345: UK property update and Peak Oil and US property investing risks

09-24-2010

PropertyInvesting.net team www.google.co.uk

PropertyInvesting.net team www.google.co.uk

1. UK Property Update

Key Autumn Period: After the summer quite period, it has been a critical period up to the end September to gauge whether the housing market would pick up and prices start firming up again. So far, the market has remained very quiet and property prices have continued their slow decline that began in May 2010. That said, there are signs that the amount of properties being put on the market has declined by about 30% in the last month and time to sale is dropping slightly from the Rightmove report issued 20 Sept – it’s still possible the property market could kick into action in October and November, but it’s more likely to remain subdued and flat. We would now expect this subdued trend to continue over the next few months for the following reasons:

still possible the property market could kick into action in October and November, but it’s more likely to remain subdued and flat. We would now expect this subdued trend to continue over the next few months for the following reasons:

· Mortgage lending remains at levels of less than 50% of their peak rates in 2007 – and the amount of mortgages agreed in the last month declined by about 5% compared with the previous month as did the lending amount

· Unemployment is expected to rise, particularly in the public sector dominated areas, in the next few months as spending cuts begin to bite

· Oil prices are at danger levels close to $80/bbl – which is slowing down the global economy

· Banks are tightening lending as they amass large amounts of capital – many prefer to hoard the cash in view of the uncertain outlook and new regulations that stipulate more reserves of cash (expect bank bonuses to be at record levels year end as profits remain high and margins between mortgages and bank rates extremely high – with lack of competition continuing along with lack of mortgage demand in most areas)

· Consumer confidence is lack-lustre

· Many young first-time buyers either cannot afford the deposit and mortgage payments, or prefer to wait to see if property prices drop – before entering the market. The rental market continues to improve and demand for rental properties is better now than for many years. We expect this trend to continue as young people opt out of being home owners (student loans, student debt, expensive wedding, holidays and lack of saving mean most have given in – or rely on wealthy parents to get a foothold on the so call “property ladder”)

Rental Rise: The rental demand increase is rather like what was experienced in 1992 after the main property price crash, for those of you that can remember – this was when rental demand and rental prices increased despite record unemployment and a recession - as so few people wanted to own their own homes wi th high bank rates. This trend could continue for a number of years – and if bank rates increase, rental demand will also increase further.

th high bank rates. This trend could continue for a number of years – and if bank rates increase, rental demand will also increase further.

For well funded buy-to-let investors, there is an obvious opportunity to purchase low priced properties and achieve high rental returns – if you don’t mind property prices that look unlikely to rise any time soon and can take the risk and hassles of being a landlord.

The level of home building remains at very low – in fact dangerously low – levels, particularly for detached houses with gardens. We expect detached house prices in southern England to remain high as the middle class aspire to own these homes and supply does not increase.

Regional Variations: Property prices in regions far away from London and southern England will more than likely continue to decline as public sector jobs cuts cause regional recessions in the north and mid-west – north of the Seven-Wash line. Expect places like Liverpool, Hull, Bury and Bradford to be particularly hard hit. But don’t expect anyone to advertise that these cities are in recession – what we always see if the UK total, but this masks large differences si nce London GDP normally grows at close to twice the national average – this could become even more extreme when the public sector jobs cuts start in earnest.

nce London GDP normally grows at close to twice the national average – this could become even more extreme when the public sector jobs cuts start in earnest.

Private vs Public: Remember the biggest population increase, biggest private sector and lowest level of house building is in London and southern England. We expect jobs growth to be strongest in private sector dominated areas – so please do not expect property prices in urban and rural areas in the Midlands, north and west to continue to rise like they did during the public sector spending boom period from 1997 to 2007. It will be a hard re-adjustment that will take many years, as the economy is re-balances.

Developments: If you also consider all the infra-structure projects and developments, they are almost entirely focussed on London. The Olympics, White City/Westfield, East London Rail, DLR extensions, Tube upgrades, airport expansions, cycle highways – these projects are designed to increase transport capacity in London as the population continues to boom. But remember very few properties are being built in London as well – with lending constraints and builders in a go slow mode - so with continued influxes of international people, we expect London prices to stay firm, whilst outlying areas drop well away from London north of the Seven-Wash line to drop.

2. Peak Oil Update and US Real Estate Investing Risks

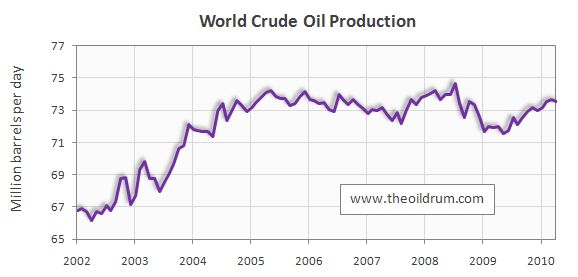

Likely Past the Peak Already: Just to point out again that we think Peak Oil production was 2005 (crude oil) and July 2008 (all oil liquids). We’re now almost into 2011, and oil production rates are lower now than they were in 2005 six years ago – so all the talk of Peak Oil being many years in the future is in our opinion is very optimistic. Because oil plays such an integral part of civilisation and economic growth, if a deficit starts to become evident in net energy availability (oil, gas, coal, nuclear, renewables) – then it will be difficult for the world to maintain robust economic growth as a whole, particularly if there is no broad-based energy efficiency and conservation measure adopted. Countries that rely only high levels of imported oil with truck and car transportation only fuelled by oil are particularly exposed – like the USA, Greece, Italy, Portugal and Spain.

