403: Western Decline and Slow Economic Collapse

11-25-2011

PropertyInvesting.net team

Fat On Debt: Its tough to admit, but the west has grown mature, lazy and fat on debt. Citizens are used to an entitlement culture, looking for hand-outs and benefits, retirement pensions and unemployment benefits. Everything has turned populist and politically correct. Gone are the days of on your bike for the unemployed.

Declining Ethnic Populations: Meanwhile the population in the west has started declining in many countries like Greece, Italy, Portugal and Spain. Populations are aging, living longer, with fewer young people and a lower birth rate in the west. Many of the young are immigrants from overseas given the  poorest paid jobs.

poorest paid jobs.

Like The Roman Empire: The European and US Empires have grown fat on debt. People have grown physically fat from driving everywhere, not getting enough exercise and eating too much. Not politically correct but true. Obesity levels have sky-rocketed the numbers of miles walked by its citizens has crashed. People spend hours each day travelling vast distances in highly risky speeding cars and trains trying to eek out a living as their taxes rise, retirement dates get put back and inflation eats into their savings and erodes their disposable income. Similar to the Roman Empire, this will eventually unfold through high inflation, printing of money and promises by politicians that cannot be delivered eventually leading to social unrest and civil strife.

Just The Start Of The Decline: The fact is this decline has only just started in our view and its going to get a lot worse. Essentially the middle classes will be destroyed by higher taxes and inflation and every time the unemployment rate rises, they will be asked to cough up even more. The governments will grab as much as they feasibly can by stealth through inflation and tax whilst stagflation continues. It will be a long slow decline and this is probably what governments want so no-one notices too much a steady decline in living standards. This is better to keep the social order and win votes.

Business Being Destroyed: For too many years, environmentalists have ma de it very difficult to grow the economy, as have public sector regulators. Free enterprise is now frowned upon by too many people making money is like a dirty word something akin to being a banker. This socialist type mentality is destroying the business fabric of many western countries and helping lead to economic decline.

de it very difficult to grow the economy, as have public sector regulators. Free enterprise is now frowned upon by too many people making money is like a dirty word something akin to being a banker. This socialist type mentality is destroying the business fabric of many western countries and helping lead to economic decline.

Some examples:

1. Shale Gas Held Back: Just as a major breakthrough in new cheap low carbon energy is found, namely shale gas, every man and his dog wants to kill the technology off saying fraccing causes earthquakes and pumps dangerous chemicals into the ground. Get real. The oil industry has been fraccing wells for 50 years - using similar methods why start complaining now? This process has the single best chance of giving low cost low emissions energy something everyone needs for health, education, wealth, jobs and development but too many people are trying to kill this off because of vested interests. Some seismograph picked up a tremor so small it could hardly be noticed by locals near Blackpool now all activity on this new UK play has come to a stand-still.

2. North Sea Oil Held Back: Chancellor Osborne massively increased oil taxes for the North Sea it immediately lead to a shock $20 Billion in cancelled and deferred investment, UK companies leaving in droves relocating rigs to Norway and elsewhere and a massive oil and gas production crash of 8% in 8 months. The same tax was also put on gas, leading to gas fields being shut-in because they are no longer economic. Now more than 40% of UK gas is imported, rising every year! Talk about shooting yourself in the foot this is an extreme example.

2. North Sea Oil Held Back: Chancellor Osborne massively increased oil taxes for the North Sea it immediately lead to a shock $20 Billion in cancelled and deferred investment, UK companies leaving in droves relocating rigs to Norway and elsewhere and a massive oil and gas production crash of 8% in 8 months. The same tax was also put on gas, leading to gas fields being shut-in because they are no longer economic. Now more than 40% of UK gas is imported, rising every year! Talk about shooting yourself in the foot this is an extreme example.

3. Financiers Run Overseas: Tobin tax this proposed tax will only drive banks and financiers to the Far East and Switzerland where transaction taxes are zero and with it huge numbers of financial jobs will be lost in London and across Europe. More banker bashing wont help.

