262: Electric Revolution, the Environment and the Next Energy Crisis

04-27-2009

PropertyInvesting.net team

Thank you for reading this special report in advance – we hope and expect you will find it very insightful and enlightening – you are also likely to find it in some respects disturbing.

Oil Price Problem: PropertyInvesting.net have been warning of sky-rocketing energy prices for years now – we identified the supply crunch from June 2007 in August 2007 that led to skyrocketing oil prices to $147/bbl (we predicted $125/bbl by end 2008). We also advised that property prices would drop and the house prices in major oil importing nations would become precarious at oil prices over $70-$80/bbl – which indeed they did. What we were surprised by was the extent of the downturn and that oil prices would crash so dramatically from $147/bbl July 2008 to $35/bbl end 2008.

Oil Price Problem: PropertyInvesting.net have been warning of sky-rocketing energy prices for years now – we identified the supply crunch from June 2007 in August 2007 that led to skyrocketing oil prices to $147/bbl (we predicted $125/bbl by end 2008). We also advised that property prices would drop and the house prices in major oil importing nations would become precarious at oil prices over $70-$80/bbl – which indeed they did. What we were surprised by was the extent of the downturn and that oil prices would crash so dramatically from $147/bbl July 2008 to $35/bbl end 2008.

Oil Price Caused Recession: For anyone that things oil prices are not important to the global economy, we advise you read our special reports on the net oil surplus/deficit at different oil prices of major oil importing and exporting nations. At $147/bbl, it was costing South Korea $150 billion a year in oil import bills alone – this was 5% of their GDP. Add to that the coal and LNG/gas bills – and its a massive burden on a manufacturing dominated nation – no wander the country has tipped into recession so quickly and dramatically. And yes, this is GDP – not profit. This is the total money-financial activity  transacted in the nation – so if someone imposes a 5% royalty type tax before you even start, it can cut your profits of 10% by half.

transacted in the nation – so if someone imposes a 5% royalty type tax before you even start, it can cut your profits of 10% by half.

Massive Oil Costs: Meanwhile the USA was spending an annualised $400 Billion on oil imports in 2008 (assuming $125/bbl). This despite producing 40% of its oil needs. Even for the USA, this is a massive amount of money, equivalent to the first announced 3-4 year financial stimulus package mentioned by Bush/Obama Q4 2008. On the other hand, Saudi Arabia was receiving $500 Billion at $125/bbl in oil revenues and Russia a staggering $500 Billion. Where did this money go? We don’t know, but we at PropertyInvesting.net believe it was a major (and the defining) contributor to the ensuing financial meltdown and subsequent global recession. What it tells us is that the world cannot afford or handle $147/bbl oil – it tipped the world into recession. Just to remind you that oil prices rose 14 fold in nine years from $10/bbl in 1999 to $147/bbl in 2008. Hardly surprising when you look back at the recessions of 1971, 1981, 1991 which all coincided with oil prices skyrocketing. Nothing seems to have changed.

Investments On Hold Sowing Seeds for Next Spike: The problem now is that about 40-50% of oil/gas exploration and development expenditure has either been deferred or cancelled. Huge oil sand projects in Canada are on hold. Many deepwater offshore projects have been cancelled or deferred. This is partly because of low oil prices and partly because of the credit crunch, lack of available bank funding and liquidity. This has sowed the seeds for the next oil price spike likely starting soon and continuing into 2010.

Investments On Hold Sowing Seeds for Next Spike: The problem now is that about 40-50% of oil/gas exploration and development expenditure has either been deferred or cancelled. Huge oil sand projects in Canada are on hold. Many deepwater offshore projects have been cancelled or deferred. This is partly because of low oil prices and partly because of the credit crunch, lack of available bank funding and liquidity. This has sowed the seeds for the next oil price spike likely starting soon and continuing into 2010.

Oil Excels for Products: The underlying issue is that oil is the premium fuel for the global economy. It is pure energy, transportable, it can be used to burn, refine, for transportation, power, chemicals, paints, pharmaceuticals, cosmetics, plastics, pipes, fertilizers – oil has a massive amount of various uses – the world cannot do without it. There is no viable substitute for many of these more specialise refined products like paint, drugs and plastics. There are other specialised products like bitumen for road building.

