413: Crisis brewing for 2013 - preparation - switch from financial to physical assets

02-10-2012

PropertyInvesting.net team

Elections and Debt: What were are seeing so far in 2012 is consistent with our predictions end Dec 2011. The key issues that will shape this year are likely to be:

1. European Debt Crisis

2. US Debt Crisis

3. US Elections

4. Iran – Nuclear Issue

Add to this the French and Russian elections, along with the Iranian elections in March and what we have is a situation where everyone is playing cat and mouse, not wanting to take any risk, content with the status quo and politicians and ruling elite wanting to get re-elected. The wild cards are whether the Iranians will get aggressive after the M arch 2012 Elections, or whether Israel will unilaterally step in before the US Elections to stop the Iranian nuclear threat – we consider these two outcomes rather unlikely but certainly possible.

arch 2012 Elections, or whether Israel will unilaterally step in before the US Elections to stop the Iranian nuclear threat – we consider these two outcomes rather unlikely but certainly possible.

Iran Wildcard: The bottom line is, as Iranian oil sanctions start to bite 1st July 2012 and the clock counts down to Iran’s ability to produce a nuclear device in some 12-18 months time and with the US elections in November 2012 – there are lots of things coming to a head end 2012. Things could start developing into a crisis any time.

Switch From Euro Ton Dollar Worries: Meanwhile the same is true for the US debt. Our best guess is that the European debt issue will bubble along like it has been for the last few years – with the Germans and French continuing to put pressure on peripheral Eurozone countries – quite rightly - to reduce their deficits and undertake austerity measures. The financial markets will come to realise that although Europe is in bad shape, at least there is a political will to try and solve the problems on a country by country basis. Remember Greece is only 3% of overall European GDP.

Continued Printing: During 2012, the Fed will continue to print money to boost Ben Bernanke’s and Obama’s re-election chances. There is no way Ben will keep his job unless Barrack get’s into power again. On the face of it, in 2012 it will look like the US is coming out of recession as the fresh shot of dollars creates a feel good factor and unemployment levels drop slightly. The Treasury will continue to fake low inflation numbers by manipulating the basket of measures for inflation. So although inflation might be quoted as 2.5% by year end, it will be more like 6% in true inflation terms.

Oil Price: As long as Iran behaves themselves, and oil prices stay below $120/bbls – it could be a nice easy run in for President Obama. The Wall Street Bankers are certainly on his side, because the waves of Fed dollars mean record bank bonuses – they all know the fiat dollar currency will implode one day – this ruling elite of bankers, Fed and politicians is just kicking the can down the road – trying to play this game out for as long as possible.

Shock In 2013: This sets the scene for a gigantic shock sometime in the period Dec 2012 to end 2013. This is when the negative market sentiment will switch from Europe to the US debt situation – and bond yields will soar. If yields rise from 2% to 7%, the US is bankrupt – it can no longer afford to pay the direct $15.2 Trillion debt and any more money printing would damage confidence even further and lead to even higher rates. What we are saying is, the US is now at a tipping point. It just needs some recessionary indicators and a run on the dollar to cause the whole shooting match to collapse like a pack of cards.

US Looks Good But Isn’t: It’s only the negative Euro sentiment that is making the US look so good. But the real story is that the US is in a worse state than Europe. The dollar has lost 97% of its value since the Fed was created in 1922. It’s just about to lose another half of it’s value.

As a backdrop to investment strategies in such times, there are two types of so called assets:

1) Physical Assets – gold, silver, property, water, oil, gas, commodities, land, metal, artwork, manufacturing plant and machinery

2) Financial Assets – currency, bonds, treasuries, stocks, hedge funds, ETFs, mutual funds