Government Control Freaks: Bottom line is, western governments have got far t oo big, want to get involved in everything, prop everything up with fiat money and want to control businesses and people for votes. This will drive businesses overseas to the Ear East and tax revenues will decline further. Unemployment will rise, bail-outs will increase and inflation will rise further. We are at a tipping point having kicked the can down the road since the crash of 2008, and we are about to go into recession once more in the UK with the USA to follow suite most likely after the 2012 elections and European staggering from one debt crisis to another. Inflation will be widespread. Food shortages will start.

oo big, want to get involved in everything, prop everything up with fiat money and want to control businesses and people for votes. This will drive businesses overseas to the Ear East and tax revenues will decline further. Unemployment will rise, bail-outs will increase and inflation will rise further. We are at a tipping point having kicked the can down the road since the crash of 2008, and we are about to go into recession once more in the UK with the USA to follow suite most likely after the 2012 elections and European staggering from one debt crisis to another. Inflation will be widespread. Food shortages will start.

Unemployment To Rise Sharply: Were now reached a tipping point where large scale unemployment will start kicking in as business confidence drops further because of non business friendly policies across Europe and the UK. Youth unemployment will be particularly badly hit - because of the increased regulatory burden, risk and their lack of experience - many of these young people will be cut out of the market. The politicians fail to understand that all tax revenues come from the private sector without the private sector there would be no revenue or public sector. It is the private sector that pays for the public sector. The public sector is far too big and inefficient. The private sector can no longer support it and will wither away as the burden becomes too intense with higher taxes and more regulation. This is not a flippant comment it is a remark borne out of observing the economic scenery in the UK for the last 15 years or more - an economic decline after earlier efficiency gains were made up until 1997 from proactive Thatcherite policies - since then, the public sector has expanded so fast during the "good years" that the UK economy cannot afford this burden now decline has set in. The promises of action on regulation and public spending have led to almost nothing f rom the current supposedly centre-right government. Net migration to the UK has hit record levels just as an example even though this government promised to reduce it thats a net 259,000 extra people coming into the UK each year more than when Labour were in power. Another example is the day the Tories announced they wanted to start building lots more affordable homes because it would add to the UK growth. However - it transpired the same day they announced this - that the rate building affordable homes has declined by 95% in the last year. There are almost zero affordable homes being built now, and home building has never been so low since WWII. Net new homes are about 75,000 a year. Meanwhile 259,000 extra people are arriving each year. Get your head around these numbers it must mean a lot of overcrowding going on in places like London. Add to this the 28% capital gains tax wrip-off instigated on all people investing, with no tapered relief - what you have is tax on inflation - not on capital gains. It's about this highest capital gains tax rate in the world. It has driven many investors away from the UK and this rot will continue. Little wonder the FT100 has stayed the same for 15 years despite inflation (its real inflation adjusted value has declined to about half since 1997).

rom the current supposedly centre-right government. Net migration to the UK has hit record levels just as an example even though this government promised to reduce it thats a net 259,000 extra people coming into the UK each year more than when Labour were in power. Another example is the day the Tories announced they wanted to start building lots more affordable homes because it would add to the UK growth. However - it transpired the same day they announced this - that the rate building affordable homes has declined by 95% in the last year. There are almost zero affordable homes being built now, and home building has never been so low since WWII. Net new homes are about 75,000 a year. Meanwhile 259,000 extra people are arriving each year. Get your head around these numbers it must mean a lot of overcrowding going on in places like London. Add to this the 28% capital gains tax wrip-off instigated on all people investing, with no tapered relief - what you have is tax on inflation - not on capital gains. It's about this highest capital gains tax rate in the world. It has driven many investors away from the UK and this rot will continue. Little wonder the FT100 has stayed the same for 15 years despite inflation (its real inflation adjusted value has declined to about half since 1997).