Peak Oil: Meanwhile we believe the world has now reached “Peak Oil” – this is when production peaks and starts a decline (never to reach its previous peak). This peak we believe – according to our extensive modelling – was July 2008. This coincided with $147/bbl. In theory, it may still be possible increase levels about this, but it would need massive and fast investment in Iraq, Venezuela, Russia and Saudi Arabia – all of which looks highly unlikely with oil prices languishing at $50/bbl and the socio-political and security aspects of these countries. The bulk of any potential oil production increase is in the hands of the national oil companies and hence governments of these states. With low oil prices, in most of these states, any income will be diverted to social programmes to keep the expanding population in content (employment, social welfare, health, education, subsidized energy and housing).

Peak Oil: Meanwhile we believe the world has now reached “Peak Oil” – this is when production peaks and starts a decline (never to reach its previous peak). This peak we believe – according to our extensive modelling – was July 2008. This coincided with $147/bbl. In theory, it may still be possible increase levels about this, but it would need massive and fast investment in Iraq, Venezuela, Russia and Saudi Arabia – all of which looks highly unlikely with oil prices languishing at $50/bbl and the socio-political and security aspects of these countries. The bulk of any potential oil production increase is in the hands of the national oil companies and hence governments of these states. With low oil prices, in most of these states, any income will be diverted to social programmes to keep the expanding population in content (employment, social welfare, health, education, subsidized energy and housing).

Declining Oil Fields: There are few if any countries that have significantly increasing oil production: Angola, Iraq, Khazkstan, Azerbijan, Canada, Brazil, China are probably the only ones. And Brazil and China need all their new oil – they will never export again! Canada’s production increase will slow because of low oil prices. It’s debatable whether UAE, Saudi Arabia, Russia or Kuwait are capable of increasing production over their July 2008 levels – in all cases, likely not and never again!

UK and USA’s Oil Decline: The UK and USA’s oil production is in terminal decline. The UK’s production is plummeting – by ca. 20% per annum. Most fields are now in late field life. New additions are very small. The USA’s oil production is dropping by ca. 6% per  annum. This is unlikely to reverse. In summary, the world has a big problem. It’s currently being masked by OPEC production cuts and the global recession. 4.5 million barrels of oil has been cut from OPEC quotas – with a compliance rate of 80% that’s about 3.8 million bbls – a huge amount (7% of total world production) – but oil prices have recovered to $50/bbl from their lows of $35/bbl Q4 2008. But what’s concerning is we cannot see the underlying decline rate of countries – we don’t know what spare capacity is out there any more. In theory it should be 3.8 million barrels, but if most oil producing nations have declining oil production after oil investment has now been starved, and this decline rate was ca. 7% per annum, then it would only take one or two years for levels to drop to the new quota level. But the problem is, when a decline sets in, it’s almost impossible to reverse. It takes 5 years of strong investments at least – so you cannot reverse this decline easily – if ever. You may slow it, but once a countries production goes off plateau, it normally dropped quickly and cannot be reversed. For a reverse to take place, the country has to find a big new oil discovery – and there have been none in the last 10-20 years that can be bought on stream in less than 5 years. Most are very small.

annum. This is unlikely to reverse. In summary, the world has a big problem. It’s currently being masked by OPEC production cuts and the global recession. 4.5 million barrels of oil has been cut from OPEC quotas – with a compliance rate of 80% that’s about 3.8 million bbls – a huge amount (7% of total world production) – but oil prices have recovered to $50/bbl from their lows of $35/bbl Q4 2008. But what’s concerning is we cannot see the underlying decline rate of countries – we don’t know what spare capacity is out there any more. In theory it should be 3.8 million barrels, but if most oil producing nations have declining oil production after oil investment has now been starved, and this decline rate was ca. 7% per annum, then it would only take one or two years for levels to drop to the new quota level. But the problem is, when a decline sets in, it’s almost impossible to reverse. It takes 5 years of strong investments at least – so you cannot reverse this decline easily – if ever. You may slow it, but once a countries production goes off plateau, it normally dropped quickly and cannot be reversed. For a reverse to take place, the country has to find a big new oil discovery – and there have been none in the last 10-20 years that can be bought on stream in less than 5 years. Most are very small.

