412: Inflation - past the point of no return - oil, gold, silver and the commodities super cycle

01-26-2012

PropertyInvesting.net team

Years of US money printing is finally catching up. The Fed will print much more in 2012 in the run up to the elections. Interest rates set by markets will start rising. Bond markets will collapse as inflation takes off - then gold and silver prices will go ballistic.

Desperate Fed: The Fed is now getting desperate. They announced today that US interest rates would stay at close to zero until well into 2014 – another 2½ years. Then they admitted that broader rates would be at 4% for the foreseeable future. They claimed inflation would stay at or close to 2%. They also indicated they would likely renew bond purchased in the foreseeable future. Th e stock markets and commodity markets reacted immediately and shot up. Why?

e stock markets and commodity markets reacted immediately and shot up. Why?

It’s Getting More Obvious: Because what they were saying was that confidence in the dollar is now in serious decline as the differential between their low base rates and actual market rates widens. They are putting more fuel on the fire of inflation. We just don’t believe inflation will stay at 2%. Un-manipulated inflation is running at more like 8%. The wave of dollars is about to hit the USA. When inflation takes off, there will be no tools left to control it. To all intense and purposed the Fed has already lost control. They know the only option left is to debase and destroy the dollar and its value. The objective is to destroy the debt, and attempt to kick start the US economy and create jobs by making imports more expensive and exports cheaper – a sort of phantom increase competiveness. The final outcome is likely to be a total re-set some time in the next 5 years. What we mean by this is hyper-inflation, banks folding, money turning to confetti and wider scale loss of fiscal control and default.

The reason why stocks and commodities – including gold and silver - went up today was because:

· Investors intuitively know that if inflationary easing takes place and base rates are unattractively low, its best to shift to equities (for dividends and inflation linked prices) or commodities (as inflation takes off).

· The smartest investors took the hint and rushed to the safe haven of gold and put bets on silver as hedges against inflation and a financial crisis.

· Miners did very well – a combination of equities and gold/silver prices rising.

Print Into Oblivion: It’s a sorry tale unfolding in front of us. But essentially it’s absolutely no surprise the Fed will continue printing money and cause global inflation. And other countries will have to compete with this flood of money and currency debasement by printing their own money. Otherwise they become uncompetitive on export pricing. The Fed is creating bubbles around the world by flooding the world (not just the US) with fiat dollars – Trillions of them – and the response from other countries will be their own printing sprees. Europe, China, Middle East and Africa will probably follow suit shortly. It will all lead to inflation – prices that you will not believe will occur in at few years time. The process is just getting started in earnest.

This is the reason why we are so bullish on:

· Silver prices

· Gold prices

· Oil prices

· Silver and Gold miners

· Oil exploration and production companies

In 1980, the total US stock market value was comprised of 25% miners (that’s oil, gas and metals mining). Now it is just 5%. That’s five time less. Why has the world changed so much and turned away from value in commodities? Surely with 7 billion people all desperate for commodities to build industry and housing, this value should be far higher? Is there really so much value in companies like Microsoft, Bank of America and Yahoo? Agriculture is only 1% of the US GDP – does this make sense? That’s why we think oil, silver, gold and miners are the stock/equity and physical investments to purchase at this time. They are destined to sky-rocket in price as the US dollar is destroyed. Also remember gold and silver is real money. It is a store of value. It has survived for centuries. All currencies are fiat. They are destroyed eventually. Just like the Mark was in Weimer Germany. The US dollar is now worth 3% of it’s 1922 value when the Fed was formed. The Fed has destroyed 97% of its value already. The next 2% destruction is likely in the next few years.