Likely Past the Peak Already: Just to point out again that we think Peak Oil production was 2005 (crude oil) and July 2008 (all oil liquids). We’re now almost into 2011, and oil production rates are lower now than they were in 2005 six years ago – so all the talk of Peak Oil being many years in the future is in our opinion is very optimistic. Because oil plays such an integral part of civilisation and economic growth, if a deficit starts to become evident in net energy availability (oil, gas, coal, nuclear, renewables) – then it will be difficult for the world to maintain robust economic growth as a whole, particularly if there is no broad-based energy efficiency and conservation measure adopted. Countries that rely only high levels of imported oil with truck and car transportation only fuelled by oil are particularly exposed – like the USA, Greece, Italy, Portugal and Spain.

Peak Oil

Bumpy Plateau: At the moment we believe the world is bumping along the Peak Oil production plateau – it’s been doing this for the last six years. It’s just no-one has convinced the politicians to admit it. Take at a look at the chart above. For the property investor, don’t be fooled. Even during low growth times when economies are struggling, oil prices remain at $75/bbl (almost ten times higher than in 1999). So if oil shortages start, oil price s will sky-rocket and the world will dip back into recession. At this point, more people will need rented accommodation, property prices will drop broadly speaking and borrowing will become even more difficult. The exit of a 1992 style housing depression into a boom some five years later will not happen again in western developed nations. The reason is that the house price boom in the UK coincided with record low oil prices in 1999 and borrowing was plentiful and cheap with inflation under control. Remember also the last property price crash in 1991 coincided with high oil prices (Iraq war), ditto 1982 and 1972 – and then a major readjustment mid 2008. But all the conditions for a housing and debt boom reverse if oil as scarce as we expect in the future. So what we could see is property prices stagnating for a while. It may seem okay for a while – but if and when oil prices skyrocket again, this could actually cause a proper property price crash, particularly if banks start to meltdown and the government can no longer afford to bail them out. The reason for describing this rather depressing scenario is that – if we are right – and oil prices sky-rocket, a recession in western developed nations will ensue - period.

s will sky-rocket and the world will dip back into recession. At this point, more people will need rented accommodation, property prices will drop broadly speaking and borrowing will become even more difficult. The exit of a 1992 style housing depression into a boom some five years later will not happen again in western developed nations. The reason is that the house price boom in the UK coincided with record low oil prices in 1999 and borrowing was plentiful and cheap with inflation under control. Remember also the last property price crash in 1991 coincided with high oil prices (Iraq war), ditto 1982 and 1972 – and then a major readjustment mid 2008. But all the conditions for a housing and debt boom reverse if oil as scarce as we expect in the future. So what we could see is property prices stagnating for a while. It may seem okay for a while – but if and when oil prices skyrocket again, this could actually cause a proper property price crash, particularly if banks start to meltdown and the government can no longer afford to bail them out. The reason for describing this rather depressing scenario is that – if we are right – and oil prices sky-rocket, a recession in western developed nations will ensue - period.

Peak oil discovery

Vanessa Hudgens - gas pump - Peak Oil

Increasing OPEC Oil Demand: We very much hope we are wrong and the oil companies and Middle Eastern OPEC producers surprise on the oil production upside – to keep oil supply levels at or above current levels to meet rising demand in China, India and other developing nations. There is plenty of cheap coal, plenty of cheap gas – but its oil that we need to worry about. 95% of all transport is oil powered. 70% of oil is used for transport. A 5% decrease in oil supply would double oil prices and lead to a recession – so the world is very exposed to a drop in oil supply for either political, security, natural disaster or production reasons. 5% is 4 million barrels being lost – through either disruption of depletion (decline in rate). The world is a very peaceful place at the moment, no riots, storms, disruptions, unrest – but if something causes a 5% drop in supply (war, blockade, riots) then this would be enough to create a financial meltdown. Just keep a watchful eye on the oil price – anything over $100/bbl in the UK spells trouble for the house prices – anything less than $60/bbl will stimulate property price increase. A simple model, but we think we have it nailed down. Also keep in eye on gold – if inflation takes hold and oil prices rise, the dollar will decline and gold will go up. Property prices will go down. The best think for property prices in the UK and USA would be someone finding 100 billion barrels of oil quickly (that’s ten times what was found last year, which was a good year) – this would keep oil prices from rising. But don’t expect heavy oil sands to make much difference – despite huge mining operations in  Canada, these only contribute 1.5 million bbls/day. The biggest unknowns are how much spare capaicuty (if any) Saudi Arabia has – and how quickly Iraq can ramp up their oil production from the meagre 2 million bbl/day today, to something like 5.5 to 9 million bbls/day which is their realistic sustainable capacity given their gigantic reserves. Regrettably, not much has happened in the last four years except some contracts being awarded. The production rate has not move higher. If the extra 3.5 to 7 million bbl/day does not materialise in 3-7 years time, we’re in big trouble.