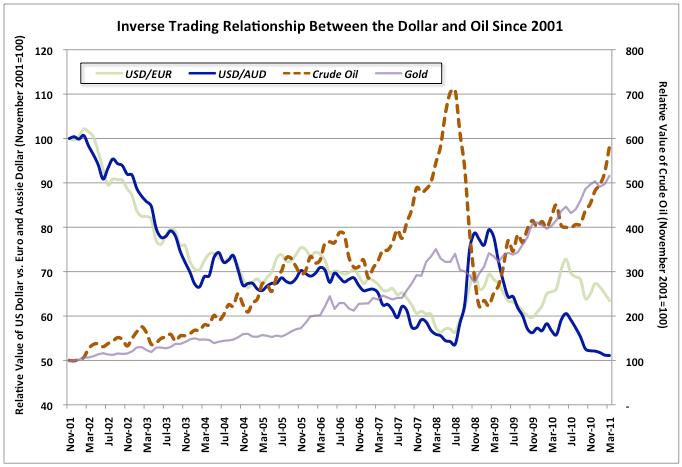

Capitalism Died: As governmen t intervention increased, capitalism and business and general freedom died. In western economies, this started sometime after the dot-com bust in 2000, as money printing presses began and failed businesses got bailed out with public tax money. This rewarded the failed businesses and banks, and led to a kind of chronie social capitalism - share many similarities with facism. What we mean is big government control of the economy and the lining of pockets in an intertwined secret government-elite business world - that rewards big public sectors and the business elite with close connections with government. A classic example is the interplay between the Fed, Goldman Sachs, JP Morgan, military and the US government. Cross-postings and the printing of fiat money to create bubbles that the investment banks can take advantage of, also knowing when markets will drop - this is when more money is made shorting and trading on big swings and hedging. The more real capitalism gets close to death, the higher oil, gold and silver prices will be driven. The Fed and US Governments will try to suppress the price of silver and gold as this "real money" competes with their fiat currency, but like all government intervention, it is doomed to failure when the international markets take over. This will be when US bonds crash, inflation sky-rockets and inflation rates are driven to levels at least twice if not three-fold higher than current levels. Thence the US sovereign default (or gigantic unimaginable money printing) will occur. There will be a massive run on the dollar as people finally realise the US dollar is not a safe haven. They will buy the Euro, Yen, Swiss Franc and Chinese Rhimnbi in droves.

t intervention increased, capitalism and business and general freedom died. In western economies, this started sometime after the dot-com bust in 2000, as money printing presses began and failed businesses got bailed out with public tax money. This rewarded the failed businesses and banks, and led to a kind of chronie social capitalism - share many similarities with facism. What we mean is big government control of the economy and the lining of pockets in an intertwined secret government-elite business world - that rewards big public sectors and the business elite with close connections with government. A classic example is the interplay between the Fed, Goldman Sachs, JP Morgan, military and the US government. Cross-postings and the printing of fiat money to create bubbles that the investment banks can take advantage of, also knowing when markets will drop - this is when more money is made shorting and trading on big swings and hedging. The more real capitalism gets close to death, the higher oil, gold and silver prices will be driven. The Fed and US Governments will try to suppress the price of silver and gold as this "real money" competes with their fiat currency, but like all government intervention, it is doomed to failure when the international markets take over. This will be when US bonds crash, inflation sky-rockets and inflation rates are driven to levels at least twice if not three-fold higher than current levels. Thence the US sovereign default (or gigantic unimaginable money printing) will occur. There will be a massive run on the dollar as people finally realise the US dollar is not a safe haven. They will buy the Euro, Yen, Swiss Franc and Chinese Rhimnbi in droves.

Powerful Negative Forces: To broaden the discussion out a bit, these are just sy mptoms from a long slow western decline caused by:

mptoms from a long slow western decline caused by:

· Peak Oil causing high borrowing as oil prices rise

· Debt bubble government creating debt bubbles from printed money after currencies came off the gold standard

· Stock bear market being 65% of the way through a 17½ year stock bear market that started in 2000

· Commodities bull run - being 65% of the way through a 17½ year commodities bull market that start in 2000

· China, India and emerging economies pulling resource away from Europe and USA increasing in competition for resources from low wage countries

· Social spending, high oil consumption and massively increasing populations in oil producing nations means oil exports will decline

Vicious Oil Price Spiral: This all means the west is suffering and will increasingly suffer from oil prices at too high a level, too high debt levels, depressed stock markets and high commo dities input prices for at least another 5 years. As commodities prices rise, national governments are likely to tax oil and mining companies even further whilst others will try and nationalise these resources and thereby further slow oil production and drive prices even higher. In a normal market, when oil prices rise, oil production would follow to then bring prices back down normal levels. But OPEC countries need $100/bbl oil to pay for their gigantic desert populations and social spending programmes - oil investment is not high enough. To prove the point, crude oil production has not risen since 2005, meanwhile oil prices have risen from $20/bbl to $100/bbl. We have remained on an undulating Peak Oil plateau (all oil liquids including biofuels and natural gas liquids) we project this to continue for a few more years at least with no meaningful increase in supply.

dities input prices for at least another 5 years. As commodities prices rise, national governments are likely to tax oil and mining companies even further whilst others will try and nationalise these resources and thereby further slow oil production and drive prices even higher. In a normal market, when oil prices rise, oil production would follow to then bring prices back down normal levels. But OPEC countries need $100/bbl oil to pay for their gigantic desert populations and social spending programmes - oil investment is not high enough. To prove the point, crude oil production has not risen since 2005, meanwhile oil prices have risen from $20/bbl to $100/bbl. We have remained on an undulating Peak Oil plateau (all oil liquids including biofuels and natural gas liquids) we project this to continue for a few more years at least with no meaningful increase in supply.

