316: Sovereign debt crisis and Peak Oil - for property investors

04-29-2010

PropertyInvesting.net team

Oil Price Rising: Oil prices have risen to $87/bbl – danger levels for most global economies. It is no coincidence the global recession in most of the developed and much of the undeveloped world started immediately after oil prices spiked up to $147/bbl. It always happens – without fail. It happened in 1973, 1981, 1990 and 2008. The reason is quite simple. If you import huge quantities of a raw materials and you are already indebted – it’s enough to tip your economy over the edge. Most large developed energy importing nations spend 3 to 6% of their GDP on energy imports . If they don’t produce any indigenous energy, it’s not surprising their economies are not robust enough to handle the impact. Quite simple really.

. If they don’t produce any indigenous energy, it’s not surprising their economies are not robust enough to handle the impact. Quite simple really.

PIGS – Portugal, Italy, Greece, Spain: For many years we have been warning of the exposure of certain countries to Peak Oil – the bottom ranking countries have been Greece, Spain, Portugal and Italy. The reason being that they produce almost no oil, gas, coal or metals – have huge energy import bills and are not famed for either finance/business service and/or manufacturing prowess. If you have highly efficient, innovative and effective manufacturing or business services – you can still survive Peak Oil without dipping severely into recession (example South Korea, Germany). But these Mediterranean countries just don’t. They also rely on airline transport for tourism - another business sector that is zapped by the affects of Peak Oil.

Contagion Potential: What’s happening now is the first significant signs of sovereign debt contagion – banks and investors starting to run away from or bet against failing indebted economies. It’s most likely to develop into a domino effect as these country’s economies tumble – most likely starting first with Greece, then Portugal, Iceland – then possibly Spain, Italy – it could then affect Ireland, and UK and USA (focus area being California).

Safe Havens: The safe havens are Norway, Canada, Switzerland, Australia, Monaco and possibly Denmark, Finland and Sweden - along with Australia. Germany is a power house – so it would take a lot to topple their economy built on solid foundations of manufacturing prowess and efficiency. France benefits from its large economy, global links, diverse economy and nuclear power.

Careful Where You Invest: The reason for mentioning all this is that – if you are considering buying property in these exposed countries – DONT. Not yet anyway. The first thing that might happen is the country will leave  the Euro (if they belong in the Euro in the first place). Thence their currency will devalue to as little as half or less of its original value. This will halve the value of your property in UK currency terms. Then there will likely be a period of high interest rates, high inflation and economic stagnation – with rising taxes, also rising property taxes and higher unemployment. Whatever cash you have invested, you will lose and more. So don’t do it! These peripheral Euro countries have benefited from large investments and sustained low interest rates despite high inflation - a boom - in the last ten years. They have not had the key lever of interest rate setting to control their economies - so when things reverse, they could not drop interest further to stimulate their recession hit economies. It's been boom then bust on the periphery - because France and Germany have set rates to provide stability for themselves - control central European inflation levels. If Greece leaves the Euro, it will be able to set it's own rates and control its economy better. In summary - this is the first key test of the Euro - and its quite possible the Central Bank will dump Greece so the rest survive. This will no doubt be on the agenda this weekend 1 May, as they decide what to do.

the Euro (if they belong in the Euro in the first place). Thence their currency will devalue to as little as half or less of its original value. This will halve the value of your property in UK currency terms. Then there will likely be a period of high interest rates, high inflation and economic stagnation – with rising taxes, also rising property taxes and higher unemployment. Whatever cash you have invested, you will lose and more. So don’t do it! These peripheral Euro countries have benefited from large investments and sustained low interest rates despite high inflation - a boom - in the last ten years. They have not had the key lever of interest rate setting to control their economies - so when things reverse, they could not drop interest further to stimulate their recession hit economies. It's been boom then bust on the periphery - because France and Germany have set rates to provide stability for themselves - control central European inflation levels. If Greece leaves the Euro, it will be able to set it's own rates and control its economy better. In summary - this is the first key test of the Euro - and its quite possible the Central Bank will dump Greece so the rest survive. This will no doubt be on the agenda this weekend 1 May, as they decide what to do.

