545: Property Investors Update

07-30-2015

PropertyInvesting.net team

PropertyInvesting.net team

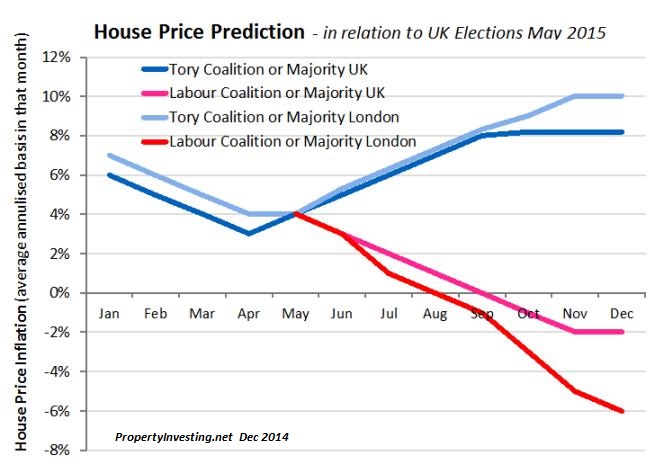

Changed Political Landscape: For property investors the political landscape has shifted dramatically since the Election. Most people before 10pm 7 May though Labour would form a minority government likely propped up by SNP, until the Exit Poll described a completely different result, namely a straight Tory majority government. This was a remarkable turn-around. For anyone with a business that wants to make a reasonable return on investment for their efforts, ingenuity and risk, it had to be a positive outcome.

Corbyn For Labour: What happened after the result is even more surprizing. Jeremy Corbyn the 100:1 outsider who only got nominated 10 mins before the deadline with some borrowed unused MP votes, is now odds on favourite to win the Leadership contest. Tony Blair’s intervention back-fired dramatically – since it seems to have had the effect of “turning everyone off” the three centre-ground candidates, even Andy Burnham the most left wing of the three. It’s now become a divisive contest between the “Bairites” and the “Far Left”. It looks like the Far Left will win. A hell of a lot of Labour voters will need a “heart transplant”.

Corbyn the 100:1 outsider who only got nominated 10 mins before the deadline with some borrowed unused MP votes, is now odds on favourite to win the Leadership contest. Tony Blair’s intervention back-fired dramatically – since it seems to have had the effect of “turning everyone off” the three centre-ground candidates, even Andy Burnham the most left wing of the three. It’s now become a divisive contest between the “Bairites” and the “Far Left”. It looks like the Far Left will win. A hell of a lot of Labour voters will need a “heart transplant”.

Corbyn Engages: If you take a few minutes to listen to Jeremy Corbyn on YouTube – he actually comes over as quite a genuine person that connects with his audiences – and his arguments about not going to war, saving billions on nuclear submarines, and women’s rights certainly resonate with most of the people that will vote in the Labour leadership contest. Our opinion, for what it’s worth, is that he will quite easily win the Labour leadership contest – especially as in the last few days all the Unions have backed him (this is how Ed Miliband beat his brother of course). Corbyn is riding a wave and most people seem to want to join in and get him voted in. Many be many of the Labour supporters release the party is now unelectable and if this is actually the case, why not vote for someone who will stand up for the people.

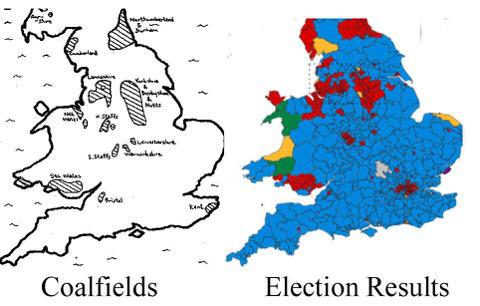

Interesting map showing the correlation of old Coalfield with Labour seats won at the 2015 Election (acknowledgement: Jonathan Dando on Twitter).

Labour Unelectable: A week in politics is indeed a long time. We believe that for all Jeremy Corbyn’s charisma compared to the rest of the dry contestants that have failed to get their message across clearly will get him elected as Leader of the party – then the part will have lurched to the left – indeed, so far left that it will become unelectable. There will be bitter infighting, “centrist” people leaving the party and there simply won’t be enough far left wing voters to ever achieve a majority, especially now that Scotland has  been lost to the SNP. This brings us to the property investing point – and economic trends – namely that you can look forward, for good or bad, to the next 15 years with a Tory majority government – with centre-right policies. If the SNP decide to have another referendum, they will probably win this. Then Labour stand even less chance of getting a majority or even forming a minority government.

been lost to the SNP. This brings us to the property investing point – and economic trends – namely that you can look forward, for good or bad, to the next 15 years with a Tory majority government – with centre-right policies. If the SNP decide to have another referendum, they will probably win this. Then Labour stand even less chance of getting a majority or even forming a minority government.

