399: Stagflation, Peak Oil, Gold and Silver – How to Make Serious Money

10-27-2011

PropertyInvesting.net team

Peak Oil Effects: What most people, economists and politicians don’t realise is a large part of the current economic difficulties are because of Peak Oil. That is to say, the period when oil production peaks for various reasons. This does not mean we are running out of oil, it just means we are running out of cheap oil. If anyone thinks this is just a bit of scaremongering, then they need to consider the following:

· Crude oil production today is now lower than in 2005 – almost seven years ago

· Only production in its totality (that’s total oil liquids including natural gas liquids, heavy oil sands and biofuels) is at a similar level to 2005 – it has barely increased since 2005

· Crude oil production has declined since 2005 despite oil prices rising from $25/bbl to $110/bbl – a 4-5 fold increase did not lead to an increase in crude oil production

· The increase in biofuels will not continue at its historic pace because food shortages and environmental constraints will curtail future growth

· Oil sands production is increasing, but not fast enough to grow overall oil production – and the environmental constraints on rapid expansion are severe – it’s a dirty strip mining business using vast quantified of water – NGO don’t like it

· Oil production increases will be constrained by political and social considerations – Middle East countries will need $100/bbl to keep their hugely growing populations happy with social spending programmes and energy/food subsidies – it is not in their interest to increase oil production significantly – they need to keep prices high

· Oil demand in Middle Eastern oil exporting countries is sky-rocketting – hence oil exports will be constrained in future years

· China’s demand for all forms of energy will keep pace with its rapid growth – at approximately half its GDP growth (e.g. 5% per annum energy increase if GDP growth is 10%) – there is no end in sight for this rapid expansion. Despite China being the manufacturing centre of the world, the average Chinese person still only uses 1/7th of the amount of energy as an American.

So what does this mean for the investor? It means that oil prices will continue to rise. Western economies will continue to languish in stagflation. At best GDP growth will be 0-1% and there could be periods of recession with GDP going to -3% per annum. Overall, most western ec onomies in the next ten years will be lucky to grow at all. Economic growth will and is being constrained by the lack of cheap oil. China and the developing world we believe will continue to grow rapidly – China at 6-12%, India 4-9%, Brazil 5-8% and the Middle East 2-5%. But Western Europe and the USA are in for a prolonged downturn. It’s quite simple:

onomies in the next ten years will be lucky to grow at all. Economic growth will and is being constrained by the lack of cheap oil. China and the developing world we believe will continue to grow rapidly – China at 6-12%, India 4-9%, Brazil 5-8% and the Middle East 2-5%. But Western Europe and the USA are in for a prolonged downturn. It’s quite simple:

· Not enough cheap oil

· Too much debt

The Worst Mix: When these two twin negatives come together – it’s a vicious mix that is very difficult to get out of. As oil prices rise, debts rise further. This is what has happened to Greece. It’s so obvious in our analysis – and we have been warning about this for years. We can see things happening – a slow long collapse of debt ridden inefficient fat countries that grew rich in the days of cheap oil (up to 2002) and off the back of German manufacturing might and subsidies.

Euro Printing: We believe the ECB will also be forced to start printing money to attempt to inflate their way out of debt. Too many countries have unsustainable debts and if no growth occurs in part because of high oil and commodities import costs, the only remaining option will be to start the printing presses. Or Germany leaving the Eurozone and starting up the Mark again. The German mark should be worth at least double the Greek currency. This stimulates exports of German goods and services around the Eurozone because they are so competitive - to such an extent that all peripheral country's import costs sky-rocket and further compound their deficits. Totally unsustainable, particularly combined with high commodities prices. The only option for countries like Greece is to devalue and default - than start competiting for goods and service back on an even keel.

