450: The 2013-2014 Collapse

11-03-2012

PropertyInvesting.net

Everyone Has Deficits: It seems that all developed nations are running with an average deficit of at least 5% (often over 10%). This means they spend 10% more than their GDP. These countries have increasing debts of about 5-10% per annum as well. Meanwhile they print 10% more money each year. Growth remains subdued if properly inflation adjusted then growth is probably zero. What does all this mean?

Bonds Bought With Printed Money: It seems government, private investors and banks are buying each  others bonds and debt at an increasing pace. They believe these bonds are relatively safe. The UK Bank of England continues to buy about 50% of the UK governments bonds. The Fed buys about 70% of the US debt issued from printed money or currency that is created on a computer from thin air. Fiat printed currency. The fact that Central Banks are buying their own bonds that means increasing the demand for them indirectly drives down interest rates keeps them low. This then destroys savers income, especially as savings rates are about negative -3% per annum, even taking the claimed inflation figures used by governments (they are probably double this - 6% if one take the true unmanipulated inflation figures.

others bonds and debt at an increasing pace. They believe these bonds are relatively safe. The UK Bank of England continues to buy about 50% of the UK governments bonds. The Fed buys about 70% of the US debt issued from printed money or currency that is created on a computer from thin air. Fiat printed currency. The fact that Central Banks are buying their own bonds that means increasing the demand for them indirectly drives down interest rates keeps them low. This then destroys savers income, especially as savings rates are about negative -3% per annum, even taking the claimed inflation figures used by governments (they are probably double this - 6% if one take the true unmanipulated inflation figures.

So where is all this leading? Its a gross market manipulation in fact these are not bond "markets" anymore because government control the yields on bonds through the supply of printed money. The whole bond market might look stable but it is anything but. It is extremely unstable. It will only be a short while before the markets start shorting bonds, and interest rates start to rise. They would only need to rise from zero % to 3% in the UK and USA to cause widespread bankruptcies and panic as banks and private investors would not be able to pay their interest payments on their gigantic debts.

Debt Growth Unsustainable: Rather than deleveraging, the USA and UK seem intent on borrowing more money, printing more money and trying to cause inflation to claim some sort of growth. But debts are rising faster than inflation, so the real terms value of the debt continues to rise in most cases. The patient is now very sick and will soon be on life support. Like a junky to dollars that needs another big monetary fix, otherwise the body will not be able to take it. This body avoids cold turkey but will eventually collapse.

US Deficit: The official US deficit is around $1.2 Trillion per annum, or 7.5% of GDP, but this number severely distorts the actual deficit. If the US was a business, its deficit would be more like $5 Trillion (or 33% of GDP) because this is the amount taking into consideration unfunded liabilities, military, pensions, social programmes etc promised in the future. This would be the deficit amount that would be required to pay for these social and government programmes. Without the ability to print money, the US would go bankrupt within months. All those entities that own US bonds (or debt) have interest paid with printed money while the US dollar is debased. But because other countries are playing the same game, its less noticeable than it would otherwise be. The printed money is given to banks to prevent them from going bankrupt. Little of this money is lent out most of the money is used by the bankers to speculate in attempts to make returns to justify or pay themselves bonuses. The Fed know this the Fed is also a private bank and it works in concert with the Wall Street bankers. In a way, they are a Wall Street bank. The government watches knowing it needs to keep the banks on their side to get elected and fund the military and social state machine. The financial empire is corrupted beyond comprehension and its only a question of time before this state sponsored financial mess unfolds.

US Deficit: The official US deficit is around $1.2 Trillion per annum, or 7.5% of GDP, but this number severely distorts the actual deficit. If the US was a business, its deficit would be more like $5 Trillion (or 33% of GDP) because this is the amount taking into consideration unfunded liabilities, military, pensions, social programmes etc promised in the future. This would be the deficit amount that would be required to pay for these social and government programmes. Without the ability to print money, the US would go bankrupt within months. All those entities that own US bonds (or debt) have interest paid with printed money while the US dollar is debased. But because other countries are playing the same game, its less noticeable than it would otherwise be. The printed money is given to banks to prevent them from going bankrupt. Little of this money is lent out most of the money is used by the bankers to speculate in attempts to make returns to justify or pay themselves bonuses. The Fed know this the Fed is also a private bank and it works in concert with the Wall Street bankers. In a way, they are a Wall Street bank. The government watches knowing it needs to keep the banks on their side to get elected and fund the military and social state machine. The financial empire is corrupted beyond comprehension and its only a question of time before this state sponsored financial mess unfolds.

Closing Rank: The western industrialise society if full of people who belong to institution s, are part of vested groups, protect themselves by protecting their institution and in a way of "paid" to do this. Whether this person is a politician, civil servant, in the military, banker, part of the emergency services or police, an employee of a private company, member of an NGO and businessman wanting to win new business from all of the above. Because of this, there are few truly objective frank voices out there. Even journalists belong to different interest groups or are paid by Newspapers. Reputations are normally safeguarded and protected in these institutions. Outside these institutions is a dangerous lonely world - exposed to ridicule criticism. That is why so many things happen - then people close rank - protect the team or entity and few people are held to account. This closing of rank is a key to the industrial military complex that has developed in the last 100 years. Bankers close rank, military close rank, private businessmen close rank. It's difficult to find out the truth. Its difficult to know what's going on behind the scenes. Because of this, we have to remain objectively sceptical about monetary policy, economics and what governments are playing around at. Only then will we be able to make good investment decisions.

s, are part of vested groups, protect themselves by protecting their institution and in a way of "paid" to do this. Whether this person is a politician, civil servant, in the military, banker, part of the emergency services or police, an employee of a private company, member of an NGO and businessman wanting to win new business from all of the above. Because of this, there are few truly objective frank voices out there. Even journalists belong to different interest groups or are paid by Newspapers. Reputations are normally safeguarded and protected in these institutions. Outside these institutions is a dangerous lonely world - exposed to ridicule criticism. That is why so many things happen - then people close rank - protect the team or entity and few people are held to account. This closing of rank is a key to the industrial military complex that has developed in the last 100 years. Bankers close rank, military close rank, private businessmen close rank. It's difficult to find out the truth. Its difficult to know what's going on behind the scenes. Because of this, we have to remain objectively sceptical about monetary policy, economics and what governments are playing around at. Only then will we be able to make good investment decisions.

US Recession on the Horizon: So what impact will the US election have on the world economy. Markets seem to be fairly sanguine about the effects or not making out in any case any particular concerns. But we think the election party is almost over. By Jan 2013, the following will have happened:

· End of the phantom election growth surge

· Start of legally binding cuts in public expenditure

· Start of tax rises

Romney Win: In the unlikely event Mitt Romney gets into power, we can expect the Fed Chairman to be sacked by Jan 2014 and interest rates to rise to encourage investors to save, and get the market back to more normality. There will still be money printing but on a lesser scale. This will mean gold and silver prices although rising will not go stratospheric - at least for now. There could be a bit of a boost from commissions set up to consider going back to the gold standard, but overall the dollar would be stronger and gold lower under Romney in the longer term since the dollar value would drop less dramatically.

Obama Win: If Barrack Obama gets into power, we can expect the Fed Chairman to continue in his money printing role for another four year term from Jan 2014 - interest rates might stay low for a while before going out of control during a crisis in 2013-2014 markets will continue to be grossly manipulated by big government interference. Wall Street bankers will continue to prosper for a while longer using the cheap printed money to speculate - driving up commodities prices. Gold and silver prices will go ballistic eventually as panic sets in. The bond market will pop, gold skyrocket and crisis and panic break out. Half of Americans pay no tax and 46 million use food stamps. The tax receipts arent enough to pay the interest on the debts. The USA will eventually have to default or hyper-inflate, and people with savings in dollars are and will be destroyed.

Obama Win: If Barrack Obama gets into power, we can expect the Fed Chairman to continue in his money printing role for another four year term from Jan 2014 - interest rates might stay low for a while before going out of control during a crisis in 2013-2014 markets will continue to be grossly manipulated by big government interference. Wall Street bankers will continue to prosper for a while longer using the cheap printed money to speculate - driving up commodities prices. Gold and silver prices will go ballistic eventually as panic sets in. The bond market will pop, gold skyrocket and crisis and panic break out. Half of Americans pay no tax and 46 million use food stamps. The tax receipts arent enough to pay the interest on the debts. The USA will eventually have to default or hyper-inflate, and people with savings in dollars are and will be destroyed.

Japan has government debt that is close to 200% of GDP. They have printed money to prevent deflation. Their economy is hardly growing. They are starting to look very sick again. The nuclear plant meltdown and tidal wave destruction affected the economy badly, and it has not really recovered since. More oil and gas imports to offset declining nuclear power has not helped, and as the Chinese economy slows and reduces imports from Japan, instability may start in the area between these two economic powerhouses.

Middle East Instability: Large parts of the Middle East remain in turmoil particularly countries that import oil. Sanctions on Iran are starting to cripple the economy and there is no telling what the Iranian might do particularly if provoked by the USA or Israel. The nuclear issue will not go away its been bubbling on now for almost ten years and its likely to deteriorate rapidly immediately after the US elections regardless of whether Romney or Obama are in power, because Israel is pressing so hard to do something. Any regional war would be a catastrophe and Iran obtaining a nuclear weapon could be very bad for general stability. Expect some actions in 2013 - with likely dire consequences.

Middle East Instability: Large parts of the Middle East remain in turmoil particularly countries that import oil. Sanctions on Iran are starting to cripple the economy and there is no telling what the Iranian might do particularly if provoked by the USA or Israel. The nuclear issue will not go away its been bubbling on now for almost ten years and its likely to deteriorate rapidly immediately after the US elections regardless of whether Romney or Obama are in power, because Israel is pressing so hard to do something. Any regional war would be a catastrophe and Iran obtaining a nuclear weapon could be very bad for general stability. Expect some actions in 2013 - with likely dire consequences.

Peak Cheap Oil: Although overall liquids oil production is increasing slightly, the overall oil production growth in the last 8 years has been only 10% whilst oil prices have risen from $33 to $110/bbl. Surely this is telling us something. Yes, there is barely an increase in supply with a three-fold increase in price. That's because it's getting harder to find, develop and produce cheap oil. The very foundation of economic society is cheap oil - and running out. Cheap oil is at an end. Meanwhile US debt levels have s ky-rocketted doubled from 2002 to 2008 then government debt doubled from 2008 to end 2012. US and Western Developed Nation's GDP and oil production up until 2008 have correlated fairly closely. But from 2008 to present, GDP has hardly grown, oil production has dropped and government debt levels have sky-rocketted. What this means is we have hit the limits to growth because of the lack of cheap oil and excessive wastage of oil (e.g. airline flights). The cost of oil imports are now around 3% of GDP for most oil importing developed nations a huge tax on the economy. Most of these economies are not robust enough to handle high oil prices. Any oil price close to $100/bbl will lead to very low growth or recession. If real inflation rates were used rather than government or civil servant manipulated numbers we would probably find the UK has been in recession for years and the US has barely grown since 2008 despite pumping $3 Trillion or printed money into the economy.

ky-rocketted doubled from 2002 to 2008 then government debt doubled from 2008 to end 2012. US and Western Developed Nation's GDP and oil production up until 2008 have correlated fairly closely. But from 2008 to present, GDP has hardly grown, oil production has dropped and government debt levels have sky-rocketted. What this means is we have hit the limits to growth because of the lack of cheap oil and excessive wastage of oil (e.g. airline flights). The cost of oil imports are now around 3% of GDP for most oil importing developed nations a huge tax on the economy. Most of these economies are not robust enough to handle high oil prices. Any oil price close to $100/bbl will lead to very low growth or recession. If real inflation rates were used rather than government or civil servant manipulated numbers we would probably find the UK has been in recession for years and the US has barely grown since 2008 despite pumping $3 Trillion or printed money into the economy.

Peak Oil Exports: This chart below is a pretty good proxy for western developed nation's economic health. Whenever exports rise, growth rises. But oil exports are dropping because growth is dropping and exports will not rise significantly henceforth because there is no more oil to export - the oil producing nations all have rapidly rising oil consumption as they industrialise. This means less oil for the western developed nations. We have hit Peak Oil Exports and Peak Cheap Oil. Our economy will hugely suffer from the effects of the end of cheap oil.

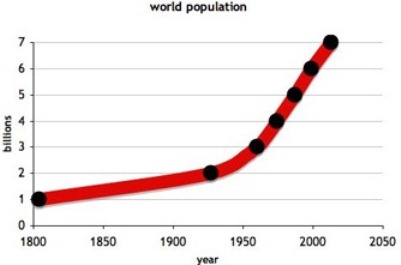

Limits to Growth: We have a fixed size of the planet, but exponential growth in population. Meanwhile oil reserves are increasing but these reserves are all high cost oil sands, shale oil and deepwater oil that was only added because oil prices rose over $70/bbl. There would need to be major technological revolutions to drive continued economic growth a similar prosperity for the expanding population moving forward. This is still possible if:

· Massive switch to natural gas and electric cars

· Expansion in low cost low emissions nuclear energy

· If oil shale, shale gas, deepwater oil production continues to expand at a rapid pace

· Mound energy conservation measures improve the efficiency of cars, transportation and reduce airline usage

· More efficiently farm and whilst conserving forests

· More efficient use of water resources

· Waste less food use less oil to produce food

Rising Costs: When oil was produced in the 1960s, it cost one barrel of energy to get 100 barrels of oil with giant high pressure light crude fields like the Ghawa Field in Saudi Arabia flowing undepleted oil. In the 1970s, this dropped to 1:25, in the 1990s, 1:15 but now with oil san ds and deepwater, it is more like 1:3. For ethanol, it takes 1.5 barrels to create a net extra 1 barrel of oil hugely inefficient and expensive. Its a frightening situation where there is a shortage of rigs, oil engineers and geologists, land-acreage, capacity and capability to increase oil production. As more Middle East countries struggle with expanding populations living in high oil intensive deserts with water shortages, oil prices need to rise to pay for the subsidies and energy requirements of these nations. The countries that used to export oil and now need to import oil have slipped into crisis as export revenues have dried up whilst oil import costs have sky-rocketted this economic shock leads to higher food prices, less subsidies and poverty. Then social unrest breaks out, followed by rioting and revolution. This occurred in Tunisia, Egypt and Yemen with Bahrain struggling to cope all countries that used to export oil and now import oil.

ds and deepwater, it is more like 1:3. For ethanol, it takes 1.5 barrels to create a net extra 1 barrel of oil hugely inefficient and expensive. Its a frightening situation where there is a shortage of rigs, oil engineers and geologists, land-acreage, capacity and capability to increase oil production. As more Middle East countries struggle with expanding populations living in high oil intensive deserts with water shortages, oil prices need to rise to pay for the subsidies and energy requirements of these nations. The countries that used to export oil and now need to import oil have slipped into crisis as export revenues have dried up whilst oil import costs have sky-rocketted this economic shock leads to higher food prices, less subsidies and poverty. Then social unrest breaks out, followed by rioting and revolution. This occurred in Tunisia, Egypt and Yemen with Bahrain struggling to cope all countries that used to export oil and now import oil.

Mining Costs: The same is true for mining costs. Ten years ago it cost $100/ounce to mine gold. It now costs $1000/ounce because of inflation, rising energy, engineering, wage and environmental costs and increasing taxation by governments with higher project risks. Many successful mines are nationalised or at least partly seized once they start-up so its no wander mining costs have sky-rocketted. It also takes more  ore to extract the same quantity of the metal and there have been few game-changing technological innovations in mining that can decrease unit costs. In part because if this, we cannot see gold dropping below $1200/ounce simply because it costs that to get new gold out of the ground. Mining stocks have been bashed down and there seems little confidence in mining companies ability to turn a sustainable profit and keep acreage intact with government increasing taxes or seizing assets. At current extraction rates, silver mining will be close to exhausted in ten years time, and gold mining is becoming ever more difficult as ore grades reduce with time. This should help support gold and silver prices and likely keep mining stocks depressed.

ore to extract the same quantity of the metal and there have been few game-changing technological innovations in mining that can decrease unit costs. In part because if this, we cannot see gold dropping below $1200/ounce simply because it costs that to get new gold out of the ground. Mining stocks have been bashed down and there seems little confidence in mining companies ability to turn a sustainable profit and keep acreage intact with government increasing taxes or seizing assets. At current extraction rates, silver mining will be close to exhausted in ten years time, and gold mining is becoming ever more difficult as ore grades reduce with time. This should help support gold and silver prices and likely keep mining stocks depressed.

In summary, and this is very important, western developed nations are struggling against:

· Demographics babyboomers retiring, aging populations and smaller families

· Peak Oil rising energy costs dragging down western developed nations

· Technology slowing down of technological revolution (saturation of internet, mobile devices, PCs) meaning productivity is slipping

The outcome of these underlying causes is:

· Socialism and big government jumping in with regulations, social spending and promises to win votes

· Denudation of personal freedom, free markets and capitalism replacing with big government, regulations, socialism

· Money printing to pay for debts caused by excessive socialism and reduced free markets

· Skyrocketting oil prices, gold prices and silver prices with higher inflation periods of crash and deflation, followed by more money printing and inflation all the time with lower productivity

1980-2000: Between 1980 and 2000 in western developed nations, we had high birth rates, young motivated population, low debt, low inflation, lowering unemployment, technology revolution (PC, internet, mobile phones), freer markets, rising asset prices, high private spending and high growth.

2005-2022: Between 2005 and 2022, we should have low birth rates, older less motivated population, high debt, high inflation, higher unemployment, less technology revolution (iPADs, Facebook dont add much value), more regulation and less free markets, bigger government, depressed asset prices, lower private spending and very low growth.

Global Elite: The Wall Street elite, Federal Reserve elite and Government work in concert - the printed money is handed to the bankers who then hoard it and speculate to drive up commodities prices - making sure they cycle the money around for fees then make gigantic bonuses. They all close rank and prop each other up. Why is it that trillions of dollars of US citizens money has been lost, squandered or stolen since 2007 yet no bankers are locked away? What happened to the $1.6 billion MF Global money that was stolen from bank accounts? Yet if you steal a crate of coke from a shop or refuse to pay your tax bill, you will be jailed. At no time in history has there been such an extreme example of financial paper pushers - rather than private business owners, engineers and manufacturers - making such gigantic personal profits when their own performance and value creation has been so abysmal. They have destroyed trillions in economic value and take gigantic slices of money out of the game. When their investments fail, they cry "too big to fail" and the government uses tax payers money to bail them out - then they keep their jobs and continue to give themselves gigantic bonuses. These corrupted behaviours at the highest banking levels in society will ultimately lead to the next financial crash - and at this time, college graduates will instead choose to be engineers, scientists, miners, farmers and entrepreneurs rather than bankers and media men. More people study media than agriculture or mining. No wander the economy is in decline.

- the printed money is handed to the bankers who then hoard it and speculate to drive up commodities prices - making sure they cycle the money around for fees then make gigantic bonuses. They all close rank and prop each other up. Why is it that trillions of dollars of US citizens money has been lost, squandered or stolen since 2007 yet no bankers are locked away? What happened to the $1.6 billion MF Global money that was stolen from bank accounts? Yet if you steal a crate of coke from a shop or refuse to pay your tax bill, you will be jailed. At no time in history has there been such an extreme example of financial paper pushers - rather than private business owners, engineers and manufacturers - making such gigantic personal profits when their own performance and value creation has been so abysmal. They have destroyed trillions in economic value and take gigantic slices of money out of the game. When their investments fail, they cry "too big to fail" and the government uses tax payers money to bail them out - then they keep their jobs and continue to give themselves gigantic bonuses. These corrupted behaviours at the highest banking levels in society will ultimately lead to the next financial crash - and at this time, college graduates will instead choose to be engineers, scientists, miners, farmers and entrepreneurs rather than bankers and media men. More people study media than agriculture or mining. No wander the economy is in decline.

QE3: This money printing binge was very predictable. You see the US has to print money to pay for its oil imports ($350 billion per annum) and military ventures ($500 billion per annum). They issue bonds to OPEC countries to pay for the oil. In return the USA uses its military to defend these nations against so call rogue states. OPEC countries have to use the dollars to sell their oil because it is the petrocurrency and the USA has told them to do so. The only countries that have tried to move away from this are Iran, Iraq, Syria, North Korea and Venezuela - and you know what's happened to these countries. They have either been invaded, marginalised and/or have sanctions against them. The US dollar is the petrocurrency of the world - as long as this remains - they can enjoy a standard of living about 33% higher than would normally be the case through this money printing and finance deficit spending. If this unfolds, it would cause the dollar to crash and the dollar to lose its status as the world reserve currency. So watch out in the next few years for any challenge from any nation to this - and the actions or rebuttal that will ensue. Iran has been the latest country to challenge this and we dread to think how this might unfold in 2013. It seems Iraq is now firmly "back in the fold" using the dollar again after a challenge from Sadam Hussain in 2002. Earlier this year, it seems China and Russia struck a deal to bilaterally trade oil in their local currencies - whether this is the beginning of a broader move or not by these and/or other nations is uncertain.

No Growth The New Norm In Western Developed Nations: We hope you can see that it will be very  difficult for most western nations to sustain growth rates over 1.5% for any extended period whilst the babyboomers are retiring and oil prices stay high. Everything points to a crash in the period 2013-2014 and some form or re-set. A possible return to the gold standard, debt amnesty and/or hyper-inflation its difficult to say. Its even possible we will see a prolonged deflationary period, but we believe that central banks will prevent this instead making electronic money from thin computer air. Ultimately, as the dollar crashes, then very high inflation will become the new norm.

difficult for most western nations to sustain growth rates over 1.5% for any extended period whilst the babyboomers are retiring and oil prices stay high. Everything points to a crash in the period 2013-2014 and some form or re-set. A possible return to the gold standard, debt amnesty and/or hyper-inflation its difficult to say. Its even possible we will see a prolonged deflationary period, but we believe that central banks will prevent this instead making electronic money from thin computer air. Ultimately, as the dollar crashes, then very high inflation will become the new norm.

Inflation of Deflation: This is a very difficult thing to predict, because it relies on knowing government policy. We dont know for sure who will be in government, and who the Central Bank leaders will be in any given year. There has been far too much debt issued, and it cannot be paid back. So the debt bubble either pops and deflates, or it is constantly inflated leading eventually to hyper-inflation. If we were to hazard a guess, we would say:

· Obama = Bernanke = Money Printing = Inflation Getting Out of Control

· Romney = No Bernanke = Less Printing = Deflationary Stagnation

However, for investors the scenarios that keep gold prices depressed is when the status quo continues if the Fed is able to prop the markets up, kick the can down the road and create an impression of normality. With occasional raid by JP Morgan on silver and gold markets to beat the price down - to create the illusion of a strong dollar reserve currency. Then there is no panic, and gold prices remain under pressure and subdued. This is the current situation. Gold will not go much lower than its current price. It can't get much more stable than it is today.

Deflation: But if severe deflation sets in through a debt crash (panic) or if hyperinflation kicks off, gold prices in these two unstable variants should under normal circumstances skyrocket. Looking forward, the chance the Fed will be able to maintain the status quo is low and hence we believe that eventually either deflation or hyperinflation will start in earnest, gold will rise fast. In our view owning physical gold bullion is therefore about the best investment or form of protecting one's wealth currently available. We see negative savings rates for some time which helps gold prices, followed by high inflation that helps gold prices or deflation which also helps gold prices. Its difficult to see a scenario in the medium term that gold prices would get bashed down. The only scenario is that the whole global economic situation stabilizes and debts are gradually eroded away with dollar remaining the strong reserve currency and sustainable growth with stable stock and bond markets. We would give this scenario less than 20% chance in the next two years - it really needs denial and rose tinted glasses to envisage this positive outcome. Everything points to turbulence and panic starting in 2013.

President Obama will get re-elected in a weeks time. Helicopter Ben will continue his money printing exploits. US unemployment will rise. Stock markets will drop. A US recession will start Q1 2013 then the pressure on the dollar will start in earnest. The bond market bubble will then pop and by end 2013 things will look bleak and gold should have surpassed $2000/ounce by then with silver over $40/ounce.

UK Situation and Property: London will be hit by financial turbulence again and the Bank of England will continue to mirror what the US is doing. Printing and shifting interest rates around to try and keep a stable banking system and inflation under control. Every time a crash looks on the cards, more money printing will follow. But eventually this situation will become extremely unstable. Then the private sector debts that were taken over by the public sector will get too much to bear most likely leading to runaway inflation.

UK Situation and Property: London will be hit by financial turbulence again and the Bank of England will continue to mirror what the US is doing. Printing and shifting interest rates around to try and keep a stable banking system and inflation under control. Every time a crash looks on the cards, more money printing will follow. But eventually this situation will become extremely unstable. Then the private sector debts that were taken over by the public sector will get too much to bear most likely leading to runaway inflation.

Physical Assets: Anyone owning property will at least have a physical asset and if your borrowing is less than 60%, you will probably do okay as long as your property is in an area of expanding population and employment. London despite being the financial centre exposed to a crash will likely do particularly well because of the global wealth inflows and people buying London property as a hedge against inflation and currency debasement. UK property has excellent legal title so international investors flock in with their cash to park it in London property when economic turbulence ensues. The canning of the mansion tax will help. Even if Sterling declines by 3% a year, many other countries also have declining currency values in comparison and as property prices rise say 8% per annum in Central London with secure title and money stashed away in a safe location, it's tough to see a London property price crash despite recent rises. These inflows should also help local employment in London.

New Wealth Creation: The new wealthy in this environment will be people that hold physical assets such as:

New Wealth Creation: The new wealthy in this environment will be people that hold physical assets such as:

· Gold, silver

· Property

· Land, farmland, forestry

· Mining, oil and mineral rights

The private investors and individuals that will see their wealth destroyed and severely decline in value will hold:

· Government bonds

· Financial paper instruments they do not understand or are controlled by bankers

· Cash holders

· Savers

· Holders of over-inflated high-tech stocks like Facebook, NASDAQ

Investment Strategy: In summary, our steer is, if you have cash and bonds get out now and put those into physical gold,  silver, property, land, artwork and oil. Avoid ETFs because they are backed by nothing and are another paper instrument controlled by bankers. Make sure you have full quality legal title to all your physical asset. Sit and wait. 2013 and 2014 are shaping up to be the crisis of a century and normally after economic crises, war starts. Dont be in denial an example was Great Britain in 1939. Everyone knew there was going to be another World War, but no-one really talked about the Nazis and the atrocities it was just too horrible. Great Britain was also under the grand illusion that it was still a super power with powerful Empire and it was only through massive endeavour, huge courage, millions getting killed and finally some help from the US that eventually the Germans were defeated, only for the Soviets to become the next enemy by 1945. This was only 68 years ago. The collapse of the Soviet Union and end of the cold war was only 26 years ago.

silver, property, land, artwork and oil. Avoid ETFs because they are backed by nothing and are another paper instrument controlled by bankers. Make sure you have full quality legal title to all your physical asset. Sit and wait. 2013 and 2014 are shaping up to be the crisis of a century and normally after economic crises, war starts. Dont be in denial an example was Great Britain in 1939. Everyone knew there was going to be another World War, but no-one really talked about the Nazis and the atrocities it was just too horrible. Great Britain was also under the grand illusion that it was still a super power with powerful Empire and it was only through massive endeavour, huge courage, millions getting killed and finally some help from the US that eventually the Germans were defeated, only for the Soviets to become the next enemy by 1945. This was only 68 years ago. The collapse of the Soviet Union and end of the cold war was only 26 years ago.

Gold - German, UK, Italy and US : The UK sold most of it's gold at a meagre $250/ounce in 2002 when Gordon Brown lost the UK £30 billion by selling at the inflation adjusted historical low price for go ld - the UK only has 300 tons left. Meanwhile Germany has 2000 tons of gold. But they are increasingly worried that 45% of their gold is sitting unaudited in a bank vault at the New York Fed in the US of all places. This is a thorny issue considering World War II - Germany wants their gold back, but they are scared to ask for it to be shipped over. Surely they don't trust that the gold is still there - but they are too polite to admit it. Wow - how did they not see this coming up - how did they get into this situation. The US gold has not been audited for over 50 years. Some speculate a lot of the gold might be missing or lent out to other people. Gold was shipped to the Chinese some years ago - and they drilled into the bars and the embarrassment of the US the Chinese were found the bars to be tungsten (gold plated tungsten bars, ordered by Bill Clinton - tungsten is 99% of the weight of gold, so if you gold plate tungsten bars, you need drill them out or measure their weight with very accurate scales to detect). The UK has 11% of German gold sitting in London and France has 15% - presumably the vestiges of a WWII Breton Woods deal. Meanwhile Italy has 2500 tons - a gigantic quantity - sitting in Italy. Germany has its eyes on the Italian gold - they have already written the Greek gold into their possession through the bail-out deal. If Italy goes the same way, the Italian gold will head north through the Alps to the vaults in Frankfurt. These hidden gold wars will hit mainstream when the crash occurs. Everyone will want gold - very quickly.

ld - the UK only has 300 tons left. Meanwhile Germany has 2000 tons of gold. But they are increasingly worried that 45% of their gold is sitting unaudited in a bank vault at the New York Fed in the US of all places. This is a thorny issue considering World War II - Germany wants their gold back, but they are scared to ask for it to be shipped over. Surely they don't trust that the gold is still there - but they are too polite to admit it. Wow - how did they not see this coming up - how did they get into this situation. The US gold has not been audited for over 50 years. Some speculate a lot of the gold might be missing or lent out to other people. Gold was shipped to the Chinese some years ago - and they drilled into the bars and the embarrassment of the US the Chinese were found the bars to be tungsten (gold plated tungsten bars, ordered by Bill Clinton - tungsten is 99% of the weight of gold, so if you gold plate tungsten bars, you need drill them out or measure their weight with very accurate scales to detect). The UK has 11% of German gold sitting in London and France has 15% - presumably the vestiges of a WWII Breton Woods deal. Meanwhile Italy has 2500 tons - a gigantic quantity - sitting in Italy. Germany has its eyes on the Italian gold - they have already written the Greek gold into their possession through the bail-out deal. If Italy goes the same way, the Italian gold will head north through the Alps to the vaults in Frankfurt. These hidden gold wars will hit mainstream when the crash occurs. Everyone will want gold - very quickly.

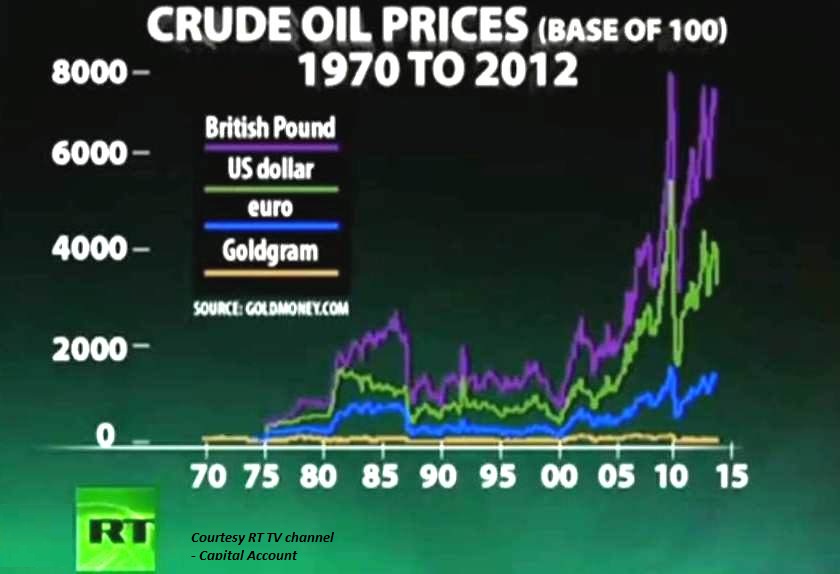

Gold/Oil Price Stable Over 45 years: Just to flag how oil prices have not risen in gold (or real sound money) terms in the last 45 years. Oil prices have risen only in terms of currency (or fiat currency) price. As currencies continue to debase, one can expect this trend to continue - with oil/gold prices starting about the same - but costing more in fiat currency terms due to money printing and debt increase.

Breakdown of Gold Reserves: Here it is. we have prepared a list of countries gold reserves and their 2011 GDP. We have divided one by the other so you can see the countries with the highest amount of gold reserves as a proportion of their overall GDP. You can then see which country is most exposed during a financial crisis as currencies are debased - and if there is a return to a gold standard. As you can see, after Gordon Brown sold the UK's reserves at record low prices ($250/ounce in 2002), leaving the UK in dire trouble. German must be eyeing Italy and Portugal's gold reserves, possibly even France's gold. China is rapidly growing its own gold reserve to play catch-up. Just a note - China is the top producer of gold in the world, but no-one has ever seen a gold bar with Chinese print on it. The reason is simple - they have never exported any of their precious metals. They are now also one of the biggest importer. Longer term they must be positioning to become the global reserve currency - possibly by 2020. But firstly they need more gold and a strong economy plus securing as much oil as possible. They are working on this no doubt. Once their GDP is triple the size and their gold reserves are eight fold - they will equal those of the USA.

GDP $ Billions Gold Reserves Tons Value of Gold $1750/ounce ($ Billion) Value of Gold as % of GDP USA 15094 8,133.5 458 3.0% Germany 3577 3,401.0 191 5.3% Italy 2199 2,451.8 138 6.3% France 2776 2,435.4 137 4.9% China 5739 1052 59 1.0% Switzerland 660 1040 59 8.9% Russia 1850 851.5 48 2.6% Japan 5866 765 43 0.7% Netherlands 840 612.5 34 4.1% India 1722 557 31 1.8% Portugal 239 421.6 24 9.9% UK 2418 310.3 17 0.7% Spain 1494 281.6 16 1.1% Austria 419 280 16 3.8% Belgium 513 227.5 13 2.5% Sweden 538 125.7 7 1.3% S Africa 408 125 7 1.7% Turkey 778 116.1 7 0.8% Greece 303 111.7 6 2.1% Poland 514 102.9 6 1.1% Australia 1486 80 5 0.3% Denmark 333 66.5 4 1.1% Finland 267 49.1 3 1.0% Ireland 218 6 0 0.2% Norway 484 0 0 0.0%

Country

PropertyInvesting.net Nov 2012

Bail Outs: It's estimated that the bankers bail-outs globally since 2008 has cost a total of $23 Trillion. That's the combined amount USA, Western Europe and Japan have spent to bail the banks out. Its gigantic. This fiat money is stupenous beyond any comprehension. What have we seen in return for this investment? The banks made bad bets - they failed - then they said "too big to fail". The government are propped them up. This next crash in 2013-2014 will be gigantic.

Counterpart Risk: Our strong steer is to avoid as much as possible counterpart risk. During the next crash - 2013-2014 - many banks, companies, money managers and investors will go under. If you are entrusting your investments to another entity, be prepared that they might lose, promise or even steal your money. Even having a safe de posit box with bullion in has a counterparty risk albeit very small - banks can foreclose and boxes can be frozen for period - legal title may be challenged. ETFs have a high counterparty risk - likely huge quantities of paper money are backed by small amounts of actual bullion probably promised to multiple investors. Allocated bullion has small counterparty risk. Non allocated bullion a medium counterparty risk. Storing bullion at home also has a counterparty risk - it might be stolen by a criminal or a even a (previously) trusted family member, in any case it's not advisable because one would become a target for criminals (or even so called friends) if people knew you had bullion at home and hence you have a residual physical danger to yourself and your family. Likely the lowest counterparty risk is storing bullion gold and silver coins and bars in a safe deposit box in a large bank in a large city (not your local bank). You really need to consider all these things. In buying bullion, you are implicitly saying you don't trust fiat currency, bankers and government's handling of the economy - counterparties. So don't then hand your gold and silver to these very same people to look after - because one day you might find it's gone and all your best plans are in ruins. This will be particularly true if you are either retired or just about to retire, because you will have no time to recoup. You will end up working again and/or in poverty.

posit box with bullion in has a counterparty risk albeit very small - banks can foreclose and boxes can be frozen for period - legal title may be challenged. ETFs have a high counterparty risk - likely huge quantities of paper money are backed by small amounts of actual bullion probably promised to multiple investors. Allocated bullion has small counterparty risk. Non allocated bullion a medium counterparty risk. Storing bullion at home also has a counterparty risk - it might be stolen by a criminal or a even a (previously) trusted family member, in any case it's not advisable because one would become a target for criminals (or even so called friends) if people knew you had bullion at home and hence you have a residual physical danger to yourself and your family. Likely the lowest counterparty risk is storing bullion gold and silver coins and bars in a safe deposit box in a large bank in a large city (not your local bank). You really need to consider all these things. In buying bullion, you are implicitly saying you don't trust fiat currency, bankers and government's handling of the economy - counterparties. So don't then hand your gold and silver to these very same people to look after - because one day you might find it's gone and all your best plans are in ruins. This will be particularly true if you are either retired or just about to retire, because you will have no time to recoup. You will end up working again and/or in poverty.

30 Year Bond Market Bubble: This started 1982 - after the gold price crashed. Bond prices have never been higher in 240 years of history since the Revolutionary war. It is the most obvious bubble mania we can see now. They are NOT a safe haven. Bonds do not offer a fail safe form of insurance against banking crises, sovereign debt default, monetising debt or any other financial meltdown. We would go as far as to say they may be the trigger for the financial meltdown. It's akin to tulip bulb mania and people will look back one day and realise how ridiculous it is.

End of an Empire: When we look at the USA today, we see a huge global empire with 250 military bases that can no longer be afforded or sustained. This military industrial complex is ba cked by the US dollar as the global reserve currency. But it's bankrupt and about to collapse like all great empires eventually do in history. The USA had its period from 1945 to 2005 sixty years. But its coming to an end and all investors need to understand this and position themselves for it, because it will have big repercussions on asset prices, growth and prosperity in the next ten years. Recall Great Britain in 1972 going cap in hand to the IMF for a bail out after it went bankrupt due to excessive spending and low growth. After it lost its Empire, it's manufacturing, jobs and before North Sea oil saved the day. There is no-one in the world that can bail the US out. $70 Trillion of liabilities are just too great and no-one really knows how things will unfold as the bond market goes pop and the USAs international friends desert the markets and dump dollars. As the Fed responds by marking more trillions out of thin air and dollars are dumped on the markets and streets, a wall of dollars and panic will ensue probably ending in hyper-inflation and the end of the currency as we know it. Watch out in 2013 to 2014 its going to look bleak. Much money will be lost and if you position yourself correctly, you might just come out a winner.

cked by the US dollar as the global reserve currency. But it's bankrupt and about to collapse like all great empires eventually do in history. The USA had its period from 1945 to 2005 sixty years. But its coming to an end and all investors need to understand this and position themselves for it, because it will have big repercussions on asset prices, growth and prosperity in the next ten years. Recall Great Britain in 1972 going cap in hand to the IMF for a bail out after it went bankrupt due to excessive spending and low growth. After it lost its Empire, it's manufacturing, jobs and before North Sea oil saved the day. There is no-one in the world that can bail the US out. $70 Trillion of liabilities are just too great and no-one really knows how things will unfold as the bond market goes pop and the USAs international friends desert the markets and dump dollars. As the Fed responds by marking more trillions out of thin air and dollars are dumped on the markets and streets, a wall of dollars and panic will ensue probably ending in hyper-inflation and the end of the currency as we know it. Watch out in 2013 to 2014 its going to look bleak. Much money will be lost and if you position yourself correctly, you might just come out a winner.