264: Another oil price spike is just about to hit us...watch out

05-07-2009

PropertyInvesting.net team

PropertyInvesting.net team

Message to the 4 million visitors to our website each year:

Oil Price Spike: Watch out for another massive oil price spike. It started today from $56/bbl and we expect $100/bbl by year end. The safest investment at the moment is oil, gas and coal company stocks or holdings or physical oil.

Property Price and Oil Price Link: We believe if oil prices stayed permanently at less then $50/bbl this would give a big economic stimulus to western oil importing nations. However, as oil prices rise, the  deficits of oil exporting nations increases as does inflation and hence interest rates. This creates $overall economic hardship as oil prices rise – unemployment will rise, property price will stay flat or decline, taxes will rise and people’s disposable incomes will drop. We are stressing the link between oil prices and property prices again. Converse to this is that – overall – if oil prices rise, it is often because of strong demand implying strong GDP economic growth. But there are two dangers here:

deficits of oil exporting nations increases as does inflation and hence interest rates. This creates $overall economic hardship as oil prices rise – unemployment will rise, property price will stay flat or decline, taxes will rise and people’s disposable incomes will drop. We are stressing the link between oil prices and property prices again. Converse to this is that – overall – if oil prices rise, it is often because of strong demand implying strong GDP economic growth. But there are two dangers here:

1. Highly energy intensive countries with large oil import bills and relatively inefficient manufacturing industry may find it difficult keeping up with the high oil import bills (e.g. Spain, Italy, Greece and to a lesser extent probably the USA)

2. Oil shortages - It is still possible oil prices can skyrocket whilst the global economy goes into recession if/when post “Peak Oil$” oil shortages occur. Hence despite demand destruction, the overall demand is still higher than a rapidly declining global oil supply – this is crisis territory where all bets are off on property prices – it very much implies a prolonged downward property price movement for all nations that important large amounts of oil (gas and coal).

Currently the UK produces about 70% of its oil and gas needs – no bad for a western nation – it’s days of Sterling being a Petrocurrency are over though. The USA imports about half it’s oil needs and produces all its own gas and coal – so despite many stories, if it was able to reduce the average car gas consumption from 22 mpg to 44 mpg, it would barely be importing any oil. It has huge coal and gas reserves. So overall, in a post Peak Oil era – with change – it is capable of withstanding a large blow because it has alternatives, even with a massive planned expansion in wind energy and to a less extent solar. But it needs to change – and change fast to escape the worst effects of Peak Oil – and the subsequent oil supply decline.

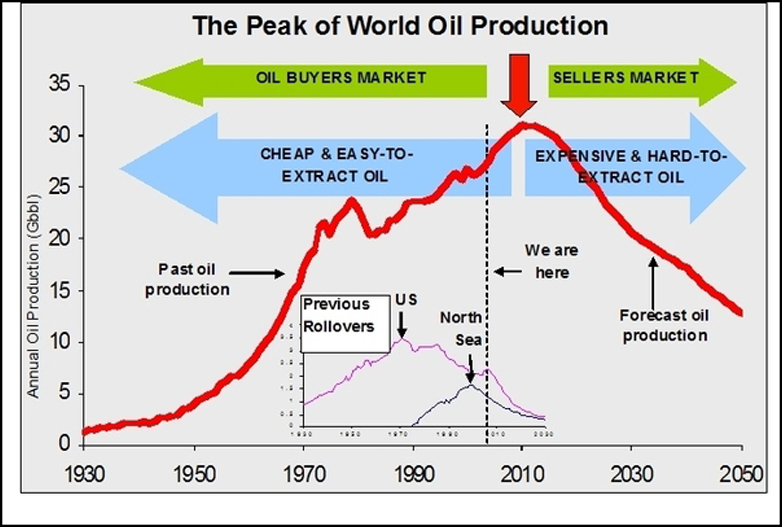

Peak Oil Behind Us: As previously advised, we believe Peak Oil “was” July 2008. The world is on an irreversible decline in oil production. The tightening of stocks will start in the next few weeks as demand picks up because of low prices and the $2 Trillion of US stimuli, plus another $1 Trillion from other countries. All those optimistic people that think tightening of oil supplies will happen in 5-10 years time we believe are wrong. We have detailed global oil production models for all countries to support our view based on many years of research. We are talking months - no year to skyrocketing oil prices.

Peak Oil Behind Us: As previously advised, we believe Peak Oil “was” July 2008. The world is on an irreversible decline in oil production. The tightening of stocks will start in the next few weeks as demand picks up because of low prices and the $2 Trillion of US stimuli, plus another $1 Trillion from other countries. All those optimistic people that think tightening of oil supplies will happen in 5-10 years time we believe are wrong. We have detailed global oil production models for all countries to support our view based on many years of research. We are talking months - no year to skyrocketing oil prices.

