568: Coronavirus Update and Oil Price Collapse

03-19-2020

PropertyInvesting.net

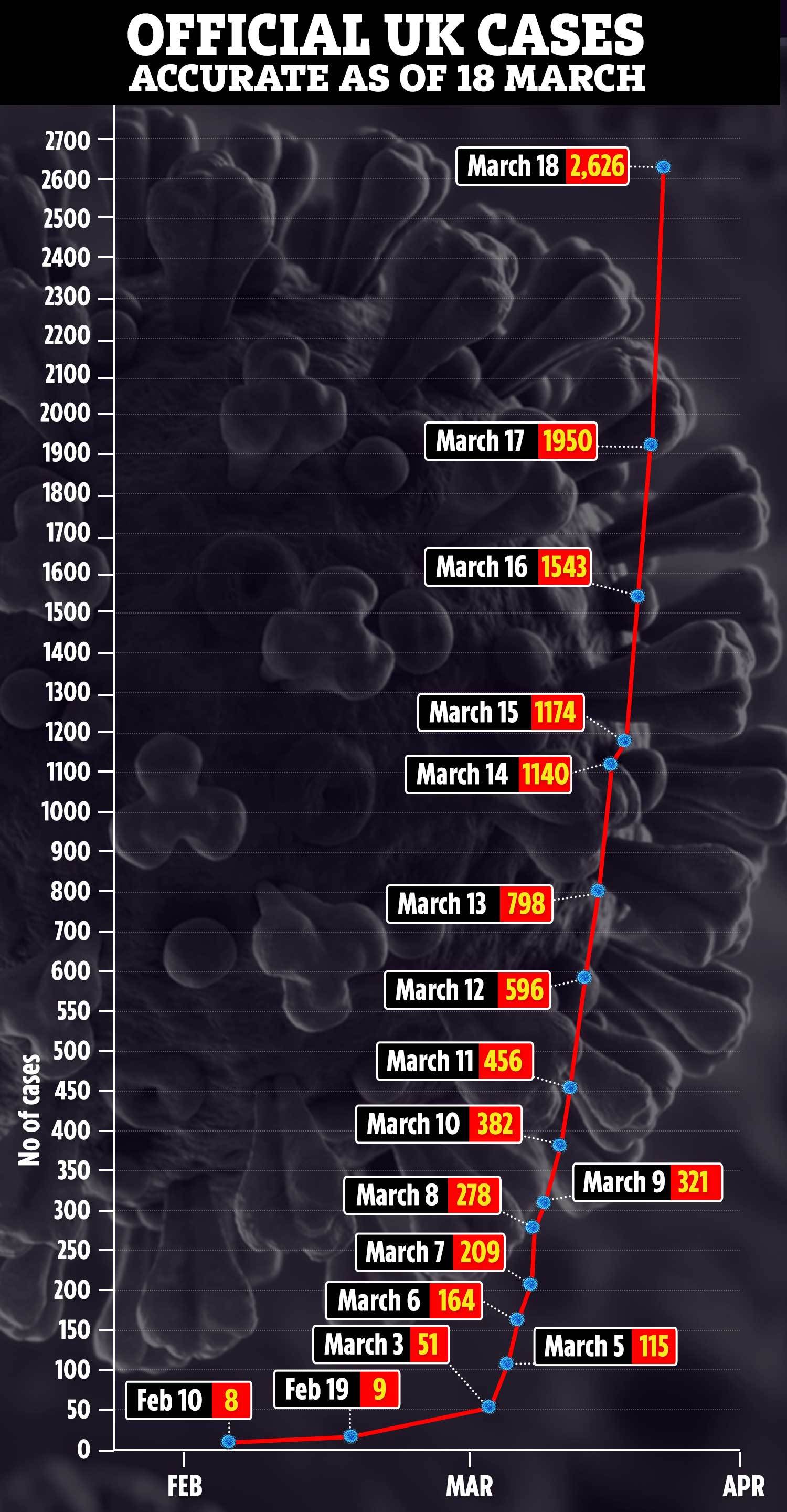

Coronavirus: Obviously, the key economic theme at the moment is Coronavirus. Just when the UK economy was picking up very nicely because of a relief rally post Tory election victory, it has been zapped back from March onwards by Coronavirus as the impact on people not going about business as normal starts to take effect. Everyone is rightfully concerned about their own health, the health of their family, friends and all citizens, particularly the elderly - very challenging times. Beyond any doubt although there are few concrete economic numbers out yet the economy will be zapped big time and a formal recession is almost for certain. The main reason is that the services sector in the UK makes up 70% of the economy thats things like eating, drinking, transport, financial services. As people venture out less and spend less the economy is likely to be very badly affected in a 3 month time frame probably a lot longer. The Bank of England did good in dropping interest rates from 0.75% to 0.25% - at least they were able to react unlike the Euro zone that have such low interest rates already, a drop would likely cause lenders to lend even less. The Budget on 11 March the day after the base rate drop was coordinated and there was some support for businesses. But many businesses are likely to rapidly get into trouble as customer numbers plummet. Because of the UK's economic vulnerability post Brexit, currency printing plans, its lack of safe haven status these days and the lower interest rates - Sterling has crashed from £1.28/$1 to £1.09/$1. Unemployment will rise sharply during this pandemic. The big question is how long will it last and how severe will the impact be on the overall economy. Coronavirus also likely to break out gain in the UK in October 2020 as the flu season re-starts not a pretty outlook. Many people will die. One could argument the media reaction is way over done, but then look at Italy as of 13 March 2020 1280 people have died. Acknowledging many of these people will have been elderly people in poor health anyway, but thats still a large number of people and its just the beginning. This is a very real health crisis because the mortality rate is about ten times the mortality rate of normal flu in the different age groups. For instance, for age group 50-60 years old, mortality of those recorded as having Coronavirus is around 1% - instead of 0.1% for normal flu. For age group 65-80 years old its more like 5% instead of 0.5% for flu. And there is no vaccine yet. It will take a year to develop one probably. Its simply best to try and avoid getting the virus as much as possible, at least before a vaccine is developed hopefully. Some health tips:

people venture out less and spend less the economy is likely to be very badly affected in a 3 month time frame probably a lot longer. The Bank of England did good in dropping interest rates from 0.75% to 0.25% - at least they were able to react unlike the Euro zone that have such low interest rates already, a drop would likely cause lenders to lend even less. The Budget on 11 March the day after the base rate drop was coordinated and there was some support for businesses. But many businesses are likely to rapidly get into trouble as customer numbers plummet. Because of the UK's economic vulnerability post Brexit, currency printing plans, its lack of safe haven status these days and the lower interest rates - Sterling has crashed from £1.28/$1 to £1.09/$1. Unemployment will rise