337: There is a better world out there....

07-16-2010

PropertyInvesting.net team www.google.com

If you think the debt crisis is the biggest issue of this decade, then read on. We’d like to share some insights into the state of the world sustainability:

- economic, environment, social -

The three pillars of life. There is much media coverage of symptoms of issues rather than the more important underlying causes. Its only through analysis of the route causes, or underlying causes – that one can investigate then recommend improvement.

To give a few examples, after analysis we believe that Peak Oil was the underlying cause of the sky-rocketing oil prices that then triggered the global recession and financial meltdown. This is just one issue that is hitting the world. We’ll describe and describe some of the key issues and underlying causes now:

Population Explosion: In the last 50 years the world population has more than doubled. In another 50 years it will have doubled again. The underlying causes are better health, more food, lack of decease, economic growth and higher standards of living - leading to increased fertility and longer life. Less people starve in 2010 than in 1960. Despite AIDS and Malaria – the average age of people in most countries continues to rise. Birth rate in Middle Eastern and Africa countries are very high.

Peak Oil: Oil production has sky-rocketed from 25 million barrels a day 50 years ago to 85 million barrels a day today. For every 1% increase in GDP, there has been a 0.5% increase in oil consumption. As populations rise, it has been normal to expect GDP to rise and labour forces expanding and economies expand. The levels of debt and money supply have broadly correlated with the rise in oil production. Oil has helped build the industrialised world of machinery, cars, factories, apartments, road, rail, ports, shopping malls and foreign holidays. Oil consumption has followed wealth – and peak global wealth could be mid 2008, at the time when Peak Oil occurred.

Rainforests: 40 years ago, the tropical rainforests were double the size – they have massively shrunk. In 40 years time, many people believe there will be no tropical rainforests left. The Amazon and Congo forests will have almost disappears due to de-forestation on a massive scale. To make way for agricultural land to grow beef and sugar cane for biofuels amongst others. The wood is sold, and burnt for fuel – as populations rise, corruption runs rampant and lack of controls hinder conservation efforts.

Social and Security: There is less war now than at any time in the last 100 years – less people getting killed – the world is remarkably peaceful as oil has built up the military defences of countries and the prosperity from oil fuelled global economies has provided employment, social projects and kept people off the streets. Oil has fertilised farmland, mechanised food production and provided a supply chain that has led to massive efficiency improvement in yields and the use of farmland – to provide low cost food. Manufacturing is now far more efficient and effective and oil has led to low cost centres booming like China and India as commodities have been shipped to these areas, then final products exported around the world. The boom in container and bulk tanker shipping has been off the back of cheap oil.

Key Issues: So what are the key issues for the next 10 to 20 years? Climate change might be an answer...but is it really a key issue? Surely it’s a symptom of mans destruction of rainforests and inefficient burning of fossil fuels – energy wastage? If we all drove electric cars powered by nuclear, CO2 emissions would be about 30% of current levels.

Global Dimming: Perversely – after the former Soviet Union shut down its dirty brown coal burning power plants in 1990 when the Soviet Empire collapsed, there was a massive increase in warming in Siberia and Russia – caused by the lack of particulate pollution (lack of global dimming). This then started melting permafrost in boggy sub-arctic Siberian tundra – which then led to a massive increase in methane bubbling into the atmosphere. Remember, pure methane is ten times more warming than carbon dioxide. So yes, the coal burning power plants helped cool the world from 1900 to 1985, then the world cleaned up and then the lack of particulate pollution started letting in more solar radiation and the world started heating up – exacerbated by increasing methane from bogs. Climate change is a complex relationship between particulate pollution (power plants, factories, airline trails, cars), CO2 emissions (factories, power plants, cars), methane emissions (bogs, beef cattle, cows), forests (trees taking in CO2 and emitting O2) – with the sea being a CO2 sink or moderator. Very few politicians or climate scientists describe these relationships – they may all group together into a zero neutral sum – we just don’t know. Take out particulate pollution and the world will warm up. Climate has fluctuated massively through geological history as have sea levels – even over short periods of time. The world is supposed to be in a cool period at the moment – probably on a warming trend. The point is – on climate – we don’t know. We would not be surprised if the world started cooling in the next ten years because China is building one coal burning power plant a week and everyone is flying more (airline trails) – so particulate pollution will increase causing more dimming again.

