373: The bubble about to pop

04-07-2011

PropertyInvesting.net team www.google.co.uk

www.google.co.uk

Markets Stable – But Not For Long: We actually find it quite remarkable that the stock markets are so stable and investors do not seem particularly worried about the North Africa and Middle Eastern situation. May be everyone has got used to the stream of bad news. But just consider this:

Libya: Gaddafi is bombing his own oil fields – NATO is bombing Gaddafi. The rebels ar e not capable of bombing anyone. NATO does not want to arm the rebels or send in any troops but wants to give the rebels the upper hand. What a complete and utter mess. Why and how come NATO got involved. Is that really a "no fly zone"?

e not capable of bombing anyone. NATO does not want to arm the rebels or send in any troops but wants to give the rebels the upper hand. What a complete and utter mess. Why and how come NATO got involved. Is that really a "no fly zone"?

In addition:

· Syria: Is waiting to go up

· Bahrain: This issue is not likely to go away – especially with the Iranians getting involved

· Saudi Arabia: So many years of autocratic kingdom rule – looking rather shaky

· Nigeria: Hundreds of people have died in the last few months in the run up to elections that were deferred by two weeks on 3 April - now planned 16 April – an accident waiting to happen

· Gabon: An oil worker strike shut down production for three days on 1 April

· Tunisia: A new government is needed

· Yemen: Just getting worse – three sectarian tribes with little trust and a history of violent conflict – looks particularly bleak

· Iran: Sanctions creating economic tension – an unstable situation with occasional rioting does not look like improving

· Jordan: Once a calm safe haven, but looking increasingly exposed

· Israel: The elephant in the room – now getting little political support from the USA and will need to “go it alone” to maintain its grip on security

· Algeria: Always been a trouble spot with riots in poor suburbs

· Oman: Even Oman has had severe riots

· Tunisia: Where it all started – the “Black Swan”

· Egypt: 85 million people living in a desert with declining oil production and unstable government

The only countries that look like they are not getting any worse are Iraq, Kuwait, Lebanon, Qatar and possibly UAE.

Cities In Deserts Are Unsustainable: All these countries, in general, have young fast growing populations with old autocratic leaders, high levels of corruption and/or unfairness, poor women’s rights, high unemployment, big cities in deserts with declining oil production per person and water scarcity. It's not as if the unemployed can work the land like in central Africa – it’s not fertile and it’s too hot, it's uncomfortable and frankly dangerous. The only reason so many people are able to live in the desert is because of oil – and if/when the oil or gas starts running out with not enough to go around – big troubles will follow. These countries have no coal, metals, agriculture or food production to spe ak of – almost all food is imported. That's what we call unsustainable.

ak of – almost all food is imported. That's what we call unsustainable.

Wastage in the West: Meanwhile the western world thinks it can continue to use huge oil supplies – with almost no regard for energy efficiency in the blind faith that oil will not run short. China pulls like crazy on oil so it can build huge cities and house 1.5 Billion people. India ditto – building homes and cities for 1.2 Billion people. The world had 3.5 Billion people in 1950 and now has 7 Billion – by 2050 there will be 9 Billion people – and less oil. The bottom line is – there is not enough oil and other resources to go around.

Crazy Low Rates: Interest rates remain stupidly low in the USA and UK – both governments are scared to do the “right thing” and control the rampant inflation. It’s almost as if these governments expect a 5-7 year economic cycle to start from the mid 2008 crash with a misguided belief that inflation will drop back to “target levels” by mid 2012. Both governments have been printing money like there is no tomorrow. Becoming increasingly indebted. In our view, its mismanagement – and will lead to a crash very shortly. We are into a different game – but everyone thinks its the same 7 year cycle game - when its a 3 year cycle instead.

Bumpy Peak Oil Plateau: What’s happening is - we're bumping along a Peak Oil plateau – where oil scarcity is dictating world growth rates. There’s not enough cheap oil to keep Europe and the USA going – so we all better get used to lower growth rates and stagflation.