sharply during this pandemic. The big question is how long will it last and how severe will the impact be on the overall economy. Coronavirus also likely to break out gain in the UK in October 2020 as the flu season re-starts not a pretty outlook. Many people will die. One could argument the media reaction is way over done, but then look at Italy as of 13 March 2020 1280 people have died. Acknowledging many of these people will have been elderly people in poor health anyway, but thats still a large number of people and its just the beginning. This is a very real health crisis because the mortality rate is about ten times the mortality rate of normal flu in the different age groups. For instance, for age group 50-60 years old, mortality of those recorded as having Coronavirus is around 1% - instead of 0.1% for normal flu. For age group 65-80 years old its more like 5% instead of 0.5% for flu. And there is no vaccine yet. It will take a year to develop one probably. Its simply best to try and avoid getting the virus as much as possible, at least before a vaccine is developed hopefully. Some health tips:

Wash your hands regularly and particularly after contact with any surfaces or rails used by the general population or family-friends wash hands thoroughly with soap for at least 30 seconds each time

Carry around some hand sanitizer so you can use this if no sink or wash basin is handy apply after you have washed your hands is best

Avoid touching your nose, eyes or mouth the virus is transferred from hands to saliva and water

Drink regularly small amounts of water and keep your through wet since the virus if your throat is dry, can pass into your lungs where is can develop its maximum negative impact ultimately leading to pneumonia/infection and thence death. The gulping of water washes the virus into your stomach where it is killed.

If you get a fever, stay away from everyone self isolate for 7 days and if you are with your family then you should all self-isolate for 14 day. Also, if you have a fever or soar throat do not do rigorous exercise particularly in cold dry areas since this will suck the virus deep into your lungs and increase the chances of pneumonia.

Property Stagnation Possible Crash: The pandemic is highly likely to lead to the property market stagnating at best, with prices falling now the new base case. Rental demand will drop as unemployment rises. Defaults of rentals will increase as people are laid off from the services  sector and struggle to pay rents. The lower interest rates will help buy-to-let landlords, but the effect of rental defaults will be more severe than the help the government gives you can be almost certain of that.

sector and struggle to pay rents. The lower interest rates will help buy-to-let landlords, but the effect of rental defaults will be more severe than the help the government gives you can be almost certain of that.

Interest Rates Drop: Since UK interest rates have dropped to their maximum realistic low of 0.25% we expect the UK government to next start printing currency devaluing the pound further. When this happens, normally gold and silver prices rise and any economic panic also normally sees gold and silver prices rising sharply. However, although gold and silver prices rose about 20% in the last six months, they recently dropped back by $100/ounce to $1500/ounce for gold this is a bit confused - albeit they stayed level in Sterling terms as Sterling declined. The Coronavirus and the threat of either massive deflation or massive inflation would normally sent gold very much higher in either case.

