savings through inflation.

War Warning: Finally, not wanting to get too gloomy, but after rampant inflation (or hyper-inflation), depression and massive unemployment and bankruptcies the world has a history of going to war. This  happened in 1918 and 1939. In the 1982 recession Britain went to war against Argentina Argentina then had an economic collapse and hyper-inflation. There was the Iranian Revolution in 1981. It always happens after hyper-inflation and high commodities prices. War breaks out. Resource wars start. So dont be too surprised hard to believe but if history is anything to go by it could happen again that by 2017-18, another big war breaks out over resources after a final gold-oil blow-off and years of recession culminates in the end of the stock bear market and the start of the next secular 18 year bull stock market. By then, many miserable people will be around. Industry will be ultra-depressed. And those people that had cash, will have none left. But those that shifted early into silver and gold will have survived this final bear market down-leg when savings and investment were destroyed. The smart investors probably started buying vast quantities of gold and silver back in 2008 after the second stock market crash after 2000. But as the slow-motion collapse unfolds these investments will shine

happened in 1918 and 1939. In the 1982 recession Britain went to war against Argentina Argentina then had an economic collapse and hyper-inflation. There was the Iranian Revolution in 1981. It always happens after hyper-inflation and high commodities prices. War breaks out. Resource wars start. So dont be too surprised hard to believe but if history is anything to go by it could happen again that by 2017-18, another big war breaks out over resources after a final gold-oil blow-off and years of recession culminates in the end of the stock bear market and the start of the next secular 18 year bull stock market. By then, many miserable people will be around. Industry will be ultra-depressed. And those people that had cash, will have none left. But those that shifted early into silver and gold will have survived this final bear market down-leg when savings and investment were destroyed. The smart investors probably started buying vast quantities of gold and silver back in 2008 after the second stock market crash after 2000. But as the slow-motion collapse unfolds these investments will shine

You can also take a medium risk approach to buying silver and gold through an internet bullion account (www.bullionvault.com is an example of an established bullion trading site that has audited bullion backing up its gold trading).

Risk: So in summary:

· Coins and bars held in a safe deposit box (in London or Zurich) low risk

· Internet bullion trading - medium risk

· Gold and silver ETFs high risk

· Bullion held at home in a safe very high risk

Oil and Mining: Also destined to do well in the next six years are oil, gas, coal, metals mining companies and agriculture, forestry, farmland and fertilizer companies. We have almost allo our investment weighting into oil, property and gold-silver (plus a little artwork). In this commodities bull market we do not invest in anything else period. Its simply property, oil, gold and silver. And cash is no longer king. Thats it.