494: Are betting for or against the western government's financial management?

12-05-2013

Which Way To Bet? : This is a key question for property investors. The reason is that western governments like people to hold their currencies, bonds/treasuries and invest in financial products and property. This helps to revive struggling economies and reduce unemployment along with winning votes at elections. What western governments are not keen on seeing is gold, silver and oil prices rising sharply – because this causes high inflation, higher unemployment, periods of recessions and if prolonged, civil strife and even economic collapse. So to invest in gold, silver, oil and commodities is normally something a sceptic of the government would do – they are betting against the government – a sort of short position on the western government. They might also be betting on the likelihood of a war or turbulence.

Trusting the Government: Most people are rather more trusting of the governments “win ning the day” – particularly because they set policy, can manipulate the markets by changing taxes, fiscal policies, interest rates and regulations. They can stimulate a property boom, or help mitigate against a bust under normal circumstances. They can often control markets – for example, the US Fed prints money that can help drive up stock markets as interest rates drop and people shift into “risk-on” assets or paper products. Printing money can debase a currency and create inflation that gives an illusion of growth. Inflation numbers can be manipulated downwards to give an impression of higher earnings and purchasing power.

ning the day” – particularly because they set policy, can manipulate the markets by changing taxes, fiscal policies, interest rates and regulations. They can stimulate a property boom, or help mitigate against a bust under normal circumstances. They can often control markets – for example, the US Fed prints money that can help drive up stock markets as interest rates drop and people shift into “risk-on” assets or paper products. Printing money can debase a currency and create inflation that gives an illusion of growth. Inflation numbers can be manipulated downwards to give an impression of higher earnings and purchasing power.

Precious Metals: The US government tries its hardest to drive gold and silver prices down indirectly by claiming gold is not real money – people hold gold through “tradition” – and likely work with banks to encourage short positions against silver to suppress its price. Gold prices have come down from their peak of $1900/ounce to $1220/ounce whilst silver prices have dropped from $45/ounce to $19/ounce. Silver prices are now almost three times cheaper in nominal terms than in 1980 when they were $55/ounce. It’s the only thing we can think of that is lower in price now than in 1980 – quite incredible. Property prices have risen five fold whilst silver prices have dropped to 40% of their previous value. It has to be a screaming bargain at $19/ounce.

Can You Predict When A Government Will Win? The best investors are probably the ones that can predict when the governments will “win the day” by keeping their currencies from collapsing, stimulating investment, stimulating growth and reducing unemployment through prudent financial management of the economy. Governments will go through periods of good financial management then poor financial management depending on the type of government, how desperate their actions are to win votes, the degree of populist policies versus their integrity and what their core values are.

Tory Coalition: At the moment, the UK government’s reputation for good financial management is definitely on the up. This is hardly surprizing as they attempt and partially succeed in rebalancing the private and public sectors and implement reforms to undo the damage done during the previous 13 years of Labour rule. But underneath the positive façade, the private and public sector debts are still gigantic and rural economies and those far from London will struggle for years to come. It’s on an improving tr end certainly, but it could be undone rapidly if there was another global financial crash or recession – or Labour got into power May 2015 and undid all the progress.

end certainly, but it could be undone rapidly if there was another global financial crash or recession – or Labour got into power May 2015 and undid all the progress.

France Socialism: If we look at the way France is heading with higher taxes, higher social spending and the mega-rich leaving the country – this could easily happen to the UK if Labour got into power in our opinion. France has gone from one of the engines of the European economy to the country with the most distressing manufacturing record – 21 consecutive months of decline.

A Commodities Bull Cycle “a bet against the western governments”

-

Gold

-

Silver

-

Bitcoin

-

Oil

-

Commodities

-

Agriculture

-

Artwork

-

Mining

B Financial Bull Cycle “a bet for the western governments”

-

Property

-

Finance

-

Banking

-

Stocks and Share

-

Retail

-

IT/Technology shares

-

Bond Prices

-

Currencies value

UK At The Moment: In the UK at the moment, scenario B is winning against A. Property prices are rising, the financial services sector is improving, banking is improving, stocks and shares are fairly strong, the retail sector is improving, bond prices remain high (yields low) and the currency value is heading higher. Meanwhile oil prices have dropped, gold and silver prices have dropped, commodities prices have dropped agriculture is looking less attractive. Mining stocks have been hammered.