Forests: But what we do know for sure is that we have destroyed the rainforests – and continue to do so – and that this will never help. Forests take up CO2 and emit O2 – and provide rain, moisture and fertile soils plus have huge biodiversity. It’s about time we all started feeling very guilty about the rainforests – because most of the destruction has happened in the last 40 years – and that’s when we’ve been alive! We have built houses, burnt fuel, bought furniture, bought newspapers. And if we live for 40 more years – and don’t see any progress, when we die, there will be no rainforests left. No rainforests for offspring - we will have used them all up. That’s a disturbing thought.

Global Forest Deal: If only there could be some sort of global deal to reduce the amount of rainforest being destroyed – but alas this seems an almost impossible concept or idea. Each country seems to care only about its own policies and want to help themselves. Politicians score votes by keeping their own populations happy – and not by campaigning for global issues. The exception is probably Climate Change in that this issue seems to have achieved political mileage for politicians – even though it’s not in our view a key issue – only time will tell. It may be a symptom but not a route cause of the illness. It will also be rapidly overtaken by Peak Oil (oil scarcity) because oil delivers food, health and jobs – and without these, people starve, get ill and/or riot.

When we look at economic concerns, social issues, population and energy – our conclusions are:

1. Peak Oil is already behind us – and oil scarcity has now commenced (don’t listen to the optimists) – oil prices will rise and we better start using it more efficiently

2. Gas is plentiful in the USA, Norway, Russia and Qatar – the faster the global economy switches to gas the better – for power generation and gas to electric power for automobile and truck transportation.

3. Scarce Oil and Abundant Gas Means A Switch To Gas Is Urgently Required: Without a big switch to natural gas, starvation, decease and population decline could start, with wars, unrest, food riots and economic stagnation with many countries or regions dropping into depression. Time is running out. All those people that say security of gas supply is an issue should think again. LNG can be shipped around the world at low cost from Qatar and other gas suppliers. USA could export gas if the government encouraged Shale Gas development and developed an energy policy. Norway and Russia are other big gas suppliers – plentiful huge reserves and plenty of diverse suppliers – means relatively secure supplies. Things have changed since Shale Gas technology (hydraulically fraccing tight shale gas horizontal wells) was developed 3-5 years ago. Its a game changer for the next 100 years. And LNG means it can be shipped around the world to all markets - delivering gas to coastal areas where most of the population lives. Prices can also be locked in with ten year contracts.

4. Ocean biodiversity has been ruined by over fishing – fish stocks need replenishing - just because we cannot see this destruction does not mean we should ignore it.

5. Land biodiversity has been ruined by systematic culling of rainforests – forests need replanting and deforestation needs to stop.

More Energy Used Efficiently: In our view, the only way to keep economic growth, prevent wars, starvation, and to stop the destruction of bio-diversity on land and at sea is to enhance pure energy production from oil, gas and nuclear - supplemented with some renewable energy – and also plant trees, reduce fishing, increase crop yields and stimulate business and the economy. Without this, our populations will decline and bio-diversity will be destroyed.