Cash Flowing Property: Cash flowing property (good rental properties) are attractive because interest rates are set to stay low for a while, bargains can be had because of lack of buyer competition and rental demand stays very high – no-one can afford to raise finance to pay for property – high fees and deposit make it prohibitive for most people. The banks don’t want to risk lending their money if property prices are to drop further. But eventually, what will happen is:

competition and rental demand stays very high – no-one can afford to raise finance to pay for property – high fees and deposit make it prohibitive for most people. The banks don’t want to risk lending their money if property prices are to drop further. But eventually, what will happen is:

· Interest rates will rise

· Borrowing costs will rise

· Rental prices will rise

· Rental demand will continue to rise

· Inflation will rise

· Property prices will rise, but not quite as fast as inflation

· Debts will decline in real terms

Debt Destroyed: Hence, anyone with properties will see their debts destroyed and their equities rise – and hence after this inflation cycle ends, they will be left with a property with very little debt – if they can hang on for the ride that is. You need to make sure you have enough cash for a few years of very high interest rates and turmoil. Many people will go bust. But if you survive and come out the other side okay with good quality long term tenants, then you will have a property largely owned by yourself rather than the bank. That is a key reason why people always buy property when inflation hits – it’s an excellent hedge against inflation because it is a real asset. It’s not a paper asset. It’s physical. You can use it. It flows cash. You can add value to it. As the global population increases and more money is printed – the best quality areas in the major cities will see good investment and rental demand. Hence any property you can buy for a low price in West London or close to Central London will probably be a good investment moving forwards. If you build up any cash reserves, best switch to gold and silver before the value is destroyed by inflation (and low savings interest rates).

the value is destroyed by inflation (and low savings interest rates).

But for the screaming best investment at this time, we would say this is:

Silver (physical pure silver bullion) - our price prediction is a top of $400/ounce some time in the next few years (current price $33/ounce) – yes, we are serious.

Returns Key: You might think this is weird coming from a property investing website. Well, we go for high returns and it’s just not honest or objective to advise buying loads of property at any stage in an investment cycle. You have to spot the bubble – get in early before it starts – then either stay for the long haul or get out before it crashes. The best investors always time the bottom of a crash and top of a bubble very well. It’s that simple.

What we mean by this is that the property bubble popped in 2007 and will continue to decline in real terms for many more years. The big property bull market bubble began in earnest in 1999 and became close to parabolic in 2004-2006. Then it popped in the US and UK end 2007. That does not mean it’s bad investment – because it will perform better than cash in the bank or bonds and probably equities in inflation adjusted terms – particularly if the relevant property flows cash. Much of the froth has been taken out of the market now – and it’s likely to stay in the doldrums for many years. But the richest people still have loads of money – the cheap printed money that Ben has provided the world. These international investors will be using this cash to buy prime real estate in safe haven places like West London, Monaco, Geneva and Singapore.

Super Cycle: But we are about 65% through a commodities super-cycle. This is an extremely important concept to understand. We are only half way or less up the curve. Gold and silver prices are set to sky-rocket whilst cash and the dollar will crash. Many people will lose all their wealth. The people left at the end of the day with gold, silver, oil, property and land will be the winners – particularly if they switch to cash at the very end of this cyclic commodities bull market, before the bubble pops.

It’s a hard concept to fully understand – we believe:

· Silver will rise from $33/ounce to something like $400/ounce (before crashing)

· Gold will rise from $1700/ounce to something like $6400/ounce (before crashing)

· Oil will rise from $100/bbl to something like $220/bbl (before crashing)

Miners Sky-rocket: Oil, gold and silver mining stocks will skyrocket towards the end of the bull market. Silver is the bargain of a lifetime. Yes, it’s the number one bargain of the century. We think there is a greater chance that silver will rise 12 fold than it will go down by 50%.The upside is enormous. The  downside is limited. We’ve been buying as much silver bullion as possible since October 2011 and storing it in a safe city bullion vault.

downside is limited. We’ve been buying as much silver bullion as possible since October 2011 and storing it in a safe city bullion vault.

Who Owns Gold? If you think gold and silver are bubbles – ask yourself this question. Do you know anyone that has bought any silver or gold? If the answer is no, then how can it be a bubble? It’s not until the herd arrives that a bubble develops and mania starts. There is zero mania. Zero bubble. Just a great bargain.

