642: Property Investors Update

06-20-2019

PropertyInvesting.net team

UK Economy: The UK economy is set to struggle for years henceforth because of a number of issues that politicians are not describing:

- Decline in the oil and gas production and revenues from the North Sea

- Increasing environmental costs related to climate change initiatives – environmental taxes on petrol/diesel and heat-power-energy

- Increasing regulation, legislation and litigations that make business far more difficult to start and prosper

- Draconian tax regimes – particularly evident in the increasing tax on property and the erosion of Landlord’s rights

- Uncertainties around Brexit – in conjunction with the start of Trade Wars between nations that will slow economic development and put up trade barriers

- Difficult and cumbersome planning regime that makes it impossible to have low cost housing and industrial developments

Courtesy Daily Mail

Counter to these negative trends are or could be in the future:

- The UK breaking away from the EU – having their own trade deals and thence gettin

g into a higher growth gear -this would only be likely with a fairly clean Brexit and a dynamic business friendly Tory government – a scenario that currently looks unlikely by early 2020

g into a higher growth gear -this would only be likely with a fairly clean Brexit and a dynamic business friendly Tory government – a scenario that currently looks unlikely by early 2020

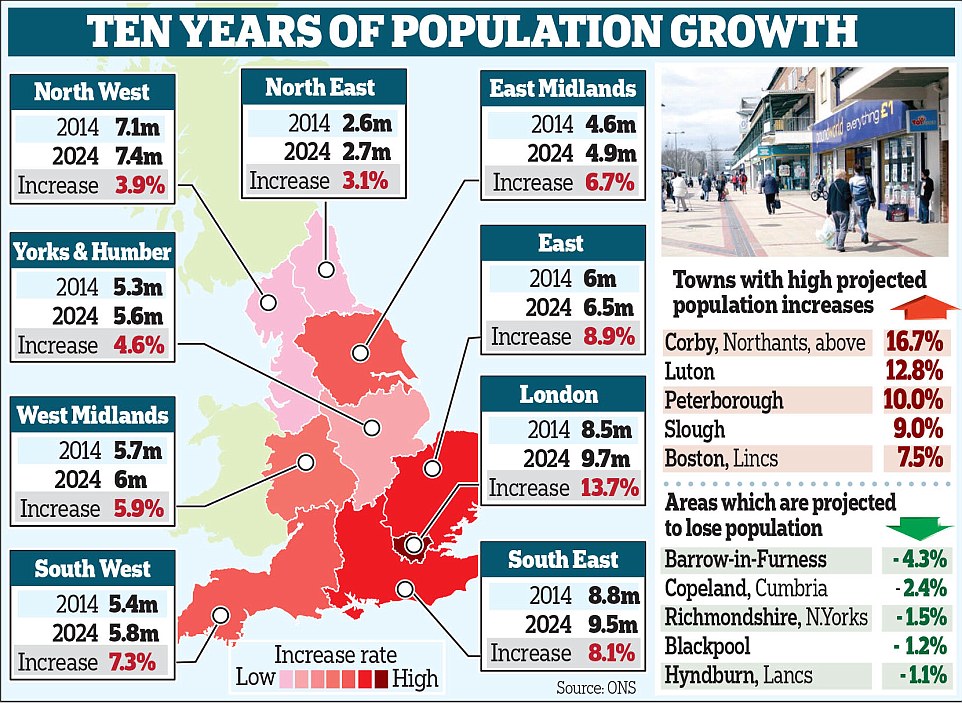

- Rapidly expanding population particularly in Southern England – particularly London.

- Higher education levels of younger people able to use technology to build small businesses in an efficient manner – often working from home

Southern England Growth: For property investors, it is most important to follow the expected outcome of economic growth in the next ten years and beyond any doubt, this will be centred around London. Other cities likely Manchester and possibly Birmingham, Leeds and Edinburgh may see higher t hat trend growth, but to be safe – the following cities-areas are likely to see the highest GDP growth, best property price increase and best rental demand – where the most higher paid jobs are created – and where unemployment is lowest - with young more dynamic populations. The highest growth areas will be:

hat trend growth, but to be safe – the following cities-areas are likely to see the highest GDP growth, best property price increase and best rental demand – where the most higher paid jobs are created – and where unemployment is lowest - with young more dynamic populations. The highest growth areas will be:

London, Reading, Cambridge, Oxford, Southampton, Brighton, Bristol, Bath, Slough, Luton, Corby, Milton Keynes, Watford, Portsmouth.

