538: Crisis Everted – Impact of the Election on Property Investment

05-08-2015

PropertyInvesting.net team

The UK Has Chosen: There was a stark choice for UK voters on 7 May. It was either a vote for Labour propped up by the Scottish Nationalists or the Conservatives – more relative financial stability, growth and a continuation of a viable economic recovery. The UK gave the Conservatives a clear mandate with a majority government to continue their work.

Wider Implications: The wider implications of this particular election are profound, also for property investors. Let us explain.

Old Labour: Firstly, knowledgeable political analysts have always known that without Labour’s Scottish votes, the UK would be overwhelmingly Tory, as long as he Tory economic delivery was acceptable - this would be likely under normal circumstances. The ~54 seat Labour held until this year were always enough  to give it about a 50% chance of swinging the UK parliament into a Labour minority or Labour majority government. Furthermore the “New Labour” centrist government sometimes looked more right leaning than left leaning and this captured the middle ground from 1997 to 2008 - it was very popular also with business. How things have changed. After Blair left, Labour started a mild lurched to the far left under Brown – then this accelerated under Miliband in 2010 (his father was a Marxist and he was voted in as leader ahead of his “New Labour” brother David Miliband by the Unions). The UK and Scotland rejected Ed Miliband's populist left wing anti-business rhetoric and the threat of hooking up with the non-elected First Minister for Scotland Nicola Surgeon with her deputy Alex Salmond - who lost his Referendum only six months ago and resurfaced to lead the nationalist charge in Westminster. Only 1.4 million Scottish voters - with their 56 seats won. Meanwhile in England and Wales, 3.9 million UKIP voters got 1 seat, 2.42 million LibDem voters got 8 seats and 1.2 million Green voters go 1 seat. The hugely disproportionate representation of the Scottish National Party in Westminster will upset the rest of the UK and it only seems a matter of time before the rest of the UK allows them to have another referendum and f

to give it about a 50% chance of swinging the UK parliament into a Labour minority or Labour majority government. Furthermore the “New Labour” centrist government sometimes looked more right leaning than left leaning and this captured the middle ground from 1997 to 2008 - it was very popular also with business. How things have changed. After Blair left, Labour started a mild lurched to the far left under Brown – then this accelerated under Miliband in 2010 (his father was a Marxist and he was voted in as leader ahead of his “New Labour” brother David Miliband by the Unions). The UK and Scotland rejected Ed Miliband's populist left wing anti-business rhetoric and the threat of hooking up with the non-elected First Minister for Scotland Nicola Surgeon with her deputy Alex Salmond - who lost his Referendum only six months ago and resurfaced to lead the nationalist charge in Westminster. Only 1.4 million Scottish voters - with their 56 seats won. Meanwhile in England and Wales, 3.9 million UKIP voters got 1 seat, 2.42 million LibDem voters got 8 seats and 1.2 million Green voters go 1 seat. The hugely disproportionate representation of the Scottish National Party in Westminster will upset the rest of the UK and it only seems a matter of time before the rest of the UK allows them to have another referendum and f ull devolution – they will be a thorn in the side of all UK political parties and be given far too much attention considering they represent only 1.45 million voters/people of the 60 million UK population.

ull devolution – they will be a thorn in the side of all UK political parties and be given far too much attention considering they represent only 1.45 million voters/people of the 60 million UK population.

Party Seats Million %

Conservative 331 11.33 36.9

Labour 232 9.35 30.4

Scottish National Party 56 1.45 4.7

Liberal Democrat 8 2.42 7.9

UKIP 1 3.88 12.6

Green Party 1 1.16 3.8

Base Case Prediction: Looking forwards, firstly we cannot see any good Labour leadership material out there, certainly they have no one of the calibre that Tony Blair (albeit with all his faults) was in 1995 when he built "New Labour" up from the ashes of a broken Union led party in the early 1990s and destroyed the Union power in the Labour party. We now predict that:

· The Scottish Nationalists will continue to be a strong party and keep Labou r out of Scotland – Labour is a spent force in Scotland

r out of Scotland – Labour is a spent force in Scotland

· Because of this, Labour will never be able to command a majority in a UK government henceforth

· Because the Liberal Democrats have been destroyed in all parts of the UK, this will help the Tories keep out Labour moving forwards

· Now that Nigel Farage has stepped down, we see UKIP in decline and think the Tories can capture back a lot of these disaffected voters – the UKIP leadership is now weak and disorganised and we don’t see it being a major force with only one seat in parliament. They may grab a few seats I by elections - this is their biggest hope.