Silver Rarer Than Gold: Just consider this. On the earth’s surface, there are total silver reserves available of 500 million ounces. There are 7 billion people. That means there is 1/14th of an ounce per person. 1/14th of a coin per person. The cost of a silver ounce coin is $33. That is $2 worth of silver on this planet per person. Silver is used for all solar, mobile phones, electrical appliances and military, weapons etc. There is 40% less silver available than gold. Silver is rarer than gold. Silver prices have been manipulated by ETFs, governments and JP Morgan – shorts – for years. The fiat paper promising silver has taken over and this will implode one day – meaning anyone with the actual silver will prosper. The paper holders will lose. This market manipulation cannot last with so little silver on the planet. The target for each smart individual investor should be to achieve the highest amount or “people’s worth of silver” as possible. Yes, buy one ounce, get 14 people’s worth of silver. Even if you only buy $1000’s worth, that equals 33 ounces or coins – or 500 people’s worth of silver. Surely after this manipulation has ended – silver prices will sky-rocket? Every electronic appliance needs silver – so surely its value should be multiples of its current price?

Silver Incredibly Cheap: Also consider that silver was $55/ounce in 1980. 32 years later, it's only $33/ounce. But stocks are 10% of the 1980 levels. And silver is used for all high end electronics and military used. In inflation adjusted terms it should be at least $200/ounce even if its ratio to gold remained the same. Some people even thing logically that silver prices should be equal to gold - simple because it is rare and is used up in industrial processes. It doesn't matter which way you look at it, this tiny $30 Billion market is way away underpriced. Its a screaming bargain. Don't hang around - don't miss the boat!

Action Not Word: Anyway, we are not dwelling or analyzing this point too much. The key is to act, move forward, buy silver, hold and never look back! If you spend your life analyzing you will surely never make an investment and never make any money. You need to be decisive – act – buy and run with it. Then you won't be one of the people that say “I always said silver would go up” then your friends say “did you buy any” and you say ”well no, but I knew it would rise so I got it right”. Then you look back and kick yourself!

Silver is the screaming buy of the century

This website has been going for 7 years - we pride ourselves on being objective and helping our website visitors with the best guidance – for free

Silver is the creaming buy of the century (and that’s objective!)

You can email us in a few years time if we are wrong.....

Peak Oil Update: Just a quick Peak Oil update. As we have been describing for years now, the world remains on an undulating plateau – a Peak Oil Plateau. All being positive – all going well – it’s still possible oil production could rise a bit further but this seems rather unlikely, at least to any great extent. The reasons are numerous:

Iraq: the petroleum law agreed 5 years ago has still not been approved and this is slowing production growth significantly – every year, expectations of Iraq’s increase in oil production drops

Iran: oil sanctions are likely to take effect July 2012 which will slow oil exports. Furthermore the banking-financial sanctions are leading to rapidly reducing oil and gas investments – so oil production will drop

Nigeria: NE Nigeria is close to civil war. Oil unions are close to striking. It’s likely Nigerian exports will drop.

Saudi: Their oil exports are rising this winter, but only because they need less electricity in the cooler winter. This summer, when they switch the oil burning electric plants on for the air conditioners in the 45 deg C heat, oil exports will drop. The huge Ghawar field is in decline and new fields bought on stream in 2010 will start to decline shortly. Even though overall oil production will rise slightly, oil exports will continue to drop because of Saudi’s gigantic consumption of 2.7 mill bbls/day, 20 times that of China per person (and 3 times that of UK per person). The consumption is growing at 7% per annum as Saudi industrialises and it population explodes.

Russia: Are struggling to maintain their high oil production plateau – it is likely to drop by end 2012.

Brazil: Despite all the hype, Brazil still imports crude oil even though huge new discoveries were made 3-5 years ago – production will increase but so is Brazil’s consumption

UK: A production crisis has hit since taxes were raised March 2011 – production has crashed 15% in less than a year and was the main reason why the UK is now in recession (15% lower oil production, 20% lower gas production, less energy construction and less manufacturing-refining of North Sea hydrocarbons) – the Chancellor shot the UK economy in the foot big time with this surprise tax hike, the third in 10 years that makes the UK the least stable oil tax regime in the world

Venezuela: Production has been in decline since 1999

USA: the administration’s offshore drilling bans has slowed production growth – the good news is the Bakken oil shale and shale gas production increases onshore. The higher unemployment rates has suppressed consumption meaning oil imports have dropped somewhat (although they still cos t a gigantic $400 Billion a year!)

t a gigantic $400 Billion a year!)