How Long? The big question is – how long with this continue – and is this the end of the commodities super-cycle bull run. For property investors in western countries like the UK with gas and oil imports, no mining, not much agricultural land and a big financial services sector – Scenario B is preferred. As long as markets keep their faith in the government – you can expect to see property prices rising sharply – increased housing demand with very low housing supply. The super-rich will continue to snap up London property has a global safe haven - since they believe in the secure policies for their investments for now.

Winning Trend: But you need to be prepared if things turn against the government – if oil prices shoot up or a financial collapse occurs – for instance – a run on the bond markets. So far, the UK governmen t has headed this off – by printing money, driving down interest rates and debasing the currency. As the economy recovers and unemployment drops further – we will almost certainly see interest rates rise, inflation rise and employment rise in the medium term. This is certainly the mainstream market expectation.

t has headed this off – by printing money, driving down interest rates and debasing the currency. As the economy recovers and unemployment drops further – we will almost certainly see interest rates rise, inflation rise and employment rise in the medium term. This is certainly the mainstream market expectation.

Hedge: If you want a strong hedge against a financial collapse, then gold is probably the best asset to purchase - it's real money. If war breaks out, then gold and oil prices normally shoot up and financials suffer severely.

Security: On the security side, things have calmed down of late but there are still very big concerns about war in the Middle East (tensions between Saudi Arabia and Iran over Syria) – and even threats in the South China Sea – between China and Japan – should be considered.

Collapse? A US economic collapse seems to have been headed off – our view is – this has only been possible because:

· Natural gas prices crashed from $12/mmbtu to $3/mmbtu in 2008 as gas reserves skyrocketed

· Oil production increase by 2.5 mln bbl/day since 2008 whilst consumption declined by 2 mln bbl/day – US oil reserves shot up – from shale oil deposits confirmed in the last 4 years

These new reserves underpinned the value of the US dollar as the global reserve currency despite massive abuse by the US Fed in the form of $40 billion a month currency printing. It has nothing to do with the Fed-Government policy – and has everything to do with the drive and innovation of the private sector oil drilling in rural lands – Texas and North Dakota. Those Texan oil men.

As the dollar confidence has increased, the gold prices have declined. The sceptics will say – nothing has changed and a collapse is just around the corner. The optimists will say – the dollar is king – real estate is cheap and the US will get back to its winning ways despite its challenges. Technology will win the day.

Oil Technology: What has caught everyone out is how the US has gone from a country import ing 8 mln bbl of oil a day (costing $525 billion a year) to a country that is projected to be energy self sufficient by 2020 (saving $525 billion a year). The innovative oil industry in the US has saved the day! The technological advance of combining extended reach horizontal drilling with multiple hydraulic fraccing in tight shales in order to extract economic rates of oil has been the key. This is having massive ramifications for global security and economic policies – since the US will no longer be reliant on oil imports from unfriendly neighbours by 2020. It has boosted the US dollar value higher than it normally would have been. It has decreased the deficit markedly. It has kept the bond market bubble from popping. It also means the US military excursions and interventions are likely to be reduced over the next ten years. Hopefully the world will be a rather safer place with less wars – though the downside is that the US retrenchment from being the “policeman of the world” will have the opposite effect.

ing 8 mln bbl of oil a day (costing $525 billion a year) to a country that is projected to be energy self sufficient by 2020 (saving $525 billion a year). The innovative oil industry in the US has saved the day! The technological advance of combining extended reach horizontal drilling with multiple hydraulic fraccing in tight shales in order to extract economic rates of oil has been the key. This is having massive ramifications for global security and economic policies – since the US will no longer be reliant on oil imports from unfriendly neighbours by 2020. It has boosted the US dollar value higher than it normally would have been. It has decreased the deficit markedly. It has kept the bond market bubble from popping. It also means the US military excursions and interventions are likely to be reduced over the next ten years. Hopefully the world will be a rather safer place with less wars – though the downside is that the US retrenchment from being the “policeman of the world” will have the opposite effect.

