343: Oil scarcity and an action plan to mitigate risk

09-04-2010

PropertyInvesting.net tea m www.google.com

m www.google.com

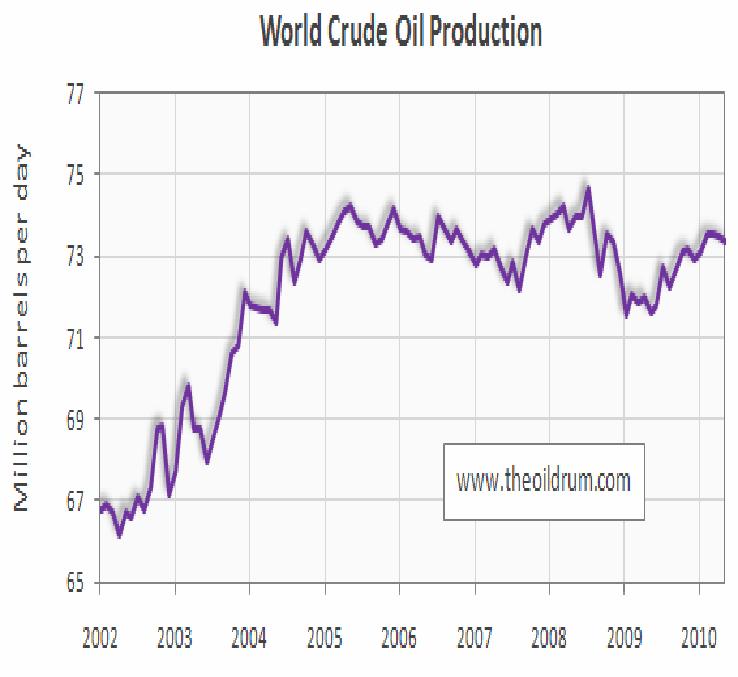

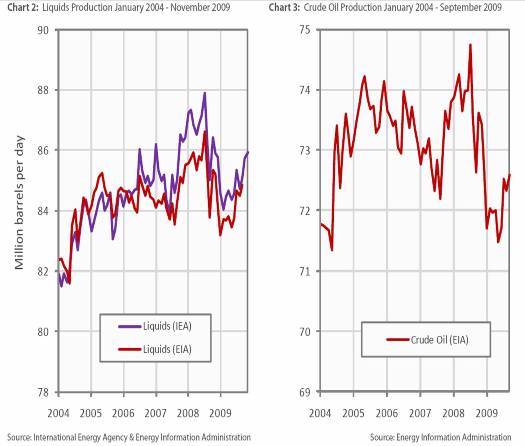

Time is running out: Peak Oil according to our analysis and detailed modelling was July 2008 (for all oil liquids). Peak Oil for crude oil only was 2005 (thats not including bio-fuels, synthetic oil and natural gas liquids). Thats five years ago yes, Peak Oil is behind us - it was years ago. As we have mentioned in numerous prior Special Reports, we are now "bumping along a Peak Oil plateau" and it will not be possible to increase oil production much if any higher rates than the monthly Peak in July 2008 - just at the time of the Beijing Olympics. It is possible rates could pop up slightly above this level but it's far more likely not to, and has a significant chance of starting a steady decline some time in the next 1-5 years. The world has now hit a buffer a barrier to global growth. We also believe Peak Oil was the trigger for the financial meltdown and recession in western oil importing nations - caused by oil shortages and prices skyrocketting to $147/bbl.

significant chance of starting a steady decline some time in the next 1-5 years. The world has now hit a buffer a barrier to global growth. We also believe Peak Oil was the trigger for the financial meltdown and recession in western oil importing nations - caused by oil shortages and prices skyrocketting to $147/bbl.

Oil Use: Oil fuels all our industry and society from trucks, cars, drugs, food, supply-chains, military, hospitals, ambulances, plastics factories, petrochemical plants, fire-brigade, police and all the public sector and private sectors plus our homes. The US military for example uses 1 million barrels a day - half of what the whole of the UK uses. If oil becomes scarce, something needs to take it's place rapidly, otherwise there will be black-outs and no petrol/gas at the pumps.

Private Individuals Will Be First to be Cut-Off: Dont be fooled into thinking the private car driver will be the last person to be hit by fuel shortages. In fact, they will be the first. Governments will take control of fuel to keep essential services going (hospitals, police, military, buses, government) and the first places to be cut will be the private individual. Trucks will get fuel before cars because food needs to be transported around the country.

Exposure With No Risk Assessment: Most countries are ridiculously exposed to Peak Oil - all those countries importing oil. It's funny how in the UK you cannot have a street party without a Risk Assessment, but the society we live in has no Risk Assessment of the effects of Peak Oil and oil shortages. Its the elephant in the room. An accident waiting to happen. It's not a popular message - we are very exposed to Peak Oil production and fuel shortages.