Physical Versus Financial: Our view is that Physical Asset prices will skyrocket in the next few years whilst Financial Assets will bomb. Some will go to zero. Others will halve in value. There will be a gigantic transfer or wealth from people owning Financial Assets to people owning Physical Assets. That is why our common investment guidance is to get out of fiat currency and financial paper – and into physical assets as much as possible, before the US dollar collapses. It’s that simple. Gold, silver, oil, land, property, art – they are all good. ETFs, bonds, currency are all bad. Anything controlled by bankers – view with extreme scepticism. Instead, own legal title to assets. Hold assets that you can touch and feel. The top physical asset at this time for us is physical silver bullion. When the financial assets melt down, there will be huge banking losses – it has barely started because the banks have been propped up using tax-payers money – bailed out using borrowed future money/debt – no-wander everyone is upset with the huge banker bonuses. People pushing paper around failed banks lining their pockets. Meanwhile private engineers, farmers, manufacturers and entrepreneurs that actually created something tangible and physical get nailed for higher taxes to pay for these failed entities and gigantic bonuses. The public sector has expanding so much it has squeezed out the private sector and most of the UK and USA are akin to a sort of soviet socialist style centrally planned state run nation that props up everything that fails using tax payers money. Of course the super rich elite get richer, and the poor certainly are getting poorer, whilst the middle class are being destroyed  by high tax and inflation. Nowhere to go. What you need to do is, get out of this paper – before you get further fleeced by the bankers – and get into physical assets not controlled by the bankers or the government. Then you will survive. Hence private property, your own physical silver and gold, your own artwork and your own land and oil/gas/mining company stock will see you survive the next massive crisis – likely in 2013.

by high tax and inflation. Nowhere to go. What you need to do is, get out of this paper – before you get further fleeced by the bankers – and get into physical assets not controlled by the bankers or the government. Then you will survive. Hence private property, your own physical silver and gold, your own artwork and your own land and oil/gas/mining company stock will see you survive the next massive crisis – likely in 2013.

Best Time To Buy: 2012 will be a great year to buy gold and silver simply because these precious metals will remain severely undervalued against the dollar because the market in our view wrongly currently thinks the US dollar is a safe haven. If you added up all the dollars held by central banks all around the world then divided it by the amount of gold the US Fed claims to have – each ounce would be worth $200,000. Yes, we are serious. That also assumes Fort Knox actually holds gold in its vaults – but we really don’t know whether this is the case or not, because the gold has not been audited since 1952. The vaults might be empty for all the average person knows. One day, someone might break in and find that there is no gold or only 1/10th of the gold they expected – has anyone seen any photos or evidence this US gold actually exists?

Fiat Currency: All currencies in history have been fiat – meaning they are eventually printed into oblivion when they come off being backed by a standard. There is then a reset. The US dollar will be no different. The upward debt trajectory started in 2008 after Ben and Barrack started printing like there was not tomorrow. All this money has found homes in bonds, treasuries, mortgages, securities, cash, stocks, commodities and lots of global dollar bubbles all around the world. One day, people will take fright and want to dump their dollars – or buy assets as quickly as possible with this devaluing currency at which time inflation will sky-rocket. The inflation bubble is just around the corner and we think it will kick in just after the US election Nov 2012. But the Fed will not be able to raise interest rates because it would bankrupt everyone, so the only option will be to let inflation zoom up and the whole lot will implode. At this time there will be a mad panic – every man and his dog will be piling into gold and silver as the final blow-off occurs. This big late run-up is most likely to happen in 2013 in our view – though it could be a little later. If the Fed then stops printing money and a recession kicks in, US stocks will crash. It will be highly turbulent. Not pretty.

Appearing Stable: The good news is that 2012 could be a relatively calm period before this final big storm. The US will do all it can to make things look rosy just before the US election, as w ill France and Russia. The three countries will work in concert to stabilize things. The US will put pressure on Israel not to do anything rash against Iran this summer. Iran may feel emboldened after their earlier March 2012 elections and start something more aggressive around the time the oil sanctions kick-in – this is a key threat. Any blockade of the Straits of Hormuz would send oil prices skyrocketing in short order briefly to $200/bbl – this would trigger a US recession. It would almost certainly be immediately countered by a naval assault by the US and a wider conflict – including missiles into Iran’s nuclear power plants and installations. This is the real hot-spot for security at present. Most likely not much will happen until after the US Elections.