Peak Oil Shock: But this all ended a few years ago as the Peak Oil shock helped cause a private sector financial crisis as oil prices in the USA and world sky-rocketted to $147/bbl in July 2008. This was the final trigger for the financial private sector collapse. But then the US and Western European governments stepped in – wanting to regulate, c ontrol and win social votes – hardly any failed banks and failed businesses were allowed to fail. GM, Ford, Bank of America, Citicorp were all saved along with Lloyds, Bank of Scotland, Northern Rock and the like. Then the bad debts were transferred to the tax pay at sovereign level. What we are now experiencing is sovereign debt crisis contagion one level higher. The temporary fix of today’s fiat deal of 27 Oct 2011 will only tide the Eurozone over for another 1-2 years then a bigger crisis will break out. It’s like watching a collapse in slow motion. The problem has not gone away – it’s just been pushed down the road and got bigger.

ontrol and win social votes – hardly any failed banks and failed businesses were allowed to fail. GM, Ford, Bank of America, Citicorp were all saved along with Lloyds, Bank of Scotland, Northern Rock and the like. Then the bad debts were transferred to the tax pay at sovereign level. What we are now experiencing is sovereign debt crisis contagion one level higher. The temporary fix of today’s fiat deal of 27 Oct 2011 will only tide the Eurozone over for another 1-2 years then a bigger crisis will break out. It’s like watching a collapse in slow motion. The problem has not gone away – it’s just been pushed down the road and got bigger.

Positive Insights: You might be feeling rather gloomy by now, but you shouldn’t be. This is an investor’s article, and the only reason why we describe all this is because out of this mess and financial mismanagement there is money to be made from investing in the correct sectors. We will explain.

Trying To Printing Their Way Out Of The Crisis: It’s quite simple – to allow growth, governments will need to print more money. They might call it different things, but essentially it is creating money (digits on a computer) out of thin air. Fiat money backed by nothing but promises and vague guarantees (not backed by assets/gold). The only way to get out of this huge debt mountain will be to inflate out of it. Meaning that everyone takes a “hair cut” in the form of inflationary losses. So savers with £100,000 will only have £50,000 worth of money in 5 years time because inflation is likely to average around 8%.

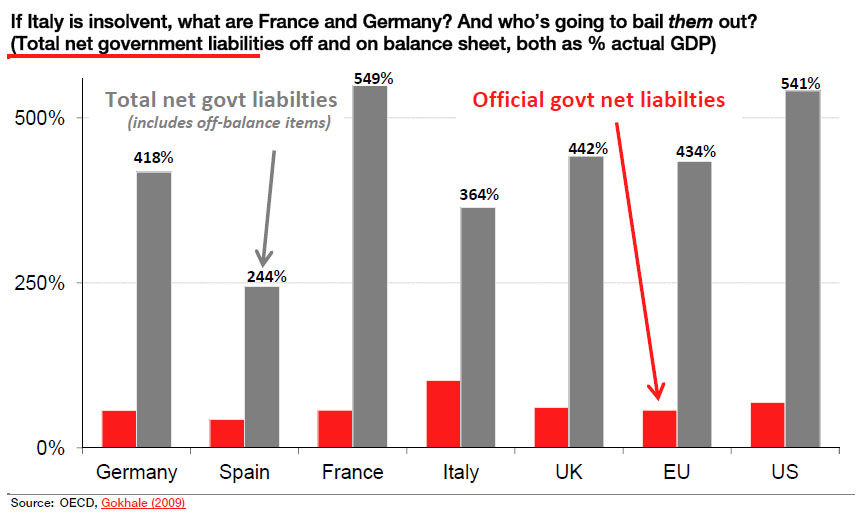

Money Creation: It’s difficult to know exactly how much money has been created in western economies in the last ten years. Some people think since 2003 the amount of money (equity and debt) has increased tenfold or more. Future liabilities have dramatically increased – most western government simply cannot afford to fund these liabilities – they will either need to default on their debts, re-structure their debts or write down these debts completely. Western politicians know this – they just want to keep the whole charade going for a while longer to keep themselves in power. It’s never good politically to give bad news – “shoot the messenger” springs to mind. If money supply rises, it should rise with GDP growth – if it rises faster than the GDP then there will be inflation and savings and the value of the currency will be destroyed. Since 2007 – for almost 5 years – there has been almost no growth in most large western economies, yet money supply has doubled. No-wander inflation has started to shift rapidly higher.