Peak Oil Summary: In summary, we’re reached Peak Oil, we are now decline, and we don’t know how fast this decline will be. It could drop, then stabilize if oil prices rise further, but if they are slow to rise, the rate of decline will increase.

Global Economic Recovery To Be Stifled by Rising Oil Prices: When the global economy finally starts to recover, likely Q4 2009 and into 2010, demand for oil will increase sharply aga in. All spare capacity will be used up – by end 2010 it will become very noticeable and there could be another oil price spike (and possible crash again). This turmoil will again affect the global economy and recovery – just when it want to get going, it will be throttled back. It’s all so distressing since one can see all the ingredients for it happening – but there is not much at present being done to mitigate these risks. The world has slipped into a melancholy acceptance of low oil prices again – people are still buying huge petrol and diesel power SUVs, big engine and inefficient cars and flying around the world for business meetings – burning precious oil that one day we will all look back and wish we’d conserved better! Yes, its the market at work – and capitalism, but there has to be a better way. 70% of oil is used for transportation. If oil disappears or becomes very scarce, our whole transport infra-structure will grind to a halt. Even many of our trains are diesel burning. All airplanes are kerosene burning – there is no substitute. We find it truly incredible that airlines have not fuel tax when kerosene is running out and the CO2 emission from flying are so high. One trip from the UK to Australia by plane for one person is equivalent to driving a car for four years! Meanwhile fuel tax in the UK is 75% of the cost of petrol/diesel. We propose the next Global Climate Change Conference should be by video-conference!

in. All spare capacity will be used up – by end 2010 it will become very noticeable and there could be another oil price spike (and possible crash again). This turmoil will again affect the global economy and recovery – just when it want to get going, it will be throttled back. It’s all so distressing since one can see all the ingredients for it happening – but there is not much at present being done to mitigate these risks. The world has slipped into a melancholy acceptance of low oil prices again – people are still buying huge petrol and diesel power SUVs, big engine and inefficient cars and flying around the world for business meetings – burning precious oil that one day we will all look back and wish we’d conserved better! Yes, its the market at work – and capitalism, but there has to be a better way. 70% of oil is used for transportation. If oil disappears or becomes very scarce, our whole transport infra-structure will grind to a halt. Even many of our trains are diesel burning. All airplanes are kerosene burning – there is no substitute. We find it truly incredible that airlines have not fuel tax when kerosene is running out and the CO2 emission from flying are so high. One trip from the UK to Australia by plane for one person is equivalent to driving a car for four years! Meanwhile fuel tax in the UK is 75% of the cost of petrol/diesel. We propose the next Global Climate Change Conference should be by video-conference!

Climate Change: Meanwhile, climate change (global warming) and CO2 emissions concern many people – and energy investment are being slowed by these concerns. The threat of sea levels rising and drying of certain areas, with flooding is other is a real one. However, the population is increasing, the undeveloped world needs electricity and power to generate wealth, good health and prosperity just as the western world has had in the last 40 years. Surely they deserve the same. But the environmental forces would say, no to more development because it increases CO2 emissions – even though hospitals and homes need electricity. The forces and imbalances at work are most disturbing. There has got to be a better way.

The economics of solar power to electricity (PV cells) is improving, but this can only be made economic in countries with strong sun/solar with low cloud cover, and close to populated area. It does not work for most countries.

