581 : Coronavirus update and property investing London and Manchester

10-07-2020

PropertyInvesting.net team

COVID-19: An update on the Coronavirus situation. Back in March there were an estimated 120,000 cases per day in the UK although early testing was almost no existent - meaning that there were only around about 7,000 recorded cases each day end March to early April. Now in early October we are seeing cases of in the range 6,000 to 20,000 a day - however the death rate is in the range 20 to 70 per day – this compares with over 1100 case at deaths a day back in March. Although there is a lot of nervousness and concern about this second COVID-19 wave, particularly in NW and NE England – currently recorded cases are only around 7% of those estimate in April with only 5% of the death rate compared to six months ago. To put this into context, on an average day there would be 1100 deaths in the UK – mainly the elderly of course – so COVID-19 equates to around 4% of deaths each day. A few days ago, all but four COVID-19 deaths were from people who had an underlying health condition. In comparison, total flu and pneumonia deaths are normally around 100 a day – so the COVID-19 at 20-70 significantly less.

at 20-70 significantly less.

Obviously, all the measure taking place are keeping a lid on the rapid spread of COVD-19 and saving lives, but we need to balance this with the economic destruction and metal health issues that the lockdowns and measures are creating – and possibly some hidden deaths from this stress. Of course it’s a balance with people arguing in both directions – many small businesses might be arguing for less measures so they survive the economic destruction and save jobs. Whilst the unions and more socially minded people – likely less in tune with jobs losses and economic aspects – might argue for more severe lockdown measures and the curtailment of all mixing of people at work or in social groups.

This pandemic certainly is rolling onwards and even if all social distancing measures were lifted by end 2020 – the economic damage caused through unemployment and businesses folding will be felt for many years. This is a Great Depression – no doubt. The GDP has tanked well over 20% and the recovery is and will be slow.

Inflation: What property investors should now expect is general inflation. The reason is simple – the Treasury is printing currency like there is no tomorrow – giving hand-outs and propping  up the whole economy. This currency value has to come from somewhere and it comes in the form of higher prices – general inflation moving forwards. Governments around the world are “pumping up” the economy in the form of tax breaks, currency printing and record low interest rates. Inflation is and will be created that will give an illusion of real growth – to try and get the economy back going again. But the fundamentals are poor – manufacturing has massively declined, productivity has dropped, millions are unemployed and business and individuals are rapidly going bankrupt despite large state interventions. General inflation initially increases food prices and reduces disposable earnings, but eventually as long as interest rates don't rise sharply - it feeds through into house prices and general inflation.

up the whole economy. This currency value has to come from somewhere and it comes in the form of higher prices – general inflation moving forwards. Governments around the world are “pumping up” the economy in the form of tax breaks, currency printing and record low interest rates. Inflation is and will be created that will give an illusion of real growth – to try and get the economy back going again. But the fundamentals are poor – manufacturing has massively declined, productivity has dropped, millions are unemployed and business and individuals are rapidly going bankrupt despite large state interventions. General inflation initially increases food prices and reduces disposable earnings, but eventually as long as interest rates don't rise sharply - it feeds through into house prices and general inflation.

What is strange in our view is how well house prices have kept up despite the turmoil. We can only deduce that the reason for the 7% house price increase since the lockdown was lifted is caused by a combination of the following aspects:

• Stamp duty holiday

• Record low interest rates

• People re-locating out of London and other city centres – looking for more outdoor space and leafier environments in case of further lockdowns and continued home working

• Pent up damage of 3 months when no sales were taking place April-June 2020

• People who have a job – are still getting paid the same – and their commuting and living costs have dropped because of home working – meaning their disposable income has risen

• The furlough scheme saved many jobs and maintained incomes

• The wave of unemployed people has not yet been seen in the housing market with regard to forced sales and personal and business bankruptcies

• A continuation of the “relief rally” post 12 Dec Election result – when people started to look forward to some stability after the Tories won a big majority for the next 4-5 years and liberal-socialist anti-Brexit arguments, distraction, turmoil and denial led by Corbyn was defeated after a 3 year battle

There is plenty that can now go wrong for the property market – namely:

• More severe measure and lockdowns occur that stifle demand – both for purchases and rentals

• End of the stamp duty holiday expected March 2021

• Massive new unemployment hits the market

• Increasing interest rates

• People continue to “bail-out” of London – in a semi-panic style – thinking (in our view wrongly) that things will never recover and home working in a rural environment will work better for them moving forwards

