193: What happens next in UK and USA with rising oil prices and credit crunch?

05-04-2008

PropertyInvesting.net team

How will things pan out this year?

Very interesting times for economic predictions. No-one has a crystal ball, but we have performed further analysis that points to the following occurring:

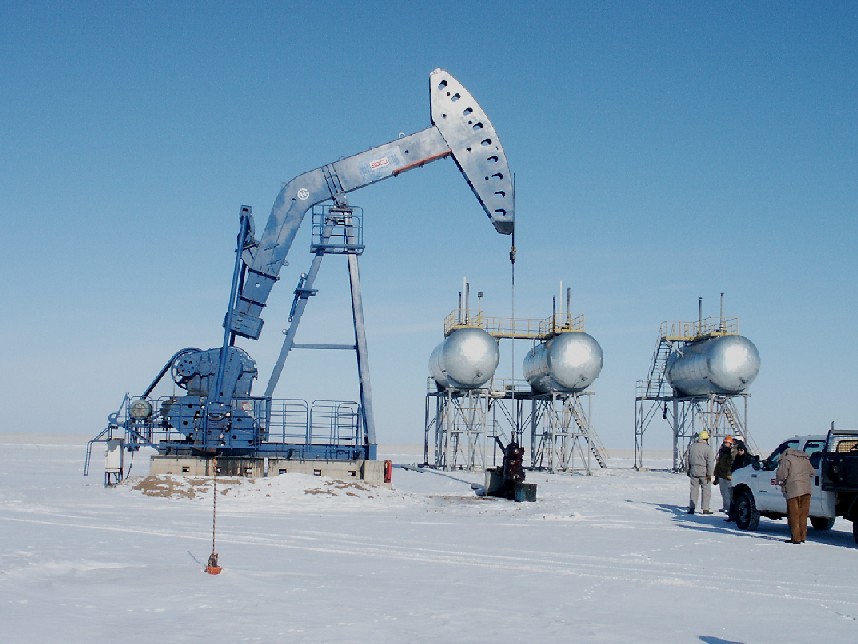

Oil Prices Rise… As predicted in June 2007, oil prices will hit $125/bbl by end 2008 – indeed, it now looks reasonably likely oil could hit $125/bbl within the next month or so. For ways to take advantage of the oil boom through property investment, refer to our extensive range of special reports below:

191: Oil Price Update and Real Estate

191: Oil Price Update and Real Estate

187: Real Estate and the commodities super-cycle

186: Oil price starts to skyrocket as predicted - how to profit

180: Oil prices continue to skyrocket

172: Make serious money - best investment sectors

169: Oil supply crunch begins… protect yourself

168: Alarm bells ringing – oil price shock now on the horizon

163: Making Serious Money as asset prices plateau – resources and property

161: Resources winners and losers - ranked list for property investors

160: Find out the winners and losers in the biggest oil boom in history - about to happen...

159: Massive oil boom - the winners and losers - be prepared

158: Supply and demand scenarios - oil boom and the property investors insights

157: Impact of "Peak Oil" for Property Investment

151: Oil price $125 / bbl and rising…how to take advantage in property

150: Peak Oil shortly due to be reach – unique insights for a property investor

148: Take advantage of the oil/gas/coal boom – key insights

The good news is, this massive oil price increase from $10/bbl in 1999 to $115/bbl today does not seem to have fed through to inflation in any substantive way. This is probably because of two things:

High oil prices act like a tax. People re-adjust and spend less on other things – so property prices rise will be subdued in countries that are oil importers, whilst booming in oil exporting nations. This hypothesis is the subject of most of our special reports above – describing the oil price impact on property prices. So if oil prices rise in a more efficient industrialized and global world, this will not necessarily feed through to inflation. This is a relatively new finding – we all wandered whether a more competitive expanding global world would act to restrain inflation and so far this seems to have been the case. One important finding is that wage inflation in the developed world has been restrained – probably because of non-unionized workforces and the competitive threat of skilled jobs moving to lower cost locations in BRIC countries. This has meant that interest rates have been able to remain low despite high oil prices - inflation has remained subdued. This is likely to continue albeit Chinese and Indian prices have started rising, and food inflation has also been high in the last year. Barring a major oil or food crisis, inflation looks like it will be controlled at reasonable levels in the UK and USA as the economy slows despite record high oil, gas, commodities and food prices. So as long as people’s wage bargaining powers remain subdued, inflation will likely remain low – this should help stabilize property prices.