Global Dimming: A little discussed physical phenomena is one of global dimming and co oling cause by particulate pollution in the atmosphere. The bulk of this pollution is cause by 1) airline trails – frozen condensation from jet engines; and 2) soot from coal burning power stations and other heavy industry and factories. After the collapse of the Soviet Empire in 1989 and the recessions in Europe and USA in 1981 and 1991 – many dirty coal burning power plants and dirty heavy industry was shut-down. The air became far cleaner in western developed countries and Russia in the period 1981 through to present day. This probably reduced dimming, also reducing global warming rates for a while. On the other side of the balance, China and India’s rapid industrialisation kicked off in earnest by 2000 and the massive sustained increase in coal usage has increased dimming again, and global airline travel has also massively increased – these will cause some degree of cooling. Overall, if the atmosphere is clean but has increasing quantifies of CO2, it will become the warmest – this occurred in the period 1982 to 2000. From 2000 onwards, dimming increased and we would therefore expect, despite CO2 levels increasing, the rate of temperature increase to abate somewhat. It’s obviously still a real issue, but in our opinion, from a combined social, economic and environmental perspective (sustainability) – Peak Oil is a bigger threat. It can lead to war, hunger and human desperation. We believe Peak Oil and Energy Crises will be far more widely discussed in the media within a 2-5 year time frame when compared to Climate Change.

oling cause by particulate pollution in the atmosphere. The bulk of this pollution is cause by 1) airline trails – frozen condensation from jet engines; and 2) soot from coal burning power stations and other heavy industry and factories. After the collapse of the Soviet Empire in 1989 and the recessions in Europe and USA in 1981 and 1991 – many dirty coal burning power plants and dirty heavy industry was shut-down. The air became far cleaner in western developed countries and Russia in the period 1981 through to present day. This probably reduced dimming, also reducing global warming rates for a while. On the other side of the balance, China and India’s rapid industrialisation kicked off in earnest by 2000 and the massive sustained increase in coal usage has increased dimming again, and global airline travel has also massively increased – these will cause some degree of cooling. Overall, if the atmosphere is clean but has increasing quantifies of CO2, it will become the warmest – this occurred in the period 1982 to 2000. From 2000 onwards, dimming increased and we would therefore expect, despite CO2 levels increasing, the rate of temperature increase to abate somewhat. It’s obviously still a real issue, but in our opinion, from a combined social, economic and environmental perspective (sustainability) – Peak Oil is a bigger threat. It can lead to war, hunger and human desperation. We believe Peak Oil and Energy Crises will be far more widely discussed in the media within a 2-5 year time frame when compared to Climate Change.

Wind is another renewable source of energy that is clean, but the required investment in wind infra-structure is massive when compared to its benefits - if the wind stops blowing, one still needs back-up base load power from other means. For countries like the UK, there is a real danger of double investment. They are also an eye-saw in western areas that rely on tourism for their income. Yes, they are good in deserted areas but we have none in the UK – and if they are deserted, it implicitly means the population is far away adding cost for electric transmission and power loss along lines. Wind generation in the mid West of the USA looks like a feasible plan given the strength and continuation of the wind, wide open spaces and proximity to populated area (Dallas-Denver-Houston) – if done on a grand scale. But wind can never replace conventional electric power systems.

Coal is cheap and relatively plentiful, uses conventional technology and the infra-structure is already in place. Peak coal is not likely to occur until ca. 2030 – so coal prices will probably remain relatively low when compared with oil/gas for years to come. However, as we all know, coal emissions are high and it is non renewable. Clean coal technology with carbon sequestration (pumping CO2 underground) is in its infancy. We would not expect any large scale sequestration project to start for at least another 5-8 years.

Coal is cheap and relatively plentiful, uses conventional technology and the infra-structure is already in place. Peak coal is not likely to occur until ca. 2030 – so coal prices will probably remain relatively low when compared with oil/gas for years to come. However, as we all know, coal emissions are high and it is non renewable. Clean coal technology with carbon sequestration (pumping CO2 underground) is in its infancy. We would not expect any large scale sequestration project to start for at least another 5-8 years.

Gas is flexible, transportable (via pipeline and LNG ships) and global Peak Gas is not likely until ca. 2015-2020. There are massive undeveloped gas reserves in the North Field (Qatar) and South Pars Field (Iran) – some 1000 Trillion Cubic Feet of Gas – if this field has used 15% of it gas by 2025 we would be very surprised. Production from this field can be massively expanded to ship LNG around the world (China, Korea, India, possibly Europe and USA at a push). Gas is also fairly plentiful in the USA and Canada – ample supply should be available for the next ten years, albeit gas prices will likely rise as oil prices rise – and coal prices will also rise. In fact, all energy prices will likely need to rise – putting an additional burden on the already strained global economy.

