362: Instability, inflation and investing

02-06-2011

Inflation Leading to Unrest: We expect growing tensions in North Africa and the Middle East leading to a rapid increase in oil prices in 2011. This is the scenario we are expecting:

· Political and civil unrest

· Increase in terrorist activities in the North African and Middle Eastern regions and outside these regions

· Disruption or threats of disruption to oil and gas supplies

· Increase in oil and gas prices

· Increase in inflation (energy and food prices)

· Increase in interest rates

· Drop in property prices – or stagnation - prices rise with inflation or below

· Increase in unemployment in North African, Middle Eastern and Western nations

· Potential financial crash and recession by end May 2011 - sovereign debt crises

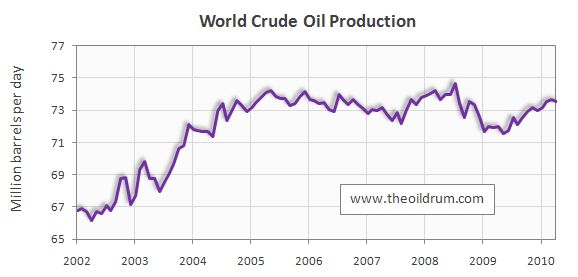

Note: Oil production is no higher today than 6 years ago - we are at the peak - now on an "undulating peak oil plateau"

Peak Oil the Underlying Issue: The key underlying issue is Peak Oil. To be more precise – the world is not able to increase oil supplies to meet the required demand to fuel growth. As we have stated in our Special Reports all the way back to June 2007 (when we first noticed the anomalies after detailed analysis) – we believe Peak Oil (crude oil) was 2005 and Peak Oil (all oil types) was July 2008. It’s quite possible the total oil levels could rise a little higher than today, but essentially for the last six year we have been on an undulating plateau of oil production. Despite oil prices rising from $40/bbl in 2005 to $147/bbl mid 2008 and $100/bbl in 2011 – oil supplies have not risen. Why would this happ en if oil was not in short supply – it defies market economics. More important for us is our detailed predictive model that looks at all countries oil investment activities and production levels and trends, then builds these into a global model. What this tells us is the world will be lucky to increase oil production by 1 million bbl/day over the next four years from its current levels – never mind the 4 million bbl/day demand increase expectation. The only way to reduce demand is to have oil prices sky-rocket then demand destruction will set in. This demand destruction could be triggered by another recession – as early as mid 2011. Essentially – global growth is now being severely constrained by the availability of cheap oil. It’s just that 99% of the population has not realised this. Some governments probably realise this – they employ some pretty bright people – but they will not tell you because we might start to panic, driving investment down and oil prices up. The Peak Oil message also does not win votes. Anyway, we are not here to win votes so we can tell you the truth objectively.

en if oil was not in short supply – it defies market economics. More important for us is our detailed predictive model that looks at all countries oil investment activities and production levels and trends, then builds these into a global model. What this tells us is the world will be lucky to increase oil production by 1 million bbl/day over the next four years from its current levels – never mind the 4 million bbl/day demand increase expectation. The only way to reduce demand is to have oil prices sky-rocket then demand destruction will set in. This demand destruction could be triggered by another recession – as early as mid 2011. Essentially – global growth is now being severely constrained by the availability of cheap oil. It’s just that 99% of the population has not realised this. Some governments probably realise this – they employ some pretty bright people – but they will not tell you because we might start to panic, driving investment down and oil prices up. The Peak Oil message also does not win votes. Anyway, we are not here to win votes so we can tell you the truth objectively.

Focus on Investing with Peak Oil in mind: Rather than getting all upset about the lack of communication on the Peak Oil issue – probably rather a fruitless exercise – we are positioning and have been positioning for Peak Oil for many years now. Because we invest and this is what we are really interested in – it becomes a key principle around our selection of things to invest in. And we are happy to share this with you – for free. As you may have noticed, we don’t charge anywhere on our website for anything – it’s all for free - 20,000 people a day visit our site to take advantage of the free insights, guidance and advice for property investors.

Competing Forces: China, India and other developing nations are  increasing their oil demand as they rapidly grow. This is a logical response to building and expansion. All commodities are required for this growth – and competition for resources has rapidly increased so western developed nations have had to pay more. This has subdued the growth rate in the west – expect this to continue.

increasing their oil demand as they rapidly grow. This is a logical response to building and expansion. All commodities are required for this growth – and competition for resources has rapidly increased so western developed nations have had to pay more. This has subdued the growth rate in the west – expect this to continue.

