259: UK property investor's update

04-11-2009

PropertyInvesting.net team

There are early signed of the UK property market “starting” to bottom out. The leading indicator from Rightmove.co.uk showed prices in February in England and Wales rose slightly on average. London performed the best. Then Nationwide report prices rising 0.9% in March whilst Halifax reported the opposite with a decline of 1.9%. Halifax has a stronger weighting to northern lower priced properties whilst Nationwide has more  southern expensive properties within their index – the Nationwide more closely matches the Rightmove analysis that suggests that the south and London are starting to experience a mild up-turn. However, we believe the ride will be rather bumpy and seasonal variations will affect prices. The normal Spring upturn is playing a part, with the underlying issue of rising unemployment, particularly in areas exposed to the manufacturing slump (-7% decline in output in the last 5 months) having a strong regional overprint. Despite the financial crisis and credit crunch, London GDP and investment activity has held up well and we expect this to continue. The stock market will likely stay turbulent – with some false dawns and some erratic mini-crashes – but all the time, stocks are being traded and commissions are being “earned”. Long term, the sheer size of money circulating through London should see City prospects improve in the coming few years.

southern expensive properties within their index – the Nationwide more closely matches the Rightmove analysis that suggests that the south and London are starting to experience a mild up-turn. However, we believe the ride will be rather bumpy and seasonal variations will affect prices. The normal Spring upturn is playing a part, with the underlying issue of rising unemployment, particularly in areas exposed to the manufacturing slump (-7% decline in output in the last 5 months) having a strong regional overprint. Despite the financial crisis and credit crunch, London GDP and investment activity has held up well and we expect this to continue. The stock market will likely stay turbulent – with some false dawns and some erratic mini-crashes – but all the time, stocks are being traded and commissions are being “earned”. Long term, the sheer size of money circulating through London should see City prospects improve in the coming few years.

There are some signs that the worst is over in the USA. As advised before, the USA is about 8 months ahead of the UK in recessionary economic impact – we believe the US economy will start to grow on a quarterly basis by ca. May 2009 and the UK economy will turn the corner and start to grow again by ca. October 2009. Unemployment will continue to rise until about March 2010 whence a fully fledged recovery will take hold. Historically, the summer is often a quiet low productivity period in Europe, and the action starts in the Autumn. We expect some more gloom late June, with the upturn becoming clear in October.

It’s getting pretty close to about the best time to buy in years now. UK property prices have dropped about 20%. Another 5-8% can be expected in the next six months. But after this, we think the chance of further significant declines are low. In 2010, there should be a tentative recovery and in 2011 we expect property prices to rise fairly robustly in London and southern England in the run up to the mid 2012 London Olympics.

Avoid Manufacturing

As previously advised for the last 5 years, if you want to reduce your risks to a minimum it is probably best to avoid all areas with high exposure to manufacturing jobs, and secondarily public sector jobs. Manufacturing in the UK is in terminal decline – don’t expect any changes here. About 50 years ago, it made up ca. 45% of the UK GDP. It is now down to 11% and shrinking fast. To those people that may doubt whether a country could survive without any manufacturing production, there are many examples of wealthy countries with minimal manufacturing – Luxembourg, Denmark, Monaco are examples. The decline of UK North Sea oil/gas production will exacerbate the problem. If 11% of GDP was replaced by financial services in the next ten years – we’d have a country even more dependent on London as the engine of the economy – and this is what we expect to happen. Manufacturing by 2020 will likely only account for 5% of the UK GDP. The bulk of economic output will be from banking, financial and business services and retail. Global international investment services will become even more important – this is why it is so important that the government does not drive these high net worth individual away from London with high taxes.