Renewables: Another renewable source of energy is hydro-electric – these are renewable, and once the infra-structure is in place, provides electricity for decades with zero fuel cost and no CO2 emissions. However, look at the Great Gorges Dam project in China that caused international consternation for an example of how difficult it is getting everyone bought into new hydro-projects. Are we interested in CO2 emissions, flora and fauna, social aspects or electricity for improved health, education and prosperity?

Biomass is an expending fuel source which is renewable in the sense that wood/grass grows again and therefore in theory has zero net CO2 emissions – one concern is people cutting down forests for fuel and not replacing them with forests (only grass). World forests are dwindling at a fast pace as the population rises and agricultural land displaces forests. This adds to CO2 emissions and threatens bio-diversity, flora, fauna and the overall balance of the eco-system. If we could find a way to plant vast forests – whilst also burning bio-mass, it would help our electric power requirements, reduce CO2 emissions and likely cool the world. Incineration of rubbish is another good energy form – not exactly renewable but one could argue it is far better than putting rubbish into land-fill/dumps, which then start generating methane gas that is given off into the atmosphere (pure methane gas is thought to have a ten times greater impact on global warming than CO2 per unit gas volume).

Biomass is an expending fuel source which is renewable in the sense that wood/grass grows again and therefore in theory has zero net CO2 emissions – one concern is people cutting down forests for fuel and not replacing them with forests (only grass). World forests are dwindling at a fast pace as the population rises and agricultural land displaces forests. This adds to CO2 emissions and threatens bio-diversity, flora, fauna and the overall balance of the eco-system. If we could find a way to plant vast forests – whilst also burning bio-mass, it would help our electric power requirements, reduce CO2 emissions and likely cool the world. Incineration of rubbish is another good energy form – not exactly renewable but one could argue it is far better than putting rubbish into land-fill/dumps, which then start generating methane gas that is given off into the atmosphere (pure methane gas is thought to have a ten times greater impact on global warming than CO2 per unit gas volume).

Corn or sugar cane to ethanol is another contentious fuel – the fertilizer and water usage to grow corn, then energy required to convert to ethanol that then offset gasoline is a very inefficient process. Some people believe there is no renewable aspect to it – and it gives off a lot of CO2 emissions indirectly. It also takes fertile land, offsetting food for human consumption and indirectly drives food prices higher for poor people. Sugar cane is more efficient, but this will not make a significant impact on displacing gasoline consumption in future years. And if rain-forests are cut down to plant sugar cane, this has an environmentally damaging impact.

Our Hydrocarbon Society: The infra-structure of developed nations is almost entirely based on the hydrocarbon society. Examples:

· Airports / airplane (kerosene)

· Trains (diesel, electric from coal)

· Cars/trucks/lorries (petrol/diesel) 70% of oil usage

· Road (bitumen, made for petrol-diesel cars)

Almost all people who work rely on hydrocarbon transport to get to work. It is the fuel for our economy and economic wealth creation. At present - no oil – no wealth creation.

In summary, there are too many people and too many developing countries chasing too few energy/fuel sources. We cannot expect people to do without electricity and transportation. Energy usage will increase whilst hydrocarbon fuel access becomes far more challenging. Oil supplies will start to dwindle soon. Global emissions threaten climate change with coal burning power stations being the worst offenders.

Someone Else’s Problem? For the babyboomer generation in western developed countries (and their  offspring), whose wealth massively increased fuelled by the hydrocarbon society, one should look at oneself critically and ask the questions:

offspring), whose wealth massively increased fuelled by the hydrocarbon society, one should look at oneself critically and ask the questions:

· Have we spent any significant time or effort thinking about energy conservation?

· Do we not feel a tinge of guilt in consuming huge amounts of oil/gas/electricity/coal within our lifestyles and working environments with scant regard to conservation of these resources?

· Have we helped position the world for when hydrocarbon resources start depleting – are we developing alternatives that are not destructive to the environment?