Stop Putting Up Barriers Otherwise Starvation Will be The Result: If barriers to oil, gas and nuclear power are put in place to prevent enough energy for the massively expanding global population, it will lead to misery, starvation, bad health and further destruction of rainforests as the expanding population gets ever more desperate for new farmland, no fertilisers are available, soil and crop yields reduce and economies go into recession. Wars could break out. These could be triggered by lack of resources. Its a very serious concern. Every time someone stops or delays an electric power plant - think about the health, education and economic benefits that go down the pan. It may seem okay today, but hard times are around the corner. If we get power shortages in all nations - its anyone's guess what might happen. Imagine not being able to use a computer, drive a car, heat your home, collect shopping and turn on the lights at night. Not a pleasant thought. Millions in Africa and Asia already suffer from lack of power and black-outs - things are so precarious in so many developed countries that capacity constraints and black-outs or gas/petrol shortages will occur if nothing is done to prepare for the main negative effects of Peak Oil in a view years time. Three of the biggest oil exporters in the world - Iran, Nigeria and Venezuela already have regular fuel shortages and power outages.

Improve Agricultural Yields: What we desperately need is to cluster populations, improve crop yields, use scarce farmland more intensively, but use less of it. And plant more forests in equatorial regions and prevent any more culling of forests.

Health, Education, Wealth: Because economic wellbeing is so closely linked to oil/gas and energy supply – for good healthcare, hospitals, schools, education, food, transport, drugs manufacture etc – if oil scarcity leads to economic breakdown and civil unrest, many people will die. It’s a very serious issue that is being completely ignores by 99.9% of the world’s population – mainly because most people are either not aware of the potential crisis or do not understand or appreciate through lack of information about the broad links between energy, health and sustainable living. Politicians are keeping quiet about this issue - they don't want to precipitate panic, unrest or more financial troubles in markets. Many people are frankly not very interested as well – can’t blame them for this “It’s someone else’s problem” is a frequent comment or “One person can’t do anything about 9 billion people”. If we are brutally honest, the world is a rather shallow place. Most news and attention is on celebrities and their relationships, crime - or the latest short-term perceived crisis.

Property Investment: The reason for mentioning all this to our property investing visitors is that we are entering an extremely problematical period. There are massive opportunities but massive threats. The coming Peak Oil crisis will make the sub-prime mortgage “crisis” of 2008 look completely tame. Our prediction is that no-one will be talking about Climate Change in 5 years time – they will all be talking about Peak Oil and how this could lead to starvation in undeveloped countries that are probably most at risk. Developed oil importing nations could be in a state of shock and depression. Many wealthy countries like Spain, Greece, Portugal and Italy will see their living standards decline – and social problems will break-out with this shock. People will wake up to the fact that energy shortages are directly affecting them - living standards will change. It will make water shortages more difficult to deal with – because money won’t be available to pay for water pipelines, water imports and desalination – energy and transportation will be too expensive. Oil exporting nations will be quietly making massive profits. Gas exporting nations will see cash surpluses increase. Gas importing nations will suffer. Unless the country you are investing in has its own oil or gas production and preferably exports, or is a world leader in low cost efficient manufacturing or financial services, don’t invest in that country – period. Such countries will – when Peak Oil begins to seriously affect economies – be in a permanent state of recession, depression or stagnation at best. Their deficits will sky-rocket. There current debts will worsen. They will stay indebted. Defaults will occur. Peak Oil in July 2008 was just the start of the problems – its just no-one has yet acknowledged they were caused by Peak Oil. Inefficient large oil importing nations cannot grow when oil prices sky-rocket – that’s why USA, Greece, Ireland, Spain, Japan, Iceland, Portugal and Italy all went into severe recession – get the common theme? – they all import gigantic amounts of oil for each GDP units they produce. Meanwhile China, India, Norway and Saudi never had a recession – the reason is they either export oil/gas or deliver high GDP per unit of oil used.