Oil Is The New Interest Rate: The new interest rate mechanism is actually oil prices. Governments have lost control of their economies – it is now being controlled by OPECs ability to produce oil or not. As oil wars continue to break out and oil prices rise, global GDP growth will drop. You see, the proceeds of high oil prices go for hand-outs in desert cities – to keep the masses silent whilst the autocrats line their pockets. It’s the brutal truth regrettably. The money is either squandered on luxuries for the elite or given out in social subsidies to the poor youthful expanding populations. That is one of the key reasons why the world drops into recession every time oil prices sky-rocket. The profits do not go into investments to make returns and create real value – they go into spending, subsidies – destroying value. This is one of the key fundamental economic principles that seems to be missed by economic commentators. This time it will be no different.

Dollar and Oil: As the dollar declines and people lo se confidence in the value of printed money with rampant inflation – physical or contractual oil will gain value – something physical that can be used to generate energy and production. If oil is ever priced in anything but the dollar – then the dollar will crash. It’s value is based on the fact that we all need to buy dollars to buy oil.

se confidence in the value of printed money with rampant inflation – physical or contractual oil will gain value – something physical that can be used to generate energy and production. If oil is ever priced in anything but the dollar – then the dollar will crash. It’s value is based on the fact that we all need to buy dollars to buy oil.

Recession Is The rational Outcome: So – as we have been saying for 6 years – whenever the oil prices rise above $120/bbl – a recession will begin. It’s just that no-one will notice for 3-6 months. But when they do, there will be another crash and this time sovereign debt default (most likely in Greece, Ireland and Portugal). Why do we think the global economy can handle $120/bbl oil now when it couldn’t mid 2008?

Why: Why do we think these countries are particularly exposed to the crash?

· Aging populations with rising unemployment

· No oil, coal, gas, metals or nuclear production and no hydro-electric

· Not well known for agricultural production

· Massive deficits exposed to Peak Oil – and high oil prices

· No acumen in manufacturing or financial services

· Tax receipts not nearly enough to pay for spending

· Exchange rates far too high – need to be decoupled from the Euro - France and Germany

· Peripheral to main Eurozone manufacturing power-base

· Exposed to climate change

· Low GDP created per unit of oil burnt – inefficient oil usage

Property Fall: We expect property in UK Sterling terms to be worth about 40% less in 3 years time – mostly caused by a currency decoupling from the Euro. The message is – don’t invest in anything in these countries at the moment – their economies will only deteriorate with rising oil prices and have at least a decade of decline or stagnation to look forward to. Italy and Spain will not fare much better – because they also have huge oil import bills and large deficits and are saddled with an uncompetitive exchange rate – their currencies would normally be at least 20% lower than France and Germany – and more in tandem with UK Sterling exchange rates.

Bleak: Indeed, the picture is bleak. If you believe us – you will get out into cash quickly – get your risk money off the table.

If you hang in there – you might get lucky and if you do – well done and we hope you are ri ght.

ght.

If things keep growing steadily, just remember it will be the first time this has ever happened – that oil prices has spiked up without causing a recession and a stock market drop.

Highest Ever Oil Price In UK: Also note that in UK Sterling terms, oil prices in the UK are now higher than in mid 2008 when they hit $147/bbl. That’s what we call extremely dangerous. And the economy is in a more fragile state. The bad debt has also been transferred from banks to government – or sovereign debt. Once the bad debts get to government level – there is nowhere else to go for a bail out. That’s been the key issue for the last four years. As governments start getting into trouble with debt – there is no-where to go – unless we’re missing something.

