295: Property investing, energy and tax exiles

11-07-2009

PropertyInvesting.net team

PropertyInvesting.net team

We’d like to describe our latest outlook on property prices, inflation, tax and energy prices.

As described before, we believe the global economy will be constrained primarily by energy prices and commodities scarcity in future years. Some examples and evidence for this:

· Every time oil prices rise above $90/bbl (in today’s money terms) the

· High oil prices coincided with the last four

· High growth periods have always corresponded with low oil prices – except where bubbles have occurred prior to a crash (e.g. 2007 to early 2008)

We believe Peak Oil – the very maximum production of oil – was July 2008. This also coincided with the massive ramp up in oil prices from $50/bbl to $147/bbl – in part caused by speculation and in part caused by genuine supply tightening and shortages caused by:

We believe Peak Oil – the very maximum production of oil – was July 2008. This also coincided with the massive ramp up in oil prices from $50/bbl to $147/bbl – in part caused by speculation and in part caused by genuine supply tightening and shortages caused by:

·

· Chinese Olympics – build up of oil reserves

· Platform shutdown

· Euphoria – expectation that high global growth would continue

These all came to an end as Lehman Brothers collapsed in August 2008, the Olympics ended, doom and gloom and down-right panic set in and the stock markets crashed >50%. People desperately had to wind-up oil commodities positions to pay cash calls, hedges and derivatives losses – so oil prices crashed. Then oil demand dropped dramatically in the

The US and  banks have survived. Lending remains almost non-existent as UK bank hoard the cash given to them by the government. Meanwhile because they lend at 6% and it cost them 0.5% - they are making massive underlying profits. This mass bail-out has at least saved the banks from meltdown but the

banks have survived. Lending remains almost non-existent as UK bank hoard the cash given to them by the government. Meanwhile because they lend at 6% and it cost them 0.5% - they are making massive underlying profits. This mass bail-out has at least saved the banks from meltdown but the

The quantitative easing continues and interest rates stay at 0.5%. As oil prices rise – if inflation does not kick-in we will eat our respective hats! As inflation kicks in, interest rates will rise and home ownership will become more expensive.

The goods news is, if you have a very large property portfolio and much debit, the value of the debit will reduce in real terms as the affects of inflation kick in. Also, property prices should inflate, although it will be precarious because if interest rates rise too sharply, property prices are likely to drop back again.

On energy prices, there seems to be two camps. The economists and many marketers seem to think as oil prices rise, new oil supplies will come on stream and demand will be met by these. They believe oil prices should stay in the $35 to $80/bbl range.

The other camp, the Peak Oil camp – populated by technologists and retired petroleum people, (as you know, we firmly in this camp). They believe Peak Oil is either behind us or soon to be reached, and supply will not be able to meet demand. Oil prices will sky-rocket again and likely cause the next recession.  Global GDP growth will be significantly impaired. No amount of gigantic investment, technological advances or innovation will be able to stem the depletion of oil supplies – we are currently on a bumpy plateau and oil production will likely start a more severe decline around 2015 or slightly before. The gigantic oil demand increase from

Global GDP growth will be significantly impaired. No amount of gigantic investment, technological advances or innovation will be able to stem the depletion of oil supplies – we are currently on a bumpy plateau and oil production will likely start a more severe decline around 2015 or slightly before. The gigantic oil demand increase from

This brings us nicely onto property investment in

· Oil/gas revenues from Africa, Middle East, Asia,

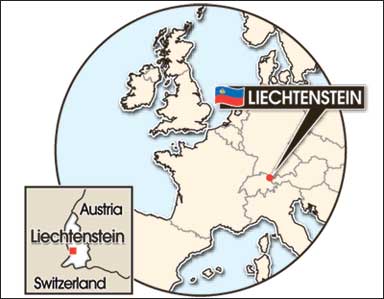

· As taxes in western nations rise to pay for bank bail-outs, pensions, aging population and very high social spending costs – the rich will leave these countries for tax havens such as

· As knowledge, education and technology further differentiate people into ultra-rich, then the middle to poor classes, more ultra-rich will feel a need to shift assets to

· Safe, secure, low crime, no social problems

· Central European destination – mountains, skiing, fresh air, lovely summers

· Not regulated by Euro-Brussels bureaucracy

· No Euro – the economic growth and inflation can therefore be directly control to prevent Euro boom-bust situations like

· Nice place to live!