Oil Price Collapse and OPEC Disintegration: Just as the affects of Coronavirus were accelerating in Italy and around the world, OPEC held their meeting 5th March 2020. Saudi Arabia asked Russia for a meagre 0.3 million bbl/day drop on top of the existing cuts (Russia produces around 11 million bbld/day of the total global oil production of 100 million bbl/day), but Russia refused saying it was technically problematical. Then Saudi Arabia the next day on 6 March, unilaterally announced they would be scrapping the current production cuts, and opening the oil flood gates they plan to increase production from around 9.5 million bbls/day to 12.2 million bbl/day with talk of 13 million bbls/day there is now likely to be a massive oil supply overhang of some 5-7 million bbls/day. On the same day, Crown Prince Mohammed bin Salman (or MBS for short) arrested the ex-Crown Prince accusing him of some form of coup attempt (or treason) his is alleged to have tried to get the seat as Chair of a Committee that would decided who the next King is when the current one passes. The ex-Crown Prince has now gone from house arrest to jail and is likely to be charged. The flooding of the oil markets on the day the arrest was made is unlikely to be coincidence.

Even More Oil: A little later, on Tuesday 10 March, the UAE announced they would increase production by 1 million bbls/day. The Saudis are playing a game of punishing Russia, Iran and Venezuela with lower oil prices but of course the also punish themselves. Its a very dangerous economic strategy for Saudi because they need about $70/bbl to break even with their budgets and have a very young population that needs social hand-outs to avoid open decent. Saud also want to destroy marginal US Shale Oil companies because these companies that have a breakeven oil price of around $45/bbl and have been instrumental in adding around 4.5 million bbl/day additional oil supply in the last ten years. The flood of oil will also probably also stimulate oil demand. But Saudi tried this in 2014 again MBS - and it spectacularly failed then they U-turned in 2016. It could just be a short-term bluff to bring the Russians and other OPEC states people back to the negotiating table we will see it rather looks like its not a bluff. Whatever happens, we cant see oil prices rising over $45/bbl and there could be years at range $25-$40/bbl henceforth after this latest collapse. Wheres The Bottom? We havent seen the bottom for oil prices yet at $28/bbl and we think by mid April oil prices could quite easily be around $15/bbl before recovering.

also punish themselves. Its a very dangerous economic strategy for Saudi because they need about $70/bbl to break even with their budgets and have a very young population that needs social hand-outs to avoid open decent. Saud also want to destroy marginal US Shale Oil companies because these companies that have a breakeven oil price of around $45/bbl and have been instrumental in adding around 4.5 million bbl/day additional oil supply in the last ten years. The flood of oil will also probably also stimulate oil demand. But Saudi tried this in 2014 again MBS - and it spectacularly failed then they U-turned in 2016. It could just be a short-term bluff to bring the Russians and other OPEC states people back to the negotiating table we will see it rather looks like its not a bluff. Whatever happens, we cant see oil prices rising over $45/bbl and there could be years at range $25-$40/bbl henceforth after this latest collapse. Wheres The Bottom? We havent seen the bottom for oil prices yet at $28/bbl and we think by mid April oil prices could quite easily be around $15/bbl before recovering.

Saudi Policy and MBS. To try and understand the Saudi policy is difficult  what one needs to do is try and imagine what is going on in the head of Crown Prince Mohammed bin Salman (MBS). He is known to be unpredictable, with a destructive streak, he can get angry, and by all accounts does not shy from confrontation. Our view is he is upset with Russia for not agreeing to cuts whilst likely not fulfilling their original OPEC-plus supply cut agreement (the Russian seemed to have pretty much ignored the previous commitment, they only delivered supply serious supply cuts when then had an oil quality issue some months ago) and then said they did not want to join the supply cut alliance moving forwards. It's possible MBS thinks he can punish Russia with lower prices that hurt Russia more than Saudi Arabia. He might also wants to try and drive the US Shale Oil Companies out of business. He also probably wants to punish Iran with even lower prices and they hardly produce any oil now on top of it since they are sanctioned and Iran economically and politically is on its knees.

what one needs to do is try and imagine what is going on in the head of Crown Prince Mohammed bin Salman (MBS). He is known to be unpredictable, with a destructive streak, he can get angry, and by all accounts does not shy from confrontation. Our view is he is upset with Russia for not agreeing to cuts whilst likely not fulfilling their original OPEC-plus supply cut agreement (the Russian seemed to have pretty much ignored the previous commitment, they only delivered supply serious supply cuts when then had an oil quality issue some months ago) and then said they did not want to join the supply cut alliance moving forwards. It's possible MBS thinks he can punish Russia with lower prices that hurt Russia more than Saudi Arabia. He might also wants to try and drive the US Shale Oil Companies out of business. He also probably wants to punish Iran with even lower prices and they hardly produce any oil now on top of it since they are sanctioned and Iran economically and politically is on its knees.