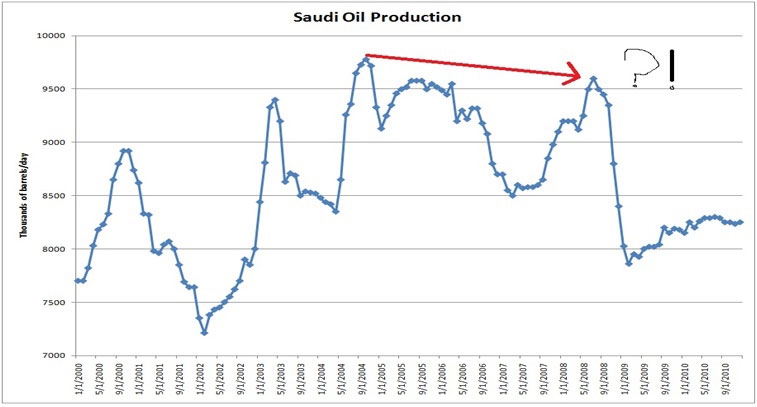

OPEC: Non-OPEC western oil production is in decline and OPEC will need to increase its supplies to make up the shortfall. However, OPEC we believe will either be unwilling to increase supplies or unable. We do not believe there is a significant spare capacity anymore. OPEC claim to have 6 million bbl/day in reserve just do not believe this – its probably more like 1-2 million bbls/day – not enough to stop oil prices rising. OPEC is pumping almost at maximum capacity. Any disruption would lead to oil prices sky-rocketting like they did mid 2008 – before another financial meltdown and crash in the west. 2011 has all the makings of 2008 almost to the month –so be very careful by May 2011 – because if oil prices are at $130/bbl – western government will be able to pay these oil import bills and there will be sovereign debt faults – probably starting with Greece, Portugal, Ireland and possibly Spain and Italy. The contagion could take hold. Do not underestimate the impact of the oil price – at the moment Greece spends 5% of its GDP on oil imports along (it’s probably more like 12% if you add in gas, electricity, coal and metals – close to a tipping point).

Despite $147/bbl in mid 2008, Saudi oil production was lower than in 2004. Despite rising from $37/bbl end 2008 to $100/bbl early 2011, Saudi oil production has barely increased. Why does anyone think OPEC have 6 million bbls/day of spare capacity (with Saudi 4 million bbls/day) - you would never believe it looking at the above chart. Also worth noting that in the last ten years, Saudi has only increase production by a maximum of 1 million bbl/day - and this has only lasted a few months before it has dropped. High level, a reservoir analyst would normally give an extremely low chance of increasing production above 9 million bbl/day looking at this chart.

Culture of Conserving For Future - Not Market: Culturally, anyone that has lived in the Middle East will understand that these countries loo k long-term. Oil supplies are often curtailed because they would like to give some of this to future generations. They do not have western style accelerated production values. So if oil prices go up, they are more likely to shrug their shoulders and say they need to reserve some oil for future generations. Some may even think it best to reduce supplies because oil prices will be higher in the future. Remember they are valuable reserves. Just as an example, if you were an American with gold reserves, and you thought the price would be higher in a year’s time, you might wait before releasing these into the market. Otherwise people could accuse you are not doing the right thing for your family or country. Cheap oil is not a charity or a right. Oil is a market. And OPEC control it with a cartel. So if the western governments upside the Middle Eastern and North African government through lack of support (e.g. not supporting President Mubarak is a good example of this, leading to destabilisation) – then OPEC nations are far less likely to want to play ball and release more oil supplies.

k long-term. Oil supplies are often curtailed because they would like to give some of this to future generations. They do not have western style accelerated production values. So if oil prices go up, they are more likely to shrug their shoulders and say they need to reserve some oil for future generations. Some may even think it best to reduce supplies because oil prices will be higher in the future. Remember they are valuable reserves. Just as an example, if you were an American with gold reserves, and you thought the price would be higher in a year’s time, you might wait before releasing these into the market. Otherwise people could accuse you are not doing the right thing for your family or country. Cheap oil is not a charity or a right. Oil is a market. And OPEC control it with a cartel. So if the western governments upside the Middle Eastern and North African government through lack of support (e.g. not supporting President Mubarak is a good example of this, leading to destabilisation) – then OPEC nations are far less likely to want to play ball and release more oil supplies.