As previously advised for the last 5 years, if you want to reduce your risks to a minimum it is probably best to avoid all areas with high exposure to manufacturing jobs, and secondarily public sector jobs. Manufacturing in the UK is in terminal decline – don’t expect any changes here. About 50 years ago, it made up ca. 45% of the UK GDP. It is now down to 11% and shrinking fast. To those people that may doubt whether a country could survive without any manufacturing production, there are many examples of wealthy countries with minimal manufacturing – Luxembourg, Denmark, Monaco are examples. The decline of UK North Sea oil/gas production will exacerbate the problem. If 11% of GDP was replaced by financial services in the next ten years – we’d have a country even more dependent on London as the engine of the economy – and this is what we expect to happen. Manufacturing by 2020 will likely only account for 5% of the UK GDP. The bulk of economic output will be from banking, financial and business services and retail. Global international investment services will become even more important – this is why it is so important that the government does not drive these high net worth individual away from London with high taxes.

Southern England and London

This is why we prefer to invest in southern England and London. This is also where the p opulation is growing fastest, more jobs are being created, more international investment is taking place, and there is most pressure on land and the environment which tends to stifle house building. All these factors lead to increases in property prices. Add to this some massive new infra-structure developments:

opulation is growing fastest, more jobs are being created, more international investment is taking place, and there is most pressure on land and the environment which tends to stifle house building. All these factors lead to increases in property prices. Add to this some massive new infra-structure developments:

· Olympics 2012

· Crossrail 2017

· East London Rail Line 2011

· Heathrow Runway and T6

· High Speed One rail links

· East London regeneration

· Dockland Light Railway Extension to Woolwich 2009

· East London rail Line Phase 2 to Surrey Quays to Wimbledon via Clapham Junction 2015

· Cricklewood West Hendon regeneration (delayed)

· Croydon regeneration

· Brentford regeneration

· Chiswick Business Park

· Wembley

· Potential expansion of Luton, Gatwick, Stanstead, City and other airports

..and you have some excellent ingredients for robust tenant demand, robust property price growth from late 2009 onwards, and superior GDP growth compared with the Midlands, Wales and Northern England.

The shear magnitude of international money that makes London it’s home is not likely to change. There are a number of reasons for this:

· Wealthy international people love London – its culture, openness, cosmopolitan environment

· Financial services and instruments in London are world class

· Great place to live, have second him and enjoy summers during school holidays

· Shopping and theatre are fantastic

We do not expect any negative change to this from any election result in mid 2010.

So don’t expect the property prices in Chelsea, Kensington and Mayfair to come crashing down. Yes, they may take a bit of a knock during this UK and global recession, but they’ll rapidly recover once the banking crises subside. And many of the wealthiest people were probably the first people to pull their money off the table  when the financial meltdown started. Where did the $2 Trillion disappear to? Some of it probably evaporated with the bubble – but a lot of it is probably sitting as cash in bank accounts – a lot will now be quietly shifting into prime London property. Considered a safe haven. You can always refer to this report in future years to see if we are accurate– we are confident we are correct in this assertion.

when the financial meltdown started. Where did the $2 Trillion disappear to? Some of it probably evaporated with the bubble – but a lot of it is probably sitting as cash in bank accounts – a lot will now be quietly shifting into prime London property. Considered a safe haven. You can always refer to this report in future years to see if we are accurate– we are confident we are correct in this assertion.

Massive Stimuli

If there are any people out there that think the country will stay in a prolonged period of deep recession we would challenge this assumption. The reasons are outlined below:

· Massive US stimulation packages >$1.3 Trillion

· Big UK stimulation package

· Massive China stimulation package

· UK infra-structure spending

· Interest rates close to zero

· Massively reduced mortgage and loan payments

· Inflation (RPI) dropping to zero

· UK government printing money – buying assets

· Currency devaluation

· Balance of payment deficit reducing as imports decrease and pound drops in value

· Oil prices crashing from$147/bbl to $50/bbl

If these stimuli do not lead to growth and inflation, we would be very surprised. Expect these combined stimuli to kick in my October 2009. Then it will be a question of reigning in the growth by the end of 2010 to prevent inflation getting out of control.