ill France and Russia. The three countries will work in concert to stabilize things. The US will put pressure on Israel not to do anything rash against Iran this summer. Iran may feel emboldened after their earlier March 2012 elections and start something more aggressive around the time the oil sanctions kick-in – this is a key threat. Any blockade of the Straits of Hormuz would send oil prices skyrocketing in short order briefly to $200/bbl – this would trigger a US recession. It would almost certainly be immediately countered by a naval assault by the US and a wider conflict – including missiles into Iran’s nuclear power plants and installations. This is the real hot-spot for security at present. Most likely not much will happen until after the US Elections.

Truth: We hope this analysis makes sense – we don’t want to come over as cynical – we are just trying to be realistic – since so much of what will happen in 2012 will be related to the elections.

Hence do not be surprised

· If stock markets rally at least until early May (before people go on holiday)

· The US appears to come out of recession

· Gold and silver prices do not go ballistic just yet

· Oil prices stay at $100-$120/bbl range

· US bond yields stay at 2%

· There is a partial solution to the Euro debt crisis

· President Obama is re-elected and Ben Bernanke keeps his job

· Everyone starts to get more optimistic

· Wall Street bankers and advisers congratulate the US Fed for “getting things back on track”

· Iran plays cat and mouse, posturing but does not start an offensive

Then by early 2013 – the **** hits the fan:

· Inflation takes off

· Panic sets in

· The US stock market crashes

· Oil prices skyrocket

· The US dollar crashes

· A US recession begins

· War breaks out with Iran

· Gold and silver prices go ballistic

Hence 2012 is a perfect orderly time to build gold and silver reserves at good prices. The big switch from financial assets (paper) to real physical assets – gold, silver, oil, land, commodities. The transfer of wealth looks most likely to occur in 2013.

Fed Chairman Has Been A Disaster: Six years of Ben Bernanke's printing money spree has been a massive failure. Just look at the underlying statistics:

Oil $56/bbl $105/bbl

Gold $480/oz $1730/oz

Employment 120 mln 113 mln

Unemployment 4% 8.6%

Teen Unemployment 12% 25%

S&P 1254 1250

Gap between jobs 15 weeks 40 weeks

Keynesian Failure - The Wrong Policy: It's not all Ben's fault of course. But what is disturbing is that he continues to maintain that printing money and his failed Keynesian economic policy will lead the USA out of recession. Basically, the USA never left the recession according to these number - it just printed money to prop up all failed entities and propped up the stock market whilst all prices rose and despite massive public sector jobs growth employment dropped off a cliff and unemployment levels sky-rocketed. Things will not change in the next year or so we believe - it will be more of the same - until a final massive fiscal crisis breaks out and changes takes place. We've now had five years since the 2007 recession began. Rather than expecting an improvement, please understand that by 2013, we are now due another major down leg. A real deep recession and shock. Expect the trends above to continue - yes, S&P may stay the same, but gold and oil prices will rise sharply, as will unemployment in 2013.

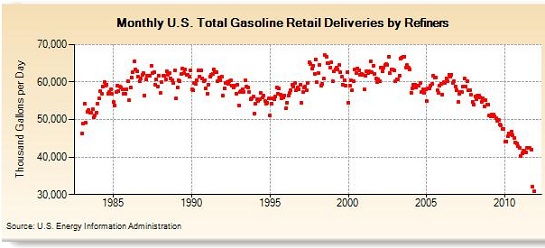

Never Really Left Recession: For anyone that things the US is coming nicely out of recession, take a look at this key indicator. It's US gasoline consumption which correlates very well with the state of the economy and overall activity and consumption - and is a key indicators knowledgeable economists monitor. It's fall off a cliff. Gasoline consumption has halved since 2008. Swaths of US East Coast refineries are closing down because demand is so week and margins are so low. In the UK, Petroplus, one of the biggest four UK refiners has just gone bankrupt. Does this look like growth?