If the answer to all these question is no – we would not be surprised. To think it’s someone else’s problem is a natural reaction to such questions. However, it IS everyone’s problem because it will affect our economic prosperity, the future prosperity and heath/security of our children, and the sustainability of the planet. We all need to show leadership within our sphere of influence to position for the transition from a world with plentiful supplies of hydrocarbons (and no climate change problems) to a world with scare hydrocarbon resources, increasing population (and a likely climate change problem). Some people call this the “Transition” – it’s probably an apt expression. There needs to be a transformation or better still an “energy revolution” before it is too late.

Depleting Resources: We should all know logically that oil, gas, coal and all other resources that we extract from the earth are finite, non-renewable and depleting. They do not come back. So when we have produced approximately half of the reserves in the ground, the production rate will generally start declining. Even throwing huge amounts of additional capital will not significantly increase production levels – it will only temporarily accelerate the production and lead to a more rapid fall off of production when the decline sets in. The easiest oil to produce will be first, with the l ater oil production becoming increasingly complex, high cost and difficult to extract in challenging environments (deepwater, polar, environmentally sensitive areas, heavy oil, oil sands).

ater oil production becoming increasingly complex, high cost and difficult to extract in challenging environments (deepwater, polar, environmentally sensitive areas, heavy oil, oil sands).

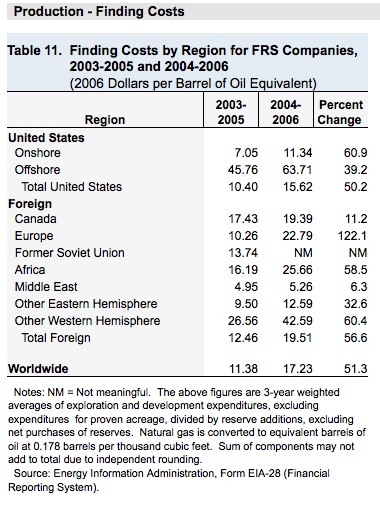

Rising Price and Costs: The period from mid 1999 to mid 2008 was an unbroken period of oil price rises, from $10/bbl to $147/bbl – it’s very unusual to have such a period of sustained and steady oil price rises and of course investment levels and activity ramped up during this time as oil prices rose – good profits could to be made by increasing production with such high prices and margins. Naturally production costs escalated from range ca. $0.5/bbl (low cost fields) to $10/bbl (high cost fields) up to the current $3/bbl (low cost fields) to $70/bbl (high cost fields). Even though the number of rigs operating worldwide doubled in this period, production rates only rose some 12% from the period 1999 to mid 2008. The bulk of the increase came from Russia from 2000 onwards - Russia seems to have started a production decline in early 2008.

Speculation: Expectation of supply shortages, supply constraints and lack of spare capacity all had their part and led the oil price spike of $147/bbl in July 2008 then catastrophic oil price collapse to $35/bbl by October 2008 as the global financial systems reached a tipping point. OPEC have cut 3.5 million bbls/day of production, investments have been delayed and cancelled and it is very doubtful in our view that production levels will ever rise above their July 2008 peak.

Global Pressures and Stresses: The world is faced with massive pressures from:

1. Depleting oil supplies – with expectations of spiking oil prices in future and supply shortages in the next decade

2. Expanding world populations – particularly in the poorer developing world

3. Industrialisation of developing countries with massive populations such as China and India

4. Denudation of rainforests

5. Increasing CO2 emission and threat of climate change (more turbulent weather with increasing temperatures in much of the world)

The Plan - Principles: We have developed a plan that works on the overarching principles that:

· The world population will continue to expand through natural growth – and the world has a duty to maintain the health and economic prosperity of this expanding population (before it likely naturally peaks towards the end of the century)

· Populations around the world require electricity for health, education, welfare and general economic prosperity and productivity (if you live in Europe or the USA and do not agree with this, then you have to ask yourself whether you could do without a good stable energy supply – the answer will invariably be no – conversely, haven’t the developing countries the same sort of rights or at least aspirations as developing countries to gain reliable energy supplies?

