351: Peak Oil and Euro Contagion

12-05-2010

PropertyInvesting.net team www.google.co.uk

PropertyInvesting.net team www.google.co.uk

We thought we should describe our view that we are bumping along a “Peak Oil” ceiling and this is the underlying cause of the Eurozone contagion – then switch to an update on the UK property market.

Peak Oil and Euro Contagion

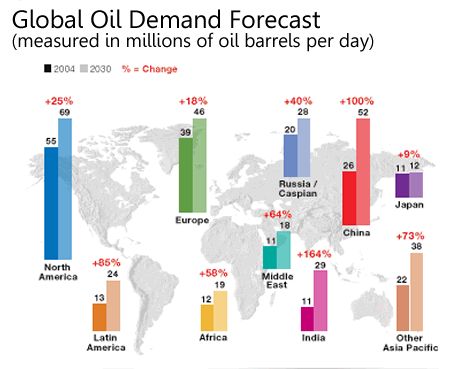

Oil prices rising: Ever noticed the trend with higher oil prices and Euro contagion. Whenever the oil price rises above $80/bbl, the peripheral Euro nations that have few exports and massive oil, gas, coal and metals imports start suffering – then their interest rates rise as the bond market gets spooked. Don’t expect this trend to go away. The reason is – China is pulling on oil supplies like there is no tomorrow and supply is barely keeping up with this strong demand. Despite a fairly benign growth rate in the Euro economies, oil prices rise putting massive pressure on these economies – because of massive Chinese oil demand. The Chinese banned diesel exports last month – they need all the diesel they ca n get for power stations because they are trying to contain the amount of coal burning for electric power. Basically the pace of growth at 10+% per annum for the last 10 years has been exceptional and looks to continue. Demand for all commodities is sky-rocketing.

n get for power stations because they are trying to contain the amount of coal burning for electric power. Basically the pace of growth at 10+% per annum for the last 10 years has been exceptional and looks to continue. Demand for all commodities is sky-rocketing.

UK energy independence: One reason why the UK is doing rather better than many expected is because it produces almost all its oil requirements and most of its gas requirements. This of course helps balance the books. The economies with weak manufacturing, high public sector spending and massive oil/gas/coal/metals imports are the ones to be careful of. Namely the PIIGS counties – that’s Portugal, Italy, Ireland, Greece and Spain. These economies all had massive property price booms off the back of the low Euro interest rates. All had their economies subsidized by central Europe – the super economies of Germany and France with help from fairly robust smaller economies like Holland, Austria, Belgium and Denmark.

Projections: We think our own oil production and supply projections are the best in the world – we think we have cracked it. We haven’t found any more robust predictions – we’ve hardly had to change them in four years. Essentially we are predicting an undulating plateau of oil production through to 2015 – then a likely slow decline. But the key message is, as China’s demand increases, if the western world does not reduce its oil demand and consumption, then there will be an oil supply shortfall. We think there is only 2.5 million barrels of spare capacity today. With projected growth in demand – this will be used up and disappear in about 1½ to 2 years. So by end 2012 there will be a crunch – oil prices should have sky-rocketed by then, and possibly crashed back down again as a further western recession or shock kicks in.

China pulling like crazy: You see – what’s actually happening is the Wester n World is hitting itself on a Peak Oil ceiling – whilst the Eastern World continues to grow at an extraordinary rate. This is because liberalisation of business in India and China with almost 3 billion people wanting cars, houses, holidays, customer goods and everything else the western world got 50 years ago will lead to a gigantic oil demand increase. Just don’t be surprised when this scenarios plays out. It’s only logical after all. No use being in denial. We need to be honest about it. Not bury our heads in the sand.

n World is hitting itself on a Peak Oil ceiling – whilst the Eastern World continues to grow at an extraordinary rate. This is because liberalisation of business in India and China with almost 3 billion people wanting cars, houses, holidays, customer goods and everything else the western world got 50 years ago will lead to a gigantic oil demand increase. Just don’t be surprised when this scenarios plays out. It’s only logical after all. No use being in denial. We need to be honest about it. Not bury our heads in the sand.

Property Investors Positioning: So to position yourself you need to avoid purchasing property in:

1 Energy intensive oil importing nations

2 Nations that have no leadership in manufacturing or financial services

3 Nations that are large importers of commodities like oil, gas, coal, wood, metals, electricity

4 Nations that do not have any oil, gas, coal or nuclear power production

5 Nations that have water shortages and are exposed to climate change

High Deficits: When we consider all these criteria, countries that come bottom tend to be Greece, Iceland, Ireland, Spain, Italy – any wander these countries are the ones the banks have least confidence. Of course these are also the countries with the biggest annual deficits as a percentage of their GDP and countries that seem most exposed to commodities price increases – because they import almost all their commodities. Meanwhile, they do not have any particular low cost or quality leadership in manufacturing and many of these countries have struggling banks and financial services.