Has The Production Decline Started? Today we unearthed some disturbing early evidence of a global oil production decline. Two months ago, global oil production dropped 585,000 bbls/day. Last month, production dropped a further 255,000 bbls/day. That’s a total of 840,000 bbls/day in two months. Why should oil production drop when demand is increasing at 1.5% or more a year – or 1,200,000 bbl/day a year? That’s 100,000 bbls/day a month. Especially in the summer driving season as the USA exits a recession into strong growth. There have been no hurricanes, no wars, no disturbances, no sanctions and OPEC have been given free range to cheat on their quotas – yet production dropped with oil prices at $75/bbl. There has been a bad oil spill – this has not helped. Drilling has been cancelled by Obama's offshore drilling ban - this will take years to recover. And oil producers are going flat-out. Or aren’t interested in producing more because they want to save some for later. There is practically no spare oil left – oil production costs rise further - there could be a temporary 1,000,000 bbls/day spare capacity from Saudi Arabia but that’s about it. Oil production has stayed flat for the last five years. Why do people think rates will rise further? 86 million bbl/day is a staggering amount of oil production a day. That’s 30 billion bbls a year – everyone zooming around in huge inefficient cars burning oil at a staggering pace with scant regard for its true value. Importing butter from New Zealand, apples from South Africa, toys from China. When an oil company announces a major new discovery, that’s normally about 300 million bbls of oil recoverable - so 30 billion bbls in one year is like burning through a hundred big new oil discoveries in a year. Sorry, the party is over, and oil prices will shortly sky-rocket again – probably starting soon by the end of 2010 with 2011 seeing continued increases. When the markets realise that the mirage production promises will not be satisfied – that little spare oil capacity exists - then prices will sky-rocket. Why do people continue to trust the Saudi Arabian and OPEC view that there is plenty of spare production capacity? – OPEC claims to have 6 million bbls/day of spare oil production capacity – we just don’t buy this. If this was the case, why has Saudi increased it's number of drilling rigs ten-fold in the last ten years? It’s because they are chasing keeping their production rates on a plateau – forget the notion increasing them. And their own oil consumption is skyrocketting with an expanding population driving cars and installing air-conditioning in new homes. Anyway, if you don’t believe us, that’s understandable and okay of course. Everyone is entitled to their own view. If you think we are not much good at predicting, then you can discount our view – but first look back at our track record - you’ll probably agree we are normally quite accurate.

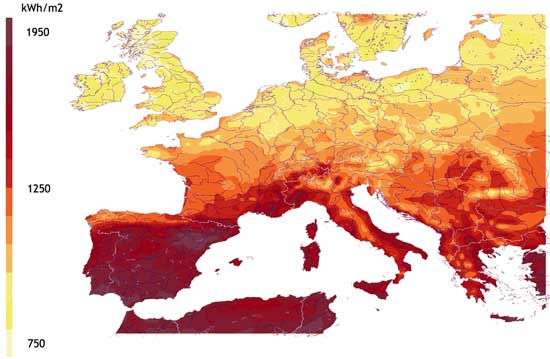

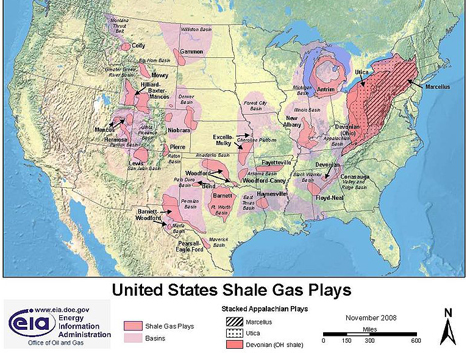

Abundant Gas Reserves: The good news is there is 1000 Trillion Cubic Feet of gas available to produce in the USA alone (half is Shale Gas, a new technology for producing tight gas formations in huge new swaths of acreage). And there is another 1000 Tillion Cubic Feet of gas available in Qatar – through Liquid Natural Gas (LNG) that can be shipped anywhere in the world. Then Russia has about 1000 Trillion Cubic Feet of Gas. All this gas is enough to power the world for the next 100 years or more, but only if we convert our cars and trucks to electric power or natural gas – and the electric power is generated by gas to power plants. All the talk of having wind farms and solar plants to do this is frankly not realistic in our view – it’s just too expensive – it uses too much metal, energy and power to create the capacity – and power supply goes to zero if it’s not sunny or windy. This power will and can only ever supplement oil, gas, coal, hydro and nuclear power. It will always be a small add on.