Low Oil Price Strategy Whats Going On? The commonly held view is that MBS is not helping Trump but Trump likes low oil prices particularly just before the election and especially during the Coronavirus outbreak. And Trump also has a tool that can help the Fed that can drive interest rates down, print dollars with impunity and help the struggling Shale Oil producers via the back-door to prevent bankruptcies and prevent jobs losses at least until after the Election. Low oil prices simulate economies oil demand and kill off renewables growth. No ones talking climate change anymore. People are more worried about diesel in the tank and power outages from Coronavirus. Low oil prices particularly stimulate economies in major oil importing nations and the USA. If we play back to 1986, most people believed the US and Saudi colluded to flood the oil market that led to a crash in oil prices from $25/bbl to $8/bbl and it cost the Soviets $14/bbl in oil production and pipeline export costs at the time so within a year they were bankrupt and the Soviet empir e collapsed spectacularly. We dont know for sure, but its possible both the Saudis and the US government are collectively targeting the following countries they want to punish for their military and socialist endeavours at this time:

e collapsed spectacularly. We dont know for sure, but its possible both the Saudis and the US government are collectively targeting the following countries they want to punish for their military and socialist endeavours at this time:

Russia for Crimea, Syria, US election interference

Iran for proxy wars Yemen, Syria, Iraq etc and Nuclear enrichment

Venezuela socialist Presidents since 1999 have always been highly critical of the US Administration, and nationalised the oil companies, arrested oil executives and made unpopular socialist policies that the US believes has hurt their ordinary citizens

Low Oil Prices Help Coronavirus Affected Countries: Interestingly and there is probably no good reason for this the countries with the highest oil important bills per GDP just so happen to be the ones that are most affected by the Coronavirus so the low oil prices will help the count ries most affected so far namely:

ries most affected so far namely:

- Italy

- China

- Japan

- South Korea

- Spain

This will be very good for property investors in oil importing nations since it keeps a lid on inflation and feeds through to lower interest rates and higher house prices. However a bigger short term negative impact is of course Coronavirus.

Elderly People: Its also worth mentioning that Coronavirus generally effects elderly people far more than younger fitter people so Italy and Spain with their older populations would no rmally fare worse. Its also likely that countries where people go out doors whilst being close together and frequent cafes and restaurants in cities and are more family oriented tactile societies - will pass the virus around faster and easier likely the Italians. We are likely to find that Londoners who tend to go out less and are more insular will see the spread rate lower than places like Milan and Madrid where the nice sunny weather also encourages people to go out and meet a lot spreading the virus.

rmally fare worse. Its also likely that countries where people go out doors whilst being close together and frequent cafes and restaurants in cities and are more family oriented tactile societies - will pass the virus around faster and easier likely the Italians. We are likely to find that Londoners who tend to go out less and are more insular will see the spread rate lower than places like Milan and Madrid where the nice sunny weather also encourages people to go out and meet a lot spreading the virus.

USA More Room and More Isolation: We will probably find that in the USA because people drive everywhere often on their own and they tend to mingle less, with more room between people, the spread rate will be lower time will tell. So our predication is that cities like Paris, Barcelona, Montpellier, Athens and Nice where people eat out a lot and mingled in the evenings will be affected more than places like Manchester, Oslo and Helsinki.

Temperatures: Its also worth remembering its seasonal, the virus thrives in temperatures of 4 to 16 deg C but above 27 deg C is gets killed off. So Iran is being hit at this time because it is cool, but come the summer when temperatures rise above 30 deg C will be die away. In the UK as t emperatures rise in May, we hope it will die off rapidly but its likely to return again in October in the northern hemisphere hopefully with less fatal consequences, though learnings from the Spanish Flu outbreak in 1918 suggests it could even be worse time will tell.

emperatures rise in May, we hope it will die off rapidly but its likely to return again in October in the northern hemisphere hopefully with less fatal consequences, though learnings from the Spanish Flu outbreak in 1918 suggests it could even be worse time will tell.

We hope this Newsletter has been insightful in giving you a flavour of the pressures and challenges developing in 2020 it really will be a year to remember and we frankly dont know whats around the corner as the pace of change accelerates and more panic sets in. We will update further around 1 April 2020 as this fast developing global economic threat Coronavirus - passes through the globe and its likely to spawn other financial and social crises, another Black Swan event. If you have any queries, please contact us on

enquiries@propertyinvesting.net