366: Oil price skyrockets again well into danger zone - recessionary crash by end May 2011

02-24-2011

PropertyInvesting.net team

North Africa and Middle East: What is happening in North Africa and the Middle East is incredibly complex and difficult to understand. On the face of it, it seems like a contagious uprising against autocratic rulers. But this is far too simplistic. Instead, the underlying issues are probably a combination of:

· Booming young and growing population

· Rising food and energy prices

· Shortage of opportunities high unemployment (lack of jobs)

· Water and land shortage reducing opportunities for expanding population to work productively on the land

· Inter-country tribal and/or ethnic frictions

· Stirring of trouble and escalation of resentments from radical fringe groups

· Lack of US leadership and support within the region (gone are the days of the USA being the policeman they are now absent)

· Old autocracies crumble as young ambitious groups demand change and more freedom

· Facebook, Twitter and Internet have meant greater access for organised protest groups and greater transparency

· High oil prices with underlying cause from Peak Oil either: 1) cause hardship in oil importing nations or 2) resentment in oil exporting nations as the expanding young population sees none of the benefits and only high food prices

Soviet Collapse Parallel: It has many of the parallels of the collapse of the Soviet Union as outdated and economically inefficient autocracies crumbled in short order in part from low oil prices as Saudi Arabia flooded the oil markets at the behest of Ronald Reagan back in mid 1986. By end 1989 the economic collapse caused new democracies to form and lead to war in Bosnia (between Christians and Muslims in the region).

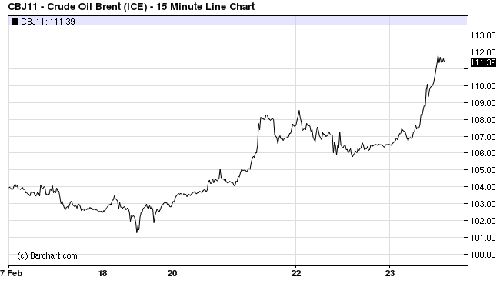

Brent Crude Oil Price Shock Rockets

Peak Oil Underlying Issue: This time, it could be that the high oil price caused by OP ECs lack of spare capacity (or desire to have a fair oil prices of $100/bbl) is the trigger for the collapse of these autocracies. What is worrying is the lack of intervention of developed nations like the USA and Europe and lack of support by the USA for security in the region viz-a-vis Israel - the real danger is this contributes to highened tensions than a regional war and/or multiple civil wars. The winner so far looks like Iran sitting on the sidelines and sending the occasional warship through the Suez Canal to distract against its own domestic problems and its desire to enrich uranium for its defence forces.

ECs lack of spare capacity (or desire to have a fair oil prices of $100/bbl) is the trigger for the collapse of these autocracies. What is worrying is the lack of intervention of developed nations like the USA and Europe and lack of support by the USA for security in the region viz-a-vis Israel - the real danger is this contributes to highened tensions than a regional war and/or multiple civil wars. The winner so far looks like Iran sitting on the sidelines and sending the occasional warship through the Suez Canal to distract against its own domestic problems and its desire to enrich uranium for its defence forces.

Israel, Palestine and Iran: What most western nations will never fully understand or acknowledge is the depth of hatred within the region for Israel and the degree of volatility that a power vacuum can cause in a region where different tribes and religions find it difficult living side-by-side peacefully. The economics of the situation and rational logic might not win through when such festering hatred exists. As Iran becomes increasing desperate with a volatile youthful and rapdily expanding population, it will want to ferment instability within the region to distract against its own internal problems whilst driving the oil price higher to gain revenues to appease the massively expanding young population. As the USA distances itself from the Middle East regional security issues it will leave the door open for Iran and a threatened Israel to have a head-to-head stand-off or worse.

Tensions Likely to Remain High: Were trying to give a frank appraisal albeit we do not claim to be particularly knowledgeable about the region (although members of our team have lived there for some years). But what we are exploring with this analysis is investment risk to steer our website visitors into the best investments and steer clear of the worst investments. Tensions will remain high.