Safest Areas to Invest: If you want a really safe place to invest that will likely keep growing on a sustainable basis – then Norway must be about the most attractive place in Europe. They have a huge surplus, massive and highly successful sovereign wealth fund (not debt), small population, massive gas and oil exports and a well educated, honest, law abiding national population. Oslo – the capital – probably ranks about the highest, or holiday homes south of Oslo along the coast – with preferably sea or river/fjord views. Because we are so convinced energy prices will rise in the longer term, we think this is as far from the problems in Greece as one can get.

More Debts As Oil Prices Rise – Worsening Conditions (Not Improving): Now, if oil prices rise over $100/bbl – what do you think will happen in Greece and Portugal? Yes, you’ve got it, their problems will be even worse. So – because we think oil prices will rise above $100/bbl by 2011 – we therefore think that definitely Greece and possible Portugal will by then have to or be forced to leave the Euro. They may decide themselves or they may get booted out – probably 50/50 which one but it does not matter – unless oil prices drop rapidly to $50/bbl whilst the Euro economy starts booming – it’s probably too late already. So if you are looking to capitalise on the crash, now is not the time to do it. The crash has not even started. The crash is likely to be in full swing in these fringe Euro countries by end 2010 and enter the trough by about mid 2011.

UK Threats: So what about the UK then you are probably thinking? Exactly what we are thinking and we are worried about it. All the arrogant political banter about the UK being in a completely different situation that Greece, will not prevent the rating agencies from re-calibrating the UK. Our prediction is that, by end May if there is no clear Tory majority government (instead a hung parliament) – then political wrangling and lack of leadership and decisiveness will lead to the rating agency’s downgrading the UK’s AAA rating. Let’s face it, if you were a banking rating agent, you would look for evidence of a solid plan to reduce the deficit – that is passed in parliament (or has a high chance of being passed). If the chance of passing these spending cuts and tax rises is very low – the rating agents WILL cut the UK’s status. We are no special case. It could even happen before end May 2010. Watch out in the next few weeks!

UK Threats: So what about the UK then you are probably thinking? Exactly what we are thinking and we are worried about it. All the arrogant political banter about the UK being in a completely different situation that Greece, will not prevent the rating agencies from re-calibrating the UK. Our prediction is that, by end May if there is no clear Tory majority government (instead a hung parliament) – then political wrangling and lack of leadership and decisiveness will lead to the rating agency’s downgrading the UK’s AAA rating. Let’s face it, if you were a banking rating agent, you would look for evidence of a solid plan to reduce the deficit – that is passed in parliament (or has a high chance of being passed). If the chance of passing these spending cuts and tax rises is very low – the rating agents WILL cut the UK’s status. We are no special case. It could even happen before end May 2010. Watch out in the next few weeks!