US Foreign Policy on the Fly: Overall, when you think about the dynamics – you can see that the USA is rapidly losing its global political and security influence through lack of support and a foreign policy that blows hot and cold. This should lead to higher oil prices as well as contr ol over oil supplies to the USA is reduced. OPEC has gained control as Peak Oil has occurred. We are into a dangerous unstable period. OPEC oil exporting countries will make huge oil revenues to feed their rapidly increasing populations. But North Africa and Middle Eastern countries without oil exports like Egypt, Tunisia, Lebanon, Palestine, Israel, Morocco and Jordon will be particularly exposed to civil unrest because they import oil and food and prices will sky-rocket. Government will have no money for food subsidies in these desert nations. Israel is surrounded by these higher risk countries – so must feel particularly threatened especially after the Obama administration showed its colours last week. The US foreign policy seems to be made up on the fly and be in disarray. How a government can turn their back on the person they were supporting for 30 years that was instrumental in bring peace to this part of the Middle East after wars in the 1960s and 1970s is almost beyond comprehension. To request him to leave immediately – and causing a power vacuum is dangerous to put it mildly Smacks of panic and populism. Other Middle Eastern nations must be sitting up and thinking this could happen to them tomorrow or any time henceforth.

ol over oil supplies to the USA is reduced. OPEC has gained control as Peak Oil has occurred. We are into a dangerous unstable period. OPEC oil exporting countries will make huge oil revenues to feed their rapidly increasing populations. But North Africa and Middle Eastern countries without oil exports like Egypt, Tunisia, Lebanon, Palestine, Israel, Morocco and Jordon will be particularly exposed to civil unrest because they import oil and food and prices will sky-rocket. Government will have no money for food subsidies in these desert nations. Israel is surrounded by these higher risk countries – so must feel particularly threatened especially after the Obama administration showed its colours last week. The US foreign policy seems to be made up on the fly and be in disarray. How a government can turn their back on the person they were supporting for 30 years that was instrumental in bring peace to this part of the Middle East after wars in the 1960s and 1970s is almost beyond comprehension. To request him to leave immediately – and causing a power vacuum is dangerous to put it mildly Smacks of panic and populism. Other Middle Eastern nations must be sitting up and thinking this could happen to them tomorrow or any time henceforth.

US Money Printing Making Bubble Worse: What the Obama administration should have forecast was that $2 Trillion of money printing would lead to an oil price explosion - banks have taken this money and invested in oil abroad. The US oil import bill has sky-rocketted to $429 Billion in a year (@ $95/bbl) - making it's deficit a gigantic 10% of GDP despite fairly robust growth. The $2 Trillion investment has delivered no additional jobs - unemployment is still rising. It's all so predictable - surely the current administration will not survive much longer - after the next $144 Billion bankers annual remuneration and another crash mid 2011 - this time sovereign - the administration will be completely out of ideas and excuses.

Inefficiency of High Oil Price: As oil prices rise, there is a gigantic transfer of wealth from western oil importing nations (except Canada, Norway and Australia) to OPEC an d Middle Eastern oil exporting nation. This transfer amounts to about $1.5 Trillion a year at $100/bbl. However, much of this money is spent on subsidies for food, fuel, power and social wealth projects - to keep expanding young populations content. So the US prints money, spends $350 Billion on oil imports, then OPEC countries spend this money - not necessarily "investing" in value creating or wealth generating activities like manufacturing, or adding economic value. Surely the outcome of this should mean lower overall GDP growth? This is exactly what we see every time the oil prices rise. High oil prices act like a tax on manufacturing and value creating industries - this "tax" money is then handed to exporters who then spend this money on social subsidies. A general model, but worth considering - to help understand why high oil prices hit the west hard - its logical.

d Middle Eastern oil exporting nation. This transfer amounts to about $1.5 Trillion a year at $100/bbl. However, much of this money is spent on subsidies for food, fuel, power and social wealth projects - to keep expanding young populations content. So the US prints money, spends $350 Billion on oil imports, then OPEC countries spend this money - not necessarily "investing" in value creating or wealth generating activities like manufacturing, or adding economic value. Surely the outcome of this should mean lower overall GDP growth? This is exactly what we see every time the oil prices rise. High oil prices act like a tax on manufacturing and value creating industries - this "tax" money is then handed to exporters who then spend this money on social subsidies. A general model, but worth considering - to help understand why high oil prices hit the west hard - its logical.