Collapse - A Tipping Point: Are we alone in thinking it very strange that Presid ent Obama pulled the rug from President Mubarak - so quickly - after the US supported this regime for 30 years. Then three weeks later stays absolutely silent when one of USA's least friendly persons - namely President Gadaffi - rises up against his own people? The first intervention created a tipping point for regional regime collapse and instability. The second non-intervention means Gadaffi's chances of retaining power have increased. No government anywhere in the world is doing anything to hassen his departure - yet, everyone seemed to jump on President Bubarak - this seems most strange to say the least. Libya could go the way of Lebanon in the 1970s as civil war breaks out between factions in the west and east - its a very disturbing prospect.

ent Obama pulled the rug from President Mubarak - so quickly - after the US supported this regime for 30 years. Then three weeks later stays absolutely silent when one of USA's least friendly persons - namely President Gadaffi - rises up against his own people? The first intervention created a tipping point for regional regime collapse and instability. The second non-intervention means Gadaffi's chances of retaining power have increased. No government anywhere in the world is doing anything to hassen his departure - yet, everyone seemed to jump on President Bubarak - this seems most strange to say the least. Libya could go the way of Lebanon in the 1970s as civil war breaks out between factions in the west and east - its a very disturbing prospect.

Possible Upside - With Rose Tinted Glasses: The upside to what is happening is that the new urban educated middle classes wanting freedom, free speech and democracy are able to develop new stable prosperous Arab nations at peace with their neighbours. It could be different this time - because rather than tribal desert and less educated peoples - we have highly educated, motivated and knowledgeable individuals that will pull together using all their resources, innovation and hard work to develop a new free civic societ y. Some parts of the region could go this way - Egypt for example. Though it seems rather unlikely this type of stability will be achieved all across the region, especially in areas where tribal or religious conflict is festering beneath the surface. And radical group can gain the upper hand. We believe the chance of achieving this upside is maybe 25%.

y. Some parts of the region could go this way - Egypt for example. Though it seems rather unlikely this type of stability will be achieved all across the region, especially in areas where tribal or religious conflict is festering beneath the surface. And radical group can gain the upper hand. We believe the chance of achieving this upside is maybe 25%.

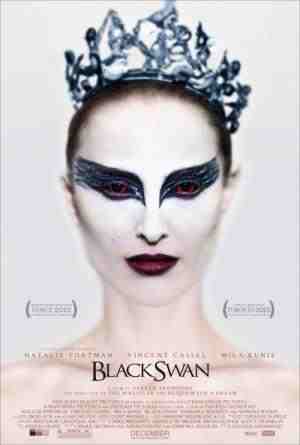

Black Swan - developing: The following advice is consistent with what we have been saying all year ever since we identified Tunisia as the Black Swan on 17th January. It looks increasingly likely the mother of a Black Swan event similar to Beirut-Lebanon in the 1970s all over again but this time on a regional scale. We'd give this a 50% chance. So for the investors all of you that visitor our website:

Safe Havens: There will be a shift from "risk" to "safe havens":

· Swiss franc and Switzerland

· Oil production-exploration companies (not exposed to North Arica and Middle East)

· Uranium

· Rare Earth Metals

· Gold

· Diamonds

· Sub-Saharan African Mining Companies (until mid 2011)

· NW Europe London/Paris/Munich/Vienna/Geneva/Stockholm/Oslo

· West London prime property Chelsea, Kensington

· Cigarette companies with high dividends

· Tax havens Geneva, Malta, Luxemburg. Channel Islands, Bermuda

Shift From Risk: There will be a shift away from risk in:

· North Africa and the Middle East

· Nigeria (elections in April)

· Airlines and tourism

· Car companies

· Banks

· Retail - shops

· USA US dollar (as currency crashes weighed by massive oil import costs)

· Indebted countries like Greece, Spain, Ireland, Belgium, Italy, Portugal, USA

· Possible crisis in China from a property bubble, unsustainable growth or riots/disturbances

Crash Within 3 Months If Oil >$100/bbl: We have another 2-3 months before a big crash. We predict a big market crash in or by early May 2011 after the affects of the oil price spike has quickly worked its way through. Up until then, the markets should be jittery and everyone will be in denial - bankers and politicians alike. The banks will be putting on a brave face to allow maximum flows of c ash into investments and the stock markets, before the senior investment bankers bail out and leave the average punter high and dry (again, just like in March 2000, Sept 2001 and July 2008). Lets face it the brutal truth is the retiring baby-boomers will drive prices higher in a short sharp bubble fuelled by Obamas ridiculous $2 Trillion of printed money then just before the summer holidays, theyll bail out big time and head for the hills possibly for the last time. They always have done. And always will do. Lets be frank who thinks these loyal investors will hang around for the long term - "it's not a charity" as they say. They make money on the ups and downs. They drive it up. Then short it down. No amount of government rhetoric or regulation will stop this. It's just about to happen again.

ash into investments and the stock markets, before the senior investment bankers bail out and leave the average punter high and dry (again, just like in March 2000, Sept 2001 and July 2008). Lets face it the brutal truth is the retiring baby-boomers will drive prices higher in a short sharp bubble fuelled by Obamas ridiculous $2 Trillion of printed money then just before the summer holidays, theyll bail out big time and head for the hills possibly for the last time. They always have done. And always will do. Lets be frank who thinks these loyal investors will hang around for the long term - "it's not a charity" as they say. They make money on the ups and downs. They drive it up. Then short it down. No amount of government rhetoric or regulation will stop this. It's just about to happen again.