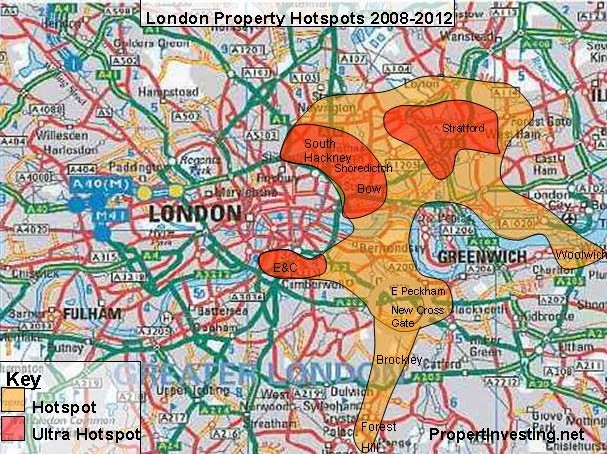

Hung Parliament Problem: So when you vote, consider that a vote for a hung parliament also means higher interest rates because Sterling will drop and it will be far more difficult for UK PLC to raise new loans and service the debt. Of course the chance of a hung parliament is very high – probably 66% at present – so you’d probably be a mug to start a big property buying spree right now, particularly in areas that will be most affected by public sector spending cuts. Hence property in the north and Midlands is probably the most exposed to property price drops as public sector cuts kick in. London will likely survive far better because of its expanding population, property shortages, 2012 Olympics, foreign buyers piling in to take advantage of the weak Sterling and other infra-structure developments. Also, let’s face it, the bankers are back in business and getting huge bonuses again – almost all of these broadly positive factors are hardly felt in places like Birmingham, Liverpool and Newcastle. Even less so in mid Wales and Teesside.

Ugly Storm: So watch out for the storm that will hit shortly – triggered by Peak Oil rearing its ugly head again, a hung parliament and Euroland indecision and politicking. We are bumping along a global GDP growth ceiling dictated by oil supply shortages and high oil prices in the western “high wage” world. All countries with no oil, gas, coal, nuclear power and metals but high wages and social spending will – and have to – decline. It’s basic logic. Particularly if their populations are declining (e.g. Greece and Italy). You’d have to be brave to invest in property in these countries at the moment. Furthermore, most stock market storms seem to start in May when the most wealthy investors divest and spend the summers on the boats in the Med. They come back end September looking for bargains – expect stock prices to drop in the next few months.

Ugly Storm: So watch out for the storm that will hit shortly – triggered by Peak Oil rearing its ugly head again, a hung parliament and Euroland indecision and politicking. We are bumping along a global GDP growth ceiling dictated by oil supply shortages and high oil prices in the western “high wage” world. All countries with no oil, gas, coal, nuclear power and metals but high wages and social spending will – and have to – decline. It’s basic logic. Particularly if their populations are declining (e.g. Greece and Italy). You’d have to be brave to invest in property in these countries at the moment. Furthermore, most stock market storms seem to start in May when the most wealthy investors divest and spend the summers on the boats in the Med. They come back end September looking for bargains – expect stock prices to drop in the next few months.

Best Potential: Look for the countries with big oil, gas, coal, nuclear power and metals exports (or at least self sufficiency) – plus a highly educated workforce, expanding population, other rich resources like wood or water, good laws-low crime and no big social problems. Namely Norway, Canada and Australia. At least the UK still produces 65% of its energy needs – so is far more protected than most people think from the ravages of Peak Oil. In the UK, as previously advised, London and Aberdeen score top – simply because they have the largest positive exposure to high energy prices. Worst areas are probably Teesside, Hull and the more depressed manufacturing heartlands of the Midlands and North of England – like Nottingham, Birmingham, Stoke, Bradford.

Energy Shortages – UK safe havens: Eventually there could be severe difficulties with energy shortages – possibly by about 2015 - and if this happens, it’s difficult to know whether it would be best to live in a remoter low crime area, or a more electrified urban area – that might be more exposed to law and order breakdown. Prosperous suburbs on high speed rail lines are probably a good way to go – with  Woking, Esher, Bedford and Guildford ranking high with Ebbsfleet another possibility (country areas just south, but close to the station). Other more central areas are Wimbledon, Richmond, Putney, Kew and Chiswick – these have low crime and high speed electric rail. They are so central that if extended electric power cuts occurred, you could always get out your bicycle or catch a bus. Slightly higher risk but regenerating areas close to the City are also attractive – particularly areas opened up by the new East London Line rail links – such as East Croydon, Brockley, New Cross, Shoreditch and Haggerston. These areas – along with Stratford, Limehouse, Plaistow, Canning Town, Hackney and Bow will also benefit from the 2012 Olympics.