Norway: Oil production has been in steep decline for 10 years – some exciting new discoveries will take ten years to bring on-stream

Syria: Oil production is being affected by the civil turmoil – discoveries have dried up

Yemen: oil production is being affected by the civil turmoil – discoveries have dried up

Libya: oil production potential was damaged by the war – the good news is flows are resuming fairly quickly though it’s not likely the new government will boost production higher than the previous regime

China: is unable to increase oil production – it’s reached at a plateau – oil imports increase 10% a years – this oil has to come as an offset against western imports

Kuwait: can no longer increase oil production

UAE: are finding it difficult to increase oil production

Angola: its oil production grew dramatically up to 2009 – it’s now not able to grow any further

Egypt: investment in the oil and gas business was dramatically impaired by the change in government and civil strife

Canada: although their oil production is growing at about 0.3 mln bbls/day a year, it’s a drop in the ocean compared to the 90 million bbls required to feed the world and China’s growth plans

Australia: oil production has been in terminal decline for ten years

Note: Although oil production may rise, exports will drop because oil producer's consumption is rising so fast:

This is the first time we have seen this analysis - we had to prepare it ourselves - Peak Exports were beyond doubt around 2006 which correlates with the height of the US real estate bubble. As exports dropped, the golbal economy implodes in 2008, and is barely recovering now 5 years later.

Italy, Spain, Portugal, Ireland, Greece: nothing new to report – they have no oil – imports remain high and this is crippling their economies (the PIIGS) – no coincidence – Peak Oil effects. These economies use far too much oil for the GDP created – the oil wastage on travel/transport is staggering. As oil prices rise and these country’s population's age and decline – they will be in a permanent recession or stagflation. Beautiful countries, beautiful people – but aging economies going no-where.

Oil and the Printed Money: Gas production globally is still rising, and Qatar, USA and Russia all have huge gas reserves, but very little is being done to switch from oil to gas – in transportation. 70% of oil is used for transportation – a terrible waste of a precious depleting resource. A crisis will need to happen to trigger a switch from oil to gas powered vehicles, But for now, gas prices remain depressed in the USA and oil prices are rising sharply. Oil refiners are closing along the US East Coast - this will force the USA to have to import diesel and fuel oil from other nations at escalating prices. It’s only because of the warm winter that prices have not gone ballistic. This summer, oil prices are likely to rise sharply as the Fed continues to print money in the run up to the next US Election in Nov 2012. Expect the run up in oil, mining, commodities stocks prices to continue for a while. Today’s Fed announcement was perfectly timed as a lead into the next election – and the money printing will accelerate through to the Election. It’s the only way Ben Bernanke will survive. If President Obama is re-elected and Ben Bernanke survives, then the sky’s the limit for gold and silver prices – seriously. There will be another four years of printed money and even higher inflation until the whole lot implodes as the bond bubble pops.

Ben Is Popular – People Like The Money: Why do you think Ben Bernanke is so popular – even though he is always wrong. All his predictions are wrong. He rarely gets criticised by the mainstream? The reason seems fairly clear to us. He is feeding lovely money into the system – bankers are making fat bonuses – the whole charade is being kept on the road – companies are making big profits and the richest elite – the financiers and government working in concert – are all doing okay as business is propped up and the addicts take ever bigger doses. It’s a feeding frenzy. But it seriously cannot last. The printing has grown into joke proportions now. Surely any objective person can see that $75 Trillion in US liabilities and $15 Trillion in direct debt (excluding Fannie Mae and Freddie Mac) with annual tax receipts of $1.8 Trillion and government spending of $2.8 Trillion just does not stack up. It’s insolvent. It’s only propped up by the goodwill of international investors buying US bonds. When this finally dries up – the whole pack of cards will come tumbling down. The US is bankrupt already. It’s just that no-one has highlighted it.