UK and US Fortunes: Overall – in both the US and the UK – whose economies have often follow closely through history – we can expect the next year to see rising property prices as oil and gold prices are suppressed and general economic optimism improves. But don’t be caught out or surprised if all of a sudden – at maximum euphoria – things collapse – as they have done so many times in the past – for instance:

-

Feb 1980

-

Oct 1986

-

March 2000 (remember the Millenium celebrations)

-

July 2008 (remember the Bejing Olympic celebrations)

Prediction: Our prediction is that around 2016-2017 there will be an almighty crash as oil and gold prices skyrocket – as the end of the commodities bull run that believe it or not – we are still in – comes to an abrupt end. This will coincide with peak babyboomer retirement and the US pensioners pulling on their 501k’s. But for now, we’ll leave it at that – since in this mid cycle period – we are likely to see property prices rise higher and gold prices edge lower as people (mistakenly) believe things are getting back to normal. The stock market will probably continue to rise even though its in an overall bear run that started in mid 2000.

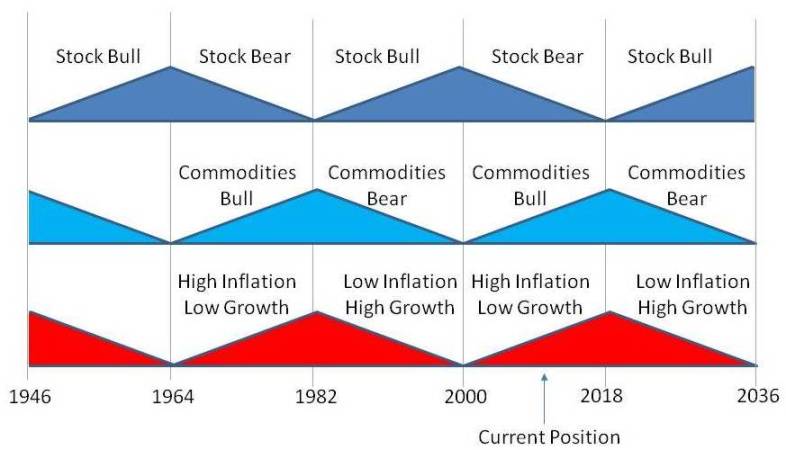

SuperCycle: Commodities versus Financial cycles tend to form in 17.5 year cycles. Our view - which is contrarian admittedly - is that we are mid way through a stock bear market that started in 2000 - and will end in 2018. We are mid way through a commodities bull run that started in 2000 and will end in 2018. This is worrying for property investors in that we would expect another large down-leg in property prices some time between 2015 and 2018 - with the end of the financial-property bear run around 2018 as inflation gets out of control and property prices in inflation adjusted terms drop sharply. At this time gold and silver prices would go ballistic - far higher - probably corresponding to a time when more wars break out. The 31 year bond bull run would come to an end with a bond market collapse from indebted western nations. We will of course see whether this prediction comes to pass - it's part of a large cyclical event that can be predicted, but many people already (likely wrongly) think the gold-commodities bull run is at an end. It's got another 5 years to go - and the correction in the last 2 years will be reversed.

Collapse: Just remember – if a collapse occurs – governments will simply increase the money printing to create inflation – so ultimately the value of currencies will decline and eventually gold and silver prices should skyrocket if our prediction is correct. We are mid cycle – and we expect property prices to rise for at least another year in the UK.

We hope this Special Report has helped you consider some economic aspects that can help you shape your investment decisions. If you have any questions or queries, please contact un on enquiries@propertyinvesting.net.