Confidence in Tories: For investors, anyone in business or the private sector, and property investors – it means a fair degree of stability and anticipation of reasonably business friendly regulatory environment and property policies. Probably more importantly, the financial markets will be encouraged by the stability - more investment and economic growth will transpire leading to higher house prices and high rental demand and rents in years to come, with a far reduced risk of economic meltdown like we saw under Labour in 2008 (remember out of all of the G7 countries, the UK had the deepest recession under Labour from early 2008 to mid-2010 – this was nothing to do with austerity).

Direction: Hence under the Tories we should directionally see:

· Pro-business policies

· Pro-wealth creation conditions

· Lower interest rates

· Strong sterling

· Lower inflation

· High GDP growth

· Higher employment

· Low wage growth

· Continue fairly high immigration levels

· Accelerating influx of global super-rich

· Continued non-dom status making London a safe tax haven for the super-rich

· Moderate-low levels of building

· Continued lack of home supply due to planning-environment and "nimby" factors

· Rising rental prices

· Rising house price

· Rising land price

· Rising wages (3%) with minimal inflation (zero %) for the next six month

· Public sector cuts that reduce the public sector and increase the private sector – rebalancing the economy further (more privatization)

Labour Transformation To Fringe Party: With Jeremy Corbyn as Leader of the Labour party, Labour will start looking more like a fringe protest party and the majority of voters even if they philosophically agree with some of his views, will not trust Labour to run the economy and will not want to risk the anti-austerity spend thrift policies that everyone knows got us in the economic mess in 2008 in the first place. Yes it was partly the banks fault, but the government and Bank of England manage the banks – and clearly the UK government and public sector had no money left, massive deficits magnified by banking mismanagement that has taken 5 years of hard work by the Tories to sort out – and even now the damage has not been completely undone.

Greece Classic Example of Socialist Mismanagement: We only need to look at what happened in Greece when the anti-austerity socialists took over and within 8 months the whole country’s economy had collapsed, banks closed and capital flew out of the country – hospitals ran out of medicine, people went hungry. What a mess. The same goes for Venezuela and ever since the socialists got into power in France – they have had stagnation whilst the UK economy has motored ahead economically. Be under no illusion that this would happen to the UK under a Labour government if they ever succeeded in getting back into power – which now seems an almost impossibility.

Super-Rich Investors: For the global super-rich investors, who like good legal title to property and a stable currency and economy, the UK now looks even more attractive compared to its competition. It’s worth noting that the Tory government is the most right wing economic government in Europe – and because of this will attract more super-rich as they will believe their investments are safer in the UK than other competitor countries. We do have a large deficit though this is on an improving trend and should be gone by about 2020. The Tories will also grab their share of tax revenues – to help reduce the deficits. But the upside to this is that at least the UK economy will be more robust when the next economic crisis hits – which could be just around the corner.

Printed Currency: Remember also all the global Trillions of dollars, Yen, Euro and Pounds swilling around – waiting for a home. Yes, ultra-low interest rates have fuelled the booming property prices. Some people think when interest rates rise, property prices will drop back as people start to struggle to pay mortgages. We have a slightly different view.

Sequence of Events: We think there is a high chance of the following happening – and we might be seeing the first manifestations of this now:

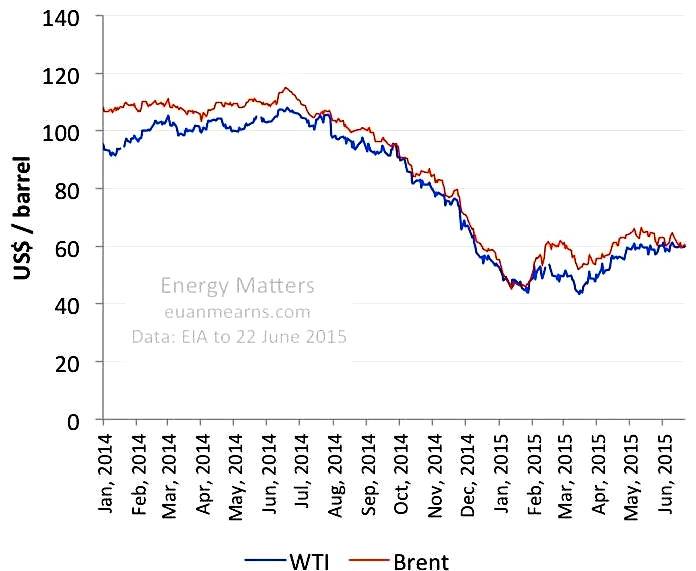

· A big deflation – oil, metals, commodities, feeding through to food and consumer prices – that started with the oil price collapse in August 2014

· Gold and silver decline – this has been ongoing in 2015 – gold has dropped from $1300 to $1080/ounce

· A stock market crash and further deflation - started with China, and could continue with the USA, UK and Europe sometime in the next few weeks

· If we get a US stock market crash, the Fed will immediately start printing money on a gigantic scale – it will be huge. We think there is a high chance of this crash could happen sometime between now and Nov 2015 and hence a high chance of this money printing starting – the Bank of England would of course join in along with the ECB.

· Then we get extremely high inflation of everything – from oil, gold, house prices, commodities then feeding through to consumer items as the currency value and huge debts are inflated away.