in western economies in the last ten years. Some people think since 2003 the amount of money (equity and debt) has increased tenfold or more. Future liabilities have dramatically increased – most western government simply cannot afford to fund these liabilities – they will either need to default on their debts, re-structure their debts or write down these debts completely. Western politicians know this – they just want to keep the whole charade going for a while longer to keep themselves in power. It’s never good politically to give bad news – “shoot the messenger” springs to mind. If money supply rises, it should rise with GDP growth – if it rises faster than the GDP then there will be inflation and savings and the value of the currency will be destroyed. Since 2007 – for almost 5 years – there has been almost no growth in most large western economies, yet money supply has doubled. No-wander inflation has started to shift rapidly higher.

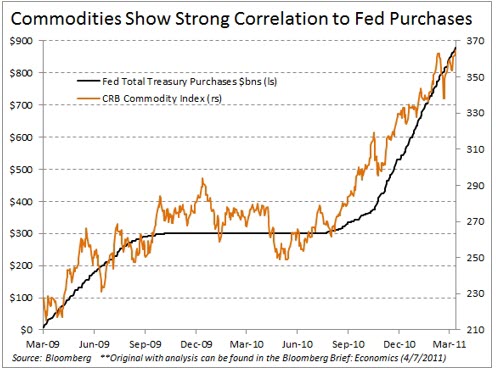

Ben Only Knows How To Print: The Fed Chairman Ben Bernacke is an academic. He is not a businessman. He is an economist. He studies economics. He has always worked in the pu blic sector (albeit some people point out that the Fed is a private institution for creating IOUs). He does not know the basics it seems about how to properly stimulate business in a sustainable way. By this we mean de-regulation, lower taxes, lower public spending, low inflation, smaller government leading to a high growth innovative private sector. Instead he and President Obama have put in place more regulation, raised taxes, printed more money, increased the size of the public sector and subsidized poorly performing businesses whilst funding social programmes. Ben only knows how to print money – there is little else in his war-chest. It’s just different printing sessions under different slogans. $3 Trillion of dollar printing hardly got the economy moving – and now the USA is heading back into recession. What this money did do was create a temporary bubble in the stock market and oil markets. This made some canny investors serious returns. It’s been simple playing the US stock market – all you have to do is get in just before the printing presses start again, and get out just before they are switched off. No wander many Wall Street bankers like him. But it’s only put off the day when inflation will hit hard and the US dollar and economic will collapse. Most of these investors will take that money and switch to gold and silver no doubt.

blic sector (albeit some people point out that the Fed is a private institution for creating IOUs). He does not know the basics it seems about how to properly stimulate business in a sustainable way. By this we mean de-regulation, lower taxes, lower public spending, low inflation, smaller government leading to a high growth innovative private sector. Instead he and President Obama have put in place more regulation, raised taxes, printed more money, increased the size of the public sector and subsidized poorly performing businesses whilst funding social programmes. Ben only knows how to print money – there is little else in his war-chest. It’s just different printing sessions under different slogans. $3 Trillion of dollar printing hardly got the economy moving – and now the USA is heading back into recession. What this money did do was create a temporary bubble in the stock market and oil markets. This made some canny investors serious returns. It’s been simple playing the US stock market – all you have to do is get in just before the printing presses start again, and get out just before they are switched off. No wander many Wall Street bankers like him. But it’s only put off the day when inflation will hit hard and the US dollar and economic will collapse. Most of these investors will take that money and switch to gold and silver no doubt.