Military Strategy and Costs: As deficits increase, the US, UK and European military might will be eroded and global instability is likely to increase. Developing nations will find it difficult to afford getting involved in conflicts there will likely be a further military re-focussing on areas with oil production/reserves. Any instability that disrupts oil supplies will lead to conflict.

I nflation Just Starting: As more money is printed by Europe, USA and other countries to pay for debt interest payments, inflation will kick-in, in 2012. In a way there is a hidden economic war being played out - a battle to print money to debase currencies - deflate currencies to make countries more competitive. Greece has been dealt a painful hand, being shackled to the might Euro - so their business is now severely uncompetitive after 15 years in the Euro. Inflation and this gigantic global money printing campaign is only just starting. Every time it looks like growth will slow to zero, there will be more money printing. And eventually it will get out of control. It always has and it always will. Just like in the 1970s. This will drive the middle class into the poor bracket and make the rich probably richer relatively. There will either be the rich or poor. There will be a gigantic transfer of wealth from savers of fiat currencies to owners of gold, silver and oil. Also from the USA to China. And Europe to the Middle East. Much of this wealth will be squandered and overall global GDP growth will drop and economic inefficiencies build up - from too much social spending - hand-outs.

nflation Just Starting: As more money is printed by Europe, USA and other countries to pay for debt interest payments, inflation will kick-in, in 2012. In a way there is a hidden economic war being played out - a battle to print money to debase currencies - deflate currencies to make countries more competitive. Greece has been dealt a painful hand, being shackled to the might Euro - so their business is now severely uncompetitive after 15 years in the Euro. Inflation and this gigantic global money printing campaign is only just starting. Every time it looks like growth will slow to zero, there will be more money printing. And eventually it will get out of control. It always has and it always will. Just like in the 1970s. This will drive the middle class into the poor bracket and make the rich probably richer relatively. There will either be the rich or poor. There will be a gigantic transfer of wealth from savers of fiat currencies to owners of gold, silver and oil. Also from the USA to China. And Europe to the Middle East. Much of this wealth will be squandered and overall global GDP growth will drop and economic inefficiencies build up - from too much social spending - hand-outs.

China and India Buy Up Gold: China and India have started amassing huge quantities of gold with their budget surpluses. They are not stupid. They look at gold as real money. Not a fiat cu rrency. Every time the gold price dips to $1700/ounce, they start piling in again. Its the same with oil every time oil dips to $90/bbl they start piling in. The reason is simple. They know the USA will continue to print money. And they know the UK started printed recently and Europe will eventually start printing. Everyone will soon be printing fiat currencies not backed by gold or physical assets. So currency values will continue to decline and gold prices in dollar terms will continue to rise. Savings will be destroyed by inflation. Cash will be destroyed by currencies devaluing. And the only safe place to put ones cash will be into gold as a saving into real money. Gold prices will balloon, a bubble will eventually develop - then the last phase will be the parabolic blow-off at the top (likely 2-6 years time).

rrency. Every time the gold price dips to $1700/ounce, they start piling in again. Its the same with oil every time oil dips to $90/bbl they start piling in. The reason is simple. They know the USA will continue to print money. And they know the UK started printed recently and Europe will eventually start printing. Everyone will soon be printing fiat currencies not backed by gold or physical assets. So currency values will continue to decline and gold prices in dollar terms will continue to rise. Savings will be destroyed by inflation. Cash will be destroyed by currencies devaluing. And the only safe place to put ones cash will be into gold as a saving into real money. Gold prices will balloon, a bubble will eventually develop - then the last phase will be the parabolic blow-off at the top (likely 2-6 years time).