Woking, Esher, Bedford and Guildford ranking high with Ebbsfleet another possibility (country areas just south, but close to the station). Other more central areas are Wimbledon, Richmond, Putney, Kew and Chiswick – these have low crime and high speed electric rail. They are so central that if extended electric power cuts occurred, you could always get out your bicycle or catch a bus. Slightly higher risk but regenerating areas close to the City are also attractive – particularly areas opened up by the new East London Line rail links – such as East Croydon, Brockley, New Cross, Shoreditch and Haggerston. These areas – along with Stratford, Limehouse, Plaistow, Canning Town, Hackney and Bow will also benefit from the 2012 Olympics.

Severe UK Deficit Needs Urgent Action – Otherwise AAA Downgrade: We don’t want to come over as too bleak, but frankly – the UK deficit is severe, public sector jobs cuts will have to be severe and taxes will need to rise further. Expect the poorer areas to be disproportionally badly hit. The prosperous areas despite the higher taxes will probably do less badly. Remember in northern England, it was only ten years ago that terrace houses cost £15,000. They now cost £80,000. It’s quite possible with higher unemployment from public sector jobs losses – these prices could drop to £40,000 or £50,000 – they would still be three times more than ten years ago. If the Tories get a majority, the impact will be even greater. But even if Labour gets into power, they cannot continue to spend massively on the public sector – otherwise there will be a Sterling crisis – then a big recession. Any way you look at it, it means less public sector jobs and higher taxes. Both these will negatively impact the north more than the south – particularly as the population is generally not growing in the north but the population is strongly growing in the south.

Underlying Housing Crisis: There is also likely to be a continued underlying housing crisis. The numbers of properties being built is now at an all time low – something like 125,000 a year. Meanwhile 25,000 get demolished. The population is increasing so at least 220,000 new properties or homes need creating each year to meet underlying demand. They are not being created of course. In fact, the new HMO regulations are causing many landlords to close down these multi-bedsit properties and convert them into houses or larger flats. The perverse rules on new developments having about 30% affordable properties put most developers off. The ones that go ahead have to pack ever increasing numbers of tiny homes onto small plots with thin walls, small rooms and low standards to be able to make a high enough margin to pay for the 30% affordable properties. Dutch and Germany new properties are on average 50% larger. Most builders cannot raise the finance to build these new homes – and many don’t want to bother because the returns aren’t good enough to match the risk. The whole supply demand situation is completely out of balance and we will definitely see rising rents – particularly in southern England, along with starter homes prices completely outside the normal first time buyer’s purchasing powers.

Cause of No Building: So what we are saying is that the combination of:

-

Red tape, increasing regulation, landlord penalties and risk

-

Problems raising low cost financing

-

Increasing fees for all professional property services and finance

-

Uncertainty on property taxes in part due to likely hung parliament and all the broken tax promises of the current government

-

Stiffer environmental and planning constraints

-

Greater powers given to tenants and reduction in powers taken from landlords

-

Low returns from developments because of high land prices, affordable housing conditions and increasing costs of raw material (in part because of Peak Oil affects)

Will cause the housing supply to dry up further whilst demand will remain robust particularly in southern England. This does not mean to say though that property prices will rise – because landlords will be exiting in dribs and drabs. Meanwhile the higher taxes and slower GDP growth plus higher interest rates will curtail any big property price increases moving forward. As our previous Special Report articulated - the Party’s Over. Unless you can latch onto Peak Oil property in countries like Norway, Canada and Australia that is – or some parts of London and Aberdeen.

Any Chance of Large Building Programme? Anyone expecting levels of building to increase under a different government are likely to be disappointed. In our opinion, all three main parties do not offer policies that stimulate home building – all for slightly different reasons. This should help underpin house prices in southern England, albeit a recession in the north and Midlands will probably suppress prices. The chance of large swathes of Greenfield sites being build on is, in our view, almost no existent. People like to live in houses – almost none are being built – period.

Think: Before you think property – think oil – then use this to guide your investments. Otherwise take an unmanaged risk or punt. And don’t be surprised if it back-fires.