Outcomes: It’s quite simple what will happen in the next few years:

· More printed money

· Inflation rises out of control

· Interest rates sky-rocket

· US dollar and Euro collapse

· Gold price skyrockets

· Oil price skyrockets

· Food prices rise

· Unemployment rises

· Rising deficit

· Lower GDP growth and recession

· Silver price goes ballistic

· Cash values crash

· Property prices rise – but lag inflation (debt burden reduces, and equity rises)

· High chance if US debt default

· Stock market stays in the doldrums – lose in inflation adjusted terms

· Western governments start defaulting on their debts

· Chinese economy slows down affecting world economy

Every time the US economy stalls, they will print more money. QE3, QE4 etc – until i nflation goes ballistic and with it, gold and silver prices.

nflation goes ballistic and with it, gold and silver prices.

1970s Crisis: It’s like the 1970s all over again. The social spending will not stop, unemployment will rise – and debt levels will keep rising. Eventually, it will be more difficult to fund energy developments and this will then affect oil supplies – and further oil shortages will occur – oil prices will rise further. Ultimately in about 5 years time, we should see a very different world. A US debt default after markets turn against the dollar. It will be like the Argentine and Mexican default of 1982 except 5 times bigger. More wars over oil will likely break out – and Libya was just a small precursor to what will happen. Inflation will kill any cash savings that people have.

The big winners will be those people that:

· Buy physical gold and silver and store in a safe deposit box

· Buy oil exploration/production company stock before the oil prices skyrocket

· Buy food, fertilizer and farmland

We are shifting our investments rapidly at this time from cash to gold and silver. And holding oil and mining company stocks. Holding property as well. It’s time to get right out of cash into gold and silver. Stay well away from Bonds and Treasuries.

Everyones Printing Money: Back in the late 1970s, a few countries like Argentina and Mexico started priting money. It created a financial crisis by 1982 that affected other large economies. But this time, everyone's printing money.

-

The USA has printed $3 Trillion

-

China is printing money

-

The UK is printing money

-

Europe will start printing money again shortly

The gigantic quantity of new money without any real economic growth since 2007 in western economies means that inflation will sky-rocket shortly. It's almost impossible that it would not lead to high inflation. This money has created bubbles everywhere - oil has risen from $37/bbl in 2008 to $110/bbl in 2011, all energy prices have rise, food prices are rising at ~12%, all commodities are rising. The US government claims inflation is a mere 2% - and they are worried about deflation. That's a massive smokescreen. Everyone knows that inflation is more like 8% in the USA. And 8% in the UK. Everything is rising fast and this inflation is accelerating. Any wander when everyone is printing money. Because they have no other option left - it's too late now - the debts are too high and they have a simple strategy - to devalue their currencies and inflation their way out of trouble.

Outlook:

· Silver is $34/Troy ounce – we see a downside to $25 (P90), a mid case to $100 (P50) and a upside to $1700 (P10).

· Gold is $1700/Troy ounce – we see a downside to $1300 (P90), a mid case to $5000 (P50) and an upside to $50,000 (P10)

· Oil is $100/bbl – we see a downside to $75/bbl (P90), a mid case of $160/bbl (P50) and an upside to $250/bbl (P10)

Silver Shortage: Because there is 35% less silver available at surface compared with gold, silver is consumed for industrial purposes, and more money is being invested in silver compared to gold at present, some people make the reasonably valid claim that silver prices should be higher than gold. We don’t  dispute this possibility in future years.

dispute this possibility in future years.

Dollar Backed By Gold: People have also calculated that if all US dollars were to be backed by gold, then because there is so little gold in the world, gold should trade for $50,000/Troy ounce. We also don’t dispute this logic either.

Money Supply: The bottom line is, despite gold’s rise from $350 in 2003 to $1700 – it is still way undervalued. The dollars in existence have risen tenfold since 2003 – gold should be worth at bare minimum of $3500.