Outcomes: The outcomes would be:

· Oil prices $100-$150/bbl again (doubling or tripling)

· Gold prices $2000-$7000/ounce (no, the 6 is not a typo!)

· Silver $40-$150/ounce

· London 2 bed flat in Fulham – prices doubling from £600,000 to £1,200,000

Hyper-Inflation: What we are saying is we are not a believer in high interest rates lasting long – the UK, US and Euro cannot afford high interest rates with all the zombie bad debt around. Instead, it has to be more money pricing – then mild hyperinflation feeding through to property prices again – with gold shooting up along with other commodities, then a recession in the western world.

Park Money In Property: For all property owners, its bricks and mortar and no-one can print properties, Property is a hard physical asset. You can gauge your wealth by the number of properties or assets you have, not in a currency that’s value is reducing all the time. Why else would a Chelsea flat cost £200,000 in 1990 but cost £2,000,000 now. This is because of money printing. Increased debt levels, and probably an element of “the rich get richer and the poor get poorer”. Either way, property prices in London will rise further – in either a sustainable way due to economic growth and only slightly rising interest rates, or a big deflation then high inflation due to currency printing then feeding through to property prices – just like we advised it would in 2010 (see our Special Reports from the time QE1, QE2 and QE3 were announced).

and QE3 were announced).

Dow and QE Correlation: Its worth pointing out the Dow Jones and oil price correlation with QE – when QE stops oil prices come crashing down and when it starts again they go up. It’s that simple. When they have stopped currency printing in the USA by Jan 2014, oil prices crashed shortly after in Aug 2014. It’s probably more to do with currency printing than oil supply and demand.

Invest in Southern England: As in the period from 2010 to 2015, the UK regions that will be hit hardest by the Tory policies are those with the smallest private sectors and largest public sectors. These are generally rural areas and areas far from London – such as Cumbria, Northumberland, west Wales, NW Wales and most of rural Scotland. Conversely, the areas that will most benefit from the Tory polices will be London and areas within commuting distance to London, the larger cities with largest private sectors (e.g. Southampton, Bristol, Manchester, possibly Birmingham) and southern areas. Area closer to London also have a higher population boom going on and lower ability to build new property because of the nimby effect, hence property prices will continue to rise also because of this.

Ripple Effect: The trend of increasing property prices in SE England will con tinue with fairly subdued property price increases in regions far from London. That said, there will be a significant continuation of the “ripple effect” from London outward. Because you can buy a 10 acre estate with a mansion house in south Lincolnshire for £1 million – which is the price of a 2-3 bedroom flat in West London, don’t be surprised to see the country house prices rising sharply in more distant areas from London as some people sell up and move out. However, also don’t be surprized if London prices continue to climb strongly – particularly those in the £200,000 to £600,000 bracket that are hit less severely by stamp duty and benefit from inheritance tax changes.

tinue with fairly subdued property price increases in regions far from London. That said, there will be a significant continuation of the “ripple effect” from London outward. Because you can buy a 10 acre estate with a mansion house in south Lincolnshire for £1 million – which is the price of a 2-3 bedroom flat in West London, don’t be surprised to see the country house prices rising sharply in more distant areas from London as some people sell up and move out. However, also don’t be surprized if London prices continue to climb strongly – particularly those in the £200,000 to £600,000 bracket that are hit less severely by stamp duty and benefit from inheritance tax changes.

Value in London: Also some leafy areas quite close to central London are now looking rather cheap – like Nunhead, Brockley, Bexley/Orpington and possibly Enfield and Upminster.

Tax Changes a Disaster: The tax changes to buy-to-let investing will certainly take the wind out of the sails of property investment for rental and capital returns. This punitive tax – treating a landlord service (or business) like a paper investment was unexpected, and is ridiculous – it will only drive rents higher and cause more misery. It will be phased in over the next five years – so at least bu y to let investors that don’t like it have got a chance to sell up which they probably will do. Of course this will lead to far lower numbers of property for rent and drive rents even higher as more tenants fight for fewer properties – we should start seeing this kick-in in 2016. The rental supply is already far too little and this new tax will only make it far worse regrettably. Yes, there might be a few more properties available for the first time buyer, but it will tighten the available rental market far more than flood the sales side we believe. Ultimately the new tax change may need to be scrapped as rents rise too sharply off the back of reduced supply of rental properties. And we all know that the public sector and housing associations are not going to fill the gap in faintly.

y to let investors that don’t like it have got a chance to sell up which they probably will do. Of course this will lead to far lower numbers of property for rent and drive rents even higher as more tenants fight for fewer properties – we should start seeing this kick-in in 2016. The rental supply is already far too little and this new tax will only make it far worse regrettably. Yes, there might be a few more properties available for the first time buyer, but it will tighten the available rental market far more than flood the sales side we believe. Ultimately the new tax change may need to be scrapped as rents rise too sharply off the back of reduced supply of rental properties. And we all know that the public sector and housing associations are not going to fill the gap in faintly.

We hope you have found this Special Report insightful. If you have any queries, please contact us on enquiries@propertyinvesting.net.