Country Ranking

Below is the country ranking we prepared back in 2009 – click here to review - well before the sovereign debt crisis started to break out. You can use these tables to help guide you to the countries with the best fundamentals with regard to peak Oil, resources and industrial acumen. As you can see, Greece comes bottom from our analysis of 2009 - hence we are not surprised what is happening now.

What we prepared in 2009 were two tables (summary of table two below). The first ta ble is a Pure Peak Oil Profits table that ranks each country on:

ble is a Pure Peak Oil Profits table that ranks each country on:

-

amount of oil exports (green) or oil imports (red)

-

amount of gas exports (green) or gas imports (red)

-

demographics moderately expanding population (green) or declining population (red)

-

stability - a summation of political, country risk, security and threat of war - green is stable, red is unstable

The rating is intuitive and qualitative - using our experience and judgement. You may not agree with all of the criteria ratings - however, we believe its a fairly measure of the countries that will do well from Peak Oil and those that will suffer the most from Peak Oil. No surprise that Norway and Canada come top. These two countries have huge oil and gas deposits, growing but relatively small populations (or oil revenue per person) and are very politically stable with excellent security. Expect their currencies and property prices to rise as oil prices rise.

UK and USA The UK comes out fairly well because it only imports very small amounts of oil and gas. It's currency is suffering at present from the gigantic deficit - however, a change of government is most likely in mid 2010 - expect the currency to recover if steps to tackle the deficit are enacted from mid 2010. The USA would do well if it were not for it's gigantic oil imports ($500 Billion a year at $100/bbl) and deficit. Regrettably with a new government this looks set to worsen - with more public sector expenditure and high taxes on the wealthy stifling GDP growth. The Dollar will likely decline further and oil prices rise as a hedge against this decline. Thence the deficit will worsen further because the USA imports 9 million barrels of crude oil a day. That's $250 Billion a year with a $70/bbl oil price - staggering - not good. the good news is the USA has plentiful coal and natural gas. Plus good demographics and excellent security. And the motivation, attitude and education of US citizens is second to none - its only a pity the tax bills will rise and the public sector well expand - thus acting as a counter measure to the private sector.

UK and USA The UK comes out fairly well because it only imports very small amounts of oil and gas. It's currency is suffering at present from the gigantic deficit - however, a change of government is most likely in mid 2010 - expect the currency to recover if steps to tackle the deficit are enacted from mid 2010. The USA would do well if it were not for it's gigantic oil imports ($500 Billion a year at $100/bbl) and deficit. Regrettably with a new government this looks set to worsen - with more public sector expenditure and high taxes on the wealthy stifling GDP growth. The Dollar will likely decline further and oil prices rise as a hedge against this decline. Thence the deficit will worsen further because the USA imports 9 million barrels of crude oil a day. That's $250 Billion a year with a $70/bbl oil price - staggering - not good. the good news is the USA has plentiful coal and natural gas. Plus good demographics and excellent security. And the motivation, attitude and education of US citizens is second to none - its only a pity the tax bills will rise and the public sector well expand - thus acting as a counter measure to the private sector.

Spain, Italy, Greece As previously advised, the countries at most risk of Peak Oil are Spain, Italy and Greece - these beautiful countries will likely see economic decline as their aging populations, lower tax receipts, higher welfare spending and massive energy import bills along with declining populations create economic hardship in previously very wealthy countries.