These are cities and towns that will see the biggest business growth and population increase in the UK. Some of the towns are “new”, not particularly attractive, like Corby and Milton Keynes, but these areas have a very high population growth that should feed off itself as new businesses move in.

Historical Cities: Other areas are well established – like Oxford, Cambridge, Bath – University cities that have many prosperous people already living their, but a shortage of building land and severe planning constraints that means house prices are likely to rise and rental demand remain very strong.

High Tech Corridor to West of London: Reading and Slough are very high growth areas – the so called “high tech corridors” leading out from West London – and the massive business expansion, loser planning controls and dynamic population are likely to see house prices, rental demand and business growth be some of the highest in the UK in the next 10-20 years. Reading and Slough are being transformed rapidly from sleepy towns to major higher tech industrial-business centres. The areas feeds of Heathrow Airport, West London and the City of London – plus critically it will have the new Crossrail service by end 2020 that will mean travel times to the City of London will be cut from 80 minutes to 40 minutes – making Reading commutable for city bankers. Other suburbs/towns that will be positively impacted to the west of London are – Acton, Ealing, Maidenhead, West Drayton-Harlington and the East Berkshire area close to the new Crossrail stations. The Heathrow expansion plans will also help growth though

US Economic Strength: When you compare the UK with the USA there is no comparis on in that the USA benefits over the UK from being:

on in that the USA benefits over the UK from being:

- Self sufficient in oil, gas, coal

- Self sufficient with food-agriculture

- Massive manufacturing centre relying on low cost energy

- Less stringent environmental and planning constraints

- Around ten times less population density

- Rapidly increasing population

- Economy benefiting from the might dollar strength – backed by its gigantic military and oil-gas reserves-production – exports. Don’t forget that the US military spending is around six times more than the next highest – which is Russia. China and the UK.

Since the oil shale boom from 2008 onwards, the US finances have been transformed and tax cuts have stimulated the economy as more activity and investment has taken place – the America first strategy although unpopular outside the USA seems to be having a positive impact on the US economy despite the trade wars that have started

Iran: Moving into the second half of 2019 the big thing to watch out for is Iran. 20 June they shot down a drone the size of an airliner over the Persian Gulf – USA and Iran have been on a collision course ever since the Trump administration unilaterally pulled the plug on the nuclear deal. Iran is enriching Uranium again, setting of rockets and bombs against different targets and our prediction is this is the beginning of a massive flair up. There have just been too many rockets and bombs set of recently as provocation and its difficult to imagine the USA sitting back and watching all of the just happen.

June they shot down a drone the size of an airliner over the Persian Gulf – USA and Iran have been on a collision course ever since the Trump administration unilaterally pulled the plug on the nuclear deal. Iran is enriching Uranium again, setting of rockets and bombs against different targets and our prediction is this is the beginning of a massive flair up. There have just been too many rockets and bombs set of recently as provocation and its difficult to imagine the USA sitting back and watching all of the just happen.

Hedge for Insurance: For those wanting to protect themselves from what looks like an impending gulf war, then oil at $62/bbl and gold at $1330/ounce and silver at $14.80 ounce look like bargains. Every large investor should have a least 10% of their investments in gold/silver and some more in oil as a hedge against war and currency collapse-devaluation or hyper-inflation. It feels like a doubling of gold and silver prices could be just around the corner. Remember also - regarding silver, there is only 1/2 billion ounces on earth with 7 billion people, so that's only one ounce per 14 people. One ounce costs around £24 - so you can buy 14 people's worth of silver for only £24. Its the only think that is cheaper in 2019 than in 1980 - when it cost $50/ounce instead of today's $14.80 / ounce. And that's after the US expanded the number of dollars about 20 times. So it must be the bargain of the century. One day, and it could be soon, silver prices will go ballistic!

Mighty Dollar: Despite everyone’s pronouncements about the death of the mighty US dollar – we rather think the worst risks for the dollar are over – these were the end of the high tax, low growth, massive oil import cost years of the Obama administration – things started to turn around after 2012 and the deficit spending is at least backed by shale oil and the mighty US military. So best not bet against the dollar in times when it looks like another big war is just around the corner – as they say, the safe haven is the dollar. Remember also - every country that has threatened to trade oil in a different currency to the dollar has either had sanctions imposed (Russia, Iran) or been bombed or invaded (Iraq, Libya). All of Iran's recent pronouncements about not trading oil in dollars has definitely increased the chance of conflict regrettably.

We hope you have found this Newsletter helpful in framing your investment decisions and giving some context to the second half of 2019. If you have any queries, please contact us on