196: European places to avoid property investing in

06-07-2008

PropertyInvesting.net team

There will be a slow and telling suppression of the economies that:

There will be a slow and telling suppression of the economies that:

· do not produce an oil, gas, coal and minerals

· have an aging and declining population

· have weak manufacturing

· are slow to reform especially if socialist government, large public sector and strong unions

· economies that prospered during low oil price times, and before the Indian and Chinese manufacturing and services global boom hit their economies

· innovation, new technology and education is not strong

In Europe, highest on the list of countries that will suffer are Italy and Greece. Much of the property price booms of these countries has been fuelled by low priced airline travel bringing in NW Europeans to prop up property prices. We see both economies suffering in the next ten years and do not advise any property investment in these developed but potentially declining economies.

Spain is also a candidate for decline, though the country is closer to wealthy NW European neighbours and its economy is rather more dynamic and progressive than Greece and Italy. The population is also more stable. So we do not expect Spain to suffer like Italy and Greece. Portugal will also suffer we rate Portugal half way between Spain and Italy.

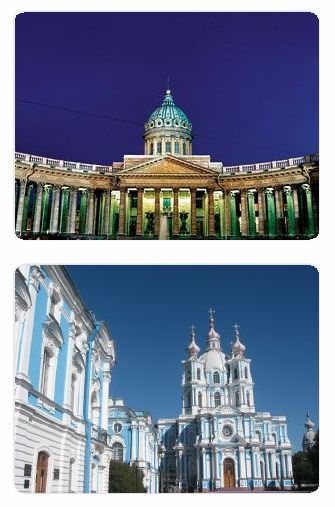

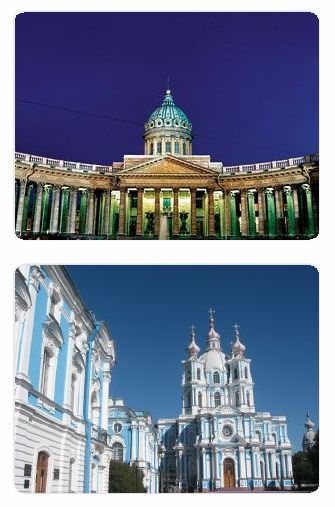

As airline travel becomes far more expensive, and routes are cut, along with new taxes because of climate change, expect any city or country that relies on foreign long distance airline travel to decline avoid these locations like the plague examples: Cape Town in South Africa, Gambia, Seychelles, Mauritius and Maldives and possibly Cape Verde. It may sound boring, but wait ten years and oil prices will have hit home in some unlikely locations. The best place to avoid such a scenario in Europe is to invest in or close to major population centers with prosperous services based businesses. These cities are less energy intensive and may actually benefit from rising oil prices examples are: London, Amsterdam, Paris, Moscow, St Petersburg, Rotterdam, Munich, Oslo and Copenhagen in Europe. But avoid areas, cities and town way off the beaten track that need much energy and cost a lot to get to unless these are the most desirable richest enclaves frequented by the most wealthy (e.g. Virgin Islands). Examples are Calabria and Sicily in Italy, and remote parts of Greece.

Other European countries we are neutral on are France, Belgium, Sweden, Finland, Estonia, Latvia and Lithuania. Prices in the countries should slowly drift upwards all of these western European countries use technology and innovation to mitigate risks of high energy prices (e.g. renewables, nuclear, wind, efficiency savings). Meanwhile the Estonia should benefit from the proximity to booming Russia and stable Finland.

Other European countries we are neutral on are France, Belgium, Sweden, Finland, Estonia, Latvia and Lithuania. Prices in the countries should slowly drift upwards all of these western European countries use technology and innovation to mitigate risks of high energy prices (e.g. renewables, nuclear, wind, efficiency savings). Meanwhile the Estonia should benefit from the proximity to booming Russia and stable Finland.

In eastern Europe, prices will still be playing catch up so we expect prices to continue climbing in Romania, Bulgaria, Montenegro, Croatia, Albania, Czech Rep., Poland, Slovenia, Slovakia and parts of Serbia. The point is, in older EU countries that boomed in the 1990s, we expect suppressed GDP and house price growth and a decline in tourism as airline travel becomes far more expensive.

We re-iterate the safest places to invest in are Aberdeen, London in UK and Stavanger, Bergen and Oslo in Norway higher risk but large upsides are St Petersburg and Moscow in Russia. The common tread theyre all oil boom towns!

.jpg)

back to top

There will be a slow and telling suppression of the economies that:

There will be a slow and telling suppression of the economies that: Other European countries we are neutral on are

Other European countries we are neutral on are .jpg)