London: With regard to London – this super city’s attractions have not really changed. It’s just that in the current stressed environment – its difficult for people to relax and enjoy experiences like – cafes, theatres, restaurants, pubs, travel, music concerts, art exhibitions, sporting events, rock concerts, public transport etc. Most of these activities are cancelled until further notice. But remember if you are young and single – you desire to be around like minded people to have social contact – many are finding the ideal partner. Living in rural areas in the dark damp rainy winter months for most young people is a miserable experience. For older people also – shops, cafes, experiences you get in major cities like London give zest to your life and beats living in the sticks. We predict that London will get back onto its feet by mid 2021 – and the international visitors will start to arrive in droves again. Just like the “roaring 20s” – which “roared” with music, parties, dancing and growth in 1922 – immediately after the Spanish flu that killed millions – we will see the roaring 20s again – in 2022 in London. So the canny property investors and young people should be snapping up bargains now before it’s too late. We know this sounds rather counter-intuitive – but the waves of currency printing and turning the corner end 2020 is likely to see some bargains early 2021 in London in particular. And by mid 2021  – people will be itching to get back to the good old days of tourism/attractions and generally having a great time in London.

– people will be itching to get back to the good old days of tourism/attractions and generally having a great time in London.

Crossrail: It’s also worth reminding everyone of Crossrail that will be opening in 2022. Everyone has been distracted with COVID-19 – but this massive new infra-structure project will regenerate places like Forest Gate, Acton, Abbey Wood, Southall, Hanwell, West Drayton, Old Oak Common, Manor Park, Seven Kings and all the way to Shenfield. Plus give a big boost to established areas like Ealing, Maidenhead, Reading, Bond Street, Farringdon and Paddington. If you are young, a two double bedroomed Victorian flat near Acton Main or a terraced house at Forest Gate look like a winners.

