268: The Intuitive Contrarian – Don’t Believe All You're Told

06-06-2009

PropertyInvesting.net team

In this Special Report we pose some Myths about oil and energy – and try to debunk these Myths for our visitors - the discerning investors. In doing so, we hope to provide you with insights into how you can position your property and investment portfolio in a post-Peak Oil world. And also take a look at some other investment opportunities and hedging.

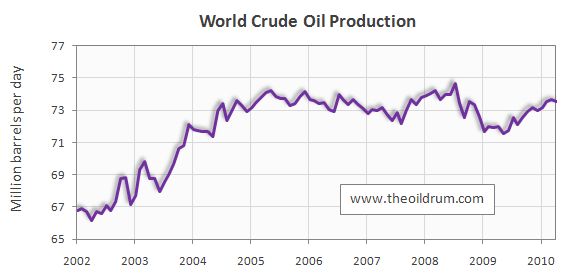

1. Oil will run out: No, not in the next 50 years. Instead, we believe oil production has started an irreversible decline after Peak Oil was reached in July 2008 and will become more scarce. Even at $147/bbl the total world oil industry struggled to keep up with rising demand from China and India and this supply shortfall in 2007 to mid 2008, along with a good  deal of market speculation, led to this oil price spike. As the global economies tumbled into recession, oil prices crashed in four months from $147/bbl to $38/bbl - production was then cut and investments were slowed or cancelled. This effect was amplified by the credit crunch and banks inability to lend to the energy businesses. It is highly unlikely we believe that total oil-liquids production will never rise above the July 2008 Peak again. But, oil will not run out. Instead, there will be a decline of between 1% and 5% per annum in total oil production worldwide from now onwards. If oil prices rose above $100/bbl and stayed there – or high oil prices were fixed or regulated – then it is still possible decline rates could be very low – may be 0.5% to 1% per annum. If oil prices are erratic (boom-bust) then investment levels, rig/equipment build and levels of development activity will not be maintained at high levels – therefore oil production could crash by 5% per annum (possibly even higher). We expect a slight decline in world oil production with bumpy plateau through to 2012, thence decline rates will accelerate because of cancelled projects end 2008. Most major oil projects have a 3-8 year lead time, so some of the investment drop-off end 2008 will not result in production declines for some years. Shorter term accelerated oil production from a ramp up in drilling activity triggered after oil prices rose above $70/bbl in mid 2007, will rapidly deplete.

deal of market speculation, led to this oil price spike. As the global economies tumbled into recession, oil prices crashed in four months from $147/bbl to $38/bbl - production was then cut and investments were slowed or cancelled. This effect was amplified by the credit crunch and banks inability to lend to the energy businesses. It is highly unlikely we believe that total oil-liquids production will never rise above the July 2008 Peak again. But, oil will not run out. Instead, there will be a decline of between 1% and 5% per annum in total oil production worldwide from now onwards. If oil prices rose above $100/bbl and stayed there – or high oil prices were fixed or regulated – then it is still possible decline rates could be very low – may be 0.5% to 1% per annum. If oil prices are erratic (boom-bust) then investment levels, rig/equipment build and levels of development activity will not be maintained at high levels – therefore oil production could crash by 5% per annum (possibly even higher). We expect a slight decline in world oil production with bumpy plateau through to 2012, thence decline rates will accelerate because of cancelled projects end 2008. Most major oil projects have a 3-8 year lead time, so some of the investment drop-off end 2008 will not result in production declines for some years. Shorter term accelerated oil production from a ramp up in drilling activity triggered after oil prices rose above $70/bbl in mid 2007, will rapidly deplete.