Socialist Ideals: Another disturbing outcome of mainstream politics and media is that the finger of blame gets pointed at the private sector. All taxes come from private sector activity - without the private sector there can be no public sector. Someone has to use capital to make a return on that investment. The poor claim they are being fleeced by the private sector (bankers are blamed). Actually what is happening is that the printed money is given at no cost to bankers - this liquidit y is then used by rich people to speculate or invest - propping up stock markets in the process. This activity makes fees for the bankers. They can then take huge share approaching 50% of profits for their bonuses (this used to be more like 5% about 40 years ago). The government use taxpayers money to bail the bankers out. Small private sector businesses die, manufacturing dies. Poor people pay higher costs for their essentials like food, energy and rental accommodation - as lack of investment by the private sector leads to shortages of these products - also as confidence declines and the private sector is taxed at a higher rate to pay for the large public sector. The public sector drowns the private sector with talented people preferring to join the public sector - also because average public sector wages are higher than the private sector (in both UK and the USA, by about 20%). Also, the public sector retire earlier and these pensions are expensive, further dragging down the private sector through taxes - needing more workers to do these jobs. The poor ask for greater entitlements as few opportunities exist. The downward spiral continues as big government stifles the entrepreneurs and medium-small private sector businesses that would normally be creating jobs. Shops close, small businesses close, unemployment goes up. The printed money goes to the rich elite of bankers and wealthy with tax rates of 15-20% accessed by using the top accountants and tools - whilst the employed middle classes with tax rates of

y is then used by rich people to speculate or invest - propping up stock markets in the process. This activity makes fees for the bankers. They can then take huge share approaching 50% of profits for their bonuses (this used to be more like 5% about 40 years ago). The government use taxpayers money to bail the bankers out. Small private sector businesses die, manufacturing dies. Poor people pay higher costs for their essentials like food, energy and rental accommodation - as lack of investment by the private sector leads to shortages of these products - also as confidence declines and the private sector is taxed at a higher rate to pay for the large public sector. The public sector drowns the private sector with talented people preferring to join the public sector - also because average public sector wages are higher than the private sector (in both UK and the USA, by about 20%). Also, the public sector retire earlier and these pensions are expensive, further dragging down the private sector through taxes - needing more workers to do these jobs. The poor ask for greater entitlements as few opportunities exist. The downward spiral continues as big government stifles the entrepreneurs and medium-small private sector businesses that would normally be creating jobs. Shops close, small businesses close, unemployment goes up. The printed money goes to the rich elite of bankers and wealthy with tax rates of 15-20% accessed by using the top accountants and tools - whilst the employed middle classes with tax rates of  60+% (income tax, national insurance and VAT) get destroyed. Middle class savers and retirees are destroyed by low savings rates a gigantic 4.5% below inflation. Poor people get poorer as food and energy prices rise, whilst benefits drop in inflation adjusted terms. This is what is happening. There is no evidence this will change in Western developed nations like the USA and UK. A further reason why you should not just sit back and let it happen - you need to buy gold, silver and oil to survive the coming rout. Otherwise the printed money will make you poor. And you will join the poor.

60+% (income tax, national insurance and VAT) get destroyed. Middle class savers and retirees are destroyed by low savings rates a gigantic 4.5% below inflation. Poor people get poorer as food and energy prices rise, whilst benefits drop in inflation adjusted terms. This is what is happening. There is no evidence this will change in Western developed nations like the USA and UK. A further reason why you should not just sit back and let it happen - you need to buy gold, silver and oil to survive the coming rout. Otherwise the printed money will make you poor. And you will join the poor.

It Is Your Choice: If you want the government and bankers to destroy you - just sit back and watch. If you want to join the poor, that is also a choice we have. If you want to be a charity at this time, yes, that's a choice as well. If you want to make sure the government and banks don't destroy any wealth you have - then buy silver, gold and oil. When you make enough wealth, you can start giving it to charities of your choice. It will certainly be better spent than at the government Treasury.