Value Destroyed: Helicopter Ben has printed well over $3 Trillion since mid 2008 and borrowed $6 Trillion (plus funded $5 Trillion for Fannie Mae and Freddie Mac bail-outs) - the US now has a debt of $15.2 Trillion. All in the quest to create jobs for President Obama and the Kensyan school of economics. Regrettably the working age population has risen 10 million since 2008. The most direct way of measuring the jobs deficit is to look at the share of the working-age population in jobs - before the 2008 recession it was 63.3% of working-age Americans had jobs. That reached a low in summer 2011 of 58.2 percent. Despite all the money printing and debt, it is now 58.5%, 4.8% more than in 2007. So all the money printing and debt have not helped unemployment - its been a gigantic wasteful exercise that has indebted the nation. This will become evident in 2013 after the US Election, has unemployment starts to rise again and the US economy implodes.

and borrowed $6 Trillion (plus funded $5 Trillion for Fannie Mae and Freddie Mac bail-outs) - the US now has a debt of $15.2 Trillion. All in the quest to create jobs for President Obama and the Kensyan school of economics. Regrettably the working age population has risen 10 million since 2008. The most direct way of measuring the jobs deficit is to look at the share of the working-age population in jobs - before the 2008 recession it was 63.3% of working-age Americans had jobs. That reached a low in summer 2011 of 58.2 percent. Despite all the money printing and debt, it is now 58.5%, 4.8% more than in 2007. So all the money printing and debt have not helped unemployment - its been a gigantic wasteful exercise that has indebted the nation. This will become evident in 2013 after the US Election, has unemployment starts to rise again and the US economy implodes.

Western Growth Not Possible With High Oil Prices: What this all means is that GDP growth in western developed oil importing nations will be severely crimped by high oil prices. The entire Italian debt that has developed in the last ten years can be attributed to their oil import bills alone. It’s just that the politicians will not admit it. They cannot really control the oil price – so they don’t point to this – because this news is bad. It’s not something to highlight. It’s very grave news for Greece that their oil, gas, coal and electricity import bill per annum are about 10% of GDP - almost exactly what their deficit is. When they joined the Euro, oil was $10/bbl and everything was fine of course – booming with cheap energy to build holiday homes for people flying in on cheap airline tickets because of cheap oil. But now, building costs have skyrocketed, airline ticket prices have risen as oil prices have risen tenfold. This is a direct affect of Peak Oil – the end of cheap oil. But don’t expect anyone to highlight this. We have spent 7 years studying this. We’ve been warning of this crisis for years. It’s really just the beginning – and a repeat of the commodities bull run of 1970 that saw a severe recession from 1979 to 1982 as oil, gold and silver prices went ballistic and war broke out. We are now entering this final phase. It will probably last about 3-4 years.

High Oil Prices = Recession: Any conventional economist can tell you that 10 of the last 11 US recessions occurred when oil prices rose to high levels. Western oil importing nations are not able to grow without cheap oil. It’s so incredibly obvious – it’s just worth highlighting. If oil prices drop by 30%, then the economy starts to move into growth, then oil rises 30% as demand increases and it goes into recession – with a 6 month lag time. It’s almost like clockwork. As western recession starts, then oil prices drop back, then governments start printing money, then the printed money stimulates the economy but this then sends oil prices higher because speculators or investors use this money to buy oil – then the economy slows again. These mini-cycles are about 18 months long. Stock prices rise with oil prices, then drop with oil prices. Both follow the printed money. As money printing ends, both crash 30%, money printing starts again, then they rise back say 40% again. But every year that passes, the dollar is devalued, inflation eats into saving at 10% and unemployment rises. It’s the lack of cheap oil that is the main culprit with the printed money driving prices even higher than they would otherwise be. It’s like a drug addict needing bigger fixes every time. But one day, this person will almost certainly collapse or overdose – go into intensive care. He’ll either have to go “cold turkey”, die or need an even bigger fix. The US is addicted to cheap oil. It’s now also addicted to cheap money. The remedy when the oil runs short is to print money. But the cheap oil and money will end when the bond market implodes and high interest rates hit.

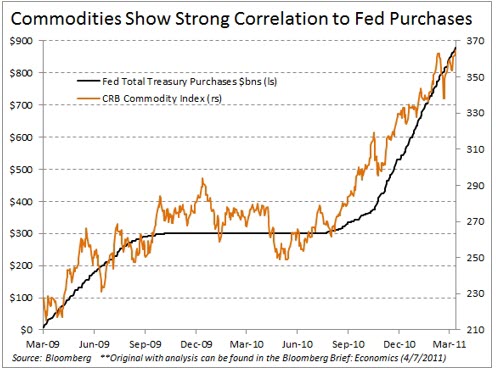

Note the clear correlation between printed money and the rise of commodities prices. The message is simple, whenever you see money being printed, you need to invest in commodities. If money printing ends, just before this time, you should consider selling down these commodities.