Peak Oil Inefficiency: As oil prices sky-rocket this acts like a monstrous additional tax on all western oil importing nations. It slows growth and increases unemployment. This is undeniable. And yet in the Middle East and North Africa, the oil revenues are needed and used to give state hand-outs to ke ep the ever increasing youthful populations quiet subsidies for food, housing and fuel. The economic model is totally economically inefficient. It does not lead to improvements in conservation, efficiency or economic well-being. Performance is not rewarded within a market place. The outcome is that global economic growth will always drop as oil prices rise and there is a gigantic transfer of wealth from western oil importing nations to OPEC Middle Eastern oil exporting nations. About $2 Trillion a year at $100/bbl.

ep the ever increasing youthful populations quiet subsidies for food, housing and fuel. The economic model is totally economically inefficient. It does not lead to improvements in conservation, efficiency or economic well-being. Performance is not rewarded within a market place. The outcome is that global economic growth will always drop as oil prices rise and there is a gigantic transfer of wealth from western oil importing nations to OPEC Middle Eastern oil exporting nations. About $2 Trillion a year at $100/bbl.

Peak Oil Was 2005 crude oil: Peak Oil was July 2008 for all types of oil (including NGLs, biofuels, unconventional oils etc). Yes, total oil production has not risen for six years. Yes weve been on an undulating plateau for 6 years how come no-one seems to have noticed. Its so obvious its staring us in the face! OPEC exports dropped 2% in December 2010 before any turmoil hit and in the middle of a nice warm Middle East winter and severe European and US cold winter just wait until electricity shortages hit with the use of air conditioners by mid 2011 all the OPEC countries needing to burn oil to fuel power stations. Exports will surely drop further also as the population increases further in OPEC nations. About 1 million bbls/day has now been taken off the market with Libya in turmoil. Other countries could follow. Nigeria has elections in April 2011 producing 2.2 million bbls/day with a real threat of disruption. Everyone was producing flat-out and oil prices rose to $100/bbl. Now the spare capacity is likely in our view - to be less than 1 million bbl/day hence to develop demand destruction, oil prices will need (and will) skyrocket in the next few months. Then by end 2011 they will probably crash after another global recession sets in.

Asymmetrical Outcomes: The affects of this transfer of wealth are asymmetrical because only half of the North Africa and Middle Eastern countries export oil. Therefore high oil prices will lead to increased instability as there is a bigger difference between wealth within the region and amongst its people - the poor and the elite. This seems to have been lost on OPEC as they have described $100/bbl as a fair oil price. A fair price for who? Do they think this price is sustainable and beneficial for the global economy never mind countries within their region? In summary, individual OPEC nations only really care about their own countries probably understandable in the local circumstances but the wave of unrest sweeping the region probably has quite a lot to do with Peak Oil and high oil prices leading to a global slowdown, high inflation, high food prices and discontent in both poor and wealthy North Africa and Middle Eastern countries. We can only hope that fundamentalist elements to do seize the opportunity to expand their influence regrettably most people remain deeply worried and sceptical that the utopian democratic peaceful outcome will transpire in North Africa and the Middle East, particularly looking back in history with the different factions and distrust within groups in the regio n and their distrust of the "west".

n and their distrust of the "west".

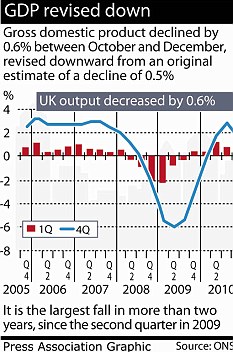

UK In Recession And No One Has Noticed: We actually think the UK has slipped back into recession end 2010 its just that no-one has realised yet. It will be like a repeat of 2008 all over again but this time worse. The reason is that instead of a banking financial collapse it will be one level higher namely sovereign debt financial collapse. This time Germany and USA will be powerless to intervene and China will not have the stomach for it either instead focussing on keeping their massive population happy.

Why Not? Just ask yourself why do you think the world is now able to handle higher oil prices than in 2008? On an average yearly basis, oil prices are now higher than in 2008. Greece and Portugal are about to financially fold its just that Germany and the European Bank has not let on yet.