For the property investors in England, Wales and Northern Ireland, this outcome is firstly hugely important and secondly hugely beneficial to allow decent returns to be made on investment and financial stability with strong growing markets for both rentals, sales, asset price increases and yields.

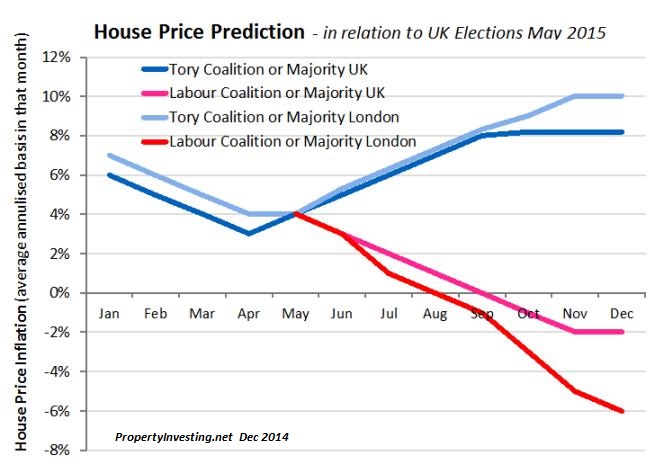

House price predictions based on Tory or Labour victory - made end Dec 2014

Policies: It was also very important the Tories were able to achieve a majority that will mean the Scottish National Party cannot start to dictate the agenda in Westminster. The initially leaderless Labour, LibDem and UKIP parties will find it difficult to block Tory budgets and policies. So we will get:

· Pro-business policies

· Lower interest rates

· Stronger sterling

· Lower inflation

· Higher employment

· Low wage growth

· More immigration

· Moderate levels of building

· Continued lack of home supply due to planning-environment and "nimby" factors

· Rising rental prices

· Rising house prices

· Rising land prices

Property Prices Rippling Out and Up: The "ripple effect" from the booming property prices in London will feed through to all places in England, Wales and start to affect Northern Ireland. Its likely property price growth in Scotland will grind to a halt because the Scottish Nationalist movement that is creating uncertainty for investors and home-owners, hence inward investment will be weaker. Also the oil price crash from $110 to $60/bbl will affect NE Scotland and this will rippled through to the rest of Scotland as deficits widen. The outlook for full independence seems more likely now and this will affect property prices we believe in the period 2015-2017.

London: In London, its good news all the way – partly because:

· The Mansion Tax will become a thing of the past – dropped completely from agendas now the LibDems are no longer part of the presiding government (it was their idea driven by Vince Cable that was then hi-jacked by Labour).

· The Non Dom status will be retained – this is hugely significant because the super-rich will continue to come to London in droves to set up businesses, employ vast amounts of workers and continue to drive economic growth in SE England that will further boost prosperity in England and Wales – some of this will filter through to Northern Ireland and Scotland in the form of public sector spending from high tax revenues built through economic growth.

· Income taxes will not be raised to 50%, instead they will either be kept at 45% or dropped to 40% in the next five years – this will stimulate growth in London in particular and the rest of the UK

· The continued mismatch between population growth, housing supply and employment growth will continue to drive up property prices in London. The safe haven status of London is retained and we expect London top end property prices to rise sharply by about 20% in the next two years – a strong relief rally after Labour’s failed attempt to gain power and tax aspirational people.