Opportunity of a Century: To ignore this opportunity could be costly indeed. Many of the financial “so called” assets – paper – will turn to nothing. This gigantic transfer of wealth (not destruction) from dollar paper to gold and other real physical assets will be more than $50 Trillion.

Prices: According to our analysis:

· Rather than $1740/ounce, gold prices should currently be at least $6400/ounce based on three separate methods of calculating

· Based on a historical gold:silver price ratio of 1:16, rather than $34/ounce, silver should be at least $400/ounce

· One ticket to a football match costs £30. That’s the same as a silver coin. That’s ridiculous.

Silver Uses: Did you know that silver is used for solar, all mobile phones, electronics, flat screen TVs, mirrors, military weapons, light bulbs. 80% of silver is used in manufacturing processes. Silver prices were  $50/ounce in 1980, 32 years ago. Dollars circulating are now ten times more, but silver is only $34/ounce. Silver is rare than gold. Yes, there is only 60% of the amount of silver stocks in the world compared to gold stocks. But the prices is 50m times cheaper. There are 7 billion people on earth. There is only 0.5 billion ounces of silver stocks. That’s 1/14th of an ounce per person. That means if you buy one silver coin for £30, you will have 14 people’s worth of silver. We bought a wet razor at Christmas with a recommended retail prices of £38. Yes, that’s one razor with five blades of more than a silver coin. Its outlandish. Silver is the deal of the century. Our guidance is for everyone to try and buy as much physical silver as possible as soon as possible – that’s certainly what we are doing!

$50/ounce in 1980, 32 years ago. Dollars circulating are now ten times more, but silver is only $34/ounce. Silver is rare than gold. Yes, there is only 60% of the amount of silver stocks in the world compared to gold stocks. But the prices is 50m times cheaper. There are 7 billion people on earth. There is only 0.5 billion ounces of silver stocks. That’s 1/14th of an ounce per person. That means if you buy one silver coin for £30, you will have 14 people’s worth of silver. We bought a wet razor at Christmas with a recommended retail prices of £38. Yes, that’s one razor with five blades of more than a silver coin. Its outlandish. Silver is the deal of the century. Our guidance is for everyone to try and buy as much physical silver as possible as soon as possible – that’s certainly what we are doing!

Inflation Lies: Lets talk about the inflation numbers issued. Don't believe them. The US official inflation 2.4%. But real inflation is about 8-10%. The reason they can keep the official number so low is a combination of the following:

-

Hedonic Adjustment: adjusting inflation down by calling technology improvements and efficiencies added value (e.g. power steering in a car, air conditioning)

-

Substitution: as an example, if beef prices rise and people substitute beef with cheaper chicken because they can no longer afford beef, the prices stays the same

-

Weighting: as an example, if the price of beef rises, the government can elect to weigh it less than chicken

-

Subtraction: money is pushed into stocks or sent overseas - exported - so it does not hit the inflation numbers - a tactic used particularly by the US government to boost global economy and their exports

Negative GDP Recession: Of course if the GDP - which is always adjusted for inflation - runs at 2% and inflation is 2.4% - this should mean the economy is growing 4% before inflation and 2% after inflation. But since inflation is more like 9%, then the actual true GDP is 2.4% minus 9% - a recession of -6.6%. Yes, the US has been in a recession for years - its just that the government has not told you. This is consistent with the rising unemployment and reducing disposable income as prices rise. This also matches the crash in gasoline consumption to half its previous levels.

Silver Price Crazy Low: Lets now take a look at silver prices. Silver was $50/ounce in 1980. Since then the government has increase dollar money circulated by over ten fold. Hence silver would normally be $528/ounce at the end of this bull r un. Silver prices are currently $33/ounce. Name one thing that costs less now than in 1980 in dollar terms! Gold was $850/ounce in 1980. It should therefore be something like $9220 in view of the increase in dollars - at the end of this bull run. As you can see, this bull run has only just started off - its got way higher to go. It's very early on. It will end with a parabolic blow-off, any time from end 2012 onwards. the gold prices should equal the Dow by the time the bull run ends. So if the Dow is 10,000, then gold prices should be $10,000/ounce - rather than its current $1730/ounce. Gold is cheap. Silver is ridiculously cheap - the bargain of the century. And we are serious.

un. Silver prices are currently $33/ounce. Name one thing that costs less now than in 1980 in dollar terms! Gold was $850/ounce in 1980. It should therefore be something like $9220 in view of the increase in dollars - at the end of this bull run. As you can see, this bull run has only just started off - its got way higher to go. It's very early on. It will end with a parabolic blow-off, any time from end 2012 onwards. the gold prices should equal the Dow by the time the bull run ends. So if the Dow is 10,000, then gold prices should be $10,000/ounce - rather than its current $1730/ounce. Gold is cheap. Silver is ridiculously cheap - the bargain of the century. And we are serious.

Silver 1980 compared to 2012:

-

In 1980, there was 4 billion ounces of silver in stocks. There are now 0.5 billion ounces.

-

In 1980 the world's population was 4.2 billion people. It is now 7 billion.

-

In 1980 only 15% of the world's population has an opportunity to invest in silver, it is now more like 50%.

-

In 1980 35% of the world's GDP was USA - the US is now only 23% and the Chinese, In

dian. Middle Eastern and Russia investors love gold and silver investment

dian. Middle Eastern and Russia investors love gold and silver investment -

In 1980 you had to buy gold and silver at banks - you can now by over the internet, on e-Bay, via ETFs (not advisable) and through funds - even if you live in a desert with satellite broadband internet usage

-

Financial news are far more pervasive now than in 1980 and debt levels are ten times high

Silver Price Suppression: have been suppressed for years by bankers – in part because they work in concert with government because if silver and gold prices rise, it damages the reputation of paper currencies like the dollar. Hence banks hold massive short positions to try and suppress the price. But we all know that this cannot last forever. One day, someone will want to get delivery of their physical silver – and if it’s not there or something else happens, silver prices will just take off in short order. It is a very small market – only $30 Billion (compared to gold which is may be 100 times bigger).

Silver is a By-Product: of copper, lead, zinc, gold and other metals. Only 20% of silver comes from silver only mines. Hence is prices rise, it does not mean supply will follow suit quickly, especially if the value compared to the main metal mined is <15%.

Electrical Properties: Silver is the best conductor of electricity – except f or gold. Only gold can match silver for conducting and not corroding. Hence only gold is a replacement for silver in electronics. We are convinced there will be sever silver shortages in years to come and are confident that silver will rise above $100/ounce in 2013 and will rise far further moving forwards.

or gold. Only gold can match silver for conducting and not corroding. Hence only gold is a replacement for silver in electronics. We are convinced there will be sever silver shortages in years to come and are confident that silver will rise above $100/ounce in 2013 and will rise far further moving forwards.

Property Is A Real Asset: Property is a real physical asset. Property in a mainstream location will always be around for decades or even centuries. Historical central city property tends to hold its value and rise faster than remote suburban newer property. High paid jobs and commerce are normally in the major cities. If you choose a city with a growing economy – with industries that are expanding – you will see property prices rise faster than declining cities with industries in recession. To give you a few examples:

· Aberdeen and London: doing well from the commodities bull run – oil, mining, gas, metals

· Dallas, Houston, North Dakota – doing well from high oil prices and expanding shale gas plays

· Detroit: doing badly from declining US auto business – long term decline and depopulation

· Las Vegas: doing badly, energy intensive, needs airline travel, tourism in decline, gambling in decline as US economy suffers

· Cambridge, Oxford: doing well with education, new technology, business parks and entrepreneurs moving in

Best Cities: If you buy central city property in London, Cambridge, Oxford or Aberdeen – it’s difficult to see how prices will crash.

Rich Pile Into London: In general, the rich tend to get richer and the poor stay poor. The world is becoming more globalized and international. This means dollars, Africa, Middle Eastern and Far Eastern money all finds its way back to London. Part of the reason is that London is considered a safe haven. It has good laws, low corruption levels, it’s an excellent place to visit for tourism/shopping and the most wealthy people put foreign money into UK property so protect their wealth. An example is someone who has made a small fortune in Africa or the Middle East, then worries that with a change in government, they may have their assets seized. They shift money into London property as a hedge against this happening. It protects their wealth. This is one of the reasons why West London property prices continued to rise sharply. It correlates with the European debt problems, and Arab Spring uprisings. Many billions of pounds worth has shifted from these regions into London property. International people can then seek non-dom status, have low tax bills and move to London if things in their mother country go pear shaped. The Chinese are starting to do this now as well. And its possible more US citizens will do this in years to come. Shift say 25% of their dollars into London property.

Eastern and Far Eastern money all finds its way back to London. Part of the reason is that London is considered a safe haven. It has good laws, low corruption levels, it’s an excellent place to visit for tourism/shopping and the most wealthy people put foreign money into UK property so protect their wealth. An example is someone who has made a small fortune in Africa or the Middle East, then worries that with a change in government, they may have their assets seized. They shift money into London property as a hedge against this happening. It protects their wealth. This is one of the reasons why West London property prices continued to rise sharply. It correlates with the European debt problems, and Arab Spring uprisings. Many billions of pounds worth has shifted from these regions into London property. International people can then seek non-dom status, have low tax bills and move to London if things in their mother country go pear shaped. The Chinese are starting to do this now as well. And its possible more US citizens will do this in years to come. Shift say 25% of their dollars into London property.

Physical Asset: Just a reminder, property is a physical asset – one can add value to it, see it, use it, upgrade it, and you have legal title to it. It cannot be seized in London. Property taxes are also not likely to rise because this would clobber half the electorate. The UK government also does not want to target rich non-doms, because they bring in huge flows of foreign income and provide many jobs – servicing the homes and people, spending huge amounts of money in London. Meanwhile these people go down the road to the City and invest in the hedge funds and financial markets in London. Bottom lines is, we cannot see this trend changing and because of this, through good and bad times, we see West London property prices continuing to rise higher. If there is a financial meltdown, prices could come off a little – but compared to the stock and bond markets, property could drop 20% but it’s not likely to crash to zero. Its also an excellent hedge against inflation of course. As more money printing occurs, prices rise and although property prices may lag real inflation somewhat, over time, debt levels reduce dramatically as the debt is inflated away and proportional equity values increase. If 10% inflation occurs for 5 years, your debt will have eroded to about 40% of its previous value in real terms. Meanwhile your debt to equity levels will have dropped and your total equity will likely have risen dramatically.

Physical Asset: Just a reminder, property is a physical asset – one can add value to it, see it, use it, upgrade it, and you have legal title to it. It cannot be seized in London. Property taxes are also not likely to rise because this would clobber half the electorate. The UK government also does not want to target rich non-doms, because they bring in huge flows of foreign income and provide many jobs – servicing the homes and people, spending huge amounts of money in London. Meanwhile these people go down the road to the City and invest in the hedge funds and financial markets in London. Bottom lines is, we cannot see this trend changing and because of this, through good and bad times, we see West London property prices continuing to rise higher. If there is a financial meltdown, prices could come off a little – but compared to the stock and bond markets, property could drop 20% but it’s not likely to crash to zero. Its also an excellent hedge against inflation of course. As more money printing occurs, prices rise and although property prices may lag real inflation somewhat, over time, debt levels reduce dramatically as the debt is inflated away and proportional equity values increase. If 10% inflation occurs for 5 years, your debt will have eroded to about 40% of its previous value in real terms. Meanwhile your debt to equity levels will have dropped and your total equity will likely have risen dramatically.