German Rates Rise: It was interesting on 24 November that German rates rose to 2.26% - above the UKs rate of 2.19% after their failed auction of bonds. This means the markets now think Germany is riskier than the UK and USA. The contagion from Greece and Ireland to Italy, then Spain then France has now started to affect mighty Germany. But whilst the focus of today was Germany, we believe the real focus will eventually shift dramatically to the USA. On 23 November they failed to agree the $1.2 Trillion deficit reduction measures - the bi-partisan in-fighting has reached chronic levels and we think its just a question of time before the markets turn on the US dollar. Just consider some of the fundamentals of the USA economy:

· $14.5 Trillion deficit

· 100% of GDP deficit

· 10% GDP deficit per annum

· $75 Trillion total liabilities

· Debt rising at >15% per year

· No deficit reduction plan

· No joined up leadership

· Struggles with $0.5 Trillion per annum oil import bill

· Medicare costs of $7000/person/year

Bankrupt USA: Its all totally unsustainable the Fed will continue printing money well into 2012 - one key reason is because Ben Bernankes only chance to keep his job is to try and print his way out of trouble. But it will only lead to rampant inflation and higher unemployment. With it oil, gold and silver prices will sky-rocket. Food and land prices will also rise sharply as shortages occur. It will drive commodities prices far higher into a blow-off bubble phase eventually. The USA will either default, or inflate and debase their currency (a form of stealth default). Directionally, this will take money from prudent savers and give it to the reckless people with big debts - bankers, failed businesses and failed public sector entities. Inflation will skyrocket. Ration books will come out. Unemployment will skyrocket as businesses fold. Ultimately, as normal, the politicians will want to deflect blame and there will be another war whether this is with Iran or Venezuela we are not sure. It might involve Israel. But it will be definitely involve a country that produces lots of oil and has large oil reserves just like it did with Libya and Iraq. Regrettable we are not being cynical we are just being realistic and honest. One day someone will come out and say "stop driving your 6 litre SUV - you cannot afford that fuel - get real". But for now - Americans continue to drive 6 litre 2 ton tanks - and view it as a federal right to do so.

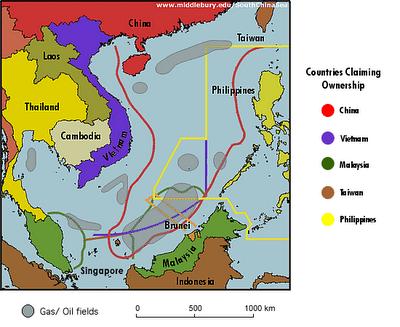

South China Sea: An other hot spot will be the South China Sea where huge oil reserves are being fought over by about six countries: China, Vietnam, the Philippines, Malaysia, Brunei and Indonesia around the Spratly Islands. Its possible the USA could get involved here with its navy, for the first time against the Chinese a dangerous flash-point. It's currently supporting the Philippines border claim. It looks like a complete mess - an accident waiting to happen.

other hot spot will be the South China Sea where huge oil reserves are being fought over by about six countries: China, Vietnam, the Philippines, Malaysia, Brunei and Indonesia around the Spratly Islands. Its possible the USA could get involved here with its navy, for the first time against the Chinese a dangerous flash-point. It's currently supporting the Philippines border claim. It looks like a complete mess - an accident waiting to happen.

Doomed European Experiment: Normally at the end of every major inflationary period there has been war. The Germans know this one reason why they have been so keen to keep inflation under control with their European Project. Politically commendable effort to prevent another war, but economically doomed to failure because one cannot have one interest rate and one exchange rate with such a diverse regional economy - from young motivated Munich bankers to the retired Greek Island fishermen. Over time the disparities and productivity always increase. The Eurozone will have to break up eventually, and this process will be accelerated with high oil prices because deficits in most European countries increase 1% for every $15/bbl oil price increase. So if oil prices rise to $150/bbl, expect the Euro to break up sooner - and move to a narrower core of countries. If oil stays below $100/bbl - it could take a few years and there many be less casualties - e.g. Greece and may be one or two others.

Safe Haven: As you can see, oil wars, inflation, printing excessive money and currency decline will all lead to gold prices skyrocketing as a safe haven and investment in "real" money rather than fake fiat currencies.

Gold: We re-iterate our stance that gold and silver are the best investments for the next few years. Oil will also probably rise further following a further dollar decline. Stocks in oil companies will outperform the general market.