Inflation and Peak Oil

As excess capacity drops dramatically mid 2010, inflation will take hold and interest rates will rise sharply. House price will be rising strongly by then. We could then get another mini-boom followed by another mini-bust, possibly late 2012. One key factor will be the oil price. If global demand picks up, and OPEC is not able to feed  the demand, oil prices will sky-rocket again (as we predicted June 2007). We believe this is highly likely because Peak Oil has been reached – in July 2008 to be exact – and we will never again surpass the production of mid 2008. Most oilfields are in a relentless and terminal decline. New oil fields are few and small. Gas production and coal production are both increasing, but not fast enough to make up for declines in oil production. So we expect (another) energy crisis to break out – probably 2012. And this could lead to the next recession, just as the first in early 2008 led to this recession. It will also put pressure on inflation, interest rates and hence house prices. It could lead to a further dip in house prices once oil prices rise above $100/bbl – late 2012 if we were to hazard a guess on timing. So be careful as the next boom takes hold, because it could be short-lived if oil prices skyrocket. You need to watch oil prices, inflation and house prices as the key indicators. If oil prices stay low, house prices should rise. If oil prices sky-rocket, all bets are off on house prices rising!

the demand, oil prices will sky-rocket again (as we predicted June 2007). We believe this is highly likely because Peak Oil has been reached – in July 2008 to be exact – and we will never again surpass the production of mid 2008. Most oilfields are in a relentless and terminal decline. New oil fields are few and small. Gas production and coal production are both increasing, but not fast enough to make up for declines in oil production. So we expect (another) energy crisis to break out – probably 2012. And this could lead to the next recession, just as the first in early 2008 led to this recession. It will also put pressure on inflation, interest rates and hence house prices. It could lead to a further dip in house prices once oil prices rise above $100/bbl – late 2012 if we were to hazard a guess on timing. So be careful as the next boom takes hold, because it could be short-lived if oil prices skyrocket. You need to watch oil prices, inflation and house prices as the key indicators. If oil prices stay low, house prices should rise. If oil prices sky-rocket, all bets are off on house prices rising!

As previously warned, any oil prices above $70/bbl moves the property investor into danger territory. We are already at $50/bbl (rising from $35/bbl). But the real economic damage to oil importing nations comes once the price reaches >$100/bbl. Countries that will be particularly hard hit will be:

· Italy

· Spain

· Greece

· Eastern European countries

· Pakistan

· Germany

· All non producing countries with little coal, gas, nuclear, hydro or minerals-metals

The UK produces about 80% of it’s oil and gas need, though oil production is declining at a rate of 7% per annum – so is not too badly off just yet. All those headline of big new discoveries in Brazil – it won’t make any difference. These discoveries are deepwater, high risk, high cost, high temperature, high pressure, sub-salt and will take at least 5 years to bring on stream. A total of 8 billion barrels was probably found last year – but this will only fuel the world for 4 months! And Brazil needs all the oil it will produce – it will NEVER export oil according to our projections!

For more details on Peak Oil and it’s importance on global property investments, please click on these links below:

191: Oil Price Update and Real Estate

187: Real Estate and the commodities super-cycle

186: Oil price starts to skyrocket as predicted - how to profit

180: Oil prices continue to skyrocket

172: Make serious money - best investment sectors

169: Oil supply crunch begins… protect yourself

168: Alarm bells ringing – oil price shock now on the horizon

163: Making Serious Money as asset prices plateau – resources and property

161: Resources winners and losers - ranked list for property investors

160: Find out the winners and losers in the biggest oil boom in history - about to happen...