Silver Under-pricing: Also consider silver was $55 in 1980 when the Hunt Brothers cornered the silver market. That was 31 years ago, when a house cost £20,000 (not £200,000 as it does today). That was also when silver was plentiful. Now silver stocks are running chronically short and huge amounts are being consumed for electronics and other industrial processes. In inflation adjusted terms, if and when silver goes into another bubble, surely it should reach $500 at least. And if governments continue printing money, possible double this.

Mining: Some people say if prices stay high, supply will rise to meet demand. What they don’t point out is that mines take 5-7 years to start production (environmental permits, appraisal, funding, infra-structure). Most mines are in undeveloped areas – strikes are common, power shortages are common, and when gold and silver prices rise, it normally coincides with when less financial funding is available from banks because of financial crises. Hence new capacity is difficult to get installed. And client governments increase taxes and tax take.

Market Manipulation: Some investors believe the silver market is being manipulated downwards by some unknown forces. Some seriously big investors or possibly sovereign entitie s keeping a lid on silver and possibly gold prices. Logically if you were a government, you would want to encourage people to invest in your currency. Buy your debt. The mainstream liquidity is in bonds, gilts, stocks and shares – but most smart governments are quietly building gold and silver reserves for the day when the currencies collapse driven by negative market sentiment, panic and the herd piling to gold and silver to protect their wealth – a last desperate measure as inflation goes ballistic.

s keeping a lid on silver and possibly gold prices. Logically if you were a government, you would want to encourage people to invest in your currency. Buy your debt. The mainstream liquidity is in bonds, gilts, stocks and shares – but most smart governments are quietly building gold and silver reserves for the day when the currencies collapse driven by negative market sentiment, panic and the herd piling to gold and silver to protect their wealth – a last desperate measure as inflation goes ballistic.

Size of Silver Market: the total size of the silver market is a mere $50 Billion. Just image if currencies collapsed and silver was used as a currency – prices need to rise 100 fold. Any big investment bank that piled into silver could drive prices ballistic very quickly. Just watch because it might happen. The upside is just astonishing when you consider fundamental ratios.

Ratio of 16: Historically silver has traded at an average of 16:1 with gold, Gold is currently $1700, hence silver should be around $110 – but it trades at $35. Even to catch up it would need to triple in price and gold stand still. Most silver investor thing it could overshoot to a ratio of 10:1 – meaning silver could be $170 without gold moving higher. Ultimately – it’s easy to see gold rising from $1700 to say $4000 with silver rising from $35 to $200 in the next 2-5 years. If gold and silver did not rise, it would mean everything returning to their goldilocks scenario around 2004 – and that seems absurdly optimistic in our view. For us, $100 silver and $3000 gold is a near certainly in the next few years.

USA vs Eurozone vs UK: Funny how the US Fed and T reasury Secretary point to the Eurozone crisis and their concerns about Greek overspending when the US deficit is 10% like Greece’s and their borrowing is a similar 100% of GDP. It’s only because the US claims to have the world’s reserve currency that it can get away with such comments and money printing actions. Ultimately the US ranks head to head with the Eurozone as far as debt problems are concerned – and in our view it’s a toss of a coin which one will have a large scale default first. And the UK is no better either – it’s in the same league as the USA and the Eurozone – all have different characteristics and it’s impossible to predict which one will default first (after the partial Greek default plays out). All three are exposed to Peak Oil – possible the Eurozone is the most exposed (Italy, Spain, Greece, Portugal, Ireland in particular).

reasury Secretary point to the Eurozone crisis and their concerns about Greek overspending when the US deficit is 10% like Greece’s and their borrowing is a similar 100% of GDP. It’s only because the US claims to have the world’s reserve currency that it can get away with such comments and money printing actions. Ultimately the US ranks head to head with the Eurozone as far as debt problems are concerned – and in our view it’s a toss of a coin which one will have a large scale default first. And the UK is no better either – it’s in the same league as the USA and the Eurozone – all have different characteristics and it’s impossible to predict which one will default first (after the partial Greek default plays out). All three are exposed to Peak Oil – possible the Eurozone is the most exposed (Italy, Spain, Greece, Portugal, Ireland in particular).