· Oil/gas/coal and metal resources are finite, non renewable and depleting – oil, then gas, then coal will all peak and decline as reserves deplete (there is strong evidence that Peak Oil “was” July 2008)

· Government taxation should consider the economic, environmental and social aspects to encourage efficiency in all three aspects for improved sustainability

The Plan – Strategy: We have prepared a ten point PropertyInvesting.net Innovative Plan to help alleviate the pressure building from environmental, social and economic stresses:

1. Energy Conservation – seriously start energy saving programmes for public and private sectors to encourage more efficient use of energy (fuel and electricity)

· Targets for car and truck fuel efficiency

· Insulation of homes

· Smart electricity meters and usage systems

· Advice, consultation and information to assist companies, public sector and residents save energy (e.g. PCs, computers, night heating, street lighting)

2. Reduce oil use from transportation - from 70% of global usage to 35% of global usage whilst halving the amount of oil used for transportation in 10 years (benefits: conserve depleting oil stocks, keep oil prices from spiking higher, reduce CO2 emissions, reduce air and noise pollution, improve health, decrease smog, reduce oil importing nations financial deficits, conserve remaining oil for high end usage – paints, airline fuel, plastics). Convert and replace gasoline/petrol/diesel powered cars and trucks with:

· Natural gas powered

· LPG powered (liquid petroleum gas)

· Natural gas-electric hybrid powered

· Electric powered

· Hydrogen powered (after technology is mature post 2020)

3. Rapidly Expand Renewable Energy Sources – wind, solar, biomass, hydro-electric, algal biodiesel, tidal, wave within economic constraints (benefits: reduce CO2 emissions, provide energy to offset depleting oil/gas reserves, reduce pollution)

4. Tax Airline Fuel – the amount of CO2 emissions of a person travelling from London to Perth is equivalent to driving a car (average usage) for four years – it pumps carbon into the atmosphere that it takes a tree 400 years to extract! Why do we accept no tax on aviation fuel meanwhile 80% tax on petrol? Surely airline travel is a luxury – more so than car usage. Meanwhile oil reserves are depleting and there is NO alternative to kerosene for the powering of planes. Any alternative is probably at least 20 years away (yes, we can spike 5% biofuels into an airplane, but not much more than that at present). So why do we accept almost zero tax on intercontinental airline travel for business, leisure, holidays when oil is running out – it’s bordering on insanity.

biofuels into an airplane, but not much more than that at present). So why do we accept almost zero tax on intercontinental airline travel for business, leisure, holidays when oil is running out – it’s bordering on insanity.

5. Clean Coal and CO2 Sequestration – build new power plants that reduce dirty emissions using clean coal technology. In the longer term, pump CO2emissions into depleted gas reservoirs to reduce carbon dioxide emissions (benefits: use coal resources to generate electric power to offset declining oil production/reserves and provide power for cars/trucks, meanwhile reduce harmful particulate and chemical pollutants, reduce CO2 emissions and help prevent climate change-global warming). Note: Clean Coal technology is already available and tends to increase the low cost of thermal coal-electric power by 50% (still cheaper than gas or oil). CO2 sequestration is about five years from being matured as an economically viable/value adding technology.

6. Nuclear Power – maintain existing nuclear power capacity or expand. Nuclear power has very low CO2 emissions per unit of energy produced. It therefore helps prevent global warming. Although not strictly renewable because Uranium is a depleting resource, it is a proven technology with a 60 year technical history and relatively low cost when compared to gas/oil/renewable electric power generation. Because each power plant location has a very small footprint, one can argue it may indirectly prevent deforestation and pollution and environmental degradation from alternatives such as coal mining and oil/gas extraction activities. The obvious downside is toxic waste that is difficult to very safely dispose of, and the security threats associated with enriching uranium. Another downside is the relatively high initial capital costs, plus long planning and public consultation processes. The best way forward is probably to expand existing nuclear power stations where employment is contributing to the local economic environment. (Benefit: reduce CO2 emissions during electric power generation, small environmental footprint, provide relatively low cost electric power, largely reliable source of power)

7. Ban equatorial rainforest de-forestation – provide incentives to national governments to replant and/or prevent further deforestation (benefit: increase carbon capture, O2 generation, cool equatorial areas, provide more rain, provide water/heat sink)