159: Massive oil boom - the winners and losers - be prepared

158: Supply and demand scenarios - oil boom and the property investors insights

157: Impact of "Peak Oil" for Property Investment

151: Oil price $125 / bbl and rising…how to take advantage in property

150: Peak Oil shortly due to be reach – unique insights for a property investor

148: Take advantage of the oil/gas/coal boom – key insights

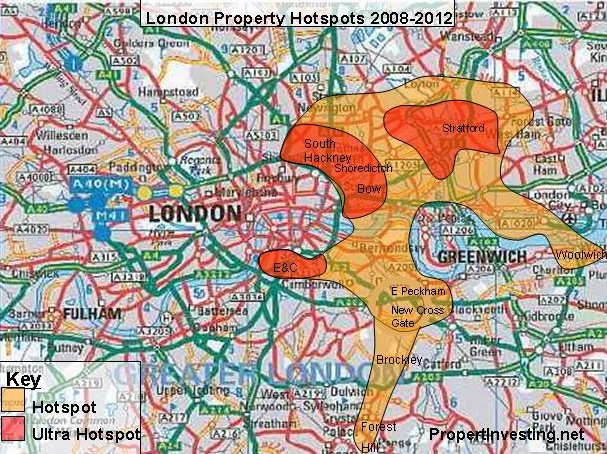

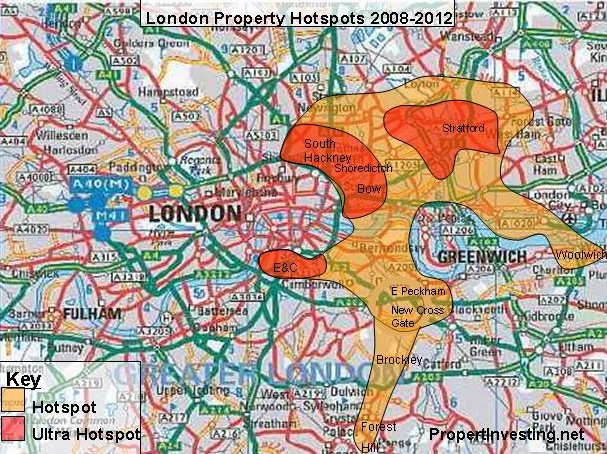

London Regeneration Update

The good news about the recession is that more public sector money seems to be being freed up for regeneration and infra-structure spending projects. Also, planning authorities appear to be giving planning permission for major projects at an increased pace – we can only presume the desperation to create jobs, stimulate the economy and provide a foundation for future growth is over-riding some of the more pedantic objections from various stakeholders. Major upgrades that have been agreed in principle in the last few months are:

· Elephant & Castle – Haygate Estate

· Battersea Power Station – signs the project is moving forwards

· East Line Rail Extension Phase 2 (Surrey Quays to Peckham, Clapham, Wimbledon)

· Peckham – regeneration of 1960s estates

· East Croydon – multiple regeneration projects – all very exciting

· Kidbrooke Ferrier Estate - Greenwich – confirmed as proceeding in March

· Stratford, Lower Leas Valley, Bow, Hackney Wick – Olympics, general regeneration on a massive scale

· Canning Town – small town centre project

· Sutton – small town centre project

These projects will give important boosts to these local economies – providing jobs and wealth creation.

These projects will give important boosts to these local economies – providing jobs and wealth creation.

Our advice is to purchase Victorian properties close to rail/tube stations and these new regeneration schemes. Alternatively low-rise 1950-1980s properties in need of minor renovation and/or redecoration. Many of the regeneration schemes involve major demolition, so during the five year period of re-development it is probably best to stay away from the dust and construction work and target neighbouring quieter areas that will eventually benefit from the new leisure, retail, jobs and improved transport links being built close by. In the meanwhile, if you let these properties, you will be able to find tenants, and if you need to sell, it won’t be part of the building site! As new high paid jobs move into the office complexes being built, many of these professional will want to live close by in the more select areas with Victorian property.