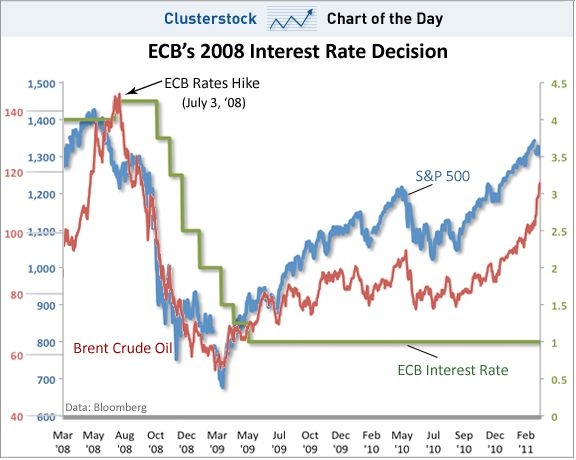

Stocks and Oil Boom Then Crash Together: Take a look at the chart below. As the stock market booms so does the oil price – as everyone looks to strong growth. People pile into stock market risk and oil price risk as things look as if they will continue to boom. The herd instinct. Euphoria - call it what you like. This off the back of either printed fiat money, low interest rates or both. But can you also now see that this can change very quickly and its not sustainable?

Familiar Cycle: Firstly interest rates will rise. Printed money will end on 20th June 2011. Oil prices will act like a huge tax. And the whole lot will come crashing down again. It definitely looks like a good old fashioned bubble to us – that's specifically global stock market values and oil prices. It was caused by low interest rates, printed money and bad debt. With investment banks building the bubble - ready to duck out. By the summer – we are pretty sure the bubble will have popped.

Short Sharp Bull Run Is Over: We always thought this bull market would be short and sweet – mainly because Peak Oil is now behind us now – maximum oil production was 2005 (crude oil) or July 2008 (all oil liquids including biofuels and NGLs). Nothing has dissuaded us otherwise trawling through all data sources – and in the last year the actions of the US Obama administration has convinced us that bad times are around the corner – examples:

· $2 Trillion of printed money

· Medicare spending of $6500/person per year – totally unsustainable

· Banning of offshore drilling just when oil scarcity begins

· Tax receipts of $1.75 Trillion with spending of $2.75 Trillion

· Record oil imports – with oil production set for a decline in 2012 after offshore drilling bans imposed

· Indecision on agreeing budgets leading to a government shutdown

· Lack of energy efficiency and conservation measures introduced despite Peak Oil

· Lack of leadership in world security

· Interest rates too low - stimulating the bubble

What We’d Do: You might wander what we would do if we were the government – in the UK we would start with:

· Setting a target to reduce oil consumption to match oil production – therefore preventing oil imports

· Reduce offshore tax to stimulate offshore drilling and production – to boost production levels

· Educate people in energy efficiency and conservation

· Give tax incentives for energy efficient cars, factories and offices

· Increase tax on energy consumption (but not supply-production)

· Increase interest rates to prevent inflation getting out of control

· Stop printing money

· Cut public sector spending

· Stop bombing Libya

· Start planting deciduous forests – for wood (bio-mass)

· Encourage higher yields in arable and farming

· Stop building roads (can't afford them) – invest more in upgrading rail capacity

· Encourage car sharing and purchase of small energy efficient cars

· Force banks to lend at reasonable rates – say 1% over base rate (rather than 5%)

What the UK needs is to balance energy production and consumption – otherwise our deficit will sky-rocket in future years.

Banks Charging The Earth: As you can understand – anyone with a mortgage is bein g fleeced at this time – because base rates are 0.5% and lending rates are about 5.5%. Banks are making 5% above base rate – that’s daylight robbery. The Bank of England lets this happen because they own 75% of the big banks now – so they get these gigantic profits. No wander rents are rising – because no-one can buy a property anymore and Landlords are not buying either – so the only way to make money in this tight rental market is to charge more rent to pay for the high bank charges – despite base rates being only 0.5%.

g fleeced at this time – because base rates are 0.5% and lending rates are about 5.5%. Banks are making 5% above base rate – that’s daylight robbery. The Bank of England lets this happen because they own 75% of the big banks now – so they get these gigantic profits. No wander rents are rising – because no-one can buy a property anymore and Landlords are not buying either – so the only way to make money in this tight rental market is to charge more rent to pay for the high bank charges – despite base rates being only 0.5%.