Labour Highly Likely Would Have Created a Financial and Constitutional Crisis: As we advised earlier this year in our Special Reports, it was a simple question of divestment (or at best a holding pattern) if Labour achieved power, versus a foot on the accelerator for property investment if the Tories retained power. This outcome is even more positive than anyone expected since Labour appear to be a spent force because the Scottish Nationalist will always keep them out of power, and Nicola Surgeon’s far left strategy has back-fired by getting the Tories back into power with a majority government that does not need her backing to get policy through. No wander despite winning all but two of the Scottish seats, she did not appear to be that happy on May 8 in interviews. It’s worth reminding everyone she does not have a seat or office at Westminster, she is unelected and not part of our UK parliament, so David Cameron won’t need to see her on a day to day basis.

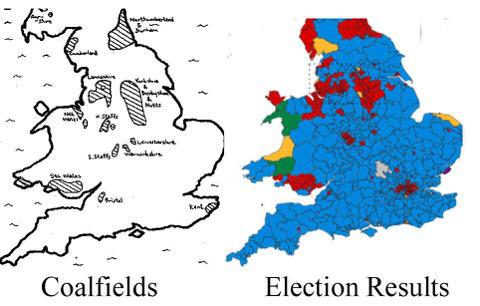

Interesting map showing the correlation of old Coalfield with Labour seats won at the 2015 Election (acknowledgement: Jonathan Dando on Twitter).

It seems highly likely that because the UK population are very intelligent indeed and know what’s going on, they reacted strongly to the threat of the 1.4 million Scottish Nationalists telling the rest of the 58.5 million people what to do – which then put David Cameron in number 10 once more. Apart from London, interestingly the remaining Labour seats in England and Wales seem to correlate strongly with the traditional old coal mining areas - almost all of which have since shut-down.

Southerners: Specifically in Scotland, people seemed to react strongly to something no-one ever talks about – namely Ed Miliband and Ed Ball were two southern OxBridge educated politicians from London that rarely visited Scotland and did not represent Scottish Labour interests (unlikely Gordon Brown, Tony Blair, Alistair Campbell etc). This became evident when Ed Balls lost his Leeds seat – voters said they never saw him and he did not represent the Yorkshire interests.

EU: The big unknowns now are what sort of deal the UK will get from the EU and whether there will be a referendum (likely) and what it will be exactly for on the EU. This is important because the big banks want to remain in the EU but not be overly regulated by them – something Osborne and Cameron will be well aware of. They don’t want HSBC and other banks moving their HQs – with the jobs losses that would ensure.

Trident and Scotland: Also – the Tories will probably want Scotland to stay in the Union – despite this potentially keeping them out of power as was seen in their canvassing with labour for the Referendum, but if the pressure build even further and this affects the financial-economic-security-stability, they and the rest of the UK may eventually want to jettison Scotland – allow them to go it alone – particularly if they block Trident. The Scottish would then take their debts and deficits with them and make their own choices – and they may not quality to be in the EU because of the high deficits. Certainly it’s been a major issue the threat of the Scottish Nationalist blocking Trident, especially given Russia’s continued threat (e.g. flying military planes unannounced into UK air space and sailing nuclear submarines into our water around our coast).

Open For Business: Moving forwards, broadly speaking expect the following policies and outcomes from t he Tories:

he Tories:

· lowering taxation

· reduced regulation

· decreasing deficits and public sector spending with smaller government

· continued implementation of pro-business policies

· slight reduction in the size of government and public sector

· low borrowing costs

· strong sterling

· strong financial markets

· booming services sector in London

· continued high levels or immigration

· challenge to EU rules and regulations, particularly those affecting the financial sector

· pro-property ownership policies

· pro-landlord and policies

· pro-private sector home building policies in developing areas

· lower unemployment, higher employment

· lower public sector spending

· lower social security payments and spending

Outcome: The outcome will be the UK growing at an even faster pace that other G7 countries, likely to be the fastest growing G7 country in the next few years, also boosted by the lower oil prices and low oil import costs.

Finally – for all property investors – what a relief that sense has prevailed and a far left socialist government is not running the UK now.

We hope you have found this Special report helpful in framing your investment strategy for 2015. If you have any queries – please contact us on enquiries@propertyinvesting.net