Canada, these only contribute 1.5 million bbls/day. The biggest unknowns are how much spare capaicuty (if any) Saudi Arabia has – and how quickly Iraq can ramp up their oil production from the meagre 2 million bbl/day today, to something like 5.5 to 9 million bbls/day which is their realistic sustainable capacity given their gigantic reserves. Regrettably, not much has happened in the last four years except some contracts being awarded. The production rate has not move higher. If the extra 3.5 to 7 million bbl/day does not materialise in 3-7 years time, we’re in big trouble.

40 year rule: For investors that want a bit more evidence of Peak Oil – from a statistical basis, please note that most countries have seen falling oil production about 40 years after the peak of their oil discoveries. This happened in the USA (took 40 years), the UK (took 30 years). The world now consumes 30 billion barrels a year – a gigantic volume, but last year – despite it being a good year – the world only discovered 10 billion barrels. Peak oil discovery was over 40 years ago. The world as a whole is now due for a production decline. It was due in 2005 – and this is actually when we think it was!

Oil Subsidy and Rising Population and Consumption in OPEC countries: The other worrying thing is that most oil exporting nations like Iran, Iraq, Saudi Arabia, UAE, Oman and Kuwait have hugely increasing national oil consumption because they subsidize oil usage, have used their oil wealth to develop the consumer classes and have massively increasing populations. Some countries are genuinely worried that  they may actually need to import oil in the future – Iran is a good example. Iran currently imports refined oil production because it lacks refinery capacity. But worse, according to our projections, if their oil production declines by 3% a year and their consumption continues to increase dramatically as it has done in the last few years, Iran will actually not be exporting any crude oil by as early as 2018. They will use all their oil themselves!

they may actually need to import oil in the future – Iran is a good example. Iran currently imports refined oil production because it lacks refinery capacity. But worse, according to our projections, if their oil production declines by 3% a year and their consumption continues to increase dramatically as it has done in the last few years, Iran will actually not be exporting any crude oil by as early as 2018. They will use all their oil themselves!

USA Peak Oil Exposure and Taxes: Another interesting fact is that, if one discounts the fact that Brazil produces ethanol in large quantities (from sugar), it will never export any crude oil despite the much publicized oil boom and new discoveries – it needs all the crude oil for its own consumption needs. This is why we think the USA is in an extremely exposed position because it has no coherent energy policy, and imports 9 million barrels of oil a day. 5% of the world’s population using 25% of the oil production – it’s staggering. The oil import bill each year at $110/bbl is $350 billion – how can USA afford this when the deficit is so huge? Any increase in oil price will cause a massive problem in the USA and the administration seems in denial with regard to how the issue can be tackled and the risks surround the issue. USA needs a massive switch to natural gas a s soon as possible, otherwise the country could be in recession for years if oil prices rise sharply. This is what we think. We are almost alone in this view – we think it’s important our property investing visitors should have these insights - the outcome of all this is, do not invest in property in the USA – it’s too risky.

s soon as possible, otherwise the country could be in recession for years if oil prices rise sharply. This is what we think. We are almost alone in this view – we think it’s important our property investing visitors should have these insights - the outcome of all this is, do not invest in property in the USA – it’s too risky.

Anti-Business Sentiment: Also, the current US administration, or President Obama at least, is anti-business as was demonstrated with the populist criticism of BP and Wall Street Banks (similar to the UK’s own anti-Business Secretary Vince Cable – as was demonstrated clearly at the Lib-Dem conference on 21 Sept). Little wonder why some of the most wealthy enterprising people are moving abroad or at least investing abroad – the USA has got to be considered now a rather risky place to invest – with the administration beating up on business constantly – and mounting investigations in Wall Street. What some politicians don’t seem to understand is that it is the taxes from the private sector that pays for all of the public sector and funds infra-structure projects. If there was no private sector, there would be no public sector (or politicians). With regard to private sector wages and bonuses, the private sector in both the USA and UK have on average seen lower pay rises than the public sector and lower growth in employment. Almost all the growth in employment in the Midlands, Scotland, Wales and North of England has been an expansion of the public sector paid for by private sector taxes (and borrowing, which is also funded by the tax payers). If one needs a few examples of populist left wing damage to business and GDP growth-prosperity, one only needs to look at Venezuela as the classic economic case history since 1999 (and its oil production decline with this). Yes, the banks probably need more regulations to prevent the mini-meltdown we saw in mud 2008, and need to start lending at competitive rates, but if government continue to beat up on business, they will only move somewhere else that is more business-friendly, like Switzerland, Hong Kong, Singapore or Dubai - then high paid and low paid jobs will go with it.

We hope you have found this Special Report helpful in providing insights for your property investing strategies. If you have any comments, please contact us on enquiries@propertyinvesting.net