Notice that most of the regeneration projects are in south London and east London – hardly surprising as these are generally the areas which were bombed in World War II, then re-built with 1960s high rise, then suffered deprivation in the recessions of 1971, 1981 and 1991. Elephant & Castle is an interesting example of an area that will be transformed by major development up until 2014, whilst it has excellent communications to the City, West End and is only ¾ of a mile from Chelsea, Bank, and Westminster. If E&C properties prices do not rise faster than the London and UK average, we would be very surprised. Anywhere within ½ mile of the E&C tube station has to be worth considering.

then suffered deprivation in the recessions of 1971, 1981 and 1991. Elephant & Castle is an interesting example of an area that will be transformed by major development up until 2014, whilst it has excellent communications to the City, West End and is only ¾ of a mile from Chelsea, Bank, and Westminster. If E&C properties prices do not rise faster than the London and UK average, we would be very surprised. Anywhere within ½ mile of the E&C tube station has to be worth considering.

Peckham Queens Road and Peckham Rye are other good examples. This deprived but up and coming areas has some nice Victorian properties, and in 2012 will benefit from proximity to the New Cross Gate - East London Line station, then in 2017 from the new extension from Wimbledon through Peckham to Surrey Keys thence onto the City and Highbury. It will go from an isolated location, to close to a hub. Developers started moving into Queens Road three years ago in anticipation – this regeneration is likely to accelerate as Peckham becomes a place people want to move to. Again, if prices do not outperform the UK or London average, we would be very surprised.

Surprisingly the massive Cricklewood-Brent regeneration project was turned down last week by the local council – which means this major regeneration project is now either scrapped or on-hold. It was touted as being a potential 4th city hub for London.

Because of the uncertainty in this project, we would advise steering clear for the time being – it still may eventually go ahead? But this part of London will not see any benefits for some time at least.

for the time being – it still may eventually go ahead? But this part of London will not see any benefits for some time at least.

Property Price Predictions

Below are our property price predictions – taking a notional flat of 200,000 pound value in London and a 140,000 pound house in the Midlands & North of England. We believe there will be a bumpy recovery, with unemployment, seasonal variations and exposure to manufacturing decline all playing key parts of any recovery. The recovery will likely also be weak. According to our projections, the bottom of the market will be September 2009. Bargains will still be available throughout 2009 and early 2010 as unemployment continues to rise. We think the stock markets may show a bumpy recovery starting late March this year. The US economy will really start to kick off in 2010 as the $1.3 Trillion investments start coming through and the UK economy start to recovery in earnest by the second half of 2010. At this point, interest rates will start to rise – and this rise could be sharp if an oil price rise sparks inflation. It’s obviously very uncertain, though we have put all our thoughts, consideration of the various economic criteria and modelling into these projections - this is what we have come up with:

London Property Price Prediction 2009-2010

Midlands and North England Property Price Prediction 2009-2010

Peak Everything and Energy Issues

One longer term consideration is Peak Oil – what will happen when oil production declines, energy becomes more expensive and scarce. We believe Peak Oil, or the maximum ever world oil pr oduction, “was” July 2008 and we are now in terminal oil decline. This will send oil prices far higher probably starting 2010 when the economy starts coming out of the recession. Central urban areas with good rail and tube communication (powered by electricity) will be the most cost and energy efficient places to live – it will be easier to get to work, with less disruption. If you live in Elephant & Castle, and work in the City, even if all modes of transport are disrupted you can still walk to work in 20 minutes, and cycle into work in 7 minutes. Not a bad place to live, with the glorious arts and leisure activities along the South Bank and West End close by – also within walking distance. Borough is another good example of a central urban area that is also energy efficient in the Peak Oil era. As are Financial Services businesses per unit of energy used. Conversely, if you live “in the sticks” and rely on long distance car or train travel, particularly if petrol-diesel powered, then expect more disruption - property prices could be affected if people consistently find it difficult to get to work in their high paid jobs in the cities. This needs to be considered in a property investment strategy – if you don’t believe in Peak Oil (or travel and energy disruptions in future) then please ignore this paragraph and the associated risk that we flag. We’ve given this a huge amount of thought and research – and we believe the ramifications of decline oil production, with a peaking of gas in ca. 2015 and coal in ca. 2025 will markedly change the way we live as we move into the next decade – and energy conservation and efficiency becomes far more important in the UK, USA and all countries in the world.