Oil is King: The reason for the analysis is simply to advise that – for the best investment returns – oil is a very good place to be. Large integrated oil companies will be chucking out dividends of 5% per annum though their share prices will probably not rise too fast. But the medium and small companies that successfully find and produce new oil reserves will continue to rise sharply though their dividends will be far lower.

End of Cheap Oil: Oil prices will continue to gyrate up and down depending on how much printed money is released to prop up the overall global economies. But if the stock markets crash, expect oil prices to drop and oil stocks/equities to decline sharply as well. The best strategy is to follow the print ed money up the stock market and oil price curve, then get out before the Fed stops printing money again. These cycles will continue until the final crisis when there will be a large scale meltdown of the dollar, as the US dollar bond market implodes after interest rates have to rise.

ed money up the stock market and oil price curve, then get out before the Fed stops printing money again. These cycles will continue until the final crisis when there will be a large scale meltdown of the dollar, as the US dollar bond market implodes after interest rates have to rise.

Fed Cannot Increase Rates Anymore: Surely everyone must realise that the Fed cannot raise interest rates from the current low levels – otherwise it would bankrupt every normal business or person in the USA. So they will continue to hold base rates well behind the interest rate and inflation curves – whilst inflation takes off. The Fed will not be able to reign inflation back in with higher rates, hence very high inflation looks by far the most likely outcome. It's difficult to see any other outcome frankly. The Fed has got itself into a corner. Beyond the point of no return.

Silver and Gold: Which brings us back to gold and silver again – of course. As the dollar crashes, Fed base rates stay well behind inflation, interest rates will have to stay low otherwise default would be inevitable. Confidence will be lost in the US dollar and bond markets, then there will be a mad panic into gold and silver – as every man and his dog smells a rat and dashes into precious metals as the only reliable store of wealth.

Dollar Confidence Disappearing: This loss of confidence in the dollar is just starting as people wake up to the fact that the European problems are relatively small compared to the US problems – at least Europe is trying to fix the problems and take spending cuts seriously, unlike the Fed that is intent on printing the dollar into oblivion. When the $75 Trillion wall of bond and derivatives money hits the US streets – everyone will buy things in shops, assets, gold and silver in a desperate attempt to offload the fiat currency. This process is just starting and is likely to kick in and up by end 2012 just after the US elections. There will be a tipping point when the focus will shift from European problems to US problems – after years of printed fiat money catches up with the Fed. At this point, investors will demand far higher interest rates as insurance against dollar debasement and default - then the bond bubble will pop and all this money will flood into gold, silver and possibly oil.

Bond Crisis: So stay well away from US bonds – and UK and European bonds as well. Buy gold and silver and oil. Hold property. Select good mining and commodities stocks. And you might survive the real crisis just about to hit the western world off the back of Peak Oil and fiat printed money.

Fiat Paper Instruments: Overall – paper in the form of derivatives, contracts, ETFs, cash, bonds, treasuries, currency – all those paper fiat tools backed by nothing buy goodwill, will implode. Meanwhile gold, silver, oil and commodities will sky-rocket as value shifts from western financiers (holders of financial paper tools) to real investors of physical assets. Bankers will be losing their jobs in droves, farmers will be doing very well indeed, oil, mining and precious metal owners will see their wealth increase to almost unimaginable levels. Property owners who survive will also be sitting pretty. Scientists and real engineers that develop new technologies that can help during the extended crisis will also be in demand. The days of pushing financial paper instruments in developed western nations is nearing an end – not even the western government can prop up these zombie banks anymore and the true extent of their collective liabilities will become transparent for all to see in the next few years.

Propped Up: There have been too many years of propping up the weaker banks and institutions with printed money using China help to save the weakening US economy. But $75 Trillion of liabilities and $15 Trillion of debt is just too much for any country to manage – so its printing and high inflation all the way.

We hope this Special Report has helped provide some insights to help you frame your investment strategies. If you have any comments, please contact us on enquiries@propertyinvesting.net