Interest Rates Move Up and Crash Follows: As interest rates rise, it’s likely property prices will drop again. We think just as the government starts increasing interest rates, the crash will start – firstly with the stock market crashing along with oil prices, then inflation dropping back, deficits increasing and possible one last attempt to re-inflate the economy with printed money. Jobs losses will be high. Businesses will go broke. It looks most likely in our view this will happen in June or July this year.

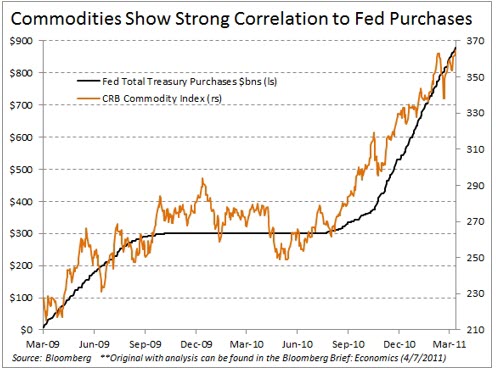

If You're Not Convinced Yet, Take A Look At This: As you can see - printed money = oil price rises = bubble (waiting to burst). When QE ends 30 June 2011, oil prices and everything else will drop. This asset bubble was created by $2 Trillion of Obama's printed money - no use blaming OPEC. The answer is on the printing presses of the US mint.

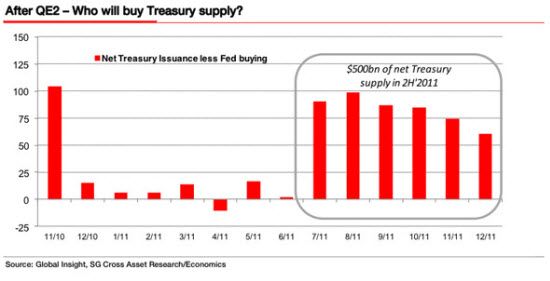

Take A Look At This: As you can also see, in the last five months, the US government has been buy almost all the debt, propping the whole lot up. Each $100 Billion purchase is calculated to add another $7/bbl to oil prices. Logically with 3.5 months of purchases left totalling $350 Billion, this would add $25/bbl to oil prices before they come crashing back down - that's if the speculators ride all the way to the top. They're not stupid, so they are likely to start bailing out a month or so before then. Expect oil prices to rise over $122/bbl (Brent) - to a maximum of $147/bbl before crashing at or before end June 2011 (by likely coincidence, the $147/bbl is what oil prices reached in mid July 2008 before crashing). Along of course with the stock market - that will crash with oil. We don't know how much more explicit or accurate we can be. And ask yourself, who will buy the debt after 30 June? Answer - no-one in their right mind!

We predict the Dow Jones crashes to 8000 by end 2011 and oil prices crash to $70/bbl.

Human Nature, Holidays, End of QE: Part of this is human nature. All the big inve stors will bail out just before the schools break – and head for the hills – to their boats in the Med. They always have and always do. They’ll reduce their positions and enjoy a nice long summer holiday. The other trigger is the end of QE on 30 June. All knowledgeable investors know damn well that as soon as QE ends, US interest rates will rocket, and businesses will struggle. Then stock markets will crash and recessions will start again. You add this into the equation with oil prices rocketing, North African and Middle Eastern turmoil, a US government shutdown and Euro contagion – and you get the message – it’s time to duck out!

stors will bail out just before the schools break – and head for the hills – to their boats in the Med. They always have and always do. They’ll reduce their positions and enjoy a nice long summer holiday. The other trigger is the end of QE on 30 June. All knowledgeable investors know damn well that as soon as QE ends, US interest rates will rocket, and businesses will struggle. Then stock markets will crash and recessions will start again. You add this into the equation with oil prices rocketing, North African and Middle Eastern turmoil, a US government shutdown and Euro contagion – and you get the message – it’s time to duck out!

Get Out: Regret not much positive to report on this week. We hold to our central view that anytime from now on within the next 6 months will be a crash.

Get out – and don’t be the last one at the party.

Ever thought we might be the only ones telling the truth around here?