Norway – Leading Northern Lights: Look to Norway and you will find  a very different proposition. A country with large budget surplus, massive oil and gas exports, relatively small population, large forestry and hydro-electric resources and a well educated population that does not have an aging problem. It’s also about the most honest and transparent country in the world. Apart from the cold winter weather – it’s tough to see how the Norwegian Kroner will not increase in value and the Greece could well exit the Euro – thence property prices in Sterling terms would crash to about half their value. Portugal, Spain and Ireland are also at risk of exiting the Euro and hence any property in these countries could see their value in Sterling or Dollar terms also crash.

a very different proposition. A country with large budget surplus, massive oil and gas exports, relatively small population, large forestry and hydro-electric resources and a well educated population that does not have an aging problem. It’s also about the most honest and transparent country in the world. Apart from the cold winter weather – it’s tough to see how the Norwegian Kroner will not increase in value and the Greece could well exit the Euro – thence property prices in Sterling terms would crash to about half their value. Portugal, Spain and Ireland are also at risk of exiting the Euro and hence any property in these countries could see their value in Sterling or Dollar terms also crash.

Gas and Coal Increases, Oil Flat: Expect global oil production to remain broadly flat - whilst gas production and coal production increases significantly to fill the energy void. Renewable energy will only make a small dent to help fill the gap – as the world population continues to grow and develop, more energy will be required to build homes, roads, fuel cars, electricity and industrialisation – yes, just like the USA and the UK in the 1950s-1980s, China, India, Vietnam, Brazil and many other Middle Eastern and African countries will develop a thirst of consumer goods, middle class luxuries and this will all require massive energy increases.

Qatar will be the richest country in the world – as their gas production continues to increase and the indigenous population of only 300,000 share these massive profits.

Middle Eastern populations will double in the next 25 years – as large families multiply – all this will need more energy.

Not Enough for all Global Growth: Ultimately, the world only has a finite supply of resources and this will need to be “shared around” – no longer with western Europe and USA having the first rights to such resources – instead, they will compete with India, China, Brazil, Russia and other developing nations. This  will drive up costs in all areas – wages will rise in China and stagnate in the USA and Europe. India stock markets will explode and the GDP will increase by 10% per annum – along with China’s. We’re into a whole new world of economic opportunities in the East and threats in the West. To ignore these trends as a property investor could severely affect your returns.

will drive up costs in all areas – wages will rise in China and stagnate in the USA and Europe. India stock markets will explode and the GDP will increase by 10% per annum – along with China’s. We’re into a whole new world of economic opportunities in the East and threats in the West. To ignore these trends as a property investor could severely affect your returns.

UK Property Market Update

Beyond any doubt, the last month has seen a miserable set of data showing consistent house price declines. However, this is the normal trend in the run up to Christmas. Normally, the market goes quiet in mid November and dead by early December – no different this year. The cold late November weather has not helped the market either – definitely kept the buyers off the streets. As we normally advise, the best time to put low-ball offers in on properties to achieve below market value acceptances is to:

1 Find a motivated sellers – that needs to sell definitely

2 Put in a low-ball offer in the first week of December – at 25% below asking prices

3 Try the second property – repeat for third and fourth – if no offer accepted then,

4 Try 20% below asking price for your top property – repeat until someone accepts.

5 Take your time – and by Christmas, someone will want to accept – just so they can feel happy with their offer over Christmas.

Stagnation: Expect the market to stay depressed until the second week of January – then start showing some tentative signs of life. The economic climate in southern England is not very bad – lots of talk of severe cuts, but our feeling is they will not be as bad as many people thing. It’s almost as if the public sector has been spooked into cutting back and reigning in – and hopefully this should be half of what is needed and there won’t be many actual jobs cuts. It will be more a question of zero recruitment and normal attrition over the period of a few years.

Stagnation: Expect the market to stay depressed until the second week of January – then start showing some tentative signs of life. The economic climate in southern England is not very bad – lots of talk of severe cuts, but our feeling is they will not be as bad as many people thing. It’s almost as if the public sector has been spooked into cutting back and reigning in – and hopefully this should be half of what is needed and there won’t be many actual jobs cuts. It will be more a question of zero recruitment and normal attrition over the period of a few years.

Stablization After Overspending: We cannot imagine property prices rising significantly next year – in the north and areas far from London, we expect some declines. But we don’t expect a fully fledged house price crash. Eventually, the UK finances will get back in order for a more sustainable future. At the moment, we’re trying to keep the financial markets on our side – and the current plans for cuts are enough to convince the markets we are moving in the right direction.

We hope this Special Report has given you some interesting insights and helps improve your returns. Happy investing. If you have any questions, please contact us on enquiries@propertyinvesting.net

Further Special Reports on Peak Oil and the remifications

277: Country Ranking in a Peak Oil World with Resources Scarcity

275: Cars - The Absurdity and Necessity

274: How susceptible are countries to high energy prices? Impact for property investors..

270: Turbulence in Property Markets Caused By Oil Price Spikes and Peak Oil

265: How to Profit from Peak Oil - USA, UK and Europe

264: Another oil price spike is just about to hit us...watch out

263: Investing in Property with Energy in Mind "post Peak Oil"

262: Electric Revolution, the Environment and the Next Energy Crisis

257: Property investing, the UK economic situation and oil & gas

244: It's the oil price again - it caused the recession

243: Oil price crash sows seed for next massive oil spike

242: Oil, Cars & Property - what we'd do if we were UK Prime Minister