UK prospective: The good news is that the UK still produces 70% of it's oil needs and 60% of it's gas needs although oil and gas production is declining at a rate of 4-5% a year. The other good news is that not particularly by strategic design the UK has an excellent rail service much of which is electric powered - the railways were built by the Victorians - the technology breakthrough at the time was fast steam locomotives. These were converted to diesel-electric and more recently fully electrified on main lines. The UK also has high speed electric rail links to Europe - the Eurostar. The country is also small and densely populated with most people living fairly close to their work when compared to the USA. 80% of the population lives in cities and towns - concentrated near London, Leeds-Manchester-Liverpool, Birmingham and Glasgow-Edinburgh. Hence it is protected more than most countries from the ravages of Peak Oil production - because people can travel short distances and still get to work - also using the trains.

Gas The Saviour: The other positive development is that the USA has found a huge 1000 Trillion Cubic Feet (TCF) pool of Shale Gas reserves in the last five years through a breakthrough in horizontal drilling and multiple hydraulic fraccing technologies - that should see low gas prices in the USA for some time and gas reserves for the USA for the next 100 years. Meanwhile another 1000 TCF of gas enough for 100 years is available through LNG or liquid petroleum gas from Qatar in the Middle East and the cost of this gas is declining annually with technology and scaling-up savings for the giant new LNG plants in the country. This gas is chilling, put into refridgerated tanks, then shipped all over the world. Its possible to purcha se gas from Qatar at a lower price than oil - even though it's shipped 12000 km. Russia also has another 1000 TCF of piped gas available so there are four competing and potentially fairly low cost sources of natural gas available for the UK plus it's own gas (indigenous gas currently supplies the UK with 60% of it's gas needs as mentioned above). Russian piped gas, gas piped from Norway and LNG shipped from Qatar are all major supply lines. There is also potential for gas imports one day from the USA if they expand their gas business and have the foresight to export some of their 1000 TCF of gas.

se gas from Qatar at a lower price than oil - even though it's shipped 12000 km. Russia also has another 1000 TCF of piped gas available so there are four competing and potentially fairly low cost sources of natural gas available for the UK plus it's own gas (indigenous gas currently supplies the UK with 60% of it's gas needs as mentioned above). Russian piped gas, gas piped from Norway and LNG shipped from Qatar are all major supply lines. There is also potential for gas imports one day from the USA if they expand their gas business and have the foresight to export some of their 1000 TCF of gas.

Oil Exports Declining: Oil is a completely different and frightening story. Peak Oil is behind us. Developing countries have massively increasing populations and their wealth and use of cars is increasing. Their own indigenous oil usage is massively increasing at rates of 5-8% a year. Countries like Iran, Saudi Arabia and India also have subsidised oil that means the government actually pays the consumer to use oil incredible. So the demand keeps going up but their production stays flat which means eventually they are not able to export any oil. This has already happened in Indonesia once one of the largest oil exporter in the world. It will happen to Mexico in the next few years yes, Mexico will start importing oil! It might also happen to Iran by as early as 2018 if their  oil demand keeps increasing at the current pace, and their production drops slightly. Yes, Iran importing crude oil. Just consider, if an oil exporting country can see that consumption will one day outpace supply, they will probably start producing less oil not more, to save the oil for future generations. Overall, its very difficult to see how any country can export more oil than at present because most oil exporting nations have rapidly expanding oil consumption and economic growth and consumer wealth off the back of the wealth created by the oil, government subsidies, expanding populations and demand for cars and air conditioning units. Oil exporting nations also often prefer to burn oil to generate electricity rather than import coal or gas. Yes, its spooky and were worried about it. One of the key reasons being that if economies slow down, so do property prices ultimately with rising oil prices, property prices can drop as affordability is stretched, food and transport costs rise, inflation rises (in all but property) and interest rates rise this then makes mortgages more expensive and property prices decline.

oil demand keeps increasing at the current pace, and their production drops slightly. Yes, Iran importing crude oil. Just consider, if an oil exporting country can see that consumption will one day outpace supply, they will probably start producing less oil not more, to save the oil for future generations. Overall, its very difficult to see how any country can export more oil than at present because most oil exporting nations have rapidly expanding oil consumption and economic growth and consumer wealth off the back of the wealth created by the oil, government subsidies, expanding populations and demand for cars and air conditioning units. Oil exporting nations also often prefer to burn oil to generate electricity rather than import coal or gas. Yes, its spooky and were worried about it. One of the key reasons being that if economies slow down, so do property prices ultimately with rising oil prices, property prices can drop as affordability is stretched, food and transport costs rise, inflation rises (in all but property) and interest rates rise this then makes mortgages more expensive and property prices decline.