Inflation: The gigantic financial stimuli from Western government will fan the flames of inflation. When inflation takes hold, the only safe place to be will be in oil, gas coal or gold. Please heed our advice on this. At least we would like to forewarn you.

We are neutral on property at the moment. Yes, prices have dropped quite significantly in the UK and USA, but they probably have another 5 to 10% further to drop before they reach bottom. As previously advised, we think the bottom of the housing market will be in September for the UK, and in the next few months for the USA.

Investing in Oil, Gas, Coal: But the big money making opportunity lies in oil, gas, coal and gold. In summary, the world is running short of low cost energy.

Investing in Oil, Gas, Coal: But the big money making opportunity lies in oil, gas, coal and gold. In summary, the world is running short of low cost energy.

· Oil and gas infra-structure is aging

· The oil and gas engineering and petroleum workforce are aging – over 50% will retire in the next ten years – skills are short and in ten years the shortage will compound the crisis - only minimal efforts are being made to recruit young engineers - in any case, most graduates would rather work in banking, finance or media/services.

· New conventional oil fields being discovered are small and will not make any significant impact on arresting the oil decline

· Non conventional oil such as oil sands is very expensive and energy intensive to extract – the environmental lobby and emissions issues will slow down development this will not stop the world from declining oil production.

· Natural gas liquids are increasing in production, but not enough to offset conventional oil supplies – much of this increase in gas liquids is from the “blow down” of depleted oil fields – not a good sign – rather a further indicating of aging oil fields

· The vast majority of oil reserves that have not yet been developed are in countries that are not openly receptive to western oil company investment – and do not favour accelerating oil production – most of the countries also have big pressure for investments in social-health-welfare of their people, and investment in their oil industry often takes second priority

· New technology that help accelerate oil production in the period 1980-2000a are losing their impact (3D seismic, horizontal drilling, multi-lateral wells, water injection, electric submersible pumps, subsea wells, deepwater drilling) – there are few new technologies that are having such a big impact from 2000 onwards.

· Deepwater developments are very expensive, high risk and take at least five years to develop – the biggest deepwater discoveries have been made.

· The twin shocks of the credit crunch (financial crisis) and low oil prices for a short period have cause many projects to be delayed or cancelled. It will take years to get these projects going again.

· OPEC claims to have cut production by 4.2 million bbls/day – with 80% compliance this is about 3.3 million barrels off the market. However, we believe with the steep underlying hidden declines in oil production now taking place, this cushion will be used up within 12 months leading to tightening supplies by year end. As demand increased end 2009 and there is no ability to raise production, it will take 6-12 months before it becomes very obvious that we have an oil supply crunch on our hands, like we had April to July 2008 that in large part lead to prices skyrocketing from $100 to $147/bbl – before causing the biggest recession since the 1930s.

· Yes – we believe the high oil prices lead the world into a recession – and the world will find it difficult to grow with oil prices over $100/bbl. And yes, this is gloomy.

· It’s too late to avoid the crisis – there are no developed alternatives to the massive oil, gas and coal usage – too many years have been wasted watching the problem get worse. It will take at least five years to shift away from our massive reliance on imported oil – 70% of oil is used from transportation. The average US car does a ridiculously low 22 mpg. To many years of wasting a precious resource will come back to haunt us all unfortunately.

· Oil has been too cheap for too long – 15 cents a cup – that can transport a car 10 miles. Travelling in luxury at 60 mpg over 10m miles for 12 cents is a ridiculously low cost.

· The is no alternative to kerosene for airline fuel – yet tax on airline travel is almost nonexistent – does this make sense?

Easy Oil is Finished: Overall, the easy oil has been produced and the difficult oil costs over $20/bbl to  develop. The net result will be declining oil production and higher costs – leading to tightening of supplies, rising prices and declining demand to match the declining production. A switch to gas will lead to higher gas prices. A switch to coal will lead to high coal prices. These will all lead to high electricity prices for businesses and home owners.

develop. The net result will be declining oil production and higher costs – leading to tightening of supplies, rising prices and declining demand to match the declining production. A switch to gas will lead to higher gas prices. A switch to coal will lead to high coal prices. These will all lead to high electricity prices for businesses and home owners.

It is most important that one invests in “upstream oil, gas and coal” – no “downstream oil, gas and coal”. These are the sectors that will have maximum positive exposure to high oil, gas and coal prices.

· Oil and gas exploration, development and production companies

· Coal mining companies

· Gold mining companies

And conversely, one needs to be careful with downstream companies such as:

· Oil refining, distribution and retail and marketing

· Gas distribution and retail companies

· Electric utility companies

These often have reduced profits when oil, gas and coal prices rise.