8. Ban new forests in frozen/snow covered areas – because the sun’s heat is absorbed in arctic pine forests (rather than reflected) this thought to contribute to global warming (Benefit: maintain cool temperatures in arctic and boreal areas to prevent ice sheets and tundra melting and methane being released from melting tundra-bog in Russia and Canada etc, reduce sea level rise)

9. Tax Beef – as countries become developed, their consumption of beef and other meats normally increases 2 to 5 fold. The problem with beef production is it is highly energy and water intensive. Furthermore, cattle emit large amounts of methane – this gas per unit volume, is about ten times more warming than CO2 gas. In addition, many new cattle ranches are or have been built by cutting down rain forests. Forests take up CO2 and give out O2, and they cool the environment and generate vapour and rainfall. Meanwhile if one cuts down a rainforest and replaces it with beef cattle, the amount of food produced is very small relative to the energy expended and water resources used, whilst methane is emitted, and compared with rainforests, CO2 levels increase, O2 levels drop, rainfall drops and the environment warms. In a world with pressure on land resources and water, surely it is far more efficient per calorie produced to grow crops – fruit, vegetables, grains. If food shortages occur after Peak Oil – the first place we should look at is land for beef – a luxury food. Why is there not an environmental tax on beef, when in the UK for example there is an 80% petrol tax for driving? Why is there no tax apart from the standard VAT, on beef imports from the other side of the world – that have been flown at great environmental cost to the consumer? The key point is, different foods have different energy intensities and environmental impacts – so in a world with water and fertile land shortages with expanding populations, should we not looking critically at taxes on the products that are the least resources efficient and most environmentally damaging. Conclusion – beef is a luxury product when considering the resources required to produce a unit volume or calorific quantity of it. It should be appropriately taxed. (Benefit: improve agricultural efficiency whilst reducing CO2, methane emissions and water usage)

10. Water – will increasingly be in short supply as the population expands, countries develop and use far more water, and climate change alters rainfall patterns. Water conservation programmes and leak detection systems need to be encouraged. Although often emotive, opportunities to provide renewable hydro-electric power and used dammed water for regional irrigation and efficient farming should be fostered rather than stifled. If our lack of an effective water and energy policy causes mass starvation and de-hydration – we will look back and regret some of the excellent hydro-electric opportunities around the world that can help reduce CO2 emissions, increase clean water supply and improve farming and food supply.

Benefits of Electricity for Populations: The Plan above acknowledges that all benefits in health, education and wealth are interlinked and only possible with electric usage. To cut waste energy and/or cut energy supply will lead to poverty, misery, poor health and ultimately starvation and/or early death. Energy brings life. No energy the converse. The plan marries a desire to boost economic GDP, wealth and support populations whilst conserving the environment, reducing CO2/methane emissions and helping prevent global warming-climate change. If you agree with all of the above ten initiatives, we would be surprised. But if you disagree with most of them, we would challenge you to consider how much energy-emissions you have used in your lifetime, whether you have any plans to decrease these, and whether the similar economic, health, social, education and wealth benefits that you desire and attain should not be available to poorer populations in other countries around the world.

Summary: In summary, we need to:

· Conserve oil, gas, coal and electric power

· Increase electric usage for transportation

· Reduce deforestation and environmental damage

· Reduce or at least stabilize CO2 emissions

· Deliver electric power systems for an expanding populations to give benefits in health, education and wealth in all countries around the world

Failure to do so would likely lead to environmental destruction on a massive scale, poverty-starvation, oil/gas shortage-crisis, and global warming—climate change thence sea level rising and coastal flooding in poor populated areas.

Final point - is, if one takes a holistic view, any delay in investment of an environmentally clean energy development will indirectly lead to poorer health, education, wealth with a downside of poverty-starvation, social-political instability and even war, if desperation takes over – plus further environmental damage. This needs to be considered before arguing against good sustainable energy developments.

We hope you have found this Special Report insightful. Please feel free to forward to your friends, family or colleagues. If you have any comments, please email us on enquiries@propertyinvesting.net

More Special reports on oil and property investing: