478: Investing Insights

06-27-2013

PropertyInvesting.net team

Tough To See Opportunities: It’s now harder than ever to see a good investment opportunity when one looks at all global countries, industry sectors and types of investment. This summer should start setting the direction for the new few years - we might well be at a crossroads for interest rates and bond prices.

Who Believes the Fed: Last week the US Fed Chairman announced that they were looking towards tapering quantitative easing – or bond purchases - later this year with a potential to cease altogether if the (so called) economic recovery gained momentum and US unemployment levels dropped towards 6.5%. The markets panicked, bond yields shot up 0.5% and gold declined sharply – as did the stock markets. T his was the QE junky starting to go cold turkey at the thought of no drugs on the horizon. They believed the Fed Chairman – probably over-reacting with gloom at the thought of the dollar stimulus drying up – and people started to bail out of everything into cash.

his was the QE junky starting to go cold turkey at the thought of no drugs on the horizon. They believed the Fed Chairman – probably over-reacting with gloom at the thought of the dollar stimulus drying up – and people started to bail out of everything into cash.

Over Reaction: Our view is that this was rather an over-reaction. We remain highly sceptical about whether the Fed Chairman is giving the true story. It's likely the Fed wanted to prevent a stock market bubble developing further - suppress the enthusiasm. Even if the Fed thinks there is a reasonable chance of a stronger recovery moving towards end 2013 – we just don’t believe this will happen. After a few days – the markets started to think the same and bond rates started to drop again, presumably because people thought money printing would likely continue as economic indicators continued to disappoint through the week. The today the Fed announced the annualized Q1 GDP number had been revised down by a massive 0.6% from 2.4% to 1.8% - hardly strong growth. This suppressed bond yields further.

Risks Are Great: We think everything would have to go swimmingly for the Fed to significantly start tightening – and we don’t see this happening because:

-

China looks on the cusp of a big slowdown – with a possibility of an outright financial crisis

-

Oil prices remain high at $100/bbl stifling global recovery and boosting general inflation

-

Japan looks like an accident waiting to happen with their massive money printing binge, nuclear power plants closing and deficit spending

-

Europe looks likely to muddle through its rebalancing period – where the southern European peripheral countries take a competitiveness hammering and stay in a depression - France is now in recession

-

The UK is mired in a long stagflationary period of miserable growth and rising costs

-

The Middle East has severe problems with regional stability with bitter infighting, strife and civil wars

-

Brazil is seeing prices rise and riots by disgruntled civilians that is likely to affect growth

-

India is suffering from high inflation, deficits and high oil prices

-

It’s been five years since the last proper recession – with high oil prices – it’s time for another recession

Which Country? There really aren’t many countries that are faring well – and there are so many big downsides that something is almost certain to trigger another contagion crisis by the end of 2013. This could be a currency crisis in one of the big economies like Japan, UK, China or the USA itself.

Global Contagion: Overall – because the global economies are so interlinked and inter-dependent from globalisation – a crisis in one part of the globe can hit other regions rapidly. The dollar remains the global reserve currency – for now at least – so as countries collapse – people might well go to the dollar as a “safe haven” even though it is not – the US will eventually collapse under it's weight of debt – that’s $17 Trillion direct debt and $70 Trillion includ ing debt including unfunded liabilities (pension, healthcare, military, education).

ing debt including unfunded liabilities (pension, healthcare, military, education).

Plundering Along: For these reasons – our central projection is that the US economy will plunder along in a low growth mode for a while longer and will need continued quantitative easing – or currency printing – to prevent collapse or crisis.

Status Quo: As long as this miserable status quo continues – then bond prices will remain low. But we need to be prepared one day that the bond market bubble finally pops – and no amount of money printing will prevent a currency collapse and/or bond market collapse (bond prices crashing and yields skyrocketing).

Gold and Mining Beaten Down: Gold has been hammered down because people think the "easy money" might stop end 2013 and interest rates will rise – meaning people can put cash into banks and get a decent interest rate. But we think this is unlikely and hence are still bullish on gold prices. We don’t believe the gold bull run has ended – we have long held the view that the end of the gold bull run should be around 2017-2018 – so in the next 4-5 years – there is room for one more big down-leg then an almighty up leg caused by gigantic currency printing and inflation – followed by panic buying of gold. This is yet to come. We are in an intermediary period. It’s always possible we are wrong, but there is not much to dissuade us that continued currency printing will be the order of the day. We are also sceptical that unemployment will drop sharply – if anything there are pressures towards rising unemployment. If US unemployment really gets to a 6.5% level which is when the bond purchase would end – it would be more based on manipulated employment numbers than a true sign of a sustained recovery.

Mines Shutting: Gold mining full cycle production costs are running at $1100/ounce and silver at $20/ounce – so mines have started to close down because prices are not high enough. Arian Silver is an example - they have shut down their mill a few days ago. As supply reduces and demand eventually picks up – we expect gold and silver prices to recover sharply.

GDP Numbers Distorted: The UK GDP revisions came out today, and it was funny to see how growth was revised overall lower but the double dip part of the recessionary period was taken out. So we now only had one recession but the GDP is still -3.9% below the peak in early 2008 - lower than before. That compares to a +3% rise in the USA and +1.5% in Germany. It really has been a miserable period for the average UK citizen.

Super Rich Love Cheap Currency: The super-rich however continue to benefit from the waves of low cost printed currency – then lend this to the middle classes and poor at inflated rates. The super-rich bankers also use this zero cos t money to speculate on assets like bonds, stocks and commodities – in search of high returns. The rich are without doubt definitely getting richer during this inflationary high tax period. The poor will get poorer as food and fuel prices rise, taxes increase without any chance to offset these, then benefits decline and inflation runs far higher than wage growth for the lower paid jobs.

t money to speculate on assets like bonds, stocks and commodities – in search of high returns. The rich are without doubt definitely getting richer during this inflationary high tax period. The poor will get poorer as food and fuel prices rise, taxes increase without any chance to offset these, then benefits decline and inflation runs far higher than wage growth for the lower paid jobs.

More Poor: Just as an example, in the last five years, the number of people using food stamps (nominally described as poor, needing state aid to eat) has quadrupled. In the 1930s, they had soup kitchens. Now they have food stamps.

Investments: This brings us to where to invest. Which sector, country or type of asset.

Paper Assets: Firstly – when the paper financial meltdown finally takes place – and no-one really knows when this will be, the following “assets” could literally go up in smoke – go to almost nothing in value – or at least get a savage hair-cut – a crew-cut:

-

Government bonds, gilts and treasuries

-

Corporate and municipal bonds

-

Currency and other paper derivatives

-

Cash savings (destroyed by inflation or seized by banks of the government)

Physical Assets: The “assets” that will retain value are “physical asset” that you can touch and feel and are very difficult to seize or tax heavily:

Gold, sliver

Oil

Artwork

Property

Farmland

Forestry

Water

Agriculture

Mining stocks

Is Paper Winning? Commodities and gold/silver have been hammered partly because people believe (we think wrongly) that the paper assets will win the day – and have the best returns – as QE slows down.

Stock Market Bubble: But we think the stock market in the UK and USA is in bubble territory, that gold and silver are being held back by markets and concerns about deflation are suppressing physical asset prices. Once it becomes clear the only way out of the currency printing game is to continue to print to keep bond yields low – then inflation starts to get out of control – all the physical asset prices above will skyrocket. Yes, it looks bleak for commodities holders at this time and we can’t blame anyone for considering bailing out of physical assets at this time – but when a financial meltdown starts with high inflation, anyone with rides out the storm will see their debts eroded by inflation and they’ll come out with some secure concrete assets that they can touch and feel – rather than currency or paper with counter-party risk.

London Prime: This is a key reason why London prime real estate prices continue to rise:

-

Super-rich are using cheap currency to make high return, then use cash proceeds to buy physical property assets in a so called “safe haven” – a secure area with good legal basis

-

The UK Sterling continues to decline making the property prices lower in foreign currency terms – they start to look well priced versus Mumbai, Tokyo, New York and Beiji

ng.

ng. -

It’s easy to get money into the UK and out of it again – tax is low for non-doms

-

People speak English, estate agents are comparatively honest compared to those overseas

-

London is brilliant for shopping, finance, tourism, entertainment – attract wealthy foreign families from all over the globe

Bubble? People say the London prime property is in a bubble, but we can see reasons why this trend might continue as long as currency printing continues, bond markets down implode and the central banks kick the can down the road.

Possible Hyper-Inflation: In addition, there is a scenario that in the event of a big bond market crash, when rates go up and a tsunami of UK Sterling and US dollars comes flooding into the UK – that this wave of money will cause hyper-inflation and London prime property prices will skyrocket as the Sterling currency crashes and the central bank has to print to oblivion.

Deflationary Threat: However, if QE end abruptly, interest rates rise and all asset prices decline – then this could cause London prime property prices to drop sharply.

Ripple Effect: This is relevant for all London property investors because there is classic “ripple effect” of rising house prices occurring at this time. The close to Mayfair-Kensington-Chelsea you are, the stronger the ripple. So prices have been rising fastest in Fulham-Hammersmith, St Johns Wood, Bloomsbury, the City, Clapham, Battersea and Kennington. As time moves on – as long as the prime prices stay high, the ripple will spread further to places Whitechapel, Stratford, Ealing, Hackney, Kilburn, Kew, Acton, New Cross. But if the prime prices crash, then these will rapidly deflate – as they did in 1990 and to a lesser extent 2009.