2. Oil will never run out: No. It will instead get scarce. How scarce how quickly is the key question. Oil prices and energy prices will rise. But the days of low oil prices are over - period. Never again will we see oil prices lower than $35/bbl. The world has produced approximately half of its reserves. Oil production  costs are rising. The cheap oil has been produced. More expensive oil in more environmentally challenging areas is left. Meanwhile constraints on CO2 emissions will slow Canadian Oil Sands production - this will not help the supply situation. In 5-10 years time, oil will be more selectively used for chemicals, plastics, drugs and specialist manufacture – high end products. The world will have to start weaning itself off gasoline/diesel powered cars and trucks. 70% of oil is used for transportation. There is no replacement for kerosene in airplanes. There will need to be a big shift into highly efficient hybrid-electric cars (>120 mpg) and electric cars for all surface transportation – otherwise the supply chain will be severely disrupted with sky-rocketting oil prices and supply shortages in oil importing nations..

costs are rising. The cheap oil has been produced. More expensive oil in more environmentally challenging areas is left. Meanwhile constraints on CO2 emissions will slow Canadian Oil Sands production - this will not help the supply situation. In 5-10 years time, oil will be more selectively used for chemicals, plastics, drugs and specialist manufacture – high end products. The world will have to start weaning itself off gasoline/diesel powered cars and trucks. 70% of oil is used for transportation. There is no replacement for kerosene in airplanes. There will need to be a big shift into highly efficient hybrid-electric cars (>120 mpg) and electric cars for all surface transportation – otherwise the supply chain will be severely disrupted with sky-rocketting oil prices and supply shortages in oil importing nations..

3. OPEC have just reduce production by 5 million barrels/day – they therefore have 5 million barrels extra production capacity on tap: No, we do not think so. There is very scant data on the actual real production capacity of OPEC countries. Announcements claim that there is 5.2 million barrels spare capacity over and above current demand. We doubt this. Instead, because of:

-

Production declines in non-OPEC countries in the last year of ca. 1.5 million bbls/day (after reduced drilling-development activity and aging oil fields)

-

Production declines in OPEC countries through reservoir depletion and reduced investment of ca. 1 million bbls/day (remember oil prices crashed from $147/bbl to $35/bbl leading to deficits in OPEC countries at oil prices of less than ca. $50/bbl)

-

Underlying increase in oil demand in OPEC countries that are still growing and have expanding populations ca. 0.5 million bbls/day

-

A rather optimistic view on OPEC spare production capacity in the first place ca. 1 million bb/day

We believe the real spare capacity is more like 1.2 million bbls/day. If demand starts to rise, and/or there is a further 5% production decline over a period of the next 12 months - both scenarios we would put at 50% chance each, there will again be an imbalance in supply and demand. This will then lead to sky-rocketting oil prices. We believe we are seeing the first signs of reduced spare capacity in May-June 2009. By mid 2010 we expect a severe tightening of supplies again. At this time, just as the global economy is beginning to recover, oil prices will sky-rocket and this will then set back the global economy again by end 2010. This is our base economic case we are working with. The problem will really surface when OPEC need to admit or face up to the fact they have no more spare oil production capacity - the "cat gets out the bag" as they say. It may take a while this final point - the markets will determine this through price. And it could sky-rocket quickly if a panic sets in. It "could even" zoom through the $200/bbl level head towards $300/bbl for a short while before triggering a further global recession.

4. Technology will save us: Yes, it’s likely that eventually technology will "help" save the day – or at least help solve an energy crisis. But not before a massive (or at least severe) period of disruption. Oil, gas, coal and metal commodities are extracted from the earth. They are therefore non renewable. They  deplete. They run out or run short of time. As oil runs short, people will dash to gas. But gas will then run short and people will dash to coal. But coal produces the largest quantities of CO2 emissions per energy unit produced – so there could then be a dash to CO2 sequestration (capture of CO2 then storage, underground, also very expensive). Meanwhile many Green Tech (Renewable) energy sources will boom – Solar, Wind and possibly Algal Biodiesel are the most prospective. Nuclear in some countries will boom – other Nuclear power plant will be closed – depending on the environmental view of national governments and energy regulators. It will be a period of severe disruption and transition - transformation is probably a better description. Rather than 90% of our energy coming from hydrocarbons, we will need to achieve 50-60% through hydrocarbons and 30-40% through renewables or nuclear by ca. 2025. Meanwhile the oil/gas industry workforce is aging, alternative energy reserahc and development is minimal and most school leavers would rather work in media and finance! Where are all those scientists that want to develop new energy forms? Where are the jobs? Where are the prospects? The drive to change is not yet there - and it will be an almighty shock int he next few years that will be needed to kick-start the renewable energy business and new technologies to make the transition. Energy Entrepreneurs will be needed - it will have to go from niche-fringe to mainstream. College graduates will need to aspire to be the iPod, Virgin, Google and MS of the energy world - Green Tech Entrepreneurs with science background need to be a key driving force.