High oil prices act like a tax. People re-adjust and spend less on other things – so property prices rise will be subdued in countries that are oil importers, whilst booming in oil exporting nations. This hypothesis is the subject of most of our special reports above – describing the oil price impact on property prices. So if oil prices rise in a more efficient industrialized and global world, this will not necessarily feed through to inflation. This is a relatively new finding – we all wandered whether a more competitive expanding global world would act to restrain inflation and so far this seems to have been the case. One important finding is that wage inflation in the developed world has been restrained – probably because of non-unionized workforces and the competitive threat of skilled jobs moving to lower cost locations in BRIC countries. This has meant that interest rates have been able to remain low despite high oil prices - inflation has remained subdued. This is likely to continue albeit Chinese and Indian prices have started rising, and food inflation has also been high in the last year. Barring a major oil or food crisis, inflation looks like it will be controlled at reasonable levels in the UK and USA as the economy slows despite record high oil, gas, commodities and food prices. So as long as people’s wage bargaining powers remain subdued, inflation will likely remain low – this should help stabilize property prices.

So what does this mean for the property investor? It means that overall UK GDP  should remain subdued but not low enough to trigger a UK house price crash. Yes, prices may drop by say 15% over the next two years, but this off the back of a 15% rise in many areas last year means it does not constitute a crash. Rather a re-adjustment to more sustainable levels. Because rental demand remains strong and many buy-to-let investors are asset rich (and have access to cash from equity), despite demanding yields, it’s still quite probable that buy-to-let investors will continue to build their portfolios, albeit at a reduced rate. They will be looking for very good bargains only – and being very picky with what they invest in. A survey by ResidentialLandlord.co.uk maintains 70% of buy-to-let investors are looking to expand their portfolios. This should also support prices from a fully fledged crash. We know this is not what the doom-mongers want to hear, but we believe this is the most likely outcome – subdued house prices in the UK in 2008 and probably also 2009.

should remain subdued but not low enough to trigger a UK house price crash. Yes, prices may drop by say 15% over the next two years, but this off the back of a 15% rise in many areas last year means it does not constitute a crash. Rather a re-adjustment to more sustainable levels. Because rental demand remains strong and many buy-to-let investors are asset rich (and have access to cash from equity), despite demanding yields, it’s still quite probable that buy-to-let investors will continue to build their portfolios, albeit at a reduced rate. They will be looking for very good bargains only – and being very picky with what they invest in. A survey by ResidentialLandlord.co.uk maintains 70% of buy-to-let investors are looking to expand their portfolios. This should also support prices from a fully fledged crash. We know this is not what the doom-mongers want to hear, but we believe this is the most likely outcome – subdued house prices in the UK in 2008 and probably also 2009.

What about the USA? In the USA, the economy cycle is approximately 9 months ahead of the UK. By Fall 2008, we believe Real Estate prices will have reached a bottom as the last of the major sub-prime rate setting takes place mid 2008. Remember interest rates shot up from 1% to 5% in a few years. No wonder property prices have stalled! In the UK it’s a very different situation – interest rates rose from 3.5% to 5.75% in about 2½ years – hence the economic impact on a home owner has been far less than in the USA on a proportional basis. As the economy has now slowed to 1.6% GDP from about 3% a year ago, interest rates are likely to drop a bit further from the  5% they are today. This should help support house prices. Employment is at record high levels, inflation remains relatively subdued at 2.5% CPI and the global economy which the UK relies on is still rising +4% - so the triggers for a fully fledged house price crash are not evident. Although re-possession are expected to rise to double the levels recorded a few years ago, the level of repossessions still remains very low and far lower than during the last crash in 1992 (off the back of interest rates doubling from 7% to 15% in a year, and unemployment rising by about 60%.

5% they are today. This should help support house prices. Employment is at record high levels, inflation remains relatively subdued at 2.5% CPI and the global economy which the UK relies on is still rising +4% - so the triggers for a fully fledged house price crash are not evident. Although re-possession are expected to rise to double the levels recorded a few years ago, the level of repossessions still remains very low and far lower than during the last crash in 1992 (off the back of interest rates doubling from 7% to 15% in a year, and unemployment rising by about 60%.

Credit Crunch. The Bank of England’s recent injection of £50 billion to improve credit lending will likely help avert a severe downturn. The bank strategists can probably see, and model, that come July 2008, the worst should be behind us as far as the “credit crunch” is concerned – and the UK economy will be better balanced. The wildcard remains oil prices. This is why we advise investing in real estate which is exposed to high oil prices and have been doing so for the last 2 1/2 years. The two key areas in the UK are Aberdeen and London – and these two cities remain our favoured investment areas. Huge amounts of oil wealth end up in London – West End – the City – so despite London not producing any oil, it is home to many successful oil and mining companies and shareholders – so if oil prices rise, expect London to benefit more than loose. Aberdeen has become a global centre for oil production/exploration – it will also prosper despite the decline in oil/gas production from the UK North Sea. Other areas, particularly energy intensive areas in the industrial north and midland plus remote agricultural areas remain negatively exposed to high oil prices (e.g. Nottingham, South Wales, Cumbria, Liverpool).