Rental Demand: Rental demand continues to rise as less young people can afford to buy property. Meanwhile the population of the UK continues to rise dramatically – especially in London. Almost no properties are being built. Waves of immigrates are arriving uncheck in London. Many one bedroom flats have five people living in them – it’s just that no-one is checking on this. The whole place is like a rabbit warren. Overcrowding is everywhere. Flats are tiny and many people cram in – with family and friends staying over on a continual basis. Lots of part time jobs. Few controls. Many foreign workers from all around the global busy getting on with their lives in this liberal environment. Rental demand continues to sky-rocket. Any property anywhere near West London will see its rooms snapped up in short order. Rental yields are high. The truth is, decades of failed housing policy and lack or building, compounded with the current lack of supply of mortgages and almost zero available social housing – means the buy-to-let business has been booming for the last 12 months. It seem set to continue. London is one of the few places in Europe with a healthy GDP and population growth rate – there isn’t any recession in London. If you take a tube at 8.30am to Waterloo you will notice. Everything is absolutely bursting. So our guidance is, pick up good rental property as close to Kensington-Soho as possible. Good secure property, that can be let out to low rise tenants like overseas women.

London Safe Haven: We believe things will get very bad in 2013 –  and London property is one of the safest places to be. Yes, prices could decline by 20% if there was a financial crash – more than likely - but if prices in London drop, then they will be a lot worse everywhere else. At least you should have tenants to fill your properties – because 10 million people live in London and 6 million people work. It’s a gigantic economy. Each person creates double the value of the average UK person – the GDP per capita in London is double the average UK per capita. London has been the wealthiest city in the UK for hundreds of years – this isn’t about to change.

and London property is one of the safest places to be. Yes, prices could decline by 20% if there was a financial crash – more than likely - but if prices in London drop, then they will be a lot worse everywhere else. At least you should have tenants to fill your properties – because 10 million people live in London and 6 million people work. It’s a gigantic economy. Each person creates double the value of the average UK person – the GDP per capita in London is double the average UK per capita. London has been the wealthiest city in the UK for hundreds of years – this isn’t about to change.

Art: Its interesting to observe the current art market. It’s clear that despite the financial crash of 2008, European debt problems and gigantic US debt issues – with a stagnant western economy, art prices have skyrocketed in the last few years. Why would this be? Our interpretation is that the financially smartest wealthiest people see the writing on the wall for currencies – and again are looking for physical assets. They are dumping the dollar and pound and euro and buying artwork instead. This could be the first indication of very high inflation – because when the middle and working classes catch on, they will also want to go out and buy just like they did in Weimer Germany – dumping their savings before they are destroyed by inflation.

Savers Destroyed: What sort of economy has n egative interest rates of 4.5% like the UK. Inflation running at 5% and base rates at 0.5%. Savers are being destroyed. This looks likely to continue for the foreseeable future – hence another reason why people are dumping cash and getting into gold and silver – along with stocks (albeit stocks are very risky of course).

egative interest rates of 4.5% like the UK. Inflation running at 5% and base rates at 0.5%. Savers are being destroyed. This looks likely to continue for the foreseeable future – hence another reason why people are dumping cash and getting into gold and silver – along with stocks (albeit stocks are very risky of course).

If you follow the richest people, you would probably:

· Hold physical gold and silver

· Have West London property

· Have stocks in oil and mining companies (ready to sell if the market tumbles)

· Have a bit of spare cash

· Purchase a small amount of quality artwork

· Manage one’s own portfolio – don’t lose or get ripped off

Portfolio Inflation Protection: Such a portfolio would be fully hedged against inflation, deflation and the bond markets imploding. Follow the rich – and you will be rich. You would rest easy at night – every time bad new hit the markets on debt, you would probably feel like you had gained. This is the type of portfolio that will gain or at least hold its value during a crisis in 2013. Its about wealth preservation at the moment. Do don’t want to be one of those people that used to be a millionaire – but lost the lot. A bad luck story.

Silver Deal Of The Century: If you are just starting out with investing, our best advice is, buy as much physical silver as you can afford. Put the coins and bars in a safe deposit box in a bank and don’t tell everyone about it. One day, a silver coins will buy far more than a ticket to a football match. More like twenty silver coins will buy a new car. 16 gold coins will buy a house. Something like that. We are serious. If you ignore this, then be prepared to look back – especially with silver – and kick yourself when the price sky-rockets into space.