Key Business Areas: These natural resources companies have three key phase to their business:

-

Exploration (high risk, high reward) - very good exposure to high oil prices in 1 to 5 year timeframe

-

Development (medium risk, medium reward) - very good exposure to high oil prices in 1 to 5 year timeframe

-

Production (low risk, lower reward) - nicely exposed to high oil/gas/coal prices though

Instead of buying physical oil, which is difficult for the normal investor, one can purchase shares in companies that have assets in the exploration, development and/or production phases of the upstream oil supply business. Companies with large reserves, large production, exciting new and large exploration prospects with a low price to earnings ratio are the best to focus on. It is always a balance between exiting exploration companies with high P/E ratio (range 15-60+ or no earnings), versus steady oil production companies with lower P/E ratios (range 5-15). If you think gas prices will rise, purchase company stock that have a lot of gas production. If you think oil prices will rise, purchase company stock with significant oil production and potential oil production growth in future years.

Instead of buying physical oil, which is difficult for the normal investor, one can purchase shares in companies that have assets in the exploration, development and/or production phases of the upstream oil supply business. Companies with large reserves, large production, exciting new and large exploration prospects with a low price to earnings ratio are the best to focus on. It is always a balance between exiting exploration companies with high P/E ratio (range 15-60+ or no earnings), versus steady oil production companies with lower P/E ratios (range 5-15). If you think gas prices will rise, purchase company stock that have a lot of gas production. If you think oil prices will rise, purchase company stock with significant oil production and potential oil production growth in future years.

The same general model is applicable to mining companies. Some are more exploration focussed - normally the smaller companies. Others are very production focussed - generally the large mining companies. Whether it be coal, gold, uranium, platinum, iron ore or other mineral or gemstone - one will find dividends and earnings in larger producing companies, with no dividend and very little or annual losses in smaller exploration focussed companies. If an exploration company makes a major find, the shares can go up tenfold in a day. But if their success is limited, they can also fold in a day - with very little warning.

In summary, if you believe in Peak Oil and higher oil, gas and coal prices through the next 1-5 years (as we do) then its best to get into stock in oil/gas/coal upstream "exploration, development and/or production". The companies with the largest booked reserves with lowest share price are the ones to particularly look out for.

Crash then Boom: Yes, oil prices have crashed from $147/bbl in July 2008 to $35/bbl in Oct 2008. They have since recovered to $55/bbl – the big rises have just started to kick in. Expect prices to climb to $100/bbl by end 2009. And with it an average assortment of upstream oil, gas and coal stocks to rise by about 30% by year end. And when inflation starts rearing its ugly head again, the best place to be will be in oil, gas and coal upstream.

What to Avoid: Just to flag, if oil/gas/coal prices skyrocket again, then the following industries will be severely hit - and the economic prosperity of areas that depend on these industries for jobs.  This of course will hit property prices in these areas:

This of course will hit property prices in these areas:

-

Automotive - cars, trucks, vans

-

Airline - plane manufacture, airports, air transportation services, food/products from remote locations

-

Food production companies - since food production in modern agriculture is hugely energy intensive

Industries that well benefit: at the airline and automotive industries expense are:

Industries that well benefit: at the airline and automotive industries expense are:

-

Rail/railroad - particularly if electrically powered

-

Short haul shipping and barge/canal transport

-

Green Tech Energy - solar, tidal, wind, hydro, nuclear power providers

-

Electric car manufacturers and fuel efficient vehicle manufacturers

-

Electric power storage companies (batteries, other technologies for storage)

Other industries:

Other industries that often do less well with high oil/gas/coal prices - because their raw materials prices skyrocket whilst they cannot pass on all of this to their customers, are:

- Petrochemicals - plastics, fertilizer

- Oil Refining

- Petrol-gas marketing distribution and retail sales

Integrated Oil Companies: Unless you understand these dynamics of the su pply-demand within these industries in the middle of the supply chain, best avoid if oil prices rise. That said, many so call integrated oil companies have components of these business within their overall portfolio. So if oil prices rise sharply, as long as the total capital employed in these business are less than say 40-50% of these companies, you will normally find these integrated oil companies share prices rising strongly as well - particularly if they have large oil reserves and large oil production per capital value of the company (barrels of proven oil reserves per $ share price being a measure one can use to judge this).

pply-demand within these industries in the middle of the supply chain, best avoid if oil prices rise. That said, many so call integrated oil companies have components of these business within their overall portfolio. So if oil prices rise sharply, as long as the total capital employed in these business are less than say 40-50% of these companies, you will normally find these integrated oil companies share prices rising strongly as well - particularly if they have large oil reserves and large oil production per capital value of the company (barrels of proven oil reserves per $ share price being a measure one can use to judge this).