USA boom areas. In the USA – we remain bullish on Real Estate in Texas (Dallas, Irving, Fort Worth, Houston, Galveston, Austin), Montana, Wyoming (Green Rover area) and to a lesser extent Oklahoma and Bakersfield in California. All areas positively exposed to soaring oil, gas, coal and energy prices. Be careful about suburban homes many miles commute to city center jobs – as oil prices rise, people will find living far distances from work more and more unaffordable – this will dent remoter suburban real estate prices. We’ve been harping on about this for a few years now – and nothing has changed. As oil prices rise, energy related areas will prosper – mining, coal, power, oil, gas – look for these industries and you will find previously low priced properties that will rise (note: Houston prices hardly rose from 1988 to year 2000 – the city now has some of the lowest real estate prices in the country but fastest real estate price increases in the last 3 years. And oil prices have risen from $10/bbl to $115/bbl – so expect property prices to rise as more oil jobs are created and global oil company profits out are re-distributed in the Texas area. New energy areas such as SW Wyoming, NW Colorado and NE Utah will prosper. Look over the border in Canada and Edmonton, Calgary, Fort McMurray and western Saskatewan for oil sands developments and the booming energy sectors.

USA boom areas. In the USA – we remain bullish on Real Estate in Texas (Dallas, Irving, Fort Worth, Houston, Galveston, Austin), Montana, Wyoming (Green Rover area) and to a lesser extent Oklahoma and Bakersfield in California. All areas positively exposed to soaring oil, gas, coal and energy prices. Be careful about suburban homes many miles commute to city center jobs – as oil prices rise, people will find living far distances from work more and more unaffordable – this will dent remoter suburban real estate prices. We’ve been harping on about this for a few years now – and nothing has changed. As oil prices rise, energy related areas will prosper – mining, coal, power, oil, gas – look for these industries and you will find previously low priced properties that will rise (note: Houston prices hardly rose from 1988 to year 2000 – the city now has some of the lowest real estate prices in the country but fastest real estate price increases in the last 3 years. And oil prices have risen from $10/bbl to $115/bbl – so expect property prices to rise as more oil jobs are created and global oil company profits out are re-distributed in the Texas area. New energy areas such as SW Wyoming, NW Colorado and NE Utah will prosper. Look over the border in Canada and Edmonton, Calgary, Fort McMurray and western Saskatewan for oil sands developments and the booming energy sectors.

back to top

191: Oil Price Update and Real Estate

191: Oil Price Update and Real Estate High oil prices act like a tax. People re-adjust and spend less on other things – so property prices rise will be subdued in countries that are oil importers, whilst booming in oil exporting nations. This hypothesis is the subject of most of our special reports above – describing the oil price impact on property prices. So if oil prices rise in a more efficient industrialized and global world, this will not necessarily feed through to inflation. This is a relatively new finding – we all wandered whether a more competitive expanding global world would act to restrain inflation and so far this seems to have been the case. One important finding is that wage inflation in the developed world has been restrained – probably because of non-unionized workforces and the competitive threat of skilled jobs moving to lower cost locations in BRIC countries. This has meant that interest rates have been able to remain low despite high oil prices - inflation has remained subdued. This is likely to continue albeit Chinese and Indian prices have started rising, and food inflation has also been high in the last year. Barring a major oil or food crisis, inflation looks like it will be controlled at reasonable levels in the

High oil prices act like a tax. People re-adjust and spend less on other things – so property prices rise will be subdued in countries that are oil importers, whilst booming in oil exporting nations. This hypothesis is the subject of most of our special reports above – describing the oil price impact on property prices. So if oil prices rise in a more efficient industrialized and global world, this will not necessarily feed through to inflation. This is a relatively new finding – we all wandered whether a more competitive expanding global world would act to restrain inflation and so far this seems to have been the case. One important finding is that wage inflation in the developed world has been restrained – probably because of non-unionized workforces and the competitive threat of skilled jobs moving to lower cost locations in BRIC countries. This has meant that interest rates have been able to remain low despite high oil prices - inflation has remained subdued. This is likely to continue albeit Chinese and Indian prices have started rising, and food inflation has also been high in the last year. Barring a major oil or food crisis, inflation looks like it will be controlled at reasonable levels in the  should remain subdued but not low enough to trigger a

should remain subdued but not low enough to trigger a  5% they are today. This should help support house prices. Employment is at record high levels, inflation remains relatively subdued at 2.5% CPI and the global economy which the UK relies on is still rising +4% - so the triggers for a fully fledged house price crash are not evident. Although re-possession are expected to rise to double the levels recorded a few years ago, the level of repossessions still remains very low and far lower than during the last crash in 1992 (off the back of interest rates doubling from 7% to 15% in a year, and unemployment rising by about 60%.

5% they are today. This should help support house prices. Employment is at record high levels, inflation remains relatively subdued at 2.5% CPI and the global economy which the UK relies on is still rising +4% - so the triggers for a fully fledged house price crash are not evident. Although re-possession are expected to rise to double the levels recorded a few years ago, the level of repossessions still remains very low and far lower than during the last crash in 1992 (off the back of interest rates doubling from 7% to 15% in a year, and unemployment rising by about 60%. USA

USA