|

|

Oil |

Gas |

Demographics |

Stability |

Overall |

|

Norway |

10 |

10 |

8 |

10 |

38 |

|

Canada |

10 |

8 |

8 |

10 |

36 |

|

Brunei |

10 |

10 |

8 |

8 |

36 |

|

Australia |

6 |

10 |

8 |

10 |

34 |

|

UAE/Dubai |

10 |

8 |

7 |

6 |

31 |

|

Algeria |

8 |

10 |

8 |

5 |

31 |

|

UK |

7 |

7 |

7 |

9 |

30 |

|

Russia |

10 |

10 |

3 |

6 |

29 |

|

Saudi Arabia |

10 |

8 |

7 |

4 |

29 |

|

Brazil |

7 |

7 |

7 |

7 |

28 |

|

USA |

2 |

9 |

7 |

9 |

27 |

|

China |

5 |

6 |

7 |

5 |

23 |

|

India |

4 |

4 |

8 |

4 |

20 |

|

Korea |

0 |

0 |

7 |

7 |

14 |

|

South Africa |

0 |

2 |

7 |

3 |

12 |

|

Portugal |

0 |

0 |

4 |

8 |

12 |

|

Japan |

0 |

0 |

3 |

8 |

11 |

|

Spain |

0 |

0 |

3 |

8 |

11 |

|

Italy |

0 |

0 |

3 |

8 |

11 |

|

Greece |

0 |

0 |

3 |

8 |

11 |

| Legend | |

| Big opportunity - positive | |

| Opportunity - positive | |

| Neutral - hedged | |

| Threat - negative | |

| Severe threat - very negative |

|

Oil |

Gas |

Coal |

Metals |

Finance |

Manufa-cturing |

Agricul-ture |

Know-ledge |

Demo-graphics |

Stability |

Overall | |

|

Canada |

10 |

8 |

9 |

9 |

9 |

5 |

8 |

10 |

8 |

10 |

86 |

|

Australia |

6 |

10 |

10 |

10 |

9 |

5 |

8 |

10 |

8 |

10 |

86 |

|

USA |

2 |

9 |

10 |

8 |

10 |

5 |

10 |

10 |

7 |

9 |

80 |

|

China |

5 |

6 |

10 |

8 |

8 |

10 |

7 |

8 |

7 |

5 |

74 |

|

Brazil |

7 |

7 |

7 |

9 |

7 |

7 |

9 |

7 |

7 |

7 |

74 |

|

Russia |

10 |

10 |

9 |

8 |

7 |

5 |

6 |

7 |

3 |

6 |

71 |

|

Norway |

10 |

10 |

0 |

0 |

7 |

5 |

4 |

9 |

8 |

10 |

63 |

|

UK |

7 |

7 |

1 |

1 |

10 |

4 |

7 |

9 |

7 |

9 |

62 |

|

India |

4 |

4 |

9 |

5 |

7 |

7 |

4 |

8 |

8 |

4 |

60 |

|

Brunei |

10 |

10 |

0 |

0 |

6 |

2 |

4 |

7 |

8 |

8 |

55 |

|

UAE/Dubai |

10 |

8 |

0 |

0 |

8 |

5 |

1 |

8 |

7 |

6 |

53 |

|

South Africa |

0 |

2 |

10 |

10 |

3 |

5 |

6 |

5 |

7 |

3 |

51 |

|

Japan |

0 |

0 |

4 |

2 |

8 |

10 |

5 |

10 |

3 |

8 |

50 |

|

Algeria |

8 |

10 |

2 |

2 |

4 |

3 |

2 |

4 |

8 |

5 |

48 |

|

Saudi Arabia |

10 |

8 |

0 |

0 |

7 |

3 |

1 |

6 |

7 |

4 |

46 |

|

Korea |

0 |

0 |

4 |

0 |

7 |

10 |

3 |

8 |

7 |

7 |

46 |

|

Spain |

0 |

0 |

0 |

1 |

8 |

4 |

8 |

8 |

3 |

8 |

40 |

|

Italy |

0 |

0 |

0 |

1 |

7 |

3 |

7 |

8 |

3 |

8 |

37 |

|

Greece |

0 |

0 |

0 |

1 |

6 |

4 |

6 |

7 |

3 |

8 |

35 |

|

Portugal |

0 |

0 |

0 |

1 |

5 |

4 |

7 |

6 |

4 |

8 |

35 |