Dow = Gold: Historically gold has normally traded at parity to the Dow Jones index during periods of financial crisis – like in 1980. Hence in a few years time, if the Dow Jones dropped to 10,000 after severe inflation (hence about 40% in inflation adjusted terms) then gold should trade at $10,000 / Troy ounce. That’s a 7 fold increase from today’s prices. Another scenario at the end of the commodities bull run is that the Dow could be say 6000, with gold at $6000.

Some Fundamentals:

Gold: In the last gold price hike in 1980, 31 years ago, gold prices were $850/ounce and the M3 money supply was $1.8 Trillion. In 2011 gold prices are $1750/ounce but M3 money supply is $18 Trillion - surely gold is cheap.

Gold Standard: If you divide the total amount of money in the world by the total amount of gold on in the world, gold would need be sold at $60,000/ounce. Hence if the world - likely lead by China - went back to the gold standard, then gold would be worth $60,000/ounce even before rampant inflation starts in 2012.

Size of Silver Market: If only 1% of US investment a year went into silver, that would be $180 Billion. But because there is only 700 million ounces available each year, if you divide one by the other - you get a price of $257/ounce - about 7 times the current price.

Silver Scarcity: Silver prices were $50/ounce in 1980. Today they are $35/ounce - despite there being only 60% of the silver compared to gold at surface compared to triple in 1980. Meanwhile there is well over ten times the amount of printed money around. Doesn't silver look cheap?

Silver Consumption: 65% if silver is consumed in important electronic and other industrial processes. Silver is more scare than gold. New mines are years from coming on-stream. At 40 time less cost than gold, surely silver looks cheap? At 35 times less than its value against a gold standard, doesn't gold look cheap. Overall, are gold and silver incredibly cheap and set to sky-rocket?

UK Gold Sold Cheap: Meanwhile in the UK, Gordon Brown – when Chancellor – sold most of the UK gold at record low prices of $300 in 2002 for about $50 billion. Prices then rose 6 fold in ten years – meaning he lost the UK $250 Billion – not even counting the potential for gold prices to rise further. What a disaster for the UK tax payer. He then printed money like there was no tomorrow meaning all our savings were diluted and eventually the UK went into financial crisis in 2008 off the back of the biggest public sector expansion in the history of the UK (53% of people in Newcastle worked in the public sector by 2008, more than in Hungary before the collapse of the Soviet Union).

worked in the public sector by 2008, more than in Hungary before the collapse of the Soviet Union).

Back To The Gold Standard: Other analysts have calculated that if the world ever goes back to the gold standard – whereby gold is used to underpin currencies, then gold would need to be at least $65,000 / Troy ounce – there is simply not enough gold out there. Many people think the Chinese are buying as much gold as they can, so they can go to the gold standard one day and dump the dollar. We don’t dispute this logic either. Also observe that the Chinese government is encouraging all private individuals to buy gold – they have gold vending machines for example. I think they see the writing on the wall for the US dollar – and plan to go back to the gold standard after amassing as much gold as possible quietly. India is also purchasing large amounts of gold – also preparing for the day currencies crash and go back to the gold standard.

Gigantic Upside – Little Downside: As you can see, there is a gigantic upside on precious metals such as silver and gold. Very little downside. They are way undervalued compared to the amount of printed dollars. Ask yourself:

· Do you think governments will stop printing money?

· Do you think deflation will start?

· Do you trust governments with your cash?

If the answer to all these questions is no, then you better buy gold and silver.