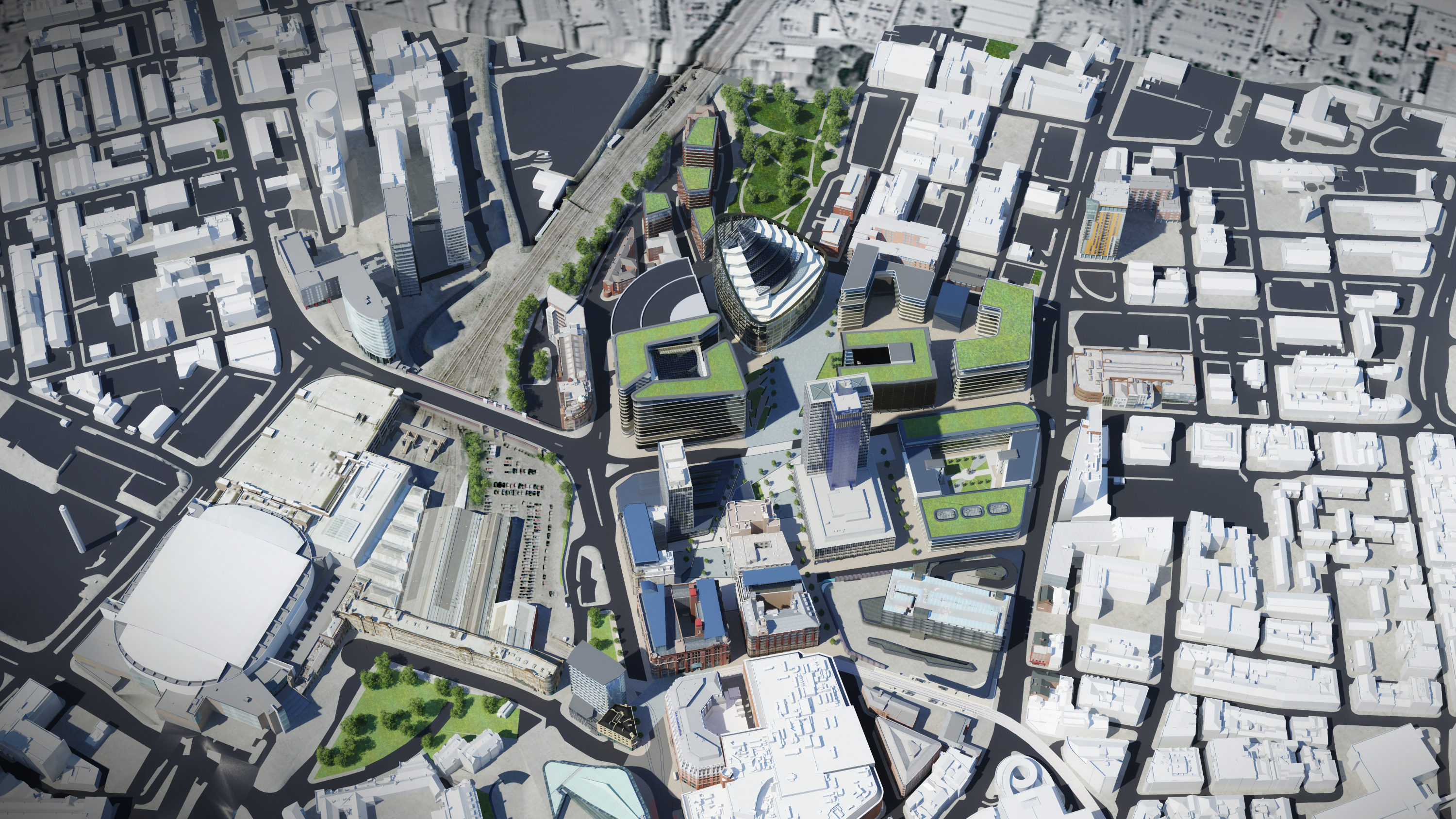

Manchester: Arguably the UK’s second city – at least for business-commerce – is Manchester. This city has a number of advantages over neighbouring cities:

• Large BBC TV centre (relocated from London)

• Two of the biggest football clubs in the world

• International airport just to the south – the second biggest in the UK after Heathrow

• Links to China – large Chinese community

• Excellent Universities – Manchester and Salford (famous for engineering-business)

• 15 million people living within an hour’s drive

• Good road and rail links to neighbouring cities and areas

• Close to the Pennines and Peak district, plus Cumbrian Lake District

Today – the COVID-19 crisis is sweeping through the city and will definitely affect the economy. But likely by early 2021 – things will have settled back down again. Manchester – with its expanding population and regeneration – plus inward investment from places like China, Europe and USA – will be a booming city we believe. House prices are reasonable – many areas are being regenerated and we see a good future for Manchester in the next 4 years. It looks like a good place to pick up a bargain at this time – and see the benefits feed through in the next 4 years.

We have outlined below some of the biggest Manchester regeneration projects:

1. Spinningfields - £1.5 billion project that has given the city of Manchester a new area, now home to much of the city’s financial community and restaurant scene. Spinningfields is described as the “Canary Wharf of the North” and is used by PWC, Deloitte, HSBC and Barclays. New building include the XYZ Building, and 1 Hardman Square both completed in 2017.

2. NOMA - biggest development project in the whole of the North West, and is focused on the redevelopment of some of North Manchester’s most neglected areas. The project’s flagship development has seen the Co-operative Group move their head office to the new One Angel Square. The project cost is around £800 million.

3. MediaCityUK - One of the biggest overhauls seen in Greater Manchester has left Salford Quays absolutely unrecognisable. Formerly an industrial hub thanks to the heaving Manchester Ship Canal, the area has been redeveloped to create a vibrant, modern area that is home to some of the UK’s biggest media names. Leisure facilities include the Lowry Outlet Mall, the Lowry Theatre, and the Imperial War Museum, Salford Quays has become a key area of the UK for those in the broadcasting industry when the BBC moved from London in the early 2000s.

4. Ardwick In 2013, a £100m regeneration project was finally started after several years of planning, with the aim of overhauling the housing provision within the Ardwick area. Ardwick’s regeneration scheme was focused on the Brunswick estate, with the pre-existing housing there, consisting of 650 social properties, being fully refurbished, and an additional 500 homes being added to the area, 200 of which would be kept as social housing while the rest will be sold privately.

5. St John’s - is an upcoming £1000 mln development, that describes itself as “Manchester’s newest city centre neighbourhood” and is on then outskirts of Spinningfields and is the former Granada Studios area.

We hope this Newsletter has been helpful for you – to assist in reading the current environment for property investors and give a few pointers to opportunities in the UK. If you have any queries or comments, please contact us on enquiries@propertyinvesting.net