Blow-Off Bubble: Eventually at the end of this commodities bull run, we should see gold prices being close to the Dow Jones index hence if the Dow was 10,000, the gold would spike to $10,000/ounce. S ilver will likely also be valued at a ratio of about 15:1 against gold. We see absolutely no reason why gold should not rise from its current level of $1700/ounce to $6000/ounce after the herd have arrived. So with silver at 15:1 this would make silver value rise from $32/ounce to $400/ounce.

ilver will likely also be valued at a ratio of about 15:1 against gold. We see absolutely no reason why gold should not rise from its current level of $1700/ounce to $6000/ounce after the herd have arrived. So with silver at 15:1 this would make silver value rise from $32/ounce to $400/ounce.

Realistic Ratio: Also recall gold reached $1000/ounce way back in 1980 and its only 70% higher now even though most prices have risen tenfold since 1980 and the money supply is about twenty fold higher. Recall also silver topped out at $55/ounce in 1980 and is now only $31/ounce despite above ground reserves being only 1/20th of what they were in 1980. Silver is running out and is used in many critical electronic manufacturing processes the world would grind to a halt without silver. This metal is very good value indeed. There is little or no re-cycling. We remind you that it really is running out. There is more gold available in vaults than silver.

Bonds and Treasuries: Gold is a safe haven from inflation. It is an alternative to fiat currencies as a real store of personal wealth. US  Treasuries are a bubble, very unsafe and likely to suffer a default. We see no way the US will be able to pay off it's debts. Bond rates will sky-rocket. Interest rates will have to follow suite then more money will be printed. Its an accident waiting to happen. It all points to gold going higher.

Treasuries are a bubble, very unsafe and likely to suffer a default. We see no way the US will be able to pay off it's debts. Bond rates will sky-rocket. Interest rates will have to follow suite then more money will be printed. Its an accident waiting to happen. It all points to gold going higher.

Print On One Side Buy Gold On The Other: Many experts believe governments, investment banks and the Fed are suppressing the price of gold and silver because they view them as competition to their fiat currency. Its our intuition, nothing else, that these same bankers are printing money whilst trying to secure as much gold and silver as possible on the other side of the fence. As inflation takes off, the average person gets their savings destroyed, these people will become very wealthy as they hold the precious metals - probably in overseas vaults. When the short positions unravel, all central banks start accumulating and the investment bankers and hedge funds start piling in, gold and silver prices will go ballistic. We are close to the bottom of a bubble - its not yet inflated this bubble will rapidly expand in the next 2-5 years then have a final parabolic blow-off before crashing to earth. Ride the bubble just make sure you get out before it pops at the top.

Buying Opportunity: We see a gold price at $1700/ounce and silver at $30/ounce as a very good buying opportunity. As described before, our target price for gold is $6000/ounce and silver $400/ounce sometime in the next 2-5 years.

Physical Gold: Its best to by physical gold through trusted traders, mints or allocated gold through a reputable internet business (avoid ETFs, they are like stocks underpinned by something uncertain - liable for shocks).

Mining Stocks: Another way of investing in gold and silver is to buy mining stocks. Mi ning stocks have lagged behind physical gold and silver prices over the last few years. Indeed, gold mining stocks are only 10% higher than their peak in 1980. Its likely this is because:

ning stocks have lagged behind physical gold and silver prices over the last few years. Indeed, gold mining stocks are only 10% higher than their peak in 1980. Its likely this is because:

· No-one trusts the stock market anymore company claims and flash-crashes being two issues along with taxes on dividends and increasing capital gains taxes (28% in the UK, up from 18% a few years ago)

· As gold and silver prices rise, governments tax miners more increasing their tax take

· Mining costs have sky-rocketed because of miners wage increases, power price increases and shortages, floods and strikes many mines are in unstable countries

· Government sometimes seize mines and nationalise them

· Environmental and regulatory pressures make production delays common and production more challenging

· Increasing populations with mobility of people mean villages spring up and stop developments

Mining Stock Volatility: A bit like ETF (Exchange Traded Funds ) you never really know where you stand with stocks reserves can be overstated, costs understated and stocks or ETF can as a whole suffer heavy losses when investor take flight from risk dumping stocks no matter what they are. So physical gold can rise while mining stocks or ETFs drop depending on market sentiment. If you pick the right mining stock, they can rise tenfold in short order, but if you pick then wrong one, its not uncommon for the small stocks to crash to 10% of their original value in a few days. If you get good at stock picks and timing, you can make large amounts of money, but you can also lose your shirt so be careful. You also get dividends and capital values paid in the fiat currency you have invested in - so if inflation increases by 15% a year, if your stock value does not rise by this amount, you actually make a negative inflation adjusted return.