deplete. They run out or run short of time. As oil runs short, people will dash to gas. But gas will then run short and people will dash to coal. But coal produces the largest quantities of CO2 emissions per energy unit produced – so there could then be a dash to CO2 sequestration (capture of CO2 then storage, underground, also very expensive). Meanwhile many Green Tech (Renewable) energy sources will boom – Solar, Wind and possibly Algal Biodiesel are the most prospective. Nuclear in some countries will boom – other Nuclear power plant will be closed – depending on the environmental view of national governments and energy regulators. It will be a period of severe disruption and transition - transformation is probably a better description. Rather than 90% of our energy coming from hydrocarbons, we will need to achieve 50-60% through hydrocarbons and 30-40% through renewables or nuclear by ca. 2025. Meanwhile the oil/gas industry workforce is aging, alternative energy reserahc and development is minimal and most school leavers would rather work in media and finance! Where are all those scientists that want to develop new energy forms? Where are the jobs? Where are the prospects? The drive to change is not yet there - and it will be an almighty shock int he next few years that will be needed to kick-start the renewable energy business and new technologies to make the transition. Energy Entrepreneurs will be needed - it will have to go from niche-fringe to mainstream. College graduates will need to aspire to be the iPod, Virgin, Google and MS of the energy world - Green Tech Entrepreneurs with science background need to be a key driving force.

5. Technology cannot help the USA out of this crisis. No – technology can hugely help - a good example of technology that has helped in the last 3 years is Shale Gas production from deep fractured horizontal wells in the USA. Massive new gas reserves have been found – some experts think up to 1000 TCF. Low cost efficient onshore drilling techniques have made this possible. Because of this, gas production in the USA has been increasing before gas prices crashed recently from $12/mmmbtu to $4/mmbtu – many gas wells are now shut in awaiting a rise in gas prices. Supply has been boosted beyond many people's dreams in 4 years - a big turnaround. In the USA, it’s quite possible if gas prices recovered to $8/mmbtu and there was a massive increase in wind-electric power degeneration in the mid-West supplemented by coal electric power, and a transfer away from gasoline/diesel powered cars/trucks to hybrid-electric and electric vehicles, then the energy balance could be retained whilst oil production dropped, leading to almost no oil imports by 2020, if big action was taken now. USA has ample coal and gas reserves, plus metals-mining – its Achilles heal is it's hugely inefficient use of oil. If cars did 50 mpg instead of 22 mpg, then the USA would not need to import any oil! The USA's oil import bill at $100/bbl is a massive $328 Billion - or 4% of GDP. There are hybrid-electric cars that now achieve 120 mpg, so it’s not unrealistic to achieve an average 55 mpg for the US car fleet in a ten year time-frame if action was taken now. It seems crazy to European's that gasoline take is only 25% when the country has such a massive decifit - and most people drive 4 litre SUVs doing 22 mpg. Whether GM, Chrysler and Ford can rise to the occasion will be seen in the next few years – Obama and his strategists are working on this. Though they will need huge resolve to change the mindset of these industrial giants.

6. As oil supply decreases, oil conservation will start across the board, then oil demand will drop. No, different countries will adopt different measures.