Herd Has Not Even Heard Of Gold and Silver: Also ask yourself, do you know anyone that owns gold and silver. The answer will almost certainly be no. Hence the herd have not even appeared never mind stampeded through yet. We are years away from the bull market parabolic blow-off we always get at the end of a bubble. Money managers and even hedge funds have barely started investing in gold and silver at this time. Most people only know bonds, gilts, stocks, shares and cash. They think investing in gold is buy a gold mining stock or an ETF. Yes, gold and silver will develop into a bubble when panic, euphoria and emotion mixed with creed will drive gold and silver prices ballistic. You know it will happen. But we are many years away and prices are still low.

years away from the bull market parabolic blow-off we always get at the end of a bubble. Money managers and even hedge funds have barely started investing in gold and silver at this time. Most people only know bonds, gilts, stocks, shares and cash. They think investing in gold is buy a gold mining stock or an ETF. Yes, gold and silver will develop into a bubble when panic, euphoria and emotion mixed with creed will drive gold and silver prices ballistic. You know it will happen. But we are many years away and prices are still low.

Gigantic Opportunity: There is a tremendous investment opportunity out there – and we are piling in as much as possible as quickly as possible at present – just like we did in London property in early 1999 when we saw prices start moving higher rapidly (they doubled in 4 years). We are already planning for very early retirement in 2017 – in less than 5 years time and gold and silver will have gone ballistic – then we will get out before the bubble goes pop. It’s a very uplifting feeling having researched all this for the last year or so – everything is coming into place for the super investment opportunity of the decade.

.gif)

Shocking Printing: When they first announced quantitative easing and we found out what it meant, we could hardly believe that it genuinely meant starting the printing presses. It seemed in 2008 so rather dishonest or underhand to a bunch of Calvinists like us – we naively thought this was a thing of the past – not allowed – something they did in the 1970s. Now in 2011 – everyone expects the printing presses to start and stop depending on an unelected academic boffin who heads to Fe d – an entity with no reserves, no gold that writes IUOs and has a bunch of private backers linked to Wall Street’s elite. Our intuition is that these insiders are buying as much gold and silver for themselves as possible before the whole lot goes pear shaped. Ben is trying to save his job, so is Obama and printing is the only option in the run up to the 2012 US Election. After 2012 – the chance of default will rise dramatically – also in the Eurozone. And everyone will look back and then point out that the very thing the Fed, ECB and Governments blamed Wall Street bankers for (leverage, excess, IOUs, default-swaps, bonuses) – they sovereign governments will have done and followed suit. But this time not even China will be able to save the day. Other reasons why gold and silver prices will go ballistic.

d – an entity with no reserves, no gold that writes IUOs and has a bunch of private backers linked to Wall Street’s elite. Our intuition is that these insiders are buying as much gold and silver for themselves as possible before the whole lot goes pear shaped. Ben is trying to save his job, so is Obama and printing is the only option in the run up to the 2012 US Election. After 2012 – the chance of default will rise dramatically – also in the Eurozone. And everyone will look back and then point out that the very thing the Fed, ECB and Governments blamed Wall Street bankers for (leverage, excess, IOUs, default-swaps, bonuses) – they sovereign governments will have done and followed suit. But this time not even China will be able to save the day. Other reasons why gold and silver prices will go ballistic.

Printed Money = High Gold and Silver: Bottom line is – the more government print money, try and push problems down the road, try inflating away the debt and then get themselves into even bigger problems – the more money we will make from gold and silver. It’s a very regrettable situation – but what we are not doing is dwelling on all the bad news, analyzing too much, or blaming too much. Instead, we need to stay action focussed – act on it now – to safeguard our savings and earnings from rampant inflation and high taxes. Buy physical gold and silver.

Does this all make sense? We make no money from giving these free insights – this website is for free – not for profits - we don’t want or ask for any money for any insights – we charge nothing, and need no-one to pat us on the back either, thank you. We are just sharing insights for our regular visitors and helping the hard working investor maximise returns in a very difficult regulated, high tax and high inflationary environment. The only thing we are sure about with regards to making serious money in the next few years is to invest in gold, silver and oil. Simple.