) you never really know where you stand with stocks reserves can be overstated, costs understated and stocks or ETF can as a whole suffer heavy losses when investor take flight from risk dumping stocks no matter what they are. So physical gold can rise while mining stocks or ETFs drop depending on market sentiment. If you pick the right mining stock, they can rise tenfold in short order, but if you pick then wrong one, its not uncommon for the small stocks to crash to 10% of their original value in a few days. If you get good at stock picks and timing, you can make large amounts of money, but you can also lose your shirt so be careful. You also get dividends and capital values paid in the fiat currency you have invested in - so if inflation increases by 15% a year, if your stock value does not rise by this amount, you actually make a negative inflation adjusted return.

Gold and Silver Shortage: Overall dont expect huge new metals supplies to come on-stream the production levels should stay flat despite rising prices, similar to oil. Yes, that's Peak Gold and Peak Silver - gold, silver and oil will be on an undulating plateau despite rising prices. So as mining company profits rise, the risks tend to increase for nationalisation and taxation this puts many investors off. Key reasons why many investors prefer to simply buy the physical metal and safely store it. At least they know it cannot be confiscated and its safe compared to currencies and taxes.

Bull and Crash Model: Below is a model to describe what we think will happen in the next five years. Essentially all major western oil importing nations will start printing even more money to pay down debts and pay interest on these debts. Every time another bout of printed money hits the markets, it will cause stock markets to rally temporarily. This will then drop back as the wisest investors take profits and buy gold, silver and oil. The Dow should drop a further 40% in inflation adjusted terms before the end of the stock bear market, sometime between 2014 and 2018. Meanwhile gold will keep rising as inflation takes hold - rising from the government claimed ~3.5% (actually more like 8%) to something like 18%. Interest rates will sky-rocket in the USA as there is a run on bonds - and will also go higher in the UK and Europe. Panic will break out and there will be a final gold and oil blow-off rally - then a severe crash likely sometime between 2014 and 2018 - coinciding with an oil war of some form or another. The next stock 17 1/2 year bull run will then commence as bad debts are written down once and for all. Many companies, governments and entities will be bankrupt by this point. The real winners will be those that bought gold, silver and oil, then got out just before the final blow-off then crash. Cash savings will be wiped out. The only money worth anything meaningful by this point will be physical gold and silver, but even these two metals will drop once debts are finally written off at the end of this huge western debt bubble. At this point, the Chinese will have increased their gold and silver holdings by 10-20 fold as central banks are forced to transfer their gold to China to pay off bad debts. We hope this makes it clear the direction things are heading - in our opinion.

Gold Britannia: For UK gold investors, also consider that buying minted Britannia Gold Coins (or money) is not subject to either VAT or Capital Gains Tax. Not surprising because these are minted coins with legal face value and are real money. So thats probably the only tax free investment or saving in the UK. Prices are not that low for Britannia coins, but certainly worth considering for about £1050 per coin (Troy ounce). Silver coins are generally subject to VAT at 20% - unless they are old used coins from a smaller supplier. Silver investment via allocated silver (internet trades) has no VAT liability. However, we urge you to check the tax situation in dependently also for your own circumstances - we do not advise on this.

dependently also for your own circumstances - we do not advise on this.

Smartest Billionaire Investors: Its not just us that think gold and silver will rise dramatically. If you listen to the really smart investors like Jim Rogers, James Turk, Marc Faber, Ron Paul, Peter Schiff and Mike Maloney that all say a similar thing in different ways, with different context and slightly different views. Why would these independent billionaires who love making money as a hobby and passion be telling everyone a pack of lies. They have their reputations and credibility to think of. We see no reason why all six of these people collectively should be saying anything but the independent objective factual truth. They appear consistent in their objectivity and it all points to higher gold, silver and inflation as central banks continue to print money as the debt bubbles implode.

We hope you have found this Special Report insightful and helpful for developing your investment options. If you have any questions, please contact us on enquiries@propertyinvesting.net

Disclosure: Long on gold, oil, silver, UK/London property (short on nothing)

Gold, Oil, Dollar Values Over Time

Silver Demand and Investment - chart by PropertyInvesting-net

Gold demand global investment

Gold demand global investment

Gold supply