A. Oil Exporting Nations: Oil demand in expanding exporting nations will continue to rise – oil conservation measures will be limited. Government subsidies for oil and gasoline/diesel will help boost local oil demand and reduce net oil exports. This will further reduce the oil supplies to western oil importing nations. Oil conservation will be a low priority for wealthy oil exporting nations. National prestige and pride for having indigenous oil supplies will over-ride any large scale energy conservation measures. Big gas-guzzling cars will still be the order of the day - status symbols for successful people – with little incentive to drive small and energy efficient car - "after all, if it's your oil, why conserve?"

B. Developed Oil Importing Nations: In developed oil importing nations, the reverse will occur. No oil subsidies, high oil taxes, a shift away from gasoline and diesel powered cars. The remaining oil burning car fleet will have smaller more efficient engines. People will drive less. Take the train more. Walk more. Cycle more. Car usage will drop. People will find it more difficult to afford new energy efficient cars. Train usage will rise. Airline usage will drop. People will dash around less and make more use of telecommunications, web-casting, web-conferencing. People will live closer to their work. The economics of living in rural areas will become more demanding. Living close to a good electric train service will become more attractive. Motorways and roads will become quieter. The cost of travel per mile will triple. The days of flying for a weekend break from UK to Spain will be over. Tax will start in airline travel that will further increase long distance travel costs. Eurostar will boom. Europlane will go bust.

B. Developed Oil Importing Nations: In developed oil importing nations, the reverse will occur. No oil subsidies, high oil taxes, a shift away from gasoline and diesel powered cars. The remaining oil burning car fleet will have smaller more efficient engines. People will drive less. Take the train more. Walk more. Cycle more. Car usage will drop. People will find it more difficult to afford new energy efficient cars. Train usage will rise. Airline usage will drop. People will dash around less and make more use of telecommunications, web-casting, web-conferencing. People will live closer to their work. The economics of living in rural areas will become more demanding. Living close to a good electric train service will become more attractive. Motorways and roads will become quieter. The cost of travel per mile will triple. The days of flying for a weekend break from UK to Spain will be over. Tax will start in airline travel that will further increase long distance travel costs. Eurostar will boom. Europlane will go bust.

C. Undeveloped Oil Important Nations: In undeveloped nations, these economies will be set back severely by energy shortages. Poverty will increase. Healthcare will be disrupted. Food prices will rise. Electric power disruptions will increase. GDP growth will be affected. Mining operations will become more difficult as power cuts become common place. Metals prices will rise. Civil strife could increase. The supply chain and food production will be disrupted. Agricultural efficiency will be negatively impacted.

David Carradine

7. The underlying problem is consumerism. To a certain extent, this is correct. But the issue is far broader than this.

1. The world population has expanded at a dramatic pace through better health, people living longer and larger families mainly in developing nations. The world population has doubled in 50 years since 1960 (USA’s populate has also doubled in the same period).

2. Each person has become more energy intensive – the hydrocarbon based consumer society we live in uses massive amounts of oil, gas and coal – all of these are non renewable resources that are depleting. We are now over 50% through the production of our oil reserves – meanwhile demand has increased at 2% a year over the last 25 years as populations have increased at about the same pace along with GDP. 1.5 billion Chinese aspire to own a cars – currently there are 200 million cars in China – in 20 years time there could be 1000 million Chinese cars – why wouldn’t there be – like there is in the USA or Western Europe? All these vehicles need power. Meanwhile oil is in decline. The numbers don’t marry – sorry – we are in for an energy crisis – and change will have to occur – fast. The days of oil at 25 cents a cup are over - period "it's been too cheap too long".

3. Oil has been the key fuel to powering our consumer based society. Most people commute to work in oil burning vehicles – food and goods are transported in oil burning vans, trucks, planes and ships. All these transportation methods are just about to get a whole lot more expensive. Bunker fuel prices for ships will skyrocket making imports more expensive. Globalisation will go into reverse. No longer will flowers be imported from Kenya, fruit from Israel, bananas from Ghana. People will reminisce about the wastages of the past – when they flew to the Seychelles for a long weekend break - we'll look back at some rediculous excesses - and wander how it all happened - and whether it would have helps to have conserved oil earlier.