If you reside in an average apartment in  many of our website visitors are in the league of considering becoming tax exiles – anyone with a million or two in assets that’s no shackled to a job as an employee has to see this opportunity as taxes on bonuses and earnings rise to 50% in April 2010. Okay, capital gains tax at 18% isn’t too bad. What’s your tax bill? It’s worth considering. If you don’t move their, you can always buy an apartment and rent it to a new arrival resident tax exile.

many of our website visitors are in the league of considering becoming tax exiles – anyone with a million or two in assets that’s no shackled to a job as an employee has to see this opportunity as taxes on bonuses and earnings rise to 50% in April 2010. Okay, capital gains tax at 18% isn’t too bad. What’s your tax bill? It’s worth considering. If you don’t move their, you can always buy an apartment and rent it to a new arrival resident tax exile.

We believe that Swiss property prices will rise in the next ten years because of the above considerations, plus:

· Hedge funds moving to

· Oil firms moving to

· Super-rich global players moving to

Okay, property prices are not exactly cheap, but they are also not as expensive as

The downside of course is you’ll be away from your family and friends. The upside is you’ll be away from Chancellor Alistair Darling.

If the Tories get into power in June 2010, don’t expect the 50% tax bracket to drop for a while – at least two years – and it may never drop back. With regret the damage has already been done.

Now, if you are a really serious property player – you can always form a Swiss company with HQ in the  state with all profits being transferred in. The downside is, you won’t be able to spend more than about 90 days in the

state with all profits being transferred in. The downside is, you won’t be able to spend more than about 90 days in the

Another consideration is that the Swiss Franc is considered a safe haven currency during rough periods. So as the dollar declines, Sterling remains under pressure and the Euro takes a battering with high oil prices, it’s likely the Swiss Franc fare well – particularly since the country has such strong reserves and gold. Interest rates will likely remain low, along with inflation – whilst

Anyway, if you tax bill is bigger than £24,000 – it’s worth considering!

So, in summary, expect oil prices and commodities prices to rise, inflation in the

· massive cash injections

· record low interest rates

· banks starting to lend more

· city bonuses

· an endemic chronic shortage of properties caused by:

· Lack of building – particularly in SE England and

· Lack of funding for building

· Planning process and environmental constraints

In the next few months a feel good factor will start to creep in as consumer confidence increase and unemployment plateaus out in ~January 2010 – prices in

Another reason why there is a property supply shortage is people rarely move anymore. The reason – a Gordon Brown “special” – stamp duty. If you own a £500,000 house you don’t want to give the government £20,000 every time you move house – that’s crazy. No wander prices continue rising in London. Another reason is Home Information Packs – and all the hassle and cost of this new system. A further reason is, buy-to-let investor rarely sell – most continue acquiring – building their portfolios – for their pensions. And the rich by second homes and take these properties off the market as well. Many partners also do not get married and keep more than one property as a hedge against splitting up.

Anyway, you’ve probably got the message. It’s a lot of hassle and expense selling (and to a lesser extent buying). So don’t expect to see a flood of properties on the market – even in bad time. People stay put. Unemployment and social benefits along with packages allow this in this decade.

That’s it. Our views are not mainstream. You can decide for yourself of course. We have 21,000 visitors a day seeking our views and opinions. We just hope we can help the serious property investor with objective impartial guidance – so YOU – can build a profitable portfolio and secure yourselves financially.

If you have any comments, please send us an email on enquiries@propertyinvesting.net. Please also feel free to forward this Special Report to family or friends.

Charlize Theron

Bipasha

Hill Harper

Konnie Huq

Kate Beckinsale

Kristen Stewart

Brad Pitt

Matt Damon

Charlize Theron

Sting

Katy Perry

Konnie Huq

Priyanka Chopra

Aisha Tyler

lindsay lohan

Halle Berry

Johnny Depp

Nastassja Kinski

Jennifer Aniston