As long as no-one notices that Peak Oil was July 2008 (all liquids), property prices should remain fairly flat. But if they get wind of Peak Oil confirmation it was actually July 2008 - and we start running short of oil inflation could rise when oil prices skyrocket then property prices could decline for many years.

As long as no-one notices that Peak Oil was July 2008 (all liquids), property prices should remain fairly flat. But if they get wind of Peak Oil confirmation it was actually July 2008 - and we start running short of oil inflation could rise when oil prices skyrocket then property prices could decline for many years.

If you look at the charts above, you will notice oil production is lower today then in 2005. You will also notice that, despite oil prices rising from $30/bbl in 2005 to $147/bbl in July 2008 - oil production hardly moved higher. Surely everyone with any spare capacity would have opened the flood gates - but it never happened because there wasn't any spare capacity. Now three years later, its difficult to imagine things have changes after another 100 Billion bbls of oil has been depleted. And oil development activity slowed when oil prices dropped to $37/bbl end 2008 and the recession hit. The oil industry has done a remarkable job at keeping up with oil demand - but its about to change in our opinion.

PropertyInvesting.net Energy Plan for the UK: The best action plan for the UK to mitigate against the risks of Peak Oil is to:

· Ban or discourage the use of oil for power generation - gas or coal should be used

· Discourage the use of fuel oil for central heating (taxing this oil at 70-80% like car drivers are taxed might seem appropriate)

· Expand gas-to-power electricity generation (2 year lead times only)

· Expand or at least keep the level of nuclear power flat - e. g. replace plants that are old and being de-commissioned

g. replace plants that are old and being de-commissioned

· Convert public sector vehicles to natural gas powered or electric power vehicles target 50% in the next 3-5 years

· Encourage oil conservation measure to help reduce oil consumption to the level of oil production by 40% over a 5 year period - target not importing any oil by 2015

· Encourage through tax breaks the conversion of cars and trucks to natural gas, LPG or electric power NOW to reduce dependency on imported oil

· Increase airline tax duties to 80% (from the current 10%) in line with tax on petrol (why should someone flying away from the UK on holiday or a globe-trotting business person pay 8 times less tax on fuel when they burn 100 times more travelling by plane - most of the time not even going to work - mostly "going on a jolly" - absolutely crazy!)

If these measures were put in place, the UK would survive global oil shortages fairly well yes, the global economy would be severely hit, but trade within the UK and with mainland Europe could still prosper. You may have noticed we have not mentioned Renew able Energy the reason is, its too little too late. Hydro-electric is excellent, but no-one wants their valley flooded the environmental lobby will not accept it. Biomass is good but not enough land is available for trees in the UK. Bio-fuels like corn are hugely inefficient and lead to forests being cut down and agricultural land being offset so food prices rise. Wind has a similar negative local community lobby in onshore rural areas - they are frankly very ugly and kill birds. Offshore, its just too oil intensive and costly all those maintenance workers burning around in oil powered boats, and the turbines and blades all need large amounts of oil energy to build, install and maintain. Just when you need wind energy the most, on a calm cold winters day, the turbines shut down through lack of wind. You still need the base-load capacity. Solar simply is not economic in the UK the sun does not shine enough or intensely enough few people want to wait 20 years to get their money back. Heat pumps take 15 years to pay back as well. The only solar that makes some sense is thermal - a simple low cost radiator on your roof for heating water, but

able Energy the reason is, its too little too late. Hydro-electric is excellent, but no-one wants their valley flooded the environmental lobby will not accept it. Biomass is good but not enough land is available for trees in the UK. Bio-fuels like corn are hugely inefficient and lead to forests being cut down and agricultural land being offset so food prices rise. Wind has a similar negative local community lobby in onshore rural areas - they are frankly very ugly and kill birds. Offshore, its just too oil intensive and costly all those maintenance workers burning around in oil powered boats, and the turbines and blades all need large amounts of oil energy to build, install and maintain. Just when you need wind energy the most, on a calm cold winters day, the turbines shut down through lack of wind. You still need the base-load capacity. Solar simply is not economic in the UK the sun does not shine enough or intensely enough few people want to wait 20 years to get their money back. Heat pumps take 15 years to pay back as well. The only solar that makes some sense is thermal - a simple low cost radiator on your roof for heating water, but  it still costs too much and is costly to maintain - it needs shut-off valves, thermostat, expensive plumbing and maintenance. One day, some renewable technology might help but for now, its just too little, too late and too expensive. As oil prices rise, people will actually have less disposable income to spend on renewable energy - and tax breaks will dry up because tax breaks and subsidies will be short as the government has less revenue - we are just trying to be realistic. Peak Oil was July 2008 and we havent got 20 years to develop a reliable renewable energy source.

it still costs too much and is costly to maintain - it needs shut-off valves, thermostat, expensive plumbing and maintenance. One day, some renewable technology might help but for now, its just too little, too late and too expensive. As oil prices rise, people will actually have less disposable income to spend on renewable energy - and tax breaks will dry up because tax breaks and subsidies will be short as the government has less revenue - we are just trying to be realistic. Peak Oil was July 2008 and we havent got 20 years to develop a reliable renewable energy source.