US Bankers: Back in the US however, interest rates are held at 0.5% whilst banks charge 5% or more for borrowing - creaming off gigantic cash resources from investors. The bankers remuneration this year will be about $144 Billion - gigantic and record setting - similar to last year. Surely the printing of money, the holding down of rates and the huge bonuses whilst unemployment rises with $100/bbl oil is just another government generated bubble ready to go pop? It certainly does not seem either equitable or sustainable - it seems to be repeating the same old mistakes of the period leading up to mid 2008. The UK bankers will give themselves $8 Billion in bonuses this year.

Bad Year for Stocks: Don't get lulled into the illusion that stocks will perform well this year. Most investors have only put their money into stocks because interest rates are so low and returns are so miserable everywhere else that it's the final port of call for the printed cash. But just wait until rates rise - then people will want to shift to cash and savings - then the bubble will go pop. Expect this popping from mid May onwards.

Investment Guidance: Its getting increasingly difficult to find good investments in this turbulent environment, though we have used all our experience and insights to come up with some directional guidance for our website visitors based on the trends mentioned above. There are two key thrusts that we believe will see far higher returns than normal:

· Oil and gas production and exploration companies with their businesses focussed on any area outside North Africa and the Middle East (following energy prices up, until they drop again, possibly as soon as May 2011)

· Residential property in stable democratic oil and gas exporting nations

Gold: Remember gold can be seized and made illegal to hold – this happened in the USA in the 1930s – and if the global economy goes pear shaped, people will need to sell their gold so the price will drop. You cannot use gold to make anything – hence we don’t like gold investment.

Commodities Exporting Western Nations: The key thrusts will be energy and commodity investments and investment in the lowest rise property as a hedge against inflation, but only in the most stable areas with oil and gas revenues. As you can see, for property there are very few clear cut places left that would stack up against this criteria. The only clear-cut countries that are generally honest (not corrupt) and export oil and gas are Canada, Norway and Australia. The UK has a very low oil and gas import bill – it produces about 70% of it’s needs – so is far better protected than most western nations.

The Nuclear Option: Another rich vein of returns could come from uranium mining. As the population explodes and the developing nations grow, far more electric energy will be required to power heating, transport, air conditioning and factories. There is a boom in nuclear power stations building particularly in China. So good quality uranium mining companies will likely see their sha re prices rise.

re prices rise.

Conservation: Energy conservation technology companies are worth a look – although more risky – most are small and fledgling. Energy efficiency consultancy companies – whether private or public could be worth investing in.

Renewables: Renewable energy is also of interest – but these shares tend to be very cyclical and if there is an oil price crash, renewable stocks will meltdown like they did in mid 2008.

Coal: Coal companies are a fairly sure bet because beyond any doubt – despite the climate change concerns – coal will be needed to fuel China’s massive expansion. Coal power 65% of all of the world’s power stations so it’s not likely to go away. Coal reserves are becoming more depleted and coal prices are likely to rise. Any small coal mining company outside China that is growing is a takeover candidate for the Chinese – so stock prices will likely rise above trend as energy supplies become tighter.

Power Turbines: As the number of power stations increases following the global pop ulation explosion, then companies that manufacture electric turbines will probably do well. We are thinking about companies like General Electric. The US government are giving out huge subsidies to stimulate clean power generation and companies like General Electric are well set to prosper.

ulation explosion, then companies that manufacture electric turbines will probably do well. We are thinking about companies like General Electric. The US government are giving out huge subsidies to stimulate clean power generation and companies like General Electric are well set to prosper.

Food: We don’t feel comfortable advising anyone to invest in food – this drives up food prices and can lead indirectly to people going hungry. Hence we’d suggest avoiding any investment in food as a commodity – because somehow it doesn’t feel right.

Countries to Avoid: We would avoid any investments with any exposure to:

· Israel

· Jordon

· Egypt

· Syria

· Lebanon

· Tunisia

· North Africa and the Middle East

Risk levels have now exploded because of the “Tunisia Black Swan” effect.

