175: US market update and the impact of skyrocketting oil prices

12-02-2007

US Market Update

The US real estate market continues to be in a distressed and depressed position in most states. However, the market varies – the

US homes prices have been most negatively affected in areas away from cities where prices shot up the most. Examples are holiday areas in

US homes prices have been most negatively affected in areas away from cities where prices shot up the most. Examples are holiday areas in

The US population has risen from 150 million in 1950 to 300 million today. The population is projected to rise to 450 million by 2050. This implies 75 million new homes will be required. The fastest growing areas are

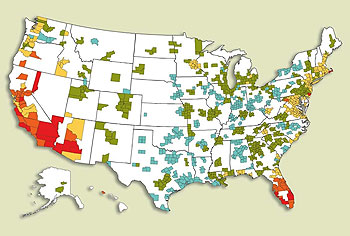

The enclosed map from June 2007 indicates home price risk of correction - though we believe the red areas are some of the areas most likely to increase in the next ten years.

But be careful investing in oil intensive areas like Detroit and Cleveland. These cities are far too reliant on the auto-industry and the increase in oil prices will hit them hard. But

Impact of Oil Prices Skyrocketing

On 14th August when oil prices were at $70 / bbl – we predicted oil prices would rise to $125 / bbl by end 2008. They almost touched $100/bbl end November before easing back to $90/bbl. We have written ten special reports on this topic – we suggest all serious property investors should read these report that have taken years of analysis and insights to prepare:

169: Oil supply crunch begins… protect yourself

168: Alarm bells ringing – oil price shock now on the horizon

163: Making Serious Money as asset prices plateau – resources and property

161: Resources winners and losers - ranked list for property investors

160: Find out the winners and losers in the biggest oil boom in history - about to happen...

159: Massive oil boom - the winners and losers - be prepared

158: Supply and demand scenarios - oil boom and the property investors insights

157: Impact of "Peak Oil" for Property Investment

151: Oil price $125 / bbl and rising…how to take advantage in property

150: Peak Oil shortly due to be reach – unique insights for a property investor

148: Take advantage of the oil/gas/coal boom – key insights

In these reports, you’ll find, for free, all you need to know about how to make serious money from the predicted boom in oil prices. The analysis of all producing oil nations has taken years to prepare and we finally think we’ve cracked it. The results shows that we are now on a rolling plateau production rate, meanwhile demand is increasing by 1.3 million barrels a year. We spotted this abnormality on 7th June 2007 and we now think prices will skyrocket. The opening gaps between oil supply and oil demand is a dangerous situation. OPEC meet early December and may very well communicate they will increase supply by 0.5 million bbls oil per day. But it’s too  little too late. Any increase in oil supply will likely be lower value high sulfur heavy crude. When the markets finds out that the global oil producers cannot increase production any further, there will be a mother of all oil price hikes. So be prepared. And don’t say we didn’t warn you!

little too late. Any increase in oil supply will likely be lower value high sulfur heavy crude. When the markets finds out that the global oil producers cannot increase production any further, there will be a mother of all oil price hikes. So be prepared. And don’t say we didn’t warn you!

This analysis is underpinned by our unique oil production mathematical model which forecast’s every country’s production up until 2015 and it does not make very pleasant reading. As already described – production is on a plateau and has been on plateau since October 2005. This is why prices are rising. But many in the market mistakenly believe there is more oil out there that can be switched on – it’s not going to happen. The plateau could be long and undulating, but we believe everyone is more or less pumping at their maximum. So for the property investor:

· do not purchase property in far off places which take a tank full of gas to reach – this includes suburban homes with a very long daily commute to work centres

· be careful about purchasing holiday homes in places that need a 10 hour flight to reach (stay within 2-3 hour flight radius from major population centres)

· be careful not to purchase huge fuel inefficient homes in cold climates requiring much heating oil, gas or electric

· the lowest risk options are city central quality apartments close to services jobs

· consider purchasing property:

o in oil, coal, gas and mining boom towns (refer to the above special reports)

o close to oil company and oil services company offices

o in areas positively affected by renewable energy developments – solar, wind, hydro-electric, low energy conservation centres.

For US investors the best places to invest in the

For US investors the best places to invest in the

·

·

·

·

·

The

As we predicted, Houston has done well in the last few years to weather any downturn in the real estate market and we expect this to continue. But be very careful not to purchase property more than a 30 minute auto commute to a city centre – when oil prices skyrocket, people will want to move into the cities to reduce their fuel bills. Outlying suburban areas will suffer. An extreme example is – don’t buy a large detached suburban house 80 minutes commute to downtown