Property Investors: For property investors, best purchase property close to electric railways, electric tube and close to high paid jobs. If you can cycle to the work, this is a good test of proximity to work and lower exposure to Peak Oil. In London - look at Angel, Borough, Bermondsey, Elephant & Castle, Poplar as benchmarks. But dont purchase far off properties that rely on oil burning cars and trucks for all g oods and services and commuting to work. With high oil prices, these areas could stay permanently depressed (e.g. West Wales, north Norfolk, SW Scotland). Best purchase property in the better areas close to London on the electric rail lines or in Central London. Aberdeen will also prosper from Peak Oil because it is the biggest oil engineering centre in Western Europe - lots of high paid jobs. Norway will also boom because it has so much oil and gas, with a small population. It also has huge hydro-electric plants - many years of forward looking investment and planning for a sustainable future - Norway has got it all sorted out. Italy, Portugal, Spain and Greece with Peak Oil will face serious decline and reduction in living standards with their aging populations, declining populations, and massive oil, gas, coal, metals and electricity import bills weigh on their inefficient manufacturing and services sectors they will face a bleak future once oil prices rise above $100/bbl. They will struggle with oil prices at currently levels of $75/bbl.

oods and services and commuting to work. With high oil prices, these areas could stay permanently depressed (e.g. West Wales, north Norfolk, SW Scotland). Best purchase property in the better areas close to London on the electric rail lines or in Central London. Aberdeen will also prosper from Peak Oil because it is the biggest oil engineering centre in Western Europe - lots of high paid jobs. Norway will also boom because it has so much oil and gas, with a small population. It also has huge hydro-electric plants - many years of forward looking investment and planning for a sustainable future - Norway has got it all sorted out. Italy, Portugal, Spain and Greece with Peak Oil will face serious decline and reduction in living standards with their aging populations, declining populations, and massive oil, gas, coal, metals and electricity import bills weigh on their inefficient manufacturing and services sectors they will face a bleak future once oil prices rise above $100/bbl. They will struggle with oil prices at currently levels of $75/bbl.

France: Paris will cope better than most cities because of it's electric rail links, proximity to Germany, electric metro and the huge use of nuclear electric power France has installed. Excellent foresight and planning by the French - demonstrating an excellent engineering prowess. If the French can convert their cars to electric and increase their nuclear power further they could become the shining example of how a country with no oil or gas production to speak of, could still prosper in Peak Oil times. Finland implemented a gignatic nuclear power programme about a decade ago - so they will also cope better than many countries despite having no oil or gas production.

Oil Prices Will Rise: Enough for now  as discussed we have oil production models to support our analysis and conclusions it could be another few years before they can be confirmed but just remember. In our view - Oil demand is rising. Oil production is stagnant. Very little spare capacity is available. No-one is at war there are no supply disruptions. Practically all oil producing nations are producing flat out they cannot or dont want to increase oil production. Talk of 6 million bbls of spare capacity is "Living in La La Land". So when the world gets wind of this, oil prices will rise and then Peak Oil production will be all over the press like a rash no-one will be talking about Climate Change anymore. We wish we were wrong - but regrettably all the modelling we have performed points to flat oil production, increasing demand and oil prices sky-rocketting again some time in the next few years - its just a question of time and "when".

as discussed we have oil production models to support our analysis and conclusions it could be another few years before they can be confirmed but just remember. In our view - Oil demand is rising. Oil production is stagnant. Very little spare capacity is available. No-one is at war there are no supply disruptions. Practically all oil producing nations are producing flat out they cannot or dont want to increase oil production. Talk of 6 million bbls of spare capacity is "Living in La La Land". So when the world gets wind of this, oil prices will rise and then Peak Oil production will be all over the press like a rash no-one will be talking about Climate Change anymore. We wish we were wrong - but regrettably all the modelling we have performed points to flat oil production, increasing demand and oil prices sky-rocketting again some time in the next few years - its just a question of time and "when".

We hope you have found this Special Report insightful and useful in guiding your property investing strategy. If you have any comments, please contact us on enquiries@propertyinvesting.net

Peak Oil