Asymmetric Instability: The reason is tha t we believe there will be a big increase in instability, in-fighting and potential one or more new civil wars. There is also the threat of a regional war. Terrorism is likely to increase as disparate groups are able to more freely operate in the region and radical groups try to seize power. We are particularly negative on North Africa and the Middle East because the economic pressures caused by Peak Oil are just starting to cause turmoil and we believe the issue will escalate – as impoverished desert nations with massive oil and food imports fall over like the Soviet Union did because oil prices were very low in the late 1980s (cutting off their export revenue). The countries that export huge amounts of oil should consider how they might reduce the oil prices to help their neighbours and stability – this would also of course reduce food prices.

t we believe there will be a big increase in instability, in-fighting and potential one or more new civil wars. There is also the threat of a regional war. Terrorism is likely to increase as disparate groups are able to more freely operate in the region and radical groups try to seize power. We are particularly negative on North Africa and the Middle East because the economic pressures caused by Peak Oil are just starting to cause turmoil and we believe the issue will escalate – as impoverished desert nations with massive oil and food imports fall over like the Soviet Union did because oil prices were very low in the late 1980s (cutting off their export revenue). The countries that export huge amounts of oil should consider how they might reduce the oil prices to help their neighbours and stability – this would also of course reduce food prices.

Below is a ranked list of Middle Eastern and North African countries – the top have the highest oil and gas exports per person in that country and would therefore seem on the face if it to be most stable – because they can afford to subsidize energy and food prices for their rapidly expanding populations. The ones at the bottom of the list have no oil or gas exports. We have p ut a star against those countries that have incurred social unrest in the last three weeks.

ut a star against those countries that have incurred social unrest in the last three weeks.

· Qatar - lowest risk

· Kuwait

· Saudi Arabia

· Libya

· Oman

· UAE

· Iraq - oil boom starting -

· Iran

· Algeria

· Syria

· Egypt *

· Tunisia *

· Jordan *

· Bahrain

· Morocco

· Lebanon

· Palestine

· Afghanistan - highest risk

Insights: We hope this Special Report has helped frame some opportunities and threats for your investment strategy. And help keep you on the track of higher returns and reduce the risk of losing the lot. If you have any comments, please contact us on enquiries@propertyinvesting.net

Peak Oil Forecast: Model Updated July 2010 - no significant oil production increase after the peak of mid 2008. Summation of 100 countries oil production forecasts and oil consumption forecasts - "bottoms up build" and analysis - by PropertyInvesting.net

Take A Look: It's easy to predict which countries will benefit from Peak Oil by referring to our latest analysis of 2011 forecast production and consumption levels and $95/bbl oil prices - based on our mathematical modelling. (Hope you can understand why we are bullish on Norway property investment).

Russian Federation

Net Oil Export or Import

Thousands Barrels A Day

Value Per Annum $ Bln

Population Mln

Surplus-Deficit - $/ Person/Annum

7,237

251

145

1,731

Saudi Arabia

7,118

247

24

10,497

Iraq

2,834

98

24

4,094

Iran

2,532

88

68

1,300

United Arab Emirates

2,531

88

5

17,551

Kuwait

2,338

81

3

27,023

Nigeria

2,061

71

131

548

Norway

1,948

68

5

13,509

Venezuela

1,614

56

28

1,999

Algeria

1,549

54

35

1,534

Kazakhstan

1,521

53

16

3,295

Libya

1,510

52

6.5

8,053

Qatar

1,168

41

1.4

28,929

Canada

1,125

39

32

1,222

Azerbaijan

1,026

36

8

4,445

Mexico

801

28

108

257

Colombia

509

18

46

384

Vietnam

366

13

87

146

Malaysia

272

9

27

349

Ecuador

267

9

14

681

Brunei

161

6

0.4

13,976

Argentina

131

5

40

114

Turkmenistan

87

3

5

602

Denmark

67

2

6

419

Egypt

-8

0

83

-3

Peru

-26

-1

12

-75

Uzbekistan

-103

-4

12

-298

Romania

-118

-4

45

-91

Brazil

-241

-8

180

-46

United Kingdom

-304

-11

60

-176

Indonesia

-377

-13

231

-57

Australia

-411

-14

22

-648

Thailand

-665

-23

64

-360

Netherlands

-1,054

-37

17

-2,150

Spain

-1,433

-50

46

-1,080

Italy

-1,462

-51

60

-845

France

-1,900

-66

58

-1,136

South Korea

-2,327

-81

48

-1,682

Germany

-2,475

-86

82

-1,042

India

-2,493

-86

1034

-84

Japan

-4,309

-149

128

-1,167

China

-5,734

-199

1309

-152

USA

-12,385

-429

288

-1,493

PropertyInvesting.net analysis

At $95/bbl early 2011 price