Money Supply: One overriding point is that – if the money supply increase by 10% a year, it’s difficult to understand why central well located property would not rise by about half of this a year – particularly if unemployment is not rising and interest rates stay low.

Bonds Rates: What yo u have to watch out for is interest rates rising sharply – caused by bond yields rising. This could spell disaster for property – particularly areas where the level of mortgage debt to house prices is high. These are generally the poorer area – and often far from London.

u have to watch out for is interest rates rising sharply – caused by bond yields rising. This could spell disaster for property – particularly areas where the level of mortgage debt to house prices is high. These are generally the poorer area – and often far from London.

Bradford Risk: For example, let’s take Bradford as an example. After prices dropped sharply from 2008 to 2011 – prices have stabilised now and are rising slightly again. But mortgage are well over half of the property value for most of these home. Prices are still rising less than inflation despite the base rate at 0.5% and mortgage rates as low as 3%. Just imagine if the base rates rose to 3.5%, mortgage rates to 6% and mortgage payments doubled – these property prices will drop again sharply – another down-leg in the north – hit hard by public sector jobs cuts.

London Risk: Let’s take the other extreme in Mayfair London. Most people are super-rich, buy in cash and have no mortgage. If the interest rates double – it would not have much of an impact – except some of these properties may need to be sold to pay for paper asset losses within a portfolio.

Comparison: So despite the claims the prime London property prices are in bubble territory – one could equality make the argument that Bradford prices are close to bubble levels since they have everything going for them at present – currency printing, lowering unemployment, ultra-low interest rates, ultra-low mortgage rates – and now “help-to-buy” and other stimuli.

FT Bond Rates: For property investors who want to keep an eye on the bond markets – use this link to the FT – in summary declining yields are good for property prices (lower interest rates, higher property prices). A sharp rise in bond prices would spell big problems for property prices.

Knowledge is King: If you invest in any asset class, it really is best to be  an expert or highly knowledgeable at the specific asset class. An example is art. If you specialise in certain types of oil paintings and/or period, you are likely to spot bargains and know which prices are likely to rise as demand rises for the artwork of a specific artist.

an expert or highly knowledgeable at the specific asset class. An example is art. If you specialise in certain types of oil paintings and/or period, you are likely to spot bargains and know which prices are likely to rise as demand rises for the artwork of a specific artist.

Another example is gold and silver mining companies. It’s almost impossible for the average investor to spot or know which company is the best investment – you can do your own research and over time, your knowledge will increase and you might get to beat the market.

Direct Investors Are Normally The Winners: Giving your money to investment advisers is normally a disaster - they charge large fees and often want to offload bad stock to their smaller low end clients – they may be getting fees or a commission for pushing certain stocks – you are likely to be one of them. It’s the same for high-tech businesses and start-ups – you need to know about the business area and develop your expertise in it – otherwise it’s like “taking a punt” or betting. No investing.

Australia and Canada Downturn: Now that commodities prices have come off their peaks and the miners are getting slammed and are slowing down capital expenditure, this will have a negative impact for time on countries like Canada and Australia that have done exceptionally well in the last five years, so be careful with their currencies, property markets and economies just at this time.

that commodities prices have come off their peaks and the miners are getting slammed and are slowing down capital expenditure, this will have a negative impact for time on countries like Canada and Australia that have done exceptionally well in the last five years, so be careful with their currencies, property markets and economies just at this time.

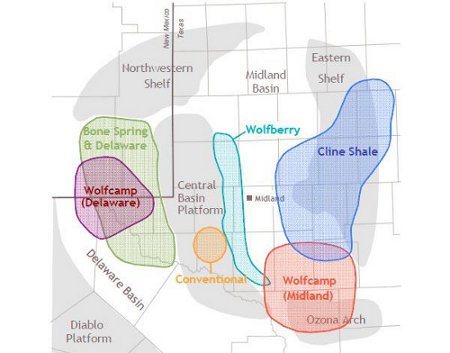

US Survival Shale Oil & Gas: As the US oil and gas production has increased – and oil consumption dropped leading to significantly less oil imports, confidence in the US has stabilised somewhat despite the gigantic currency printing exercise – it’s probably given the US a few more years before the currency crashes. The rise in oil and gas reserves of course helps the US and the US dollar as a reserve currency – since it is of course partly backed by something physical. It might just save the USA from a complete financial meltdown depending on how they manage the currency printing.