But the probable single most important underlying cause of the impending oil crisis is:

8. There Are Economic Incentives. No - there are actually no incentives to reduce oil consumption - that's the big problem

Until someone can come up with a global method of incentivising the conservation of oil, gas and coal – no action will be taken – it will need a further bout of oil prices skyrocketting and further massive economic damage for something to happen. Global warming will take a back seat to Peak Oil within the next year - we have no doubt about this. The two issues marry into one another because they both are helped by an expansion of renewable energy and nuclear power - but very little is currently happening.

Until someone can come up with a global method of incentivising the conservation of oil, gas and coal – no action will be taken – it will need a further bout of oil prices skyrocketting and further massive economic damage for something to happen. Global warming will take a back seat to Peak Oil within the next year - we have no doubt about this. The two issues marry into one another because they both are helped by an expansion of renewable energy and nuclear power - but very little is currently happening.

Such an incentive could be:

· Harmony on increases in taxation on hydrocarbon based fuels at the pump

· CO2 emissions taxes or credits – with proceeds being funnelled into alternative renewable energy projects

· Increase in tax on aviation fuel – with proceeds being funnelled into alternative renewable energy projects

· Regulation and/or tax on inefficient car/truck/van usage – with proceeds being funnelled into alternative renewable energy projects

One of the key problems is – the proceeds of tax on fuels normally goes into the Government’s coffers to pay for health, education and welfare – an honourable thing one could argue. But short term unfortunately. To expect governments to divert funds into renewable energy in times of economic and social hardship is frankly wishful thinking. This is a key dilemma. During the low oil priced “good times” – GDP was motoring away at 3-4% per annum and taxes were used to expanding the public sector – and jobs – often with little economic or efficiency gain. Now energy prices are rising, and the case for action is pressing, larger oil import bills mean oil importing governments have less money to be proactive and invest long term to improve their energy security, and reduce oil/gas import bills. And hence weaning off a hydrocarbon based economy is even more challenging. We have no answer to this dilemma.

9. Wealthy oil exporting nations will lend money to oil importing nations –to invest in renewable energy We think not.

One scenario is that the massive transfer of wealth from oil importing nations to oil exporting nations will allow the oil exporting nations to then invest in Green Tech globally – make further profits from the transition from oil-gas-coal to renewable-electric energy in years to come. But alas, social spending pressures in oil exporting nation plus their own increasing oil/gas demand will probably prevent these funds from becoming available – and it frankly seems to conflict with exporting oil nations economic self interest. It would reduce demand for oil/gas – “it’s not my problem” is one thought that would spring to mind.

to oil exporting nations will allow the oil exporting nations to then invest in Green Tech globally – make further profits from the transition from oil-gas-coal to renewable-electric energy in years to come. But alas, social spending pressures in oil exporting nation plus their own increasing oil/gas demand will probably prevent these funds from becoming available – and it frankly seems to conflict with exporting oil nations economic self interest. It would reduce demand for oil/gas – “it’s not my problem” is one thought that would spring to mind.

For property investors who are wandering how this can help or hinder their property investment strategies, we encourage you to read our Special Reports - links enclosed - plus a summary below:

10. The Best Countries to Invest In – Ask Yourself - has the Country Got Natural Resources and Is the Country Good at Something.

For investors in the stock market and investment funds, we enclose our listing of sectors that we expect to benefit and those that will not benefit from the next energy crisis from 2010 onwards.

In summary, if the country has no natural resources (oil, gas, coal, mining, forestry, water) – then it will be at severe risk from a commodities price super-spike. As the US dollar deflates (its value reduces) and inflation starts to take off, investors will hedge against inflationary risks by purchasing energy-commodities assets and physical oil and commodities.

If a Nation is particularly good at one or two industries, it could still prosper despite Peak Oil – as long as their margins and efficiency are high. Examples are

· Monaco, Lichtenstein, Jersey – tax havens, banking

· South Korea – ship building (rigs, LNG tankers, super tankers)

· India – low cost services, call centres, low cost high-tech IT and web building

· China – low cost manufacturing

· USA – energy/services technology

· UK-London – banking/financial services/niche/international wealth management

But if the country has no resources and you cannot think of how the country would compete to be the best in the world at one or two sectors of industry – then its best to avoid investing in that country.