Greece's Deficit Just Skyrocketted Again: When oil prices were $55/bbl - Greece's defi cit was about 13% of GDP. Even after severe spending cuts, now that oil prices have risen to $110/bbl and the Euro has recovered against the dollar, this hike as added about -2.5% to the Greek GDP deficit because of their gigantic oil imports and relatively small GDP ($16 bln oil import bill at $110/bbl with GDP of $330 bln). So their deficit according to our rough calculations should be about 15.5% now. If this is not enough for debt default - we don't know what is. We believe the North African-Middle Eastern security situation coupled with Peak Oil will then cause the Euro-zone to split because the Greek currency will have to de-couple and drop to about 55% of its current value to allow the country to remain competitive. This is most important for anyone considering buying property in Greece (or Spain, Italy and Portugal for that matter). Expect the Sterling or Euro value to drop by 45% if this happens. Hence our guidance is - don't even consider buying properties in such countries where the currency could crash out of the Euro. Very risky. Also bear in mind Spain uses 3.4% of its GDP for oil imports at $110/bbl, Holland 4.6% and South Korea a monstrous 9.7% with France and Italy in the arange 3.5%. This is excluding coal and gas import bills.

cit was about 13% of GDP. Even after severe spending cuts, now that oil prices have risen to $110/bbl and the Euro has recovered against the dollar, this hike as added about -2.5% to the Greek GDP deficit because of their gigantic oil imports and relatively small GDP ($16 bln oil import bill at $110/bbl with GDP of $330 bln). So their deficit according to our rough calculations should be about 15.5% now. If this is not enough for debt default - we don't know what is. We believe the North African-Middle Eastern security situation coupled with Peak Oil will then cause the Euro-zone to split because the Greek currency will have to de-couple and drop to about 55% of its current value to allow the country to remain competitive. This is most important for anyone considering buying property in Greece (or Spain, Italy and Portugal for that matter). Expect the Sterling or Euro value to drop by 45% if this happens. Hence our guidance is - don't even consider buying properties in such countries where the currency could crash out of the Euro. Very risky. Also bear in mind Spain uses 3.4% of its GDP for oil imports at $110/bbl, Holland 4.6% and South Korea a monstrous 9.7% with France and Italy in the arange 3.5%. This is excluding coal and gas import bills.

UK Interest R ates: We find it quite remarkable that the Bank of England has watched inflation rise to 5% and kept interest rates at 0.5%. One can only imagined they either want the UK nationalised banks to make serious money out of the average UK mortgage borrower for as long as possible - to feed into the government coffers. Or they are genuinely behind the curve and do not knowing it. Inflation is now out of control - period - and its rather too late to do anything about it. Because oil prices are sky-rocketting, we expect the Bank of England to start raising interest rates just before the economy crashes again. They will look rather late to put it kindly - and foolish of our prediction is accurate. So expect a shift in rates either March, April or May 2011 - then a general market crash in May once everyone realises the USA, UK and Europe are in recession again. Once unemployment rises by year end and GDP is confirmed as well into recession, all the talk will be about printing money again (and bringing rates back down to 0.5%), if there are any takers for the UK government debt that is. We regret being so miserable about this. What we cannot get our head around is, if the BoE's Monetary Committee's key objective is inflation stability at 2% target rate, why they have let inflation rise to 5% whilst stubbornly keeping interest rates at 0.5% over an extended 2 year period. Inaction, indecisive, too late and too slow. The inflation genie is out the bottle and it will now lead to a crash - far away from the inflation stabilit

ates: We find it quite remarkable that the Bank of England has watched inflation rise to 5% and kept interest rates at 0.5%. One can only imagined they either want the UK nationalised banks to make serious money out of the average UK mortgage borrower for as long as possible - to feed into the government coffers. Or they are genuinely behind the curve and do not knowing it. Inflation is now out of control - period - and its rather too late to do anything about it. Because oil prices are sky-rocketting, we expect the Bank of England to start raising interest rates just before the economy crashes again. They will look rather late to put it kindly - and foolish of our prediction is accurate. So expect a shift in rates either March, April or May 2011 - then a general market crash in May once everyone realises the USA, UK and Europe are in recession again. Once unemployment rises by year end and GDP is confirmed as well into recession, all the talk will be about printing money again (and bringing rates back down to 0.5%), if there are any takers for the UK government debt that is. We regret being so miserable about this. What we cannot get our head around is, if the BoE's Monetary Committee's key objective is inflation stability at 2% target rate, why they have let inflation rise to 5% whilst stubbornly keeping interest rates at 0.5% over an extended 2 year period. Inaction, indecisive, too late and too slow. The inflation genie is out the bottle and it will now lead to a crash - far away from the inflation stabilit y that we all desire. A sizable mini-bubble as formed off the back of Obama's $2 Trillion printed money - and its just about to pop again, off the back of Peak Oil and high oil prices.

y that we all desire. A sizable mini-bubble as formed off the back of Obama's $2 Trillion printed money - and its just about to pop again, off the back of Peak Oil and high oil prices.