Oil Exporting Nations - Property: Globally, one will find that property prices in all oil exporting nations will generally see rises as oil prices skyrocket. The converse is true for oil importing nations - particularly if they import all their oil, gas, coal and metals for electricity production and car fuel/power. Examples of companies that export huge quantities of oil/gas per population that are also very stable politically are Norway and Canada with Australia being next behind (huge metals reserves). Developed countries most exposed to very high oil, gas and coal prices that have little nuclear power also, are: Italy, Spain, Greece, South Korea, most eastern European countries - Croatia and Slovenia being two example (no coal production or oil/gas production). For more details, refer to Special Reports

Declining Industries: Also take note of large car companies that fail to shift into electric car manufacture or at least smaller more fuel efficient car manufacture soon enough. They will be wiped out by the competition. Large swathes of the industrial landscape will change for ever if they do not react quick enough with Peak Oil now behind us. Message - you don't want to have property in these areas - because the value will head down for many years as the decline of these industries takes hold and the hydrocarbon age starts to come to an end for fuel inefficient car manufacturers. If oil prices rise to $200/bbl, which is quite possible, no-one will want massive 4x4 trucks doing 15-20 mpg! Remember in the USA 10% or employment is directly or indirectly related to car manufacture-servicing-transport. And a staggering 9% is related to airline manufacture-servicing-transport. If and when people start buying far less new gas guzzling cars and stop using airlines because of hike in kerosene prices, the economies of the areas-regions affected will be hit hard and with it property prices.

UK Property Investors: For UK property investors, take note that relatively wealthy employees will soon be taxed at 50% (on earnings and bonuses over 150,000 pounds). To attempt to avoid this tax, we believe these people will start buying property – in part because it is only subject to a flat 18% capital gains tax. Switch out of 50% earning income tax and into 18% capital gains tax. The massive financial stimuli of western countries and the UK plus public spending on infra-structure projects and the Olympics all hitting London at once, plus the improving City financial situation in 2009 will lead we believe to a recovery of London and southern England house prices by year end. The Olympics in the run up to 2012 will also help – it always does. The recovery could be sharp but short lived if oil prices rise above $100/bbl. This is therefore a further reason for hedging ones investment portfolio with upstream oil, gas and coal. If you don’t make it with property, you’ll make it with oil/gas/coal/gold and vice versa.

UK Property Investors: For UK property investors, take note that relatively wealthy employees will soon be taxed at 50% (on earnings and bonuses over 150,000 pounds). To attempt to avoid this tax, we believe these people will start buying property – in part because it is only subject to a flat 18% capital gains tax. Switch out of 50% earning income tax and into 18% capital gains tax. The massive financial stimuli of western countries and the UK plus public spending on infra-structure projects and the Olympics all hitting London at once, plus the improving City financial situation in 2009 will lead we believe to a recovery of London and southern England house prices by year end. The Olympics in the run up to 2012 will also help – it always does. The recovery could be sharp but short lived if oil prices rise above $100/bbl. This is therefore a further reason for hedging ones investment portfolio with upstream oil, gas and coal. If you don’t make it with property, you’ll make it with oil/gas/coal/gold and vice versa.

We hope you have found this Special Report insightful – we aim to give you the best advice and insights to assist you maximising your investment returns and minimising your risks.

More Special reports on oil and property investing:

- 251: Peak Everything !

- 246: Peak Oil - called July 2008 - massive switch needed despite $35/bbl oil

- 244: It's the oil price again - it caused the recession

- 243: Oil price crash sows seed for next massive oil spike

- 242: Oil, Cars & Property - what we'd do if we were UK Prime Minister

- 238: Oil, Cars & Real Estate - what we'd do if we were Pres. Obama

- 191: Oil Price Update and Real Estate

- 187: Real Estate and the commodities super-cycle

- 186: Oil price starts to skyrocket as predicted - how to profit

- 180: Oil prices continue to skyrocket

- 172: Make serious money - best investment sectors

- 169: Oil supply crunch begins… protect yourself

- 168: Alarm bells ringing - oil price shock now on the horizon

- 163: Making Serious Money as asset prices plateau - resources and property

- 161: Resources winners and losers - ranked list for property investors

- 160: Find out the winners and losers in the biggest oil boom in history - about to happen...

- 159: Massive oil boom - the winners and losers - be prepared

- 158: Supply and demand scenarios - oil boom and the property investors insights

- 157: Impact of "Peak Oil" for Property Investment

- 151: Oil price $125 / bbl and rising…how to take advantage in property

- 150: Peak Oil shortly due to be reach - unique insights for a property investor

- 148: Take advantage of the oil/gas/coal boom - key insights