A good example is Pakistan – we struggle to think of any industry that Pakistan is a world beater in – we also know oil/gas/coal/minerals and Green Tech industries in Pakistan are almost non-existent. As Pakistan's population continues to expand and oil import bills increase, unless the country can produce and export something valuable, it will likely make far less economic progress than the norm.

Sectors and industry to consider investing in:

11. Recommended to Invest in:

· Natural gas production and exploration

· Oil production and exploration

· Oil service companies and Drilling companies

· Coal production companies

· Metals mining companies – exploration and production - gold, iron ore, aluminium, copper, zinc, uranium, platinum, lead, silver etc

· Railroad

· Batteries and electric storage

Electric cars, electric trucks, electric buses, electric generators, electric trains

· Green Tech – solar, wind, algal biodiesel, hydro-electric, wave, tidal etc

· Smart electric meters-energy conservation

12. Recommended not to invest in:

· Airline

· Airports

· Gasoline/diesel powered cars and trucks

· Tourism in far flung destinations

· Property in remote regions away from developed service industries

· Business conference centres, hospitality, long distance tourism

· Utility companies (that are exposed to high fuel prices)

13. Countries that will perform best in a Peak Oil environment

· Low risk: Canada, Norway, Australia

· Medium risk: Brunei, Qatar, Saudi Arabia, UAE, Russia, Kuwait, Oman, Azerbaijan, Kazakhstan

· High risk: Angola, Mongolia, Iraq

14. Countries to avoid in a Peak Oil environment (few if any oil/gas/coal/metals/forestry/Green Tech)

· Italy, Spain, Greece, Pakistan, Morocco, Turkey, African countries without oil/mining, Nepal, land locked countries with no natural resources or low cost manufacturing

15. Property Investing: So expect property prices and currency values to rise in Canada, Norway and Australia in the next few years – as they become safe havens for foreign investors. Oil wealth will also flow into cities such as Bahrain, Abu Dhabi, Dubai, London, Geneva, Monaco, Moscow, St Petersburg, Olso, Calgary, Edmonton, Luxemburg, Lichtenstein, Macao, Brunei, Doha, New York, Houston, Dallas, Bagdad, Baku and Almaty, Luanda, Muscat, Bogota and Rio de Janeiro.

So don’t be unaware of the changing economic dynamics of the world as the effects of Peak Oil start to  kick-in. Position yourself and your portfolio for the events that are unfolding. Be smart and proactive. Don’t let the expected crisis catch you unawares.

kick-in. Position yourself and your portfolio for the events that are unfolding. Be smart and proactive. Don’t let the expected crisis catch you unawares.

And for UK property investors, best stick with London, Aberdeen and southern England. Wealthy commuting towns close to London on excellent electric train routes will be well protected (St Pancras, Stratford, Ebbsfleet, Ashford, Folkstone spring to mind ref: Eurostar). Far flung villages and towns well away from electric rail lines will suffer the most (e.g. New Quay in Wales). The days of cheap travel are drawing to a close – sometime in the next two years expect the impact to start shaping the future local economies of the world. Manufacturing will become more localised. Trade will become more regional and local - transport across land by rail rather than sea and air. People will work from home more. Travel less. Go on holiday locally. Trans-continental travel will become far more expensive. And we’ll all start seeing far more of our neighbours as we walk, cycle and catch the electric train, rather than spending half our lives such in a fume infested traffic jam. If you are an employee, you might find opportunitis to work from home. You might then see more of your family – your disposable income will likely reduce, but who knows – you might enjoy life far more and your health may improve with it!

We hope this Special Report has been insightful. And we’ll keep you post in Peak Oil developments as they unfold. Please feel free to send this to any of your familiy, friends and/or business associates.

enquiries@propertyinvesting.net