Divest As Soon As Possible: So our advise is divest as fast as possible from now until end of April 2011 then take a seat and watch the crash. After a full year there could be a rebound and this would be the time to re-enter the market. There would likely be 2-3 big deep dips and you would have to select the deepest and hold your nerve to make the most spectacular gains. It really could be period of opportunity to double your money in a short period of time. All the investment bankers will no doubt be eyeing up the same opportunity - make no mistake.

Property Investment Steer: For property expect prices in the UK to slip down as interest rates rise from as early as March 2011 onwards - then the recession kicks in again. Rental demand will remain high and rental yields fairly strong in all areas close to London. Mortgages will be very difficult to find by end 2011 because banks will again be struggling. Mortgage  defaults will be on the rise by end 2011. Regrettably the landscape has now changed since oil prices have risen above $110/bbl all growth bets are off.

defaults will be on the rise by end 2011. Regrettably the landscape has now changed since oil prices have risen above $110/bbl all growth bets are off.

Bleak Outlook: We regret we are so bleak it all looks so healthy at this time. But there are huge economic issues related to Peak Oil dislocation - current measures such as printing money and giving hand-outs appear to be "papering over the cracks". We are entirely consistent with our views expressed in the last 3 years that the world economy cannot handle oil prices over $100/bbl for any period of time (e.g. a few months). Festering underneath the surface is a big shock about to happen. If it does not happen, it will be the first time in the worlds history that high oil prices did not lead to a massive economic shock. The shock will be in a few months time and the ball is rolling fast now oil prices have risen to $114/bbl (Brent crude). It wont be a shock to us though - we hope it wont be for you either. Its time to take the profits and run for the hills. And dont expect the problems in North Africa and the Middle East to get any better its looking particularly bleak and in the early stages of a gigantic Peak Oil shock.

Surplus/Deficit: The table below shows our analysis of the transfer of wealth from oil importing to oil exporting nations - and how much this is worth per person at $110/bbl. The analysis is based on current oil exports (production minus consumption) - except for Libya which has curtailed production in the last few days.

Net Oil Export or Import

Thousands Barrels A Day

Value Per Annum $ Bln

Population Mln

US$ Surplus/Deficit Per Person Per Annum

Qatar

1,168

47

1.4

33,497

Kuwait

2,338

94

3

31,290

United Arab Emirates

2,531

102

5

20,322

Brunei

161

6

0.4

16,183

Norway

1,948

78

5

15,642

Saudi Arabia

7,118

286

24

12,154

Libya

1,510

61

6.5

9,325

Azerbaijan

1,026

41

8

5,147

Iraq

2,834

114

24

4,741

Kazakhstan

1,521

61

16

3,816

Venezuela

1,614

65

28

2,314

Russian Federation

7,237

291

145

2,004

Algeria

1,549

62

35

1,777

Iran

2,532

102

68

1,505

Canada

1,125

45

32

1,415

Ecuador

267

11

14

789

Turkmenistan

87

3

5

697

Nigeria

2,061

83

131

634

Denmark

67

3

6

486

Colombia

509

20

46

445

Malaysia

272

11

27

404

Mexico

801

32

108

298

Vietnam

366

15

87

169

Argentina

131

5

40

132

Egypt

-8

0

83

-4

Brazil

-241

-10

180

-54

Indonesia

-377

-15

231

-65

Peru

-26

-1

12

-86

India

-2,493

-100

1034

-97

Romania

-118

-5

45

-105

China

-5,734

-230

1309

-176

United Kingdom

-304

-12

60

-204

Uzbekistan

-103

-4

12

-345

Thailand

-665

-27

64

-417

Australia

-411

-17

22

-750

Italy

-1,462

-59

60

-979

Germany

-2,475

-99

82

-1,207

Spain

-1,433

-58

46

-1,251

France

-1,900

-76

58

-1,315

Japan

-4,309

-173

128

-1,351

USA

-12,385

-497

288

-1,728

South Korea

-2,327

-93

48

-1,948

Netherlands

-1,054

-42

17

-2,489

PropertyInvesting.net analysis

At $110/bbl 24 Feb '11 price

UK entering another recession - further evidence of Peak Oil

Returns: We hope this Special Report has helped your investment strategy and analysis to shape your investment decisions moving forwards through 2011. If you have any comments, please contact us on enquiries@propertyinvesting.net.