USA and Shale Gas Boom: If only the USA could convert 65% of its autos and trucks to natural gas (or electric powered from gas to power), it would then become energy sufficient – why the US is not doing this now we frankly find unbelievable. The USA imports up to 2 million barrels of day from one of their most unfriendly neighbours Venezuela...why on earth would the USA not want to use their own gas and cut these imports to zero in short order is beyond comprehension. The USA also has the biggest global reserves of high quality coal. And a fair number of nuclear power plants. Its big problem is the gigantic 13 million barrels a day of oil it imports – that’s forty times more than the UK with a population of five times more. This is now get worse because of the drilling ban and the Obama administration's anti-business rhetoric.

Best Countries: In summary, as the Peak Oil crisis hits further, the best safe haven countries to invest in will be:

· Norway, Canada, Australia

Avoid: The countries to avoid are:

· Greece, Spain, Italy, Portugal, all small inefficient developed nations that do not have their own oil, gas, coal, forests and metals - with the threat of water shortages

Middle East Boom: If you invest in the Middle East, then some winners will be:

· Qatar, Saudi Arabia, Kuwait, UAE, Iraq - these countries will continue to export large quantities of oil or gas

Russia Boom: In Euro-Asia, Russia will continue to be the biggest overall exporter of oil and gas in the world even if their oil and gas production declines a bit. They produce a staggering 9 million barrels a day of oil and about 60% of this amount in energy equivalent terms in gas exports.

South America:

Columbia, Brazil – both are expanding their oil production and economies, but don’t touch Venezuela with a barge pole (production is in decline despite having the second largest reserves in the world).

Mongolia: If you want a country that will boom from commodities other than oil and gas, Mongolia is a top best place to visit. This country has a massive growth rate, is rich in minerals and there is even talk of large reserves of oil and gas. It's a satellite manufacturing and service centre for China and half way between the mineral and oil/gas wealthy Russia and the the global growth engine China. It’s perfectly positioned to prosper. Mongolia frankly looks like a winner – and its expanding population in the capital will see property prices we think continue to rise.

UK: As far is the UK is concerned, the good news is the UK still produces 55% of its gas requirements and 70% of its oil requirements so is pretty insulated from the very negative impact of Peak Oil. Pretty neutral. The energy situation will likely deteriorate but not too fast. The North Sea is seeing higher activity now –and one would hope with a more business friendly government now in place and better tax treatment, the decline in North Sea oil and gas production could level off if drilling activity is stimulated. The UK's openness to the concept of Peak Oil is also progressive - Transition Towns was initiated in the UK (Totnes was the first town) - and the government seem to be interested in the risks of Peak Oil - even though they remain fairly quiet about it. All political parties seem genuinely interested in stimulating Green Technology and innovation - though the pace of change and investment remains fairly low. Be careful where you invest, and if you are a UK investor, consider farmland as a good hedge against Peak Oil - read our Special Report 332 if you are interested.

If you are interested in Peak Oil and the impact this will have in property, also consider reading the Special Reports below:

277: Country Ranking in a Peak Oil World with Resources Scarcity

275: Cars - The Absurdity and Necessity

274: How susceptible are countries to high energy prices? Impact for property investors..

270: Turbulence in Property Markets Caused By Oil Price Spikes and Peak Oil

265: How to Profit from Peak Oil - USA, UK and Europe

264: Another oil price spike is just about to hit us...watch out

263: Investing in Property with Energy in Mind "post Peak Oil"

262: Electric Revolution, the Environment and the Next Energy Crisis

257: Property investing, the UK economic situation and oil & gas

244: It's the oil price again - it caused the recession

243: Oil price crash sows seed for next massive oil spike

242: Oil, Cars & Property - what we'd do if we were UK Prime Minister

We hope you have found these insights of interest and they are helpful guiding your property investment decisions. If you have any comments, please contact us on enquiries@propertyinvesting.net