oduction, “was” July 2008 and we are now in terminal oil decline. This will send oil prices far higher probably starting 2010 when the economy starts coming out of the recession. Central urban areas with good rail and tube communication (powered by electricity) will be the most cost and energy efficient places to live – it will be easier to get to work, with less disruption. If you live in Elephant & Castle, and work in the City, even if all modes of transport are disrupted you can still walk to work in 20 minutes, and cycle into work in 7 minutes. Not a bad place to live, with the glorious arts and leisure activities along the South Bank and West End close by – also within walking distance. Borough is another good example of a central urban area that is also energy efficient in the Peak Oil era. As are Financial Services businesses per unit of energy used. Conversely, if you live “in the sticks” and rely on long distance car or train travel, particularly if petrol-diesel powered, then expect more disruption - property prices could be affected if people consistently find it difficult to get to work in their high paid jobs in the cities. This needs to be considered in a property investment strategy – if you don’t believe in Peak Oil (or travel and energy disruptions in future) then please ignore this paragraph and the associated risk that we flag. We’ve given this a huge amount of thought and research – and we believe the ramifications of decline oil production, with a peaking of gas in ca. 2015 and coal in ca. 2025 will markedly change the way we live as we move into the next decade – and energy conservation and efficiency becomes far more important in the UK, USA and all countries in the world.

We hope you have found this special report insightsful. For any questions, please contact us on enquiries@propertyinvesting.net

And now for something completely different - for all property lovers, here are some beautiful houses

Cher's home in Palm Springs USA

JK Rolling's house

Freddie Mercury's house in London

Cher's house

Pabo Picasso's house in Provence, France

Kate Moss's house

Lairmont Manor

Manor West Challow Wantage

Crabwall Manor near Chester

Mansion House Dublin Ireland

Neckar Island

Necker house

Mansion in LA USA

Penhouse in New York City

Villa Kembali, Bali Island

| The 10 richest models in the world |

|

The age of the supermodel is definitely not over. The world’s top models have proved their earning power this year despite fashion designers downgrading their runway shows because of the recession. For the second year in a row, Gisele Bündchen, the Brazilian model tops Forbes magazine'd richest models list, based on estimated earnings from June 2008 – June 2009.

1. Gisele Bündchen, pictured above, £15 million

Despite earning US$10 million less this year, due to the loss of Victoria’s Secret and other contracts, this Brazilian beauty has topped the list for the second year in a row. With her own shoe line and success from campaigns such as Versace, Dior, and True Religion jeans, the 28 year old earned about £15 million last year. She also found time to hold two wedding receptions with her husband, American football player Tom Brady.

2. Heidi Klum, £9.7 million

At 35, this mum of three (soon to be four, with husband Seal) and Victoria’s Secret Angel has made her fortune through TV and endorsements. When she wasn’t busy hosting her hit TV series Project Runway and Germany’s Next Top Model, she designed a range of sandals for Birkenstock. Klum endorses brands that range from Diet Coke and Volkswagen, to McDonalds and LG.

3. Kate Moss, £5 million

This year Moss shot down rumours of a pregnancy by saying she's "just fat" and was also attacked for being old (yes, she is 35), but the supermodel isn't going anywhere. She achieved great successes in the past year as the face of Longchamp, Versace, and David Yurman, and her range for Topshop, which also debuted in New York, has made her the third highest earning model.

4. Adriana Lima, £4.8 million

Another angel, famous for her sultry poses, Lima's career has taken off with the support of the lingerie brand. Although her contract with Maybelline ends later this year, the one-time Ford “Supermodel of the year” is busy away from the catwalk too. She appeared on Ugly Betty last September, and is now expecting her first child with her husband, basketball player Marko Jaric.

