346: Labour leadership - what it means for the UK property investor

10-03-2010

Prop ertyInvesting.net team www.google.co.uk

ertyInvesting.net team www.google.co.uk

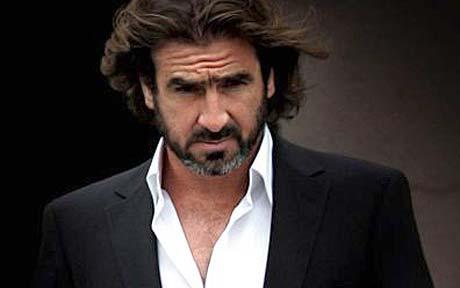

Labour Leadership Red Ed or another New Labour?

The unions hold 33% of the vote for electing the Labour leader they were the difference when it came to voting in Ed Miliband ahead of his talented older brother who most thought was the front runner David Miliband. Its hardly surprising David was gutted and stepped down the whole family saga was the wrong discussion point at their Conference. His younger brother at 40 year old (as opposed to David's 45) was a surprize late entry into the leadership contest and most people thought he had little chance against David Miliband and Ed Balls. The unions got their man - by 1% of the vote. Labour will shift further to the left. Blair gained the centre ground, Brown shifted left and Ed will go further left.

For all Tory and Liberal Democratic voters, this is good news in that, unless we are not seeing things clearly, it will be far more difficult for Labour to get a majority in the future because they will almost certainly frighten many of the middle ground v oters with Ed Miliband as leader he will no doubt fill the shadow cabinet with like minded people with a similar value set. Now it looks like Ed Balls the most experienced financial person in Labour - will get passed over in favour of his wife another family spat if she accepts the job as shadow chancellor that is. Ed proudly announced the end of New Labour a few days ago but the obvious question is what do Labour have as an alternative what is the new policy statement and direction? Well wait and see what seems pretty obvious is that Labour is no longer a major force and it will take many years of repair the legacy of overspending and high taxation will take years to forgive and/or forget for most voters. Their shadow cabinet is likely to comprise of career politicians with no business background or experience something unheard of in the government in the period 1950 to 1995. Meanwhile, the ex-foreign minister David Miliband, the person who seemed most comfortable in front of the cameras and was hugely ambitious - has quit. Probably the most talented labour politician decided not to muddy the water and let his you brother have the freedom - not a bad call in the circumstances.

oters with Ed Miliband as leader he will no doubt fill the shadow cabinet with like minded people with a similar value set. Now it looks like Ed Balls the most experienced financial person in Labour - will get passed over in favour of his wife another family spat if she accepts the job as shadow chancellor that is. Ed proudly announced the end of New Labour a few days ago but the obvious question is what do Labour have as an alternative what is the new policy statement and direction? Well wait and see what seems pretty obvious is that Labour is no longer a major force and it will take many years of repair the legacy of overspending and high taxation will take years to forgive and/or forget for most voters. Their shadow cabinet is likely to comprise of career politicians with no business background or experience something unheard of in the government in the period 1950 to 1995. Meanwhile, the ex-foreign minister David Miliband, the person who seemed most comfortable in front of the cameras and was hugely ambitious - has quit. Probably the most talented labour politician decided not to muddy the water and let his you brother have the freedom - not a bad call in the circumstances. May be he also thinks his brother made a mistake in going for the leadership. It was rather disconcerting to learn that David's wife burst out crying when she found her husbands political career was put to an end by his younger brother of all people - and Ed's partner (they are not married) was non too pleased either - because she shuns publicity. It's only just the beginning and one can feel for the whole Miliband family because this may tear them apart. One must hope that Ed does not regret his decision to stand for the leadership in the long term. Most people would rather have the backing of their family rather than the unions.

May be he also thinks his brother made a mistake in going for the leadership. It was rather disconcerting to learn that David's wife burst out crying when she found her husbands political career was put to an end by his younger brother of all people - and Ed's partner (they are not married) was non too pleased either - because she shuns publicity. It's only just the beginning and one can feel for the whole Miliband family because this may tear them apart. One must hope that Ed does not regret his decision to stand for the leadership in the long term. Most people would rather have the backing of their family rather than the unions.

If there was a snap election, we dont think there would be many people out there thinking Labour would do well at this time. The Tories will have their own challenges with the current arguments over defence spending cuts - quite likely to boil over. At least the financial markets seem to be impressed and Sterling has been stable and strengthening the FT100 index has also risen 10% since the election.

For the property investor, this means the door lies wide open for public sector spending and jobs cuts and the chance of the Tory/Lib-Dem coalition staying together for an extended period has gone up markedly. So expect a rebalancing of the economy, and in a few years time, London and southern areas to prosper whilst the north will probably struggle more than it would have done under Labour. At least the IMF will keep the UKs AAA rating and stability will be restored. But new banking regulation is likely to depress lending and the rental market, particularly in London, will boom. House prices might not rise too much in London in the next year or so, but rental prices certainly will because no properties will be built and first-time buyers will be almost non-existent.

the UKs AAA rating and stability will be restored. But new banking regulation is likely to depress lending and the rental market, particularly in London, will boom. House prices might not rise too much in London in the next year or so, but rental prices certainly will because no properties will be built and first-time buyers will be almost non-existent.

In the last few days end September 2010 there has been the clearest evidence so far of an emerging north-south divide in house price growth expect this to continue as the supply of houses for both purchase and rent dries up in London but increases in the north as private enterprise recovers whilst the public sector goes into recession. The weakness of the opposition is likely to embolden the Coalition and spending cuts will therefore be more severe in the short term than one would have expected back in May.

Expect to see some glossy presentations on growth plans - as the Coalition try to convince the population that the rebalance of public spending to private enterprise will lead to high GDP growth and a more prosperous UK in the future. Let's hope the private sector gets some top talent back making returns rather than dreaming up good ways to spend it.

We hope this short Special Report has helped you put property investing into perspective and has helped stimulate some positive thoughts on how to improve your business. If you have any queried, please contact us on enquiries@propertyinvesting.net