5. Doutzen Kroes, £3.6 million

This Dutch model, the latest to join the entourage of Angels, recently signed up with Seven For All Mankind jeans after her contract with DeBeers expired. At just 24, Kroes is also the face of cosmetic company L’Oreal, and the fragrance Calvin Klein Eternity.

6. Alessandra Ambrosio, £3.6 million

Last autumn, the 28 year old returned to the Victoria’s Secret runway just three months after giving birth. Having starting modelling for their PINK line, she is now one of the brand’s biggest names. Ambrosio is also a model for the European retail outlet C&A and the Mexican department store Liverpool.

7. Natalia Vodianova, £3.3 million

This Russian-born beauty has not forgotten her roots, using some of her fortune to run Naked Heart Foundation, which helps provide playgrounds for children in Russia. Vodianova, 27, is most recognisable for her work with Calvin Klein fragrance Guerlain, but over the next three years, she will be designing and modelling various collections for French lingerie company Etam.

8. Daria Werbowy, £2.7 million

After winning a modelling competition, this Polish-born Canadian has shot to fame as the face of Lancome and Louis Vuitton. Werbowy’s other campaigns include H&M, Balmain, Roberto Cavalli, and Vogue Eyewear. At just 25, she was inducted into Canada’s Walk of Fame, alongside film director James Cameron.

9. Miranda Kerr, £1.8 million

Equally famous for being Orlando Bloom’s leading lady as for her sultry Victoria’s Secret campaigns, this fresh-faced Aussie made her mark signing on to be the new face of Maybelline and XOXO. Following the devastating Australian bush fires earlier this year, Kerr lent a hand to the Australia Unites fundraiser.

10. Carolyn Murphy, £1.8 million

The long-time face of Estee Lauder has proved her staying power in the industry, at 35. She is also the only American on the list. Having posed for Playboy and Sports Illustrated swimsuit in the past, her most recent campaigns include Banana Republic and Lord & Taylor.

By Vanessa Kortekaas

http://timesbusiness.typepad.com/ |

back to top

southern expensive properties within their index – the Nationwide more closely matches the Rightmove analysis that suggests that the south and London are starting to experience a mild up-turn. However, we believe the ride will be rather bumpy and seasonal variations will affect prices. The normal Spring upturn is playing a part, with the underlying issue of rising unemployment, particularly in areas exposed to the manufacturing slump (-7% decline in output in the last 5 months) having a strong regional overprint.

southern expensive properties within their index – the Nationwide more closely matches the Rightmove analysis that suggests that the south and London are starting to experience a mild up-turn. However, we believe the ride will be rather bumpy and seasonal variations will affect prices. The normal Spring upturn is playing a part, with the underlying issue of rising unemployment, particularly in areas exposed to the manufacturing slump (-7% decline in output in the last 5 months) having a strong regional overprint.  As previously advised for the last 5 years, if you want to reduce your risks to a minimum it is probably best to avoid all areas with high exposure to manufacturing jobs, and secondarily public sector jobs. Manufacturing in the UK is in terminal decline – don’t expect any changes here. About 50 years ago, it made up ca. 45% of the UK GDP. It is now down to 11% and shrinking fast. To those people that may doubt whether a country could survive without any manufacturing production, there are many examples of wealthy countries with minimal manufacturing – Luxembourg, Denmark, Monaco are examples. The decline of UK North Sea oil/gas production will exacerbate the problem. If 11% of GDP was replaced by financial services in the next ten years – we’d have a country even more dependent on London as the engine of the economy – and this is what we expect to happen. Manufacturing by 2020 will likely only account for 5% of the UK GDP. The bulk of economic output will be from banking, financial and business services and retail. Global international investment services will become even more important – this is why it is so important that the government does not drive these high net worth individual away from London with high taxes.

As previously advised for the last 5 years, if you want to reduce your risks to a minimum it is probably best to avoid all areas with high exposure to manufacturing jobs, and secondarily public sector jobs. Manufacturing in the UK is in terminal decline – don’t expect any changes here. About 50 years ago, it made up ca. 45% of the UK GDP. It is now down to 11% and shrinking fast. To those people that may doubt whether a country could survive without any manufacturing production, there are many examples of wealthy countries with minimal manufacturing – Luxembourg, Denmark, Monaco are examples. The decline of UK North Sea oil/gas production will exacerbate the problem. If 11% of GDP was replaced by financial services in the next ten years – we’d have a country even more dependent on London as the engine of the economy – and this is what we expect to happen. Manufacturing by 2020 will likely only account for 5% of the UK GDP. The bulk of economic output will be from banking, financial and business services and retail. Global international investment services will become even more important – this is why it is so important that the government does not drive these high net worth individual away from London with high taxes. opulation is growing fastest, more jobs are being created, more international investment is taking place, and there is most pressure on land and the environment which tends to stifle house building. All these factors lead to increases in property prices. Add to this some massive new infra-structure developments:

opulation is growing fastest, more jobs are being created, more international investment is taking place, and there is most pressure on land and the environment which tends to stifle house building. All these factors lead to increases in property prices. Add to this some massive new infra-structure developments:

when the

when the  the demand, oil prices will sky-rocket again (as we predicted June 2007). We believe this is highly likely because Peak Oil has been reached – in July 2008 to be exact – and we will never again surpass the production of mid 2008. Most oilfields are in a relentless and terminal decline. New oil fields are few and small. Gas production and coal production are both increasing, but not fast enough to make up for declines in oil production. So we expect (another) energy crisis to break out – probably 2012. And this could lead to the next recession, just as the first in early 2008 led to this recession. It will also put pressure on inflation, interest rates and hence house prices. It could lead to a further dip in house prices once oil prices rise above $100/bbl – late 2012 if we were to hazard a guess on timing. So be careful as the next boom takes hold, because it could be short-lived if oil prices skyrocket. You need to watch oil prices, inflation and house prices as the key indicators. If oil prices stay low, house prices should rise. If oil prices sky-rocket, all bets are off on house prices rising!

the demand, oil prices will sky-rocket again (as we predicted June 2007). We believe this is highly likely because Peak Oil has been reached – in July 2008 to be exact – and we will never again surpass the production of mid 2008. Most oilfields are in a relentless and terminal decline. New oil fields are few and small. Gas production and coal production are both increasing, but not fast enough to make up for declines in oil production. So we expect (another) energy crisis to break out – probably 2012. And this could lead to the next recession, just as the first in early 2008 led to this recession. It will also put pressure on inflation, interest rates and hence house prices. It could lead to a further dip in house prices once oil prices rise above $100/bbl – late 2012 if we were to hazard a guess on timing. So be careful as the next boom takes hold, because it could be short-lived if oil prices skyrocket. You need to watch oil prices, inflation and house prices as the key indicators. If oil prices stay low, house prices should rise. If oil prices sky-rocket, all bets are off on house prices rising!  These projects will give important boosts to these local economies – providing jobs and wealth creation.

These projects will give important boosts to these local economies – providing jobs and wealth creation. then suffered deprivation in the recessions of 1971, 1981 and 1991. Elephant & Castle is an interesting example of an area that will be transformed by major development up until 2014, whilst it has excellent

then suffered deprivation in the recessions of 1971, 1981 and 1991. Elephant & Castle is an interesting example of an area that will be transformed by major development up until 2014, whilst it has excellent  for the time being – it still may eventually go ahead? But this part of London will not see any benefits for some time at least.

for the time being – it still may eventually go ahead? But this part of London will not see any benefits for some time at least.

oduction, “was” July 2008 and we are now in terminal oil decline. This will send oil prices far higher probably starting 2010 when the economy starts coming out of the recession.

oduction, “was” July 2008 and we are now in terminal oil decline. This will send oil prices far